![]()

PART One

Introduction to the Practical Application of Behavioral Finance

![]()

CHAPTER 1

What Is Behavioral Finance?

People in standard finance are rational. People in behavioral finance are normal.

—Meir Statman, Ph.D., Santa Clara University

To those for whom the role of psychology in finance is self-evident, both as an influence on securities markets fluctuations and as a force guiding individual investors, it is hard to believe that there is actually a debate about the relevance of behavioral finance. Yet many academics and practitioners, residing in the “standard finance” camp, are not convinced that the effects of human emotions and cognitive errors on financial decisions merit a unique category of study. Behavioral finance adherents, however, are 100 percent convinced that an awareness of pertinent psychological biases is crucial to finding success in the investment arena and that such biases warrant rigorous study.

This chapter begins with a review of the prominent researchers in the field of behavioral finance, all of whom support the notion of a distinct behavioral finance discipline, and then reviews the key drivers of the debate between standard finance and behavioral finance. By doing so, a common understanding can be established regarding what is meant by behavioral finance, which leads to an understanding of the use of this term as it applies directly to the practice of wealth management. This chapter finishes with a summary of the role of behavioral finance in dealing with private clients and how the practical application of behavioral finance can enhance an advisory relationship.

BEHAVIORAL FINANCE: THE BIG PICTURE

Behavioral finance, commonly defined as the application of psychology to finance, has become a very hot topic, generating new credence with the rupture of the tech-stock bubble in March of 2000. While the term behavioral finance is bandied about in books, magazine articles, and investment papers, many people lack a firm understanding of the concepts behind behavioral finance. Additional confusion may arise from a proliferation of topics resembling behavioral finance, at least in name, including behavioral science, investor psychology, cognitive psychology, behavioral economics, experimental economics, and cognitive science. Furthermore, many investor psychology books that have entered the market recently refer to various aspects of behavioral finance but fail to fully define it. This section will try to communicate a more detailed understanding of behavioral finance. First, we will discuss some of the popular authors in the field and review the outstanding work they have done (not an exhaustive list), which will provide a broad overview of the subject. We will then examine the two primary subtopics in behavioral finance: Behavioral Finance Micro and Behavioral Finance Macro. Finally, we will observe the ways in which behavioral finance applies specifically to wealth management, the focus of this book.

Key Figures in the Field

In the past 10 years, some very thoughtful people have contributed exceptionally brilliant work to the field of behavioral finance. Some readers may be familiar with the work Irrational Exuberance, by Yale University professor Robert Shiller, Ph.D. Certainly, the title resonates; it is a reference to a now-famous admonition by Federal Reserve chairman Alan Greenspan during his remarks at the Annual Dinner and Francis Boyer Lecture of the American Enterprise Institute for Public Policy Research in Washington, D.C., on December 5, 1996. In his speech, Greenspan acknowledged that the ongoing economic growth spurt had been accompanied by low inflation, generally an indicator of stability. “But,” he posed, “how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?”1 In Shiller’s Irratonal Exuberance, which hit bookstores only days before the 1990s market peaked, Professor Shiller warned investors that stock prices, by various historical measures, had climbed too high. He cautioned that the “public may be very disappointed with the performance of the stock market in coming years.”2 It was reported that Shiller’s editor at Princeton University Press rushed the book to print, perhaps fearing a market crash and wanting to warn investors. Sadly, however, few heeded the alarm. Mr. Greenspan’s prediction came true, and the bubble burst. Though the correction came later than the Fed chairman had foreseen, the damage did not match the aftermath of the collapse of the Japanese asset price bubble (the specter Greenspan raised in his speech).

Another high-profile behavioral finance proponent, Professor Richard Thaler, Ph.D., of the University of Chicago Graduate School of Business, penned a classic commentary with Owen Lamont entitled “Can the Market Add and Subtract? Mispricing in Tech Stock Carve-Outs,”3 also on the general topic of irrational investor behavior set amid the tech bubble. The work related to 3Com Corporation’s 1999 spin-off of Palm, Inc. It argued that if investor behavior was indeed rational, then 3Com would have sustained a positive market value for a few months after the Palm spin-off. In actuality, after 3Com distributed shares of Palm to shareholders in March 2000, Palm traded at levels exceeding the inherent value of the shares of the original company. “This would not happen in a rational world,” Thaler noted. (Professor Thaler is the editor of Advances in Behavioral Finance, which was published in 1993.)

One of the leading authorities on behavioral finance is Professor Hersh Shefrin, Ph.D., a professor of finance at the Leavey School of Business at Santa Clara University in Santa Clara, California. Professor Shefrin’s highly successful book Beyond Greed and Fear: Understanding Behavioral Finance and the Psychology of Investing (Harvard Business School Press, 2000), also forecast the demise of the asset bubble. Shefrin argued that investors have weighed positive aspects of past events with inappropriate emphasis relative to negative events. He observed that this has created excess optimism in the markets. For Shefrin, the meltdown in 2000 was clearly in the cards. Professor Shefrin is also the author of many additional articles and papers that have contributed significantly to the field of behavioral finance.

Two more academics, Andrei Shleifer, Ph.D., of Harvard University, and Meir Statman, Ph.D., of the Leavey School of Business, Santa Clara University, have also made significant contributions. Professor Shleifer published an excellent book entitled Inefficient Markets: An Introduction to Behavioral Finance (Oxford University Press, 2000), which is a mustread for those interested specifically in the efficient market debate. Statman has authored many significant works in the field of behavioral finance, including an early paper entitled “Behavioral Finance: Past Battles and Future Engagements,”4 which is regarded as another classic in behavioral finance research. His research posed decisive questions: What are the cognitive errors and emotions that influence investors? What are investor aspirations? How can financial advisors and plan sponsors help investors? What is the nature of risk and regret? How do investors form portfolios? How important are tactical asset allocation and strategic asset allocation? What determines stock returns? What are the effects of sentiment? Statman produces insightful answers on all of these points. Professor Statman has won the William F. Sharpe Best Paper Award, a Bernstein Fabozzi/Jacobs Levy Outstanding Article Award, and two Graham and Dodd Awards of Excellence.

Perhaps the greatest realization of behavioral finance as a unique academic and professional discipline is found in the work of Daniel Kahneman and Vernon Smith, who shared the Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel 2002. The Nobel Prize organization honored Kahneman for “having integrated insights from psychological research into economic science, especially concerning human judgment and decision-making under uncertainty.” Smith similarly “established laboratory experiments as a tool in empirical economic analysis, especially in the study of alternative market mechanisms,” garnering the recognition of the committee.5

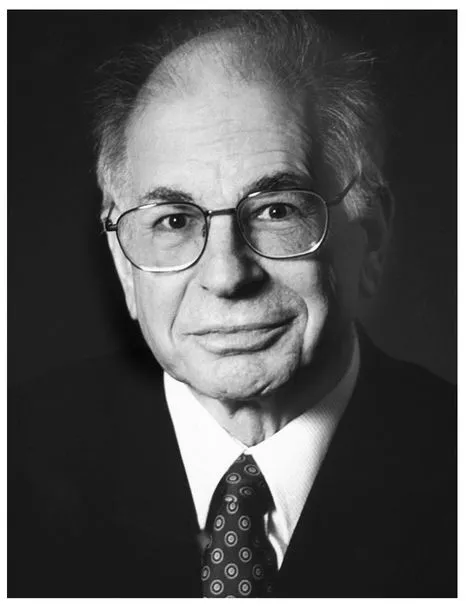

Professor Kahneman (Figure 1.1) found that under conditions of uncertainty, human decisions systematically depart from those predicted by standard economic theory. Kahneman, together with Amos Tversky (deceased in 1996), formulated prospect theory. An alternative to standard models, prospect theory provides a better account for observed behavior and is discussed at length in later chapters. Kahneman also discovered that human judgment may take heuristic shortcuts that systematically diverge from basic principles of probability. His work has inspired a new generation of research employing insights from cognitive psychology to enrich financial and economic models.

FIGURE 1.1 Daniel Kahneman

Prize winner in Economic Sciences 2002. © The Nobel Foundation

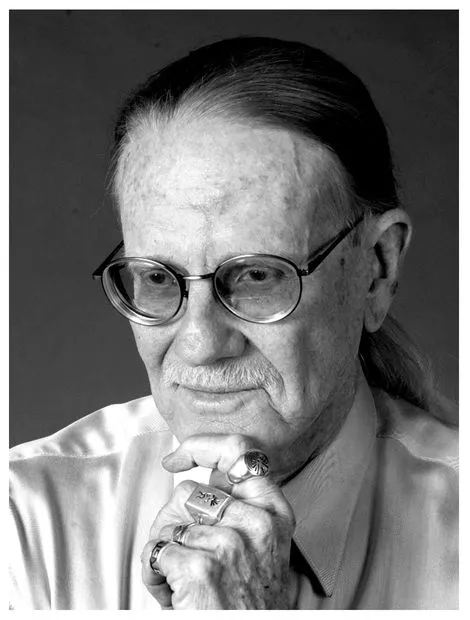

Vernon Smith (Figure 1.2) is known for developing standards for laboratory methodology that constitute the foundation for experimental economics. In his own experimental work, he demonstrated the importance of alternative market institutions, for example, the rationale by which a seller’s expected revenue depends on the auction technique in use. Smith also performed “wind-tunnel tests” to estimate the implications of alternative market configurations before such conditions are implemented in practice. The deregulation of electricity markets, for example, was one scenario that Smith was able to model in advance. Smith’s work has been instrumental in establishing experiments as an essential tool in empirical economic analysis.

FIGURE 1.2 Vernon L. Smith

Prize winner in Economic Sciences 2002. © The Nobel Foundation.

Behavioral Finance Micro versus Behavioral Finance Macro

As we have observed, behavioral finance models and interprets phenomena ranging from individual investor conduct to market-level outcomes. Therefore, it is a difficult subject to define. For practitioners and investors reading this book, this is a major problem, because our goal is to develop a common vocabulary so that we can apply to our benefit the very valuable body of behavioral finance knowledge. For purposes of this book, we adopt an approach favored by traditional economics textbooks; we break our topic down into two subtopics: Behavioral Finance Micro and Behavioral Finance Macro.

1. Behavioral Finance Micro (BFMI) examines behaviors or biases of individual investors that distinguish them from the rational actors envisioned in classical economic theory.

2. Behavioral Finance Macro (BFMA) detects and describe anomalies in the efficient market hypothesis that behavioral models may explain.

As wealth management practitioners and investors, our primary focus will be BFMI, the study of individual investor behavior. Specifically, we want to identify relevant psychological biases and investigate their influence on asset allocation decisions so that we can manage the effects of those biases on the investment process.

Each of the two subtopics of behavioral finance corresponds to a distinct set of issues within the standard finance versus behavioral finance discussion. With regard to BFMA, the debate asks: Are markets “efficient,” or are they subject to behavioral effects? With regard to BFMI, the debate asks: Are individual investors perfectly rational, or can cognitive and emotional errors impact their financial decisions? These questions are examined in the next section of this chapter; but to set the stage for the discussion, it is critical to understand that much of economic and financial theory is based on the notion that individuals act rationally and consider all available information in the decision-making process. In academic studies, researchers have documented abundant evidence of irrational behavior and repeated errors in judgment by adult human subjects.

Finally, one last thought before moving on. It should be noted that there is an entire body of information available on what the popular press has termed “the psychology of money.” This subject involves individuals’ relationship with money—how they spend it, how they feel about it, and how they use it. There are many useful books in this area; however, this book will not focus on these topics.

THE TWO GREAT DEBATES OF STANDARD FINANCE VERSUS BEHAVIORAL FINANCE

This section reviews the two basic concepts in standard finance that behavioral finance disputes: rational markets and rational economic man. It also covers the basis on which behavioral finance proponents challenge each tenet and discusses some evidence that has emerged in favor of the behavioral approach.

Overview

On Monday, October 18, 2004, a very significant article appeared in the Wall Street Journal. Eugene Fama, one of the pillars of the efficient market school of financial thought, was cited admitting that stock prices could become “somewhat irrational.”6 Imagine a renowned and rabid Boston Red Sox fan proposing that Fenway Park be renamed Steinbrenner Stadium (after the colorful New York Yankees owner), and you may begin to grasp the gravity of Fama’s concession. The development raised eyebrows and pleased many behavioralists. (Fama’s paper “Market Efficiency, Long-Term Returns, and Behavioral Finance” noting this concession at the Social Science Research Network is one of the most popular inves...