![]()

1

Introduction: The Housing Economy and the Credit Crunch

Colin Jones

The world is still trying to adjust to the international banking crisis of 2007 that wrought recession and a dramatic downturn in housing markets across much of the globe, followed by a fiscal crisis in many countries that has yet to be fully resolved. The consequences for national housing markets have varied dependent on the specifics of their housing system, the point in the economic cycle and the exposure to the banking collapses. This book examines the different experiences of countries in Europe, Australasia and the USA and draws out the challenges to housing markets in the short and long term.

The credit crunch and its aftermath has also emphasised the importance of the housing market to the economy. The relationship between the housing market and the economy has always stimulated debate but it has recently risen to greater prominence as special editions of Journal of Housing Economics (13.4) and the Oxford Review of Economic Policy (24.1) bear witness. In the latter volume, Muellbauer and Murphy (2008) offer a survey of the multiple interactions between the housing market and the economy but they leave many questions unanswered. The events at the end of the last decade have given this issue even more momentum as Gabriel et al. (2009) note, writing about the position in the USA, ‘The far-reaching economic and social consequences of the housing crisis require nothing less than the wholesale evaluation and redesign of housing policy, regulation, and the finance systems.’

This introduction begins by illustrating the scale of the impact by reference to the extreme example of Ireland. It then sets out a statistical overview of international housing market trends over the past four decades by examining price cycles to provide a context for the book. These trends demonstrate that the links between the macroeconomy and the housing market vary between countries (Meen, 2002a, Demary, 2009). The next section reviews the fundamental dynamics of the housing market and the importance of tenure institutional structures and market parameters in each country. The following section highlights the relationship between the housing market and the economy. The chapter then outlines the origins and impact of the recent financial crisis on house prices in individual countries. The contents of the remaining chapters are then described explaining which aspects of the housing economy and market cycles are highlighted in the different countries studied.

The Irish example

The Republic of Ireland is an extreme example yet its experience is instructive as a magnification what happened in many countries. During a decade-long economic resurgence from the mid 1990s, recognised by the term ‘Celtic Tiger’, per capita incomes in Ireland rose dramatically and the population increased by 17%. With no property tax, income taxes and interest rates falling, and the liberalisation of mortgage finance making it readily available, a housing market boom was generated which saw prices roughly quadruple to their peak at the end of 2006 (ESRI, 2011). In the process mortgage debt per capita more than doubled supported by easier access to international finance for Irish banks and foreign banks entering the market (Norris and Winston, 2011).

Following the credit crunch, house prices fell by 38% from the end of 2006 to 2010 (ESRI, 2011). The parallel problems in the commercial property market, together with the collapse of the housing market, contributed to the subsequent collapse of the banking system and a bailout by the Irish government. This in turn led to a fiscal crisis, and the Irish government needed to be sustained by a bailout of €85bn in November 2010 by the other European governments and the IMF. The internal political fallout from these events led to a successful vote of no confidence in the government and a general election that returned the opposition. Further afield it has contributed to uncertainties on the international financial markets about the future of the euro currency.

Beyond these headlines the impacts on the Irish housing system were more subtle. Historically the homeownership level was high in Ireland reflecting both low house prices and that it was the normal tenure in rural areas. The boom priced out low-income households, particularly in urban areas, who had to look to the private rented sector while there was an increased concentration of high housing debt among successful young first-time buyers. The downturn has hit this latter group worst with negative equity but they also tend to be relatively affluent, while older home owners, who represent a broad range of incomes and largely own outright, have also suffered capital losses (Norris and Winston, 2011).

The full consequences of the credit crunch for the housing market in Ireland, as in other countries, have yet to fully work their way out, and that continues to create uncertainty. The recession in the house market has focused even more public attention on house prices and their future prospects. Their prominence reflects the importance of the housing market to household decision making and to the economy. With owner occupation the dominant tenure around the world such household pressures will have been felt in most countries. The inevitable and unanswered questions for which many are searching is where are these trends taking us and when (and if) the upturn will arrive.

International historical housing market context

In the UK, where monitoring the housing market has become a national obsession since the credit crunch, newspapers have periodically and enthusiastically reported negative forecasts, by prophets of doom, of dramatic falls in house prices. These conclusions are normally based on a return to a market price level associated with house-price-to-income ratios last seen just after the millennium. It is a simple analysis, and a message that dampens market expectations and plays on fears about the fragility of the housing market and household wealth bound up in a home. The theoretical basis of these reports is questionable as they consider only one linkage of the complex forces that shape the housing market and its dynamics. It does not draw on the experiences of the many other countries that have been similarly influenced by the global downturn, or at least only those that are consistent with their message. Similar national parochial analyses are being repeated in other countries.

It is important to remember that homeownership is effectively treated distinctively in different cultures with implications for how housing markets work and trends in house prices. For example, in southern European countries households rarely move from their home, which is often purchased with the help of the family. Often several generations live together under the same roof. In contrast, in many Anglo-Saxon countries owner occupiers have sought to purchase at an early age, and move to adjust their housing requirements through the family life cycle so there is a much more active housing market. It is interesting to note that rising unaffordability, particularly in the latter stages of the last property boom, led, as the book chapters show, not only to a rise in the age of first home purchase in many countries but also a move towards a return to several generations living together. Furthermore, in the UK first time purchasers increasingly received financial support from parents to raise the deposit. A national survey by the Alliance and Leicester (2007) at the time found that parents were paying on average £21,314 to help their children get on the property ladder,

One of the major motivations for this book is to take an international perspective on the short-term impact of the financial crisis on the housing market and review the reasons for differences between countries. To gain some initial understanding on the current housing market it is useful to begin by taking an overview of long-term trends worldwide by reference to OECD house price data (it excludes some major economies such as China). Some care should be taken in the comparison of this data as they are constructed in different ways and as a result they can be biased, for example towards certain segments of the market (Eiglsperger, 2010). This issue is also discussed for the particular case of Germany in chapter 7. In the analysis below our interest is just to establish a broad overview.

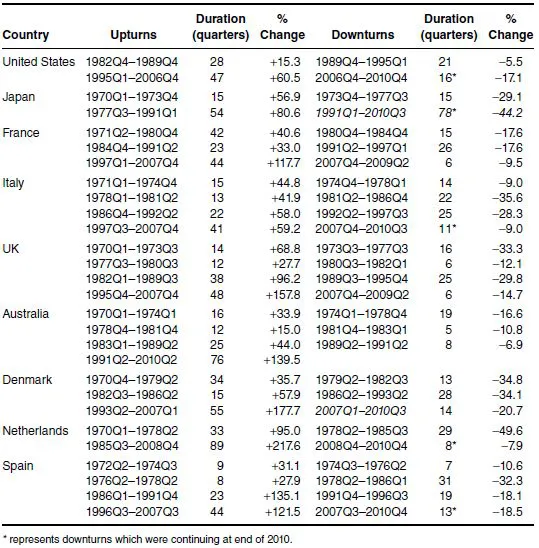

A useful way to compare international housing market experiences is to focus on the different cycles of countries. Table 1.1 reports on major upturns and downturns in real prices since 1970 for selected countries. André (2010) defines major cycles in the housing market as real house price changes of at least 15% within some of the largest economies and ignores more modest upward and downward adjustments. Judged by this table, the UK housing market is the most volatile followed by Spain, Italy and Denmark. Although not reported in the table, Finland and Sweden show a similar volatility to Denmark albeit the cycles are different. Many countries experienced significant upturns in the housing market at the beginning of the 1970s. In the case of France the house price boom lasted most of the decade but for Italy, the UK and Japan the tripling of oil prices in 1973 and the recession that followed was mirrored in a downturn in house prices that lasted up to four years.

The beginning of the 1980s saw a divergence of house price trends into two camps. In much of continental Europe real house prices fell substantially – Germany, France, the Netherlands, Spain and Italy (as well as Ireland, Sweden and Canada) – for the first half of the decade if not longer before showing dramatic growth in the latter part of the decade (Germany excepted). In contrast the early 1980s saw the beginning of substantial upturns in real prices in Finland, Denmark, the UK and the USA. These upswings (with the exceptions of Norway and Denmark) lasted most of the 1980s.

This almost universal (in terms of OECD countries) house price boom of the (later) 1980s falls away around the end of the decade, and the beginning of the 1990s saw a period of modest negative price adjustment for most countries. In the case of France, Finland, Italy, Spain, Switzerland and the UK substantial downturns lasted approximately six years. A new significant upturn emerged for most OECD countries in the middle of the decade, some earlier (Ireland 1992 and Scandinavian countries 1993) and others later (Canada 1998, Italy 1998, New Zealand 1998 and Switzerland 2000). For virtually all these countries the house price continued until a sudden end with the credit crunch.

These long upward movements in house prices were not only the longest in recent times but also led to the doubling of real prices in some countries. Yet despite the longevity of the upswing there was considerable variance in the scale of the upturn. At one extreme the highest real increases were Ireland 302%, Norway 199%, Denmark 174% and the UK 173%. On the other hand, the US and Canadian real rises were only 56% and 72% while in Switzerland it was only 20% although it was not affected by the latest downturn. There were also mini-cycles within the long upswing with periods when prices surged and other periods when prices plateaued.

There are a mass of micro-detail differences between countries of which the above commentary has only begun to scratch the surface. Nevertheless the review emphasises the important role and scale of cycles in the housing market. It also establishes a degree of commonality especially in the past 15 years of the cycles, reflecting the significance and impact of globalisation. Yet there is sufficient variation to demonstrate the importance of national factors. There are countries that stand out in different ways. Australia has not had a significant downturn in real house prices over the whole 40-year period, while the USA suffered its first substantive collapse of prices in living memory after the credit crunch.

Japan has perhaps the most distinctive pattern of real house prices with long upswings and downswings. First, house prises rose by 57% in real terms between 1970 and 1974 in just 15 quarters. Then after a downward adjustment over the next three years of 31%, rising by 77% through 54 quarters, almost 14 years, from 1977 until 1991. This is followed by almost two decades of prices declining in total by over half in real terms over the period to the present day. Germany too suffered a long downward movement in real house prices from 1994 to 2008 which saw a real fall of 26.5% when most European cities were living through a strong housing market. The Netherlands in contrast has the reverse experience with real prices consistently rising over a 23-year period from 1985 to 2008 by 233%.

Dynamics of the housing market

A key influence on these house price cycles is the business cycle of the individual country with peaks in the two cycles broadly coinciding (Aherne et al., 2005, André, 2010). This is not always true as the Netherl...