eBook - ePub

Naked Forex

High-Probability Techniques for Trading Without Indicators

Alex Nekritin, Walter Peters

This is a test

Share book

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Naked Forex

High-Probability Techniques for Trading Without Indicators

Alex Nekritin, Walter Peters

Book details

Book preview

Table of contents

Citations

About This Book

A streamlined and highly effective approach to trading without indicators

Most forex traders rely on technical analysis books written for stock, futures, and option traders. However, long before computers and calculators, traders were trading naked. Naked trading is the simplest (and oldest) trading method. It's simply trading without technical indicators, and that is exactly what this book is about.

Traders who use standard technical indicators focus on the indicators. Traders using naked trading techniques focus on the price chart. Naked trading is a simple and superior way to trade and is suited to those traders looking to quickly achieve expertise with a trading method.

- Offers a simpler way for traders to make effective decisions using the price chart

- Based on coauthor Walter Peters method of trading and managing money almost exclusively without indicators

- Coauthor Alexander Nekritin is the CEO and President of TradersChoiceFX, one of the largest Forex introducing brokers in the world

Naked Forex teaches traders how to profit the simple naked way!

Frequently asked questions

How do I cancel my subscription?

Can/how do I download books?

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

What is the difference between the pricing plans?

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

What is Perlego?

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Do you support text-to-speech?

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Is Naked Forex an online PDF/ePUB?

Yes, you can access Naked Forex by Alex Nekritin, Walter Peters in PDF and/or ePUB format, as well as other popular books in Desarrollo personal & Finanzas personales. We have over one million books available in our catalogue for you to explore.

Information

PART ONE

Naked Forex Trading Revealed

CHAPTER 1

The Fundamentals of Forex Trading

Gregory: “Draw thy tool …”

Sampson: “My naked weapon is out.”

—Shakespeare, Romeo and Juliet

Welcome to the world of forex trading. Forex is the largest market in the world. Forex traders exchange $4 trillion each day, but is forex the best market for you? The answer depends on what you are looking for. If you want a market that never sleeps, if you want the opportunity to trade at any time of the day, if you would like to make a boatload of money in a short amount of time, forex may be for you (it should be noted that you may also lose an incredible amount of money in a short amount of time). Traders with very little money can begin trading forex. In forex, you may take relatively large trades with small amounts of money because of the favorable leverage requirements. There are many reasons to become a forex trader, but before jumping into the reasons, perhaps we should take a closer look at the characteristics of a forex trade.

A QUICK LESSON IN CURRENCIES

“Forex” is simply an abbreviation for “foreign exchange.” All foreign exchange transactions involve two currencies. If an individual trader, a bank, a government, a corporation, or a tourist in a Hawaiian print shirt on a tropical island decides to exchange one currency for another, a forex trade takes place. In every instance, one currency is being bought and, simultaneously, another currency is being sold. Currencies must be compared to something else in order to establish value; this is why forex trading involves two currencies.

If you and I go to the beach and I tell you the tide is low right now, how do you know this is true? You may decide to compare the current water level to the pier. If there are starfish and mussels exposed on the pier, you may believe me because you can compare the current water level to the previous water level. In forex, we compare currencies in much the same way, currencies are traded in pairs and, thus, one currency is always compared to another currency.

An example may be helpful to illustrate how currencies are traded. If you are a hotshot forex trader, and you believe that the EUR/USD is going to go up, you may decide to buy the EUR/USD. Thus, you think that the Euro currency will get stronger, and the U.S. dollar will weaken. You are buying the EUR/USD currency pair, another way to look at this is to say you are buying Euros and simultaneously selling U.S. dollars. The unique (and often difficult to understand) aspect of forex trading to keep in mind is this: Each forex transaction involves the buying of one currency pair and simultaneously the selling of another currency pair.

If you have experience buying or selling in any market—the stock market, a futures market, an options market, the baseball card market, or the used car market—then you understand markets. For any market transaction a buyer wants to buy something and a seller wants to get rid of something. The forex market is simply a money market, the place where speculators exchange one currency for another. In many ways, the forex market is no different from the stock market. The major differences between forex and the stock market are as follows: A forex transaction involves buying one currency pair and selling another, also, the symbols to identify forex pairs are consistent and systematic, unlike the symbols used to identify companies listed on a stock exchange.

Forex traders buy and sell countries. It is true: Forex traders are basically buying “shares” in a country, just as a stock trader buys shares in a company. For example, if forex trader Emma decides to sell the EUR/USD, she is essentially selling the European Union (and buying the United States). To be even more specific, we might suggest Emma is buying the economy of the United States, and selling the economy of the European Union. Does this mean that Emma must keep tabs on all the economic data for all the countries that she is trading? The short answer is no, but we will talk more about news and trading based on economic news and data a bit further on in this book.

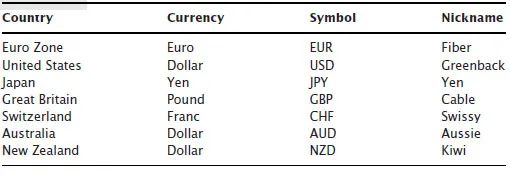

Just as a stock has a symbol, so do currencies. Table 1.1 illustrates the most popular currencies and their symbols. Do you notice a pattern? There is a secret code for currencies. The three-letter code for each currency pair is composed of the country (first two letters) and the name of the currency (last letter). So, for example, the Japanese yen is JPY, the “JP” stands for Japan, and the “Y” stands for Yen. The currencies listed in Table 1.1 are the major currencies; these are the most widely traded currencies.

Table 1.1 Major Currencies of the World

PLAYERS OF THE FOREX MARKET

The forex market is an enormous, growing market. Forex trading doubled from 2004 to 2010, and today the amount of money traded in forex each day is staggering. The New York Stock Exchange, the world's largest stock market, turns over about $75 billion each day. Forex traders trade five times that amount each day.

You often hear people claim that because the forex market is so large, it is relatively easy for forex traders to jump in and ride the trends in this gigantic market, the world's largest market. However, most forex traders trade what is called the retail forex market; this is a different market (akin to a parallel universe) to the “real” forex market in which $4 trillion is exchanged each day. In essence, there are two markets in forex. There is the interbank market, where banks, hedge funds, governments, and corporations exchange currencies, and there is the retail market. Most forex traders trade in the retail forex market, an entirely different market to the “real” interbank market.

In the retail forex market, your competition is the other forex traders trading the retail forex market, and, believe it or not, your broker. When you make money trading forex, these other traders in the retail market lose, and so does your broker. Most retail forex traders do not make money. In fact, your forex broker will assume that you are going to lose money in the long run. This is a perfectly reasonable assumption, since the large majority of forex traders lose money.

Would you like to know about the secret that forex brokers don't want you to know? Here it is: Forex brokers divide all traders into two groups. There are the winners—these are the forex traders who make money—and then there are the losers—these are the forex traders who lose money. Guess which group all new forex traders get put into? Retail forex brokers believe that all new customers are unlikely to make money, so all new accounts are placed into the loser group. After several months of consistently profitable Forex trading a trader may be placed into the winner group.

It may sound surprising, but it is true. If you start making money trading forex over several months, you will join the winners. Your retail forex broker will begin to hedge your trades. In other words, if you are in the winner group, your retail forex broker will take trades in the real forex market, the interbank market, to offset the profits accumulated by the winner group. For example, if most of the traders in the winner group have decided to buy the EUR/USD, then the broker will put in a trade to buy the EUR/USD in the interbank market in the hopes that, if the winners are correct, the forex broker can use the profits in the interbank market to pay the winning traders. This is how your retail forex broker deals with winning traders.

What about losing traders? Since most forex traders are losing traders, your forex broker assumes that you will not make money when you open up an account. Only after you have consistently made money trading forex will your broker become concerned with your trading. Guess what happens to all of those losing trades? Those losing trades fatten your broker's pocket. All losing trades are “business profits” for your broker. This is because your broker takes the other side of your forex trade. Although it is true that some retail forex brokers match up trade orders so that a trader with a buy trade order is paired up with a trader with a sell trade. However, the overwhelming majority of retail forex brokers do not do this. Unless you are a consistently winning trader, your broker will take the risk on your trades, and assume that your trades will lose money in the long run. This is not something that is widely discussed, but it is true. Your forex broker wants you to lose, because your losses are your broker's profits.

How would you like to make the jump from the group of losing traders to the group of winning traders? Would you like to join the 5 percent of winning traders? I know you can join the 5 percent, and I will show you precisely how you can leap into the group of winners in later chapters.

TOOLS OF THE TRADE: FUNDAMENTAL VERSUS TECHNICAL INDICATORS

So, how do forex traders decide when to buy or sell? There are basically two schools of traders, and you must decide which school fits your trading personality. The first school is the school of fundamental analysis. Fundamental traders use economic reports and news reports as the basis for their trading decisions. Forex traders who have a fundamental approach will closely examine world events, interest-rate decisions, and political news. Fundamental traders are concerned with properly interpreting news, whereas the focus for the technical forex trader is quite different.

The technical forex trader uses technical indicators (or “indicators”) to properly interpret price movement on a chart. The forex trader who adopts a technical, indicator-based approach will examine the price charts. So, while the fundamental forex trader is concerned with interpreting news and world events, the technical trader is concerned with interpreting price on a chart.

What are technical indicators? Indicators are simply another way of looking at a market price. In much the same way that it is possible to examine the speed of a car in many different ways, it is possible to examine price charts in many different ways, with indicators. Just for a moment, consider how many different ways you may measure the speed of a car:

- Measured in kilometers per hour.

- Measured in miles per hour.

- Measured in the time it takes to travel one mile.

- Measured by the time it takes to accelerate to 60 mph.

- Measured by how quickly the car can stop.

Likewise, there are many ways to look at price on a chart. There are more technical indicators than telephone call centers in India.

WHAT IS NAKED FOREX?

It can be very confusing for the novice trader, and this is one reason why naked trading, trading without indicators, can be liberating. When starting out, many traders focus on the indicator. This is completely understandable since nearly 90 percent of the forex trading books, the vast majority of fore...