- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Wills, Probate, and Inheritance Tax For Dummies, UK Edition

About this book

Planning how to pass your estate on doesn't have to mean complications, legal jargon and huge bills. Wills, Probate and Inheritance Tax For Dummies, 2nd Edition takes you through the process step-by-step and gives you all the information you need to ensure that your affairs are left in good order. It shows you how to plan and write your will, minimise the stress of probate, and ensure that your nearest and dearest are protected from a large inheritance tax bill.

Discover how to:

- Decide if a will is right for you

- Value your assets

- Leave your home through a will

- Appoint executors and trustees

- Choose beneficiaries

- Draw up a DIY will

- Work out how inheritance tax works and if you're liable to it

- Find out what can and can't be taxed

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Part I

Planning Your Will

In this part . . .

B efore putting pen to paper you have to put in the groundwork. First up you have to work out what your estate – everything you own – is worth. You then have to put together a clear picture in your own mind of who you want to inherit your pot of gold. As for your biggest asset – the family home – I show you the tactics you can use to make sure this passes intact to your loved ones when you die. If you want the reassurance of using a solicitor, accountant, or financial adviser to draw up your estate plans, check out this part because I show you how to spot duffers from the able and committed.

Whatever your will plans, you’ll need the help of family and friends to make it happen. This part shows you what to look for in will executors, trustees, guardians, and witnesses.

If you’re embarking on the estate planning journey and want to know how to prepare properly, this is the part for you.

Chapter 1

Preparing for the Inevitable

In This Chapter

Are you a wise owl or a head-burying ostrich when it comes to the dreaded d-word?

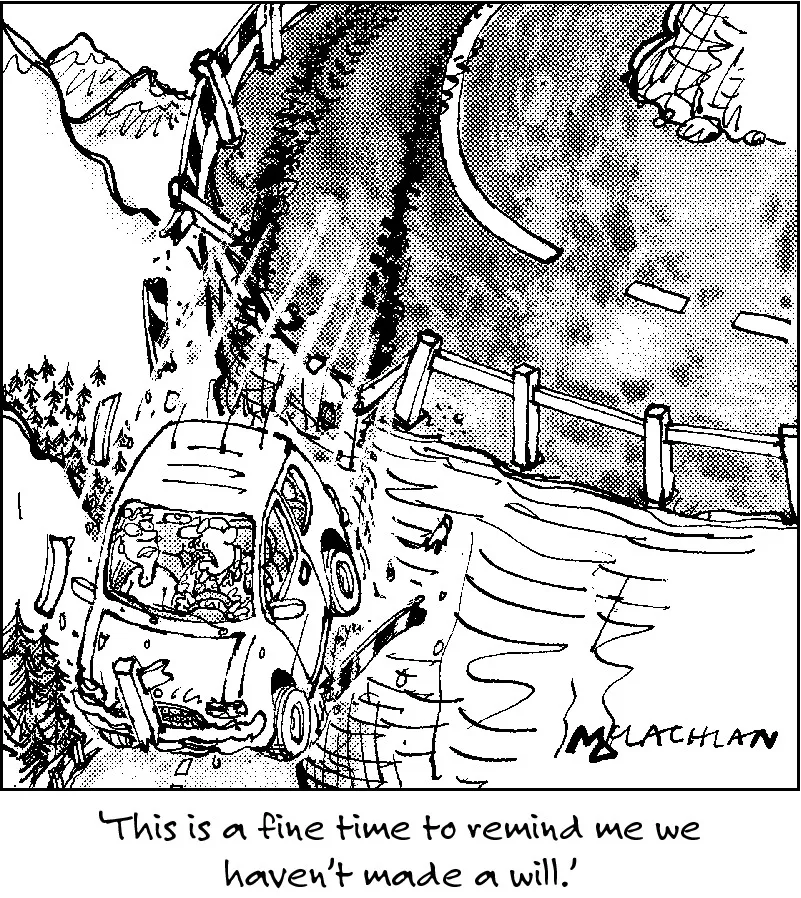

If you’re an ostrich, you prefer not to think about the inevitable. Being an ostrich means trusting the fortunes of your loved ones to chance once you’ve gone, and having no control over what happens to your possessions and who should benefit from them. To an ostrich, death is five letters, one syllable, and a load of stigma.

If, however, you’re a wise owl, you take the time to think, question, and act in order to write a will, and take tax-saving steps to protect your loved ones when you’re gone.

I’m betting that as you’ve picked up this book you’ve had enough of the ostrich lifestyle and want to be a wise owl instead! So don’t be squeamish – this book has lots of examples of things that can happen when you’re no longer around, so grit your teeth and bear it! I’m going to be talking about your death – yes, yours – so no hiding behind the sofa; it’s time to look the grim reaper squarely in the scythe and make proper plans for the inevitable.

In this chapter, I look at the basics of what should make up a bang-on strategy to protect your loved ones and frustrate the tax-collector.

Recognising the Advantages of Putting Your Estate in Order

A particular life event – a wedding, the birth of a child, or a health scare – can prompt you to start thinking about planning for the inevitable. Alternatively, you may just have a general feeling that it’s time to stop putting off writing down your big plan.

Oddly, people spend days choosing everyday items such as cars, kitchens, or just the right colour scheme for the downstairs loo, but won’t spend a few hours – and that’s all it has to take – drawing up a will and getting their bits and pieces into tax-saving shape to save their loved ones a mountain of heartache.

Whether you’re in your twenties and have just got your foot on the property ladder, or you’re an octogenarian with a gaggle of grandchildren around you, making a will and tax planning have huge benefits. The benefits include:

-plgo-compressed.webp)

Understanding what happens if you don’t plan

Sorry to bring the tone down – this is a book about death and taxes, after all – but think about the situation if you were to die next week, tomorrow, or even right now! What state would your financial affairs be in? Most people would answer: A bit of a mess.

More than half the UK population dies without making a will, and an even higher percentage make no tax-saving plans during their lifetimes. The tax-collector loves these people because they leave their estates wide open for a tax grab. However, the family left behind is probably less pleased at the lack of forward planning.

What’s more, the tax-collector doesn’t hang around, but, in most cases, demands IHT before the deceased’s assets can be sold. As a result, the deceased’s nearest and dearest sometimes need to borrow money to pay the tax. Just a small planning step like buying a life insurance policy to cover any IHT bill can save loved ones a great deal of hassle and heartache at what is likely to be a very difficult time.

Making plans for the inevitable makes you, as Yogi Bear was fond of saying, ‘smarter than the average bear’. Your plans may take the form of a full-blown will with lots of tax-saving steps built in, or you may simply decide to talk to those around you and sort out your paperwork, making it easier for those who have to cope when yo...

Table of contents

- Title

- Contents

- Introduction

- Part I : Planning Your Will

- Part II : Writing Your Will

- Part III : Managing Probate

- Part IV : Taxing Times: Inheritance Planning

- Part V : The Part of Tens

- : Further Reading

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Wills, Probate, and Inheritance Tax For Dummies, UK Edition by Julian Knight in PDF and/or ePUB format, as well as other popular books in Law & Civil Law. We have over one million books available in our catalogue for you to explore.