![]()

CHAPTER 1

Private Equity: An Introduction

This chapter provides the reader with an overview of the basic fundamentals of private equity as an asset class. In addition, the reader will be introduced to the Inventis Private Equity Model, which encapsulates the workings of private equity from entry to exit. This is particularly useful as it provides a model for readers to apply throughout subsequent chapters of the book. Readers who are familiar with the basics of private equity may skip this chapter.

OVERVIEW

Private equity is an asset class consisting of equity securities in companies that are not publicly traded on a stock exchange. Private equity consists of long-dated capital commitments from its investors aimed at achieving long-term value creation through active management of the invested companies in order to achieve higher investment returns than the public markets. Private equity funds are typically deployed to invest in companies in control or quasi-control situations. This differs from public equity that consists of capital that is invested in liquid markets and can be redeemed in a short time period. Public equity funds are typically characterized by a passive approach to shareholder governance. Private equity firms can invest in public companies through private-investments-in-public-equity (PIPE) deals.

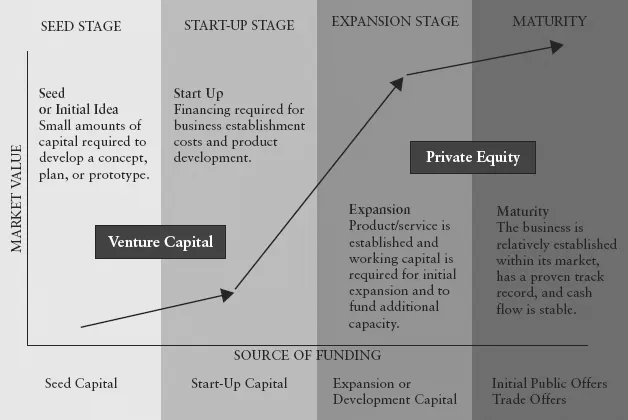

For purposes of this book, private equity investments will refer to investments made in firms that are in the expansion-to-maturity stage. This delineation is important to highlight, as the considerations behind a venture capital (VC) and private equity (PE) investment can vary widely. Many people use the terms venture capital and private equity interchangeably. This, however, fails to account for some significant differences between the two. In order to understand these differences, it is important to understand the various stages of development of a company.

Stages of Development of a Company

A typical investment life cycle of a company goes through five main stages: seed, start-up, expansion, and maturity, to distressed. It is important to note that not all companies go through the distressed stage, but it is deliberately included here because distressed companies can sometimes be attractive for private equity investors. As the company expands, there is a perennial need for capital and the absolute amount of funds required will vary across the stages. Correspondingly, its market value will increase; as a result its equity will become more expensive to own for investors and the risk of failure will reduce. In the early seed and start-up stage, the types of investment into such firms are generally called venture capital.

Seed Stage

In the seed stage, equity investments are made in companies that are in the early development stages or companies that are perceived to have a breakthrough invention or idea. Due to the small size of the company, venture capital investments are relatively small, in the range from a few hundred thousand dollars to several million dollars. Investing in early stage investments are high-risk ventures, as the company does not have any solid track record yet. Hence, investors will demand a higher return to compensate for the high risks. Venture capital firms have a long investment horizon that can easily be more than five years, depending on how fast the development of the company is. Venture capital firms can exit their investments through subsequent rounds of financing and by selling their equity stake to other investment firms. An initial public offering (IPO) is typically the most favored exit for venture capital investments.

Start-Up Stage

In this stage, the company focuses on product development with the goal to commercialize the product and validate it with its customers. The management team will have to monitor the feasibility of the product and its potential market success. Companies looking to attract financing will have to present a clear business plan on how to realize their ideas and the potential for investment returns. Compared with the seed stage, the risk of losing the investment is lowered as uncertainty is reduced.

Expansion Stage

Equity investments are made in relatively mature companies that are looking for capital to grow their business operations, restructure and systematize operations, enter new markets, or finance a major acquisition without major changes in the control of the company. In expansion stage investments, a minority stake in the company is typically sold in return for expansion capital and management expertise that can add value to the corporate strategies. Companies can also raise capital by being listed on the stock exchanges. The listing process requires significant funds and expertise to accomplish. Stock exchanges have stringent criteria that the company must meet before approval for the listing is given. Private equity firms that invest in the period just before a company lists are called pre-IPO investors. Private equity firms look to capitalize on a higher valuation accorded to its investment by the public market than when it was a private company. Timing the listing process is an important consideration. If market conditions are generally favorable and there is a lot of hype surrounding the IPO, private equity firms can reap significant rewards for its pre-IPO investments.

Maturity Stage

Companies that are in the mature stage generally experience slower growth, but they generate stable operating cash flows. Private equity firms can also invest in companies that are listed on the stock exchange through a PIPE deal, which can be a minority stake investment (typically in China) or majority stake (typically a buyout in the United States and Europe). For the former, there is usually little room for the private equity firm to influence key decisions made by the management, as it has not acquired an equity stake that gives its board voting or control rights unless explicitly structured. However, there are still significant potential upsides to minority-type PIPE deals in China, as evidenced by TPG’s investment in shoe retailer Daphne and Bain Capital’s investment in electronics retailer Gome.

MORGAN STANLEY AND INTERNATIONAL FINANCE CORP INVESTS IN ANHUI CONCH CEMENT

On May 1, 2006, Morgan Stanley Asia Investment, an entity controlled by Morgan Stanley Private Equity Asia and International Finance Corp (IFC), the investment arm of the World Bank, conducted a PIPE deal and purchased a combined 14.33 percent stake in China’s Anhui Conch Cement Co Ltd (SHA 600585; HK 0914) for 1.22 billion yuan, representing about 6.8 yuan per share. Morgan Stanley’s private equity division took 10.51 percent of China’s largest cement producer, while IFC took 3.82 percent.a

Anhui Conch Cement Company Limited is the largest cement producer in China and the fifth largest in the world by capacity. It is one of the leading suppliers of high-grade cement in the coastal areas in the eastern and southern regions of the PRC. Conch was listed on the Hong Kong Stock Exchange in 1997 and the Shanghai Stock Exchange in 2002.b

In the latter case, where private equity firms seek a majority stake in a publicly listed company, these deals are called buyout deals. If the deal was done using a mix of equity and debt instruments to finance the acquisition, it is called a leveraged buyout (LBO). As these deals are generally large in the range of a few hundred million or billions of dollars, private equity firms can utilize leverage by pledging the assets of the company as collateral and getting sizeable loans from several banks to help finance the LBO. After the successful LBO by the private equity firms, the company is then delisted from the stock exchange. At this time, the private equity firm would begin to restructure the company—its assets and liabilities, management, corporate strategy—while shunning public scrutiny and periodic financial reporting that was required earlier as a listed stock. The restructuring process is usually long, possibly taking up to a few years before the benefits start to materialize. After the restructuring is completed, the company would be ready for relisting on the stock exchange (known as a reverse LBO). A company going through a reverse LBO would typically command a higher valuation than the initial price paid by the private equity firm.

Distressed Stage

There are the private equity funds that focus on investing in companies that are distressed or in special situations. These companies face a severe decline in their businesses, having serious cash flow problems that put their abilities to function on an ongoing basis in question. Despite the deteriorating situation in the company, there is still intrinsic value in the company’s owned assets, patents, licenses, brand name, and customer base. Private equity firms, which specialize in turnaround investments, have the deep expertise and resources to extract values from these troubled companies. Extensive due diligence is conducted and the private equity firm will prepare a systematic plan to turn around the troubled assets. The firm that is in distress will have to sell assets at below net asset value in order to attract private equity firms. After the sale of the distressed company is completed, the private equity firm will begin to execute the turnaround plan and restructure the company. This may include stripping the company’s assets. The non-core or non-performing assets are sold/disposed of and the rest of the core and performing assets are kept and improved upon. Upon the success of turning around and when the business begins to profit again, the private equity firm will then be able to seek exit opportunities through trade sales or through an IPO.

Differences between Private Equity and Venture Capital

Private equity firms invest in companies that are in the expansion or mature stage, while venture capital firms invest in companies that are in the seed or start-up stage. Expansion or mature stage companies would have a proven operational track record, and a business model that has relatively low risks. These firms would have financial records dating back a few years, which can provide the private equity firms with some key data to conduct their valuation and due diligence. However, a venture capital firm looks to invest in companies that are in the seed or start-up stage. These two stages ar...