![]()

1

Introduction

“Merger” is the consolidation of two firms that creates a new entity in the eyes of the law. The French have a good word for it: fusion—conveying the emergence of a new structure out of two old ones. An “acquisition” on the other hand, is simply a purchase.The distinction is important to lawyers, accountants, and tax specialists, but less so in terms of its economic impact. Businesspeople use the terms interchangeably. The acronym, “M&A,” stands for it all.

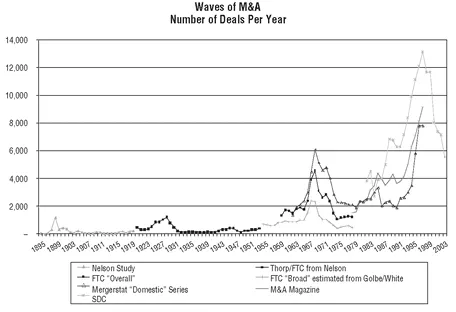

M&A enters and leaves the public mind with waves of activity, such as those depicted in Figure 1.1. These waves roughly synchronize with equity market conditions and thus carry with them the cachet of excess, hype, and passion that swirl in the booms. Over time, M&A activity radically transforms industries, typically shrinking the number of players, inflating the size of those who remain, and kindling anxieties about the power of corporations in society. Every M&A boom has a bust, typically spangled with a few spectacular collapses of merged firms. These failures significantly shape the public mind, and especially business strategies and public policy. We should study M&A failure not merely as a form of entertainment, but as a foundation for sensible policies and practices in future M&A waves.

Failure pervades business, and most firms fail eventually.Venture capitalists typically reject 90-95 percent of proposals they see. Up to 90 percent 1 of new businesses fail not long after founding. Even mature businesses pass on: Of the 501 firms listed on the New York Stock Exchange in 1925, only 13 percent existed in their independent corporate form in 2004. Within healthy growing businesses, failure is a constant companion. Most patented inventions fail to become commercial successes. Most new products fizzle out not long after the launch pad. Paradoxically, the success and renewal of capitalism depends on this enormous rate of failure, what the economist Joseph Schumpeter called the “perennial gale of creative destruction.” In the world of M&A, most transactions fail to close: That deal you may be discussing has perhaps a one-in-ten chance of consummation. And those transactions that do close, though profitable on average, tend to fall short of the most optimistic expectations.

Figure 1.1 M&A Activity by Year

Source: Author’s analysis with data from indicated sources.

Studying M&A failure offers titillating entertainment, worthy of Cosmopolitan , the National Enquirer, or Geraldo. However, it is also a springboard to business insight. All professions understand that the study of failure is the source of thoughtful advances. Medicine began with the study of pathology. Engineers study mechanical and structural failures. And psychologists study errors, anomalies, and biases in human behavior. At business schools, the study of cases considers successes and failures. To my knowledge, this book is the first focused study of failure in mergers and acquisitions.

Perhaps the chief insight of this book is that M&A failure is complicated, the result of a convergence of forces. But conventional thinking sees it differently, preferring quick and dismissive explanations arguing, for instance, that merger failure is due to some bad apples in the executive suite, nonobservance of one big Golden Rule (“They took their eye off the customer”), or some kind of industry hoo-doo curse (“Technology mergers have never ever worked”). While these may contain a nugget of reason, they are more remarkable for what they ignore than what they tell us. Most importantly, they are not terribly useful to guide the man or woman on the hot seat toward doing good business. Such bromides remind one of Woody Allen, who took a speed reading course and then read Tolstoy’s War and Peace. All Allen could say about the book was “It’s about Russia.”

I wrote this book to fill the gap in our understanding. It addresses four questions:

1. What is “merger failure”? How can we measure it?

2. How prevalent is failure among mergers and acquisitions?

3. What causes merger failure?

4. What are the implications of our answers for managers and policymakers?

OVERVIEW OF THE BOOK

I frame the response to these questions in the three parts of this book. Part I (chapters 2, 3, and 4) offers perspectives on merger failure from the standpoints of previous research. Chapter 2 summarizes what we know about merger failure and success based on more than 130 studies drawn from research in business and financial economics. The research shows that the field of M&A is highly segmented; there are attractive and unattractive neighborhoods. This is the foundation for my argument that all M&A is local. Chapter 3 offers a summary profile of the best and worst deals from 1985 to 2000. Chapter 4 gives a perspective on the processes of failure, drawn from analyses of real disasters and from concepts in a number of disciplines, including cognitive psychology, sociology, and engineering. Thus, Part I constructs a lens through which to view the causes of merger failure.

Part II lends texture to our understanding of M&A failure through 10 case studies of big M&A disasters. I have paired each of the 10 with a counterpoint or complementary case so that each chapter is actually a paired comparison of what can go wrong and how. The comparison cases are not intended to be deals from heaven; they merely differ in some instructive way. The comparisons suggest how little the situation must differ in order to deliver rather different results.

These 10 cases are not necessarily the worst in any absolute sense. However, judged on common standards there can be little disagreement that they belong on a short list of bad deals. One has a large pool of candidates from which to select. I chose these 10 for several reasons.

• Size of damage. Big bad deals certainly get one’s attention and have face validity. I looked for losses in the billions of dollars, for layoffs, CEO change, tarnished reputation, and possibly, bankruptcy.

• Diversity of industry, deal type, and challenges. I could fill a book of M&A disasters drawn from any one of a number of industries. However, as I argue here, industry conditions have a powerful effect on merger success and failure. Thus, diversity of settings sharpens our understanding about how industry has an impact and intrigues us with its local surprises.

• Access to information. In half of these cases, I was fortunate to find insiders or knowledgeable outside observers to interview and inform the discussion. However, most participants do not want to discuss their M&A failures. In five instances, I was able to tap valuable archives that lent some insight into senior management’s views. For the rest, I relied on a diverse collection of investigative journalism, security analysis, and open commentary. Regardless of sources of information, I aimed to bring a fresh lens through which to view these cases, informed by economics and a scientific mind-set.

I tried to avoid M&A disaster cases caused mainly by crimes, looting, fraud, and sabotage.These are more appropriate for a book on white-collar crime. Such cases are a small fraction of the larger sample of messes we can find and by their notoriety, tend to obscure more important lessons for CEOs and the public. Even so, criminal litigation followed two of the cases described here.

The research and framework from Part I and the case studies in Part II open the door to Part III. There I offer some summary implications for CEOs, investors, and those concerned with public policy.

This is an exercise in inductive research, the generation of a way of thinking about failure in M&A, drawn from a detailed look at the research and cases. These were all failures that could have been avoided or sharply mitigated. I hope to show why and how. The result is a volume that seeks to teach, rather than harangue, titillate the reader, or humiliate the protagonists. Where the facts do not fit with sympathetic explanations, I speak plainly; but generally, my bias is to view the challenges facing executives as extremely difficult, arenas in which scholars and the casual reader could easily have done worse. Other analysts may beg to differ on the interpretation of specific events in certain cases or of detailed points in the research stories summarized here.Yet such differences should not obscure the larger point that there are considerable similarities among merger failures and that such similarities lend insight into the causes of failure and the implications for managers.

OVERVIEW OF THE FINDINGS

The key message of this book is that mergers fail because of a “perfect storm” of factors that combine to destroy the new firm. This message invites consideration of the definition, frequency, profiles, and process of failure.

What Is Merger Failure?

The first question is definitional. Though “failure” is commonly understood, it has several differing applications. For instance, the

Oxford English Dictionary defines “failure” as:

1. A failing to occur, to be performed, or be produced; an omitting to perform something due or required; default . . . 2. The fact of becoming exhausted or running short, giving way under trial, breaking down in health, declining in strength or activity, etc. . . . 3. The fact of failing to effect one’s purpose; want of success . . . 4. The fact of failing in business; bankruptcy, insolvency . . .2

As the dictionary suggests, “failure” connotes both a process (“a failing to occur . . . omitting to perform . . . giving way . . . breaking down”) and an outcome (“fact of . . . want of,” and bankruptcy). In this book, I aim to discuss both process and outcome. My method is to begin with identifiable outcomes and induce from them some insights about process.

What, then, is the outcome of M&A failure? Consider at least these six dimensions:

1. Destruction of market value. Harnessing the perspective of the providers of capital, we measure the destruction of value by the percentage change in share values, net of changes in a benchmark, such as a large portfolio of stocks.

2. Financial instability. Some of the saddest M&A deals are those that, rather than making the buyer stronger, actually destabilize it. In most of these cases, the buyer overreaches its financial capacity. Degree of financial stability is reflected in debt ratings, earnings coverage ratios, probability of default, and other measures of the ability of the firm to bear risk.

3. Impaired strategic position. Many M&A transactions are motivated by a strategic purpose that seeks to improve the firm’s competitive position, acquire new capabilities, improve agility, or obtain resources that are vital to future prosperity. Indications of failure in this dimension would include loss of market share, and involuntary abandonment of products, geographic markets, or research and development (R&D) programs.

4. Organizational weakness. Knitting together two firms is especially challenging from an organizational perspective. Most CEOs would agree with the old slogan “People are our most important asset.” In essence, one could measure organizational strength in terms of depth of talent and leadership, effectiveness of business processes, and the transmission of culture and values. Adverse changes in human resources appear in unanticipated workforce layoffs, involuntary changes of leadership in senior management and the board, and defections of talented individuals to competitors.

5. Damaged reputation. The M&A deal should improve the reputation of the acquirer and its deal architects. Usually, the realization of these other aims will do just that. But one can imagine deals that depend on acrimony, subterfuge, and a win-lose mentality—in a world of repeated play, the executive must consider how these qualities might affect one’s M&A success in future deals. Measurable outcomes in this dimension would include changes in name recognition, reputation, analyst sentiment, and press coverage.

6. Violation of ethical norms and laws. You can gain financial, organizational, and strategic objectives in M&A, but in ways that violate norms such as equity, duty, honesty, and lawful observance. After the corporate scandals of recent years, any assessment of outcomes would be incomplete without consideration of laws and ethics. Adverse judgments in criminal and civil litigation would be a rough measure of M&A failure, though they usually follow an extended lapse in ethics.

I was influenced in my selection of the 10 case studies by all of these factors. However, some of these criteria are difficult or impossible to benchmark. As a result, the discussion that follows gives somewhat more attention (though not necessarily more weight) to the financial dimension.

How Prevalent Is M&A Failure?

M&A failures amount to a small percentage of the total volume of M&A activity. Investments through acquisition appear to pay about as well as other forms of corporate investment. The mass of research suggests that on average, buyers earn a reasonable return relative to their risks. M&A is no money-pump. But neither is it a loser’s game. Conventional wisdom seems to think otherwise, even though the empirical basis for such a view is scant.

Of more interest to the thoughtful practitioner is not the average result, but the distribution around it. The wide variation in findings about the profitability of M&A suggests that something may be going on to tilt the odds of success and failure. Chapter 2 identifies 18 neighborhoods or dimensions of the M&A market, along which returns to buyers vary significantly. For instance, acquisitions of public companies tend to be much less profitable to buyers than are acquisitions of privately held companies.

The existence of neighborhoods of return suggest that all M&A is local . That is, managerial choice can have a huge impact on the results of M&A: Quite simply, where you choose to do business will influence success or failure.

What Causes M&A Failure?

That M&A is loc...