![]()

CHAPTER 1

Introduction to Private Equity

DOUGLAS CUMMING

Associate Professor and Ontario Research Chair, York University, Schulich School of Business

INTRODUCTION

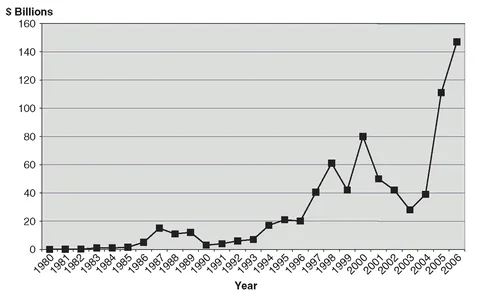

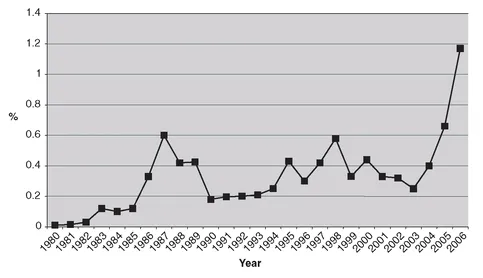

Private equity markets experienced a golden age up to the second quarter of 2007 (Shadab 2009). The massive amounts of capital flowing to private equity funds up to this period are highlighted on an absolute and relative basis in Exhibits 1.1 and 1.2, respectively. This rise of the private equity mark has been attributed to the superior governance model of private equity relative to the publicly traded corporation ( Jensen 1989), regulatory costs of being a publicly traded company (see more generally, e.g., Bushee and Leuz 2005), the comparatively low price of debt finance up to the second quarter of 2007 (Acharya et al. 2007; Kaplan 2007), the rise of the hedge funds (Acharya et al. 2007; Shadab 2007) and sovereign wealth funds (Fotak et al. 2008; Bortolotti et al. 2009), among other things.

The collapse in private equity since mid-2007 can be explained perhaps most directly by the collapse in credit markets and inability to effectively leverage private equity investments. Further, there are diseconomies of scale in managing private equity funds (Kanniainen and Keuschnigg 2003, 2004; Cumming 2006; Bernile et al. 2007; Cumming and Dai 2008; Cumming and Walz 2009; Lopez de Silances and Philappou 2009). Funds grew too large leading up to 2009, thereby leading to too much money chasing too few quality deals, inefficient due diligence, and too little value-added provided by fund managers. The crisis has brought on increasing calls for regulation of private equity funds (Cumming and Johan 2009), as well as hedge funds (Verret 2007; Cumming and Dai 2007, 2009) and sovereign wealth funds (Epstein and Rose 2009).

In the 1980s and 1990s, there was comparatively little academic work on private equity finance. This gap in the literature was largely attributable to a dearth of systematic private equity data. More recently, however, there has been a growing number of academics who have taken an interest in the topic and have collected systematic data for empirical studies both in the U.S. context and abroad. This empirical work has in turn inspired theoretical analyses of private equity finance. As of 2009 there are a significant number of academics who have contributed greatly to our understanding of private equity markets.

This book provides a comprehensive view of private equity by describing the current state of research to better understand the current state of the private equity market. The chapters herein discuss the structure of private equity funds and fund-raising, the structure of private equity investments with investees, financial and real returns to private equity, and international perspectives on private equity and the regulation of private equity markets. This book is organized into four parts that collectively cover each of these areas, as explained below. This brief introduction serves as a road map to the range of topic areas covered in this book.

Exhibit 1.1 Commitments to U.S. Private Equity Partnership, 1980-2006

Source: Acharya et al. (2007), Kaplan (2007), Venture Economics database.

Exhibit 1.2 Commitments to U.S. Private Equity Partnerships as a Fraction of Total Stock Market Capitalization, 1980-2006

Source: Acharya et al. (2007), Kaplan (2007), Venture Economics database.

Part One of this book covers the structure of private equity funds and fundraising. In Chapter 2, Grant Fleming analyzes institutional investment in private equity, including motivations for limited partnership private equity investment, strategies for achieving objectives and evidence on performance. Sridhar Gogineni and William Megginson in Chapter 3 analyze the recent phenomenon of the public listing of private equity funds, with funds like Blackstone selling equity in their fund on stock exchanges. In Chapter 4, Bastian Bergmann, Hans Christophers, Matthias Huss and Heinz Zimmermann provide a further analysis of the overall listed private equity market, with detailed statistical information on structure and performance.

Part Two of this book focuses on the structure of private equity investments with their investee firms. In Chapter 5, Andy Lockett, Miguel Meuleman, and Mike Wright describe the practice of syndication in the private equity industry. In Chapter 6, Gennaro Bernile, Douglas Cumming, and Evgeny Lyandres present theory and evidence on the structure of private equity fund portfolios, and the efficient size of private equity portfolios in terms of the number of investees per fund manager.1 Alternative forms of private equity investments have emerged in the twenty-first century, particularly a growing importance of PIPE (private investments in public equity) investments, which are examined in Chapter 7 by Na Dai. In Chapter 8, Cécile Carpentier and Jean-Marc Suret empirically analyze private placements in the Canadian market in view of the interesting lessons from the institutional setting in Canada. In Chapter 9 Stefano Gatti and Chiara Battistini explore the convergence of hedge fund and private equity investment activities, and provide an international context of this convergence in practice.

Part Three of this book considers both financial and real returns to private equity. The financial returns to private equity are difficult to measure, as private equity investments are held with the view towards capital gain, and it typically takes at least a few years before an exit event (such as an IPO, acquisition, secondary sale, buy-back or write-off) can come to fruition. Hence, private equity fund returns have a mix of exited and unexited investments at any given point in time. Simulated returns in private equity are studied in Chapter 10 by Axel Buchner, Philipp Krohmer, Daniel Schmidt, and Mark Wahrenburg. Value creation in buyout transactions are discussed in Chapter 11 by John Chapman and Peter Klein. In order to secure additional capital from their investors, private equity fund managers often exaggerate the value of their unexited portfolio. These and related issues in measuring the financial returns to private equity are discussed in Chapter 12 by Ludovic Phalippou.2 Oliver Gottschalg discusses appropriate things to consider for due diligence when selecting private equity funds in Chapter 13. But returns to private equity are not just about financial rewards; that is, private equity may also significantly influence the value of investee companies in terms of the productivity (as discussed in Chapter 14 by Don Siegel) and employment (as discussed in Chapter 15 by Robert Cressy).

Part Four of this book provides analyses of international differences in private equity markets, many of which are attributable to legal and regulatory factors. In Chapter 16 Douglas Cumming, Andrej Gill, and Uwe Walz describe a need for the role of regulation in curbing overreporting behavior by private equity funds in terms of inflating unexited returns that are reported to institutional investors. Joe McCahery and Eric Vermeulen discuss further reporting standards and other methods to regulate private equity funds. International private equity flows are studies in Chapter 18 by Sophie Manigart, Sofie De Prijcker, and Bivas Bose. Alexander Groh provides empirical evidence on private equity in emerging markets in Chapter 19. Laura Bottazzi considers private equity developments in Europe in Chapter 20. Specific country studies on private equity in Europe are provided by Simona Zambelli for Italy (Chapter 21), Wolfgang Bessler, Julian Holler, and Martin Seim for Germany (Chapter 22), Morten Bennedsen, Kasper Meisner Nielsen, Søren Bo Nielsen, and Steen Thomsen for Denmark (Chapter 23). Finally, Canada’s experience with regulation and phasing out inefficient legislation in recent years is empirically examined by Douglas Cumming and Sofia Johan in Chapter 24.

Specific features of earlier stage venture capital deals are not the focus of this volume, but are examined in detail in the Companion to Venture Capital, a related volume published by John Wiley & Sons in the Companion to Finance Series. There are various other topics related to private equity and other authors have made important contributions, many of which are highlighted in each of the chapters herein. Areas where further research is needed are likewise highlighted in each chapter. In view of the empirically documented importance of private equity as an efficient governance model, we hope and expect private equity research will help guide the theoretical understanding and practical implementation among students, academics, practitioners, and policymakers alike. The contributions in each of the chapters in the Companion to Private Equity likewise provide insights into the current state of the market and how the market is likely to evolve over coming years in terms of fund structures, fund-raising, investment structures, financial and real returns, and regulation.

NOTES

1 For related work see Kanniainen and Keuschnigg (2003, 2004) and Keuschnigg (2004).

2 See also Cumming and Walz (2009), Phalippou and Zullo (2005), and Lopez-de-Silanes and Phalippou (2009).

REFERENCES

Acharya, Viral V., Julian Franks, and Henri Servaes. 2007. Private equity: Boom and bust? Journal of Applied Corporate Finance 19:1-10.

Bernile, Gennaro, Douglas J. Cumming, and Evgeny Lyandres. 2007. The size of venture capital and private equity fund portfolios. Journal of Corporate Finance 13:564-590.

Bortolotti, Bernardo, Veljko Fotak, and William L. Megginson. 2009. Sovereign wealth fund investment patterns and performance. Available at SSRN: ssrn.com/abstract=1364926.

Bushee, Brian J., and Christian Leuz. 2005. Economic consequences of SEC disclosure regulation: Evidence from the OTC bulletin board. Journal of Accounting and Economics 39 (2): 233-264.

Cumming, Douglas J. 2006. The determinants of venture capital portfolio size: Empirical evidence. Journal of Business 79:1083-1126.

Cumming, Douglas J., and Na Dai. 2007. A law and finance analysis of hedge funds. Financial Management, forthcoming. Available at SSRN: ssrn.com/abstract=946298.

Cumming, Douglas J., and Na Dai, 2008. Fund size and valuation. Available at SSRN: ssrn.com/abstract=1099465.

Cumming, Douglas J., and Na Dai. 2009. Capital flows and hedge fund regulation. Journal of Empirical Legal Studies, forthcoming.

Cumming, Douglas J., and Sofia A. Johan. 2009. Venture capital and private equity contracting: An international perspective. Amsterdam: Elsevier Science Academic Press.

Cumming, Douglas J., and Uwe Walz. 2009. Private equity returns and disclosure around the world. Journal of International Business Studies, forthcoming (formerly, Center for Financial Studies Working Paper 2004, presented at the European Finance Association Annual Conference 2004.) Available at SSRN: ssrn.com/abstract=1370726.

Epstein, Richard A., and Amanda M. Rose. 2009. The regulation of sovereign wealth funds: The virtues of going slow. University of Chicago Law Review 76:111-134.

Fotak, Veljko, Bernardo Bortolotti, and William L. Megginson. 2008. The financial impact of sovereign wealth fund investments in listed companies. Available at SSRN: ssrn.com/abstract=1108585.

Jensen, Michael. 1989. The eclipse of the publicly held corporation. Harvard Business Review 67:61-74.

Kanniainen, Vesa, and Christian Keuschnigg. 2003. The optimal portfolio of start-up firms in venture capital finance. Journal of Corporate Finance 9:521-534.

Kanniainen, Vesa, and Christian Keuschnigg. 2004. Start-up investment with scarce venture capital support. Journal of Banking and Finance 28:1935-1959.

Kaplan, Steven N. 2007. Private equity: Past, present and future. Paper presented at the American Enterprise Institute, Washington D.C., November.

Keuschnigg, Christian. 2004. Taxation of a venture capitalist with a portfolio of firms. Oxford Economic Papers 56:285-306.

Lopez-de-Silanes, Florencio, and Ludovic Phalippou. 2009. Private equity investments: Performance and diseconomies of scale. Available at SSRN: ssrn.com/abstract=1344298.

Phalippou, Ludovic, and Mario Zullo. 2005. Performance of private equity funds: Another puzzle? University of Amsterdam and INSEAD Working Paper, presented at the European Finance Association Annual Conference, 2005.

Shadab, Houman B. 2009. Coming together after the crisis: The global convergence of Private Equity and Hedge Funds. Northwestern Journal of International Law and Business 29:603-616.

Verret, Jay W. 2007. Dr. Jones and the raiders of lost capital: Hedge fund regulation, Part II, a self-regulation proposal. Delaware Journal of Corporate Law 32:799-8...