eBook - ePub

Getting a Job in Private Equity

Behind the Scenes Insight into How Private Equity Funds Hire

Brian Korb, Aaron Finkel

This is a test

Share book

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Getting a Job in Private Equity

Behind the Scenes Insight into How Private Equity Funds Hire

Brian Korb, Aaron Finkel

Book details

Book preview

Table of contents

Citations

About This Book

If you're seriously considering a career in private equity, you have to become familiar with how firms hire. With Getting a Job in Private Equity, you'll gain invaluable insights that will allow you to stay one step ahead of other individuals looking to secure a position in this field. Here, you'll discover what it takes to make it in PE from different entry points, what experience is needed to set yourself up for a position, and what can be done to improve your chances of landing one of these limited opportunities.

Frequently asked questions

How do I cancel my subscription?

Can/how do I download books?

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

What is the difference between the pricing plans?

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

What is Perlego?

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Do you support text-to-speech?

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Is Getting a Job in Private Equity an online PDF/ePUB?

Yes, you can access Getting a Job in Private Equity by Brian Korb, Aaron Finkel in PDF and/or ePUB format, as well as other popular books in Business & Private Equity. We have over one million books available in our catalogue for you to explore.

Chapter I

GETTING STARTED

The private equity market has gone through a major transformation over the past two decades, with many of the most dramatic changes occurring over the past few years. As you are likely aware, you are attempting to enter one of the highest profile sectors of the financial markets—one that is wielding significant influence on the economy while at the same time creating great wealth for its investors. The wealth that has been amassed has played a significant role in increasing the attractiveness of the sector and thereby further fueling the competitive environment to enter. This chapter begins with a brief overview of the current state of the private equity market giving particular attention to how recent changes have affected hiring. It also provides a basic introduction to private equity.

THE MARKET TODAY

Notwithstanding the 2008 credit crunch and general market turbulence, it’s safe to say that today’s private equity (PE) industry is still a major force in the financial world and that it bears little resemblance to the fledgling market of nearly 30 years ago when there were just a few practitioners. Perhaps nowhere is the magnitude of the industry more apparent than in the size of today’s buyout funds. In 1980, Kohlberg Kravis Roberts & Co. (KKR) ran the world’s largest buyout fund at $135 million. In today’s buyout world, in which firms compete to one-up each other, $1 billion funds are commonplace and the $20 billion barrier has been broken.

The clout of individual PE firms was pointed out in more detail in a November 2004 article in the Economist titled “The New Kings of Capitalism.” The article pointed out that The Blackstone Group alone had equity stakes in about 40 portfolio companies which, combined, had over 300,000 employees and annual revenue of more than $50 billion. If they were a single unit, the holdings would have made Blackstone one of the top 20 Fortune 500 firms.

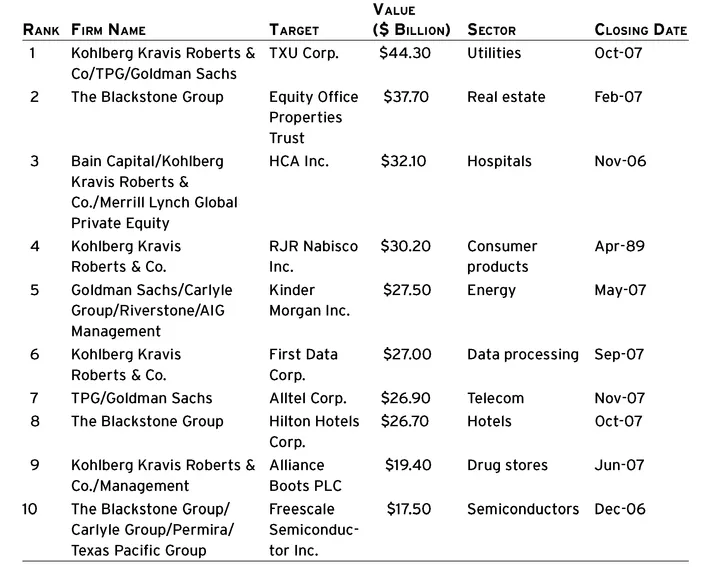

In the same article, the Economist noted that in 2004, Texas Pacific Group’s portfolio companies had over 255,000 employees and revenue of $41 billion, while The Carlyle Group’s portfolio companies had 150,000 employees and revenue of $31 billion. With their recent deals, the portfolios of Blackstone, Texas Pacific Group (TPG), and Carlyle are even bigger and, along with Apollo Advisors LP, Bain Capital, Kohlberg Kravis Roberts & Co. (KKR), Warburg Pincus LLC, and others, are part of an elite group of funds that oversee billions of dollars of capital. Table 1.1 lists the largest PE-backed leveraged buyouts (LBOs) ever, in which many of these firms were participants. These funds are pioneers of the industry, and anyone looking to break into private equity must be familiar with them and the impact they have on the market. Many of these large funds have also diversified their activities. In addition to its LBO funds, Blackstone manages mezzanine, real estate, hedge funds, and private equity fund of funds. Carlyle runs leveraged finance, buyout, venture and growth capital, and real estate funds.

Table 1.1 Ten Largest Closed PE-Backed LBOs

Source: Thomson Financial’s Buyouts magazine. Data accurate as of December 31, 2007

Private equity’s higher profile has also put the industry under an additional spotlight—that of government regulators which have been scrutinizing tax issues, governance, and reporting, among other things. Although the large funds get a lot of attention, there are still many smaller PE funds impacting the market, and it is not uncommon to find one run by just a handful of investment professionals that are successful in their own right.

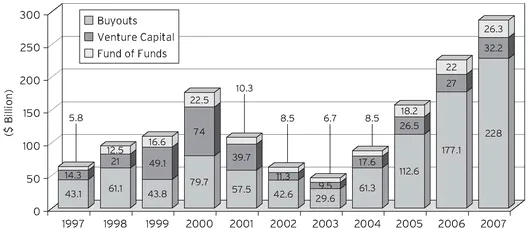

Despite the slowdown of 2008, the private equity market remains stronger by many measures than it has ever been. Indeed, up until 2008, the industry was enjoying one of its most dynamic periods, with unprecedented growth in assets and a surge in overall prominence; 2007 was a banner year, with U.S. buyout funds raising a record $228 billion, 29 percent more than the previous mark of $177.1 billion set in 2006, according to Private Equity Analyst data. Venture capital and fund of funds have also been attracting new money. In 2007 firms in those two asset classes brought in $32.2 billion and $26.3 billion, respectively, representing increases of 19 percent and 20 percent over 2006. Figure 1.1 presents a breakdown of annual fund-raising by buyout, venture capital (VC) and fund of funds.

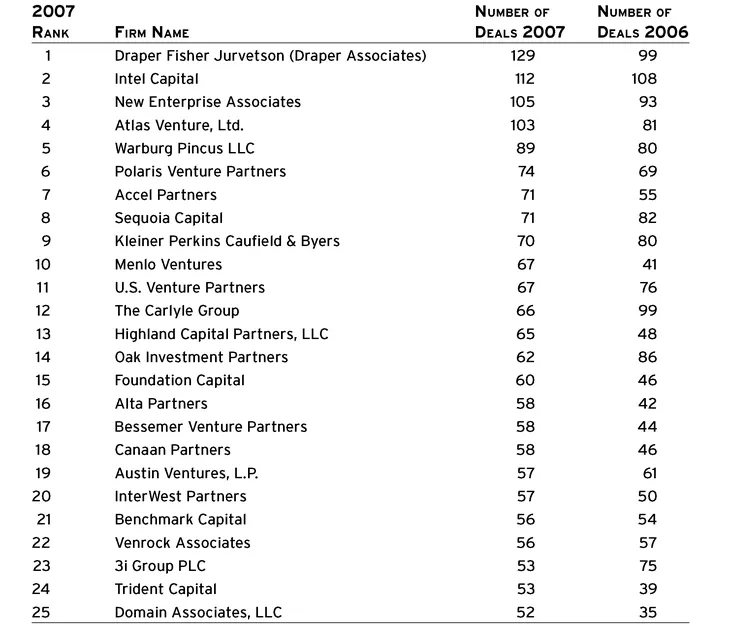

Another indication of the prominence of the private equity industry is the well-known business leaders, celebrities, and former politicians who have joined its ranks, including Jack Welch (Clayton, Dubilier & Rice), Lou Gerstner and Arthur Levitt (Carlyle), the U2 rocker Bono (Elevation Partners), former senator Bill Frist (Cressey & Company), and former U.S. Treasury Secretary Paul O’Neill (Blackstone). Al Gore is also a partner at venture capital firm Kleiner Perkins Caufield & Byers. Table 1.2 lists the most active VC investors of 2007.

Figure 1.1 Private Equity Fund-Raising, 1997-2007

Source: Private Equity Analyst

Table 1.2 Top 25 Most Active Venture Capital Investors of 2007

Source: Thomson Financial’s Venture Capital Journal

A Global Market

Over the past several years the private equity market has continued to grow into a global industry, both in terms of where funds are investing and in the profile of the Limited Partners (LPs). Pools of capital have also become more sophisticated, with PE firms adding new asset classes to their stable of investment vehicles (some added fixed-income, hedge fund, and other products). Underscoring the maturation of the industry, one firm (Blackstone) led a groundbreaking initial public offering and others are expected to follow suit.

There are large global firms that oversee investments in many different countries, and major firms such as Advent International, Apax Partners, Bain Capital, Blackstone, Carlyle, KKR, TPG, and Warburg have offices outside of the United States to monitor those investments and to source new ones. While companies in China and India continue to attract significant interest, funds are also investing in companies in other emerging regions including Eastern Europe (specifically Russia), other areas of Asia (Vietnam has seen strong growth), the Middle East and Latin America (Brazil, in particular). Many well-known firms have launched new funds specifically to invest in many of these countries.

Sovereign investment funds, which invest the capital of non-U.S. governments, are expected to continue to invest in U.S.-based private equity funds as they look for higher rates of return than can typically be made by investing directly in stocks and bonds. One noteworthy example is GIC Special Investments, which manages private equity investments for the government of Singapore and has been a longtime investor in KKR. In fact, a report by McKinsey & Co. estimated that through 2012, sovereign funds in oil-exporting countries alone would invest about $300 billion in alternative assets, a figure that is about equal to the amount raised by all U.S. PE firms in 2007, according to PE Analyst. The same McKinsey report notes that the Abu Dhabi Investment Authority earmarks 10 percent of its $875 billion for private equity. In addition to being investors, some sovereign funds have become owners of PE funds. Most notably, the China Investment Corp. paid $3 billion for a 10 percent stake in Blackstone, the Mubadala Development Corp. (Abu Dhabi) paid $1.35 billion for a 7.5 percent piece of the Carlyle Group, and the Abu Dhabi Investment Authority bought 9 percent of Apollo Management LP.

Not to be outdone by their foreign counterparts, U.S. institutions are still major players, with the California Public Employees’ Retirement System (CalPERs) and the California State Teacher’s Retirement System (CalSTRS) being two of the largest. As of February 29, 2008, CalPERs had $241.7 billion in assets, of which $22.8 billion was in private equity, while CalSTRS had committed $12.7 billion of its $171.9 billion to PE. Other major investors include the Canada Pension Plan Investment Board, the New Mexico Public Employees’ Retirement Fund, the New York State Teachers’ Retirement System, the Oregon Investment Council, the Pennsylvania State Employees’ Retirement System, Teachers’ Retirement System of Illinois, the Teacher Retirement System of Texas, and the Washington State Investment Board. University endowments, including those run by Harvard and Yale, have been consistent investors in PE funds. Newcomers such as the Kentucky Retirement Systems and the New Jersey State Investment Council made recent investments.

Employment Scene

It’s not surprising that as the size and scope of private equity funds have expanded over the years, so, too, have their hiring habits. Although we’ve seen some effects from recent market turbulence, the pace of hiring and the corresponding demand for highly capable professionals remains strong. In any given year, we continue to see many firms bringing on multiple new hires.

As recruiters, we analyze the hiring market in terms of supply and demand—the supply of candidates looking for jobs versus the demand from firms looking to hire. Although in private equity the demand never technically exceeds the supply (meaning there are always more qualified candidates seeking positions), on an absolute basis there are more positions available in the past few years than ever before. And even on a relative basis, the competitive environment has shown improvement, particularly for pre-MBAs finishing their investment banking and consulting programs and for graduating MBAs. A lot of the improvement is due to the spectacular fund-raising in 2006 and 2007, which, has led to the need for more investment professionals to help put the money to work.

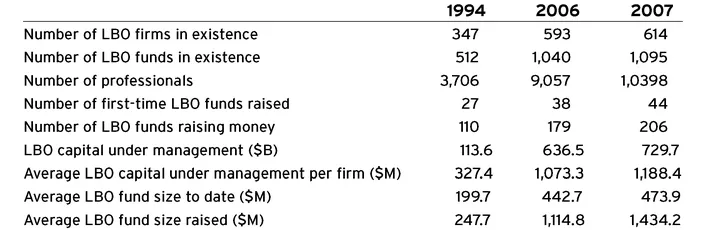

Looking at how the private equity market has evolved over the past decade gives further evidence that the overall hiring has not matched one-for-one the capital that has been raised. Table 1.3 shows that over the past 13 years the amount of capital under management has increased by more than six times, the number of professionals working in the industry has nearly tripled, and thus the amount of capital per professional has increased over time (it would be incorrect to conclude that the industry is severely understaffed, but it probably means there is some room for growth). In terms of geography, New York City is far and away home to the largest private equity workforce, according to the 2008 Global Private Equity Review published by Private Equity Intelligence. Following New York are London and the San Francisco Bay area. The top 10 cities for private equity employment account for nearly half of the global total, with Boston, Chicago, Los Angeles, Dallas, Paris, Stockholm, and Tokyo rounding out the list.

Some of the most notable changes to the private equity hiring market are being driven by the tactics of the mega-funds (those funds with several billion dollars in assets under management). Over the past few years the number of mega-funds has increased significantly, which means that as a group they have an even greater impact on the hiring behavior and compensation structures of most other funds, regardless of their size, geographic location, and/or the stage of a company in which they invest. By virtue of their size the mega-funds need more junior investment professionals. Each year they set the tone for hiring by beginning their annual recruiting earlier than most other funds and offering higher compensation packages. Over the past few years, hedge funds have also emerged as a force to be reckoned with. In spite of the recent market turbulence, hedge funds have grown into an asset class that increasingly competes with private equity funds for top talent (we go into more detail about the effect hedge funds have on the hiring market in Chapters III and IV).

Table 1.3 Evolution of the Buyout Market

Source: Thomson Financial’s Buyouts magazine

PRIVATE EQUITY 101

Before initiating your job search, there are a few things about private equity with which you should be thoroughly familiar. Ev...