eBook - ePub

EconoPower

How a New Generation of Economists is Transforming the World

Mark Skousen

This is a test

Share book

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

EconoPower

How a New Generation of Economists is Transforming the World

Mark Skousen

Book details

Book preview

Table of contents

Citations

About This Book

EconoPower will provide you with a firm understanding of the influence of modern economics and how it can be used to improve the world we live in. It offers practical advice on numerous personal financial matters—earning, saving, investing, and retiring—based on the breakthrough contributions of behavioral economists. And it looks at how economists are working successfully on issues such as public education, crime, and global warming. EconoPower also examines how a new economic philosophy may dominate the new millennium.

Frequently asked questions

How do I cancel my subscription?

Can/how do I download books?

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

What is the difference between the pricing plans?

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

What is Perlego?

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Do you support text-to-speech?

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Is EconoPower an online PDF/ePUB?

Yes, you can access EconoPower by Mark Skousen in PDF and/or ePUB format, as well as other popular books in Volkswirtschaftslehre & Wirtschaftstheorie. We have over one million books available in our catalogue for you to explore.

Information

Part One

PERSONAL FINANCE

EARNING, SAVING, INVESTING, AND RETIRING

The new behavioral economists have made exciting advances in the area of personal finance, discovering how to improve people’s ability to earn, save, invest, retire, budget, and get out of debt.

I start this important section with a simple but powerful plan that has the potential of tripling workers’ savings rates. It’s already become law (the 2006 Pension Protection Act), due to the ingenuity of Chicago economist Richard Thaler, who is a leader in the new field of behavioral economics.

We also look at radical new proposals to improve Social Security and other welfare plans. These huge social programs have provided a safety net for retirees and the poor, but they have a serious downside. For most Americans, Social Security does not deliver the goods at retirement. It is a lousy and inflexible savings program and a heavy tax on low-income workers and minorities. Many economists characterize public retirement plans as defective and counterproductive, and favor replacing them with some form of personal investment accounts similar to those offered to federal employees (the thrift accounts) or the personal savings accounts that Chilean citizens now enjoy. In this section, I tell the story of a Chilean labor economist, José Piñera, who has made a major difference in his own country and the rest of the world.

Interestingly, major corporations faced the same problem facing Social Security today—the unfunded liability problem. Fortunately, business has largely solved its pension problem by switching from defined-benefit plans to defined-contribution plans, such as 401(k)s or IRAs.

Chapter 1

Economist Discovers a Painless Way to Triple Your Savings Rate

The $90 Billion Opportunity

—RICHARD H.THALER UNIVERSITY OF CHICAGO1

—ROBERT SHILLER YALE UNIVERSITY

In 1999, a study by two British economists,Wynne Godley and Bill Martin, warned that the United States was headed for serious trouble. They point to three unsustainable imbalances: an overvalued stock market, the collapse in private saving, and an alarming increase in debt.2

In 2000-2001, the booming U.S. economy suddenly fell into recession, America was struck by Islamic extremists, and the robust stock market began a long descent that took blue chip stocks down 30 percent and technology stocks down more than 70 percent.The Federal Reserve stepped in to prop up the economy by slashing interest rates and expanding the money supply, and the economy and the markets recovered.

Yet serious problems remain. Most economists and political leaders recognize that easy money cannot solve long-standing issues, such as the saving crisis. Saving, investing, and capital formation are the principal ingredients of economic growth. Recent studies by the World Bank conclude that countries with the highest growth rates (most recently in Asia) are those that encourage saving and investing: that is, investing in new production processes, education, technology, and labor-saving devices. Such investing in turn results in better consumer products at lower prices.3 Harvard’s Greg Mankiw concludes, “Higher saving leads to faster growth.”4

The United States Is Living on Borrowed Time

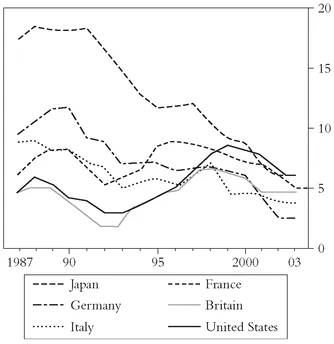

That’s why America faces a potential crisis. Private net saving in the United States has hit alarmingly low levels. Given this positive relationship between saving and economic performance, what are we to make of the gradual decline in private net saving in the United States? The latest data indicates that private net saving—the gap between disposable income and spending—has fallen to record lows as a percentage of GDP for most industrial countries. (See Figure 1.1.)

What is the primary cause of the gradual decline in private savings in the United States and elsewhere? Many economists note that private savings figures don’t include appreciation from real estate and stocks owned by Americans, and thus the saving crisis has been postponed by higher prices in real estate and stock market holdings. But with the recent collapse of the credit markets in real estate and a shaky stock market, a financial crisis may appear around the corner.

Figure 1.1 Decline of Savings Rate in the United States and Other Countries: 1987-2003

Other economists contend that Social Security and income taxes discourage saving. With FICA taxes squeezing more than 15 percent of all Americans’ wages and salaries off the top, the government’s mandatory welfare system makes it difficult for most Americans to make ends meet. Social Security taxes especially hurt the poor who are deprived of the necessary funds to buy a home or start a business. (See Chapters 5 through 8 for radical solutions to the Social Security crisis.)

Of course, millions of Americans continue to save for retirement, investment, and other reasons, but lately the debtors have outnumbered the savers. Who makes up for the imbalance? Foreign investors (as reflected in the growing current-account deficit) are pouring billions into U.S. debt and equity securities, bank accounts, and real estate. As long as foreign investors make up the difference, America will survive and prosper. But what happens when they stop?

Behavioral Economics Enter the Workplace . . . with a Little Help from Washington

To head off a potential financial savings crisis, in 2006 President George W. Bush signed into law the Pension Protection Act. A major part of this law known as “autosave” encourages companies to sign up employees for 401(k) plans automatically. For the first time, employers will automatically enroll workers in their 401(k) plans. Workers can choose not to participate, but they must specifically request exemption. This is the opposite of what was the norm in employee benefits. In the past, workers had to sign up for their 401(k) plans to participate, and, on average, only a third did. Before, no action was the same as choosing “no.” Now, no action is the same as choosing “yes.” Consequently, even procrastinators will be invested in a 401(k)!

In addition, there is a mechanism to increase gradually the amount saved, and employers are encouraged to match some of the dollars that workers invest each year. This new rule is known as “contribution escalation.” When workers receive a pay raise, some of that wage or salary increase will automatically go into their 401(k) investment plan.

This small change in the law will have a big impact. According to Business Week, “the new rules could bring investment managers an extra $90 billion in retirement assets.”5

The Economist behind the SMART Plan

Who’s behind this new law? These two new pension ideas are the brainchild of Brigitte Madrian, professor of public policy at Harvard University, and Richard Thaler, professor of economics at the University of Chicago Graduate School of Business and a leader in the hot new field called “behavior economics.” Madrian earned her Ph.D. in economics at MIT in 1993, and Thaler earned his Ph.D. from the University of Rochester in 1974 and considers himself a maverick from the standard rational approach to economics. He is also the founder of an asset management firm.

Consider the titles of two recent books by behavioral economists on the subject: Irrational Exuberance by Robert Shiller of Yale University (who correctly warned investors that the bull market on Wall Street in 2000 was not sustainable) and Why Smart People Make Big Money Mistakes by Gary Belsky and Thomas Gilovich.

To understand behavioral economics, consider the following four questions:

1. Are you constantly surprised by the size of your credit card bill?

2. Do you live in fear that you haven’t saved enough for retirement?

3. Do you often find yourself buying stocks at the top and selling at the bottom?

4. Have you failed to update your will?

If you answered “yes” to any of these questions, join the crowd. Most of your fellow citizens are in the same boat. Two-thirds of Americans think they are saving too little. Fortunately, help is on the way, at least for two of the problems listed above: overspending and not saving enough for retirement.

Essentially, the behavioral economists take issue with a fundamental principle of economics—the concept of rational predictable behavior. They argue that investors, consumers, and businesspeople don’t always act according to the “rational economic man” standard of the textbooks, but instead suffer from overconfidence, overreaction, fear, greed, herding instincts, and other “animal spirits,” to use John Maynard Keynes’s term.6

Their basic thesis is that people make mistakes all the time. Too many individuals overspend and get into trouble with credit; they don’t save enough for retirement; they buy stocks at the top and sell at the bottom; they fail to prepare a will. Economic failure, stupidity, and incompetence are common to human nature. Robert Shiller observes that “a pervasive human tendency towards overconfidence” causes investors “to express overly strong opinions and rush to summary judgments.” 7 As Ludwig von Mises noted, “To make mistakes in pursuing one’s ends is a widespread human weakness.”8

Fortunately, the market has a built-in mechanism to minimize mistakes and entrepreneurial error. The market penalizes mistakes and rewards correct behavior. As Israel Kirzner states, “Pure profit opportunities exist whenever error occurs.”9

But the new behavioral economists go beyond the standard market approach. They argue that new institutional measures borrowed from the principles of psychology can be introduced to minimize error and misjudgments, without involving the government. The Pension Protection Act helps those who make the mistake of saving too little of their income.The government persuades without force.

At the American Economic Association meetings in Atlanta in January 2002, Richard Thaler of the University of Chicago presented a paper on his “SMART” savings plan, a systematic way to increase dramatically and painlessly the savings rate of American workers. “By incorporating simple lessons of psychology, and a little common sense about human nature, it is actually easy to help Americans save,” he told Congress in 2004. His findings were reported in an academic article in a 2004 issue of the Journal of Political Economy. Thaler, author of The Winner’s Curse and a pioneer in behavioral economics, has developed a new institutional method to increase workers’ savings rates.

Thaler noted that the average workers’ savings rates are painfully low. Many blame the low rate on high withholding taxes for Social Security and Medicare and a national proconsumer, antisaving mentality. But Thaler suggested that part of the problem is the way retirement programs are administered. Most corporations treat 401(k) plans as a voluntary program, and, as a result, only a third of their employees choose to sign up. He convinced five corporations in the Chicago area to adopt his SMART plan and have their employees enroll in an “automatic” investment 401(k) plan.

Thaler’s plan, developed with his collaborator Shlomo Benartzi of UCLA, is threefold: (1) employees are automatically invested in 401(k) plans unless they choose to opt out; (2) they commit to increasing their savings in the future, although most refused to commit to increasing their savings immediately; and (3) employees agree to automatically invest a portion of any pay increase in higher contributions to their 401(k) plans, without reducing their take-home pay.

From Reluctant to Enthusiastic Savers

Here were the results: Instead of 33 percent signing up (as they do in a typical corporate investment plan), 86 percent participated in 401(k) plans. In just 14 months from the time the SMART plan was instituted, the participants increased their savings rate from 3.5 percent to 9.4 percent, and after two more years they were saving 13.6 percent of their salary. Their savings rates nearly quadrupled! And this was from a group that had been reluctant savers.

Thaler’s SMART plan is simple, but effective. Having authored several investment books advocating “automatic investing” and dollar-costaveraging plans,10 I applaud Professor Thaler (and Professor Madrian) for taking the concept of automatic investing to a new level. It works on three levels to achieve high levels of saving over time: (1) it encourages high saving rates; (2) the saving rates tend to increase automatically ove...