![]()

Chapter One

Awareness

Discovering What Kind of Taxes Your University Is Subject To—How to See the Forest, Not Just the Trees

As a tax manager for three different universities, I had the best job in the world. After all, we were tax exempt. What would I do all day? Colleges and universities are tax exempt, aren't they? I loved entering into discussions with people that had this view of universities.

Defining Tax Exempt

Let's explore what tax exempt means and what it doesn't mean. Technically, according to the IRS, if you are a state institution then your exemption is found in a certain section of the IRS code. If you're an independent, private university then you are exempt under a different section of the Internal Revenue Code. It's that simple.

However, it's important to note that regardless of whether you're a state institution or private, independent institution both are considered nonprofit organizations by the Internal Revenue Service. That may sound like a simple statement. But what I find is that many people in higher education consider themselves to be separate and distinct in some manner and do not really pay much attention to the IRS when they talk about nonprofit organizations. Perhaps they're thinking the IRS means organizations like the YMCA, the American Red Cross, or the Big Brothers, Big Sisters. However, the same rules that apply to those organizations also apply to higher education.

Also, as a tax-exempt organization, whether public or independent, you may be exempt from paying sales tax on purchases in your home state and several (not all) of the other states.

The Six Steps of Tax Compliance

So does this mean we do not pay any tax in higher education? How about taxes like social security tax, Medicare tax, sales tax, unrelated business income tax, hotel and motel tax, excise tax, or oddities like a severance tax in West Virginia?

It is also important to note, that like any other organization, tax-exempt organizations like colleges and universities act as a “withholding agent” for the IRS. What that means in the eyes of the IRS is that you are knowledgeable of all taxable events on campus and further that the university is held responsible for the payment of those taxes. That's right, the university is responsible, not the individual, if the university failed to withhold or pay over the tax due to the IRS. We are also a collection and withholdings agent for state sales tax, federal excise tax, employee payroll tax, payments to independent contractors, a receipting agent for charitable gifts from donors, and reporting agent for educational tax credit items—things like scholarships, grants, and tuition-related payments.

Many of the training courses the new business officers receive, like those from their regional or national Association of Business Officers failed to offer any education about the Chief Financial Officer's (CFO) role and taxes for the university. These courses cover many other topics for the Chief Business Officers but pay little heed to the importance of taxes and the consequences of not getting it done right—and on time.

When something goes wrong between your university and the IRS, the buck will stop on the CFO's desk. It just goes with the title in the position. That's why they make the big bucks.

Yet, I find that many new and even experienced CFOs, Associate Vice Presidents of Business and Finance, or Controllers have a limited knowledge about how taxes are to work at their university and the impact taxes can have on their university. This is especially interesting to me in that more than half of one class of new business officers came to higher education from other sectors, including health care, public accounting, or real estate and have no knowledge of nonprofit taxation. It's critical for you to know your campus, the activities that occur that may be subject to taxation—and to know what the IRS requires from your department.

This book will help you to develop an effective tax compliance program for your university by taking you through six steps. Along the way you'll see some tips and techniques to help you establish this tax compliance program. Achieving these steps will make your division more operationally efficient and save your university dollars. See Exhibit 1.1.

The first step is awareness. This chapter gives you some tips on how to build your awareness of your tax obligations at your university. Without this awareness you are destined for difficulty with the IRS and your university. There are approximately 4,000 universities in the United States and some have not yet been audited or it may have been a long period of time since they were last audited. Do you want to play audit roulette with your school's and your personal reputation?

The Five Things You Need to Do First

If you are new to things, there are five things you need to do first before all else. These will be helpful regardless if you are a new CFO or have many years of experience. The rest of this chapter outlines these important tasks.

Task 1: Look at Management

Determine who is managing your tax compliance program for your school. Find out who is responsible on your campus for being knowledgeable of tax issues affecting your institution and managing/preparing tax returns and reporting to the IRS.

At a smaller institution without a tax manager or a designated tax person you may find tax compliance is disbursed throughout the organization. For instance, you may find your employment tax is being deposited by the payroll department as well as the employment tax returns being prepared, signed, and filed by the payroll department. You may find that 1099 forms (for payments to independent contractors) are being prepared and filed by the Accounts Payable department and you may find the forms necessary for every student attending a class prepared and filed by your student financial aid department.

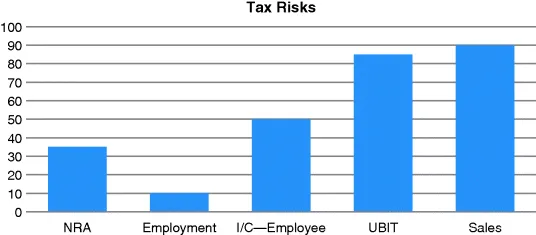

At a larger school where there may be a tax manager and even a tax department, have a meeting with your tax manager and ask them what they view as the biggest tax risk to the university. Ask them to develop a visual university tax risk matrix for you. It can be something as simple as the image in Exhibit 1.2.

This type of presentation will show you areas for improvement. It appears from Exhibit 1.2 that your first efforts should be to look at the areas of Sales Tax and the Unrelated Business Income Tax. Ask your tax manager or the person responsible for these areas what they see as the first steps to take and what obstacles are in front of them. Then take steps in your position as CFO to remove those obstacles. In many cases, an obstacle will be gaining the cooperation of the various departments.

I suggest the meeting be between you and the tax manager, not the supervisor of the tax manager and the tax manager, as a tax manager may be reluctant to press their true feelings in the presence of the supervisor.

Task 2: Assess the Current State of Your Tax Compliance Program

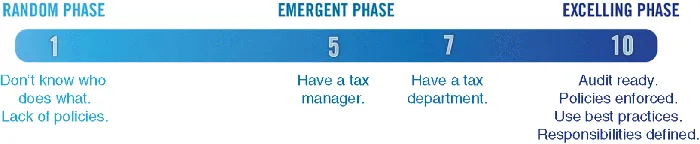

Make an assessment of where your tax compliance program is now. Rate yourself on the scale in Exhibit 1.3.

If you feel your score is to the left of the scale then you are in the random phase of tax compliance. This is where you, as a CFO, have no or very little knowledge of what it takes to comply with the various tax laws. You don't know who is preparing tax returns, who is making the tax deposits, or there may be a lack of policies and procedures surrounding the tax environment of your school.

Or you may feel that all is being done correctly and on time and your university is in compliance with the federal, state, and local tax laws, but you may have no way to prove it. Further, you may feel this way because you are not advised of the university's tax issues. This happens more than you think.

If you are in the middle of the scale, or the Emergent Phase, you have a tax manager who takes care of all of the tax issues. If you are somewhere between the left side and the middle you may have a designated tax person who has tax responsibility as an “other duty as assigned.” Most often this falls to the controller or the associate vice president of the institution. If this is the case, you should meet with them and develop a sense of their awareness of tax issues and also to determine how they keep up with tax law changes that affect the university. You'll want to ask about what types of controls are in place to see that there are no late deposits or missed filings of tax returns.

At the right end of the scale you are in the Excelling Phase and nearest to the top of the tax compliance program pyramid in what I refer to as Tax Nirvana. Here you are fully aware of all tax issues, know how to address them, and are prepared for an audit at any time. This is the place for thought leaders in operational efficiency in Business and Finance departments.

Using my tax pyramid will move your organization up the scale of tax compliance. The six steps contained in this book will give you practical and easy-to-use methods to take your school to Tax Nirvana.

The tax compliance program is not for wimps. It will require collaboration and communication with all of the permits in your school's academic and administrative departments. It will need executive-level support from you. Be that support or bear the consequences upon an IRS audit. It takes a village, but where the tax compliance program is concerned, you will be able to create that village.

Task 3: Develop a Team Approach

Consider starting quarterly tax update meetings involving Payroll, Accounts Payable, Human Resources, Athletics, Student Financial Aid, Accounting, and Procurement. All of these departments and others may be included on your team because there are tax consequences for each and all of these departments. Start a yearly tax calendar for your institution. List all known tax filings and who is responsible and the due dates for all returns and deposits. Review this calendar at each quarterly meeting to ensure no filings or deposits are missed.

I cannot overcommunicate the value of the tax compliance program at your university. You may need to tailor your advocacy of the tax compliance program to the departments. You need to provide an answer to their question of “What's in it for me?”

You can count the efficiencies in processing that will be of benefit to them (for example, that there will be less time to receive approval or payments). Or you may state that money saved as a result on payments to taxing authorities could be better spent on education in dealing with academic departments. To further demonstrate your commitment to a tax compliance program, consider hosting a tax conference for surrounding schools at your institution.

Overall, this book begins by asking you to be a change agent in the area of tax management at your school. You can expect resistance to this, as with all change, but you can use enhanced technology, such as workflow approvals, to speed up processing.

Getting a Hold on the Process

Getting a hold on taxes is important because the IRS is your largest vendor. I make this pronouncement at many of my presentations around country to business officers just like you. It gets their attention because many of them are not aware of this. I challenge them to run a very simple query in the accounts payable software: simply ask your accounts payable manager to run a very simple query that produces the vendor with...