- 160 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

The development of Nigeria's oil industry is examined comprehensively in this book, originally published in 1984. It charts the changing course of her economy and examines the dramatic effect oil has had on Nigeria's domestic and international policies. Oil has enabled her to command a powerful position in African affairs and within OPEC itself, but at the same time, has held back other forms of economic development. Nigeria's future in the oil industry, as well as in related fields such as gas, is assessed both in the light of her former policies and in the changing world economy. This book will be of interest to all concerned in the oil industry, international finance or world power politics.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

1 MULTINATIONALS IN THE NIGERIAN ECONOMY

Multinationals, transnationals or international financial conglomerates are large firms which are characterised by large capital outlay, abundance of technological know-how, a variety of technical and managerial manpower and efficiency in the pursuit of profit. In the developing economies of Africa, Asia and Latin America, where the spirit of nationalism is still very much alive, multinationals are regarded as the agents of neocolonialism whose sole objective is to exploit the resources of the developing economies to the advantage of their native countries.

Multinationals began operations in the area now known as Nigeria long before Nigeria became a political entity. Although the area was ceded to the British in 1885 as a colony by the Treaty of Berlin, which partitioned Africa among the European powers, Nigeria only became a political entity in 1914, when the Northern and Southern provinces of Nigeria were amalgamated by Lord Lugard. Before 1914, some multinationals in banking and commercial spheres had already established themselves in Nigeria. For example, the African Banking Corporation (ABC) began operations in Lagos in 1891, while the Royal Niger Company, which traded in palm produce along the Nigerian coast, was established in 1886.

Until Nigeria became independent in 1960 only British companies or those of British dominions or protectorates and those of other Western nations duly permitted by the British authorities were allowed to do business in Nigeria. With the attainment of independence in 1960 the Nigerian goverment and people became worried about the economic and political implications of doing business with British companies only. As a number of advantages could be derived by opening up trade links with other countries of the world, the policy of multilateral economic relationships with the rest of the world was adopted. Nigeria therefore began to do business with companies from Western Europe, the United States, Commonwealth and Asian countries and the Socialist countries.

This chapter will examine the aggregate activities of multinationals operating in the Nigerian economy as summarised by the total investments from their countries of origin. It was only after Nigeria’s political independence in 1960 that it became possible to keep a fairly good record of the activities of foreign companies in Nigeria and the nations from which such companies originated. Such records became necessary for planning purposes and for defining the strength of economic and political relationships between Nigeria and those countries.

1. Growth and Decline of Foreign Investments in Nigeria

Table 1.1 suggests strongly that the United Kingdom still leads other countries of the world in terms of total investments of multinationals operating in Nigeria. In 1962 the total investments made in Nigeria by multinationals of UK origin totalled ₦271.2 million or approximately 61.4 per cent of total foreign investments in Nigeria. By 1967 cumulative British investments in Nigeria had declined to 47.1 per cent, but this decline of British investments in Nigeria after Nigeria’s independence is understandable. With the attainment of independence, Nigerian businessmen became more enterprising. The bureaucratic bottlenecks which had hindered their operations during the colonial era were reduced. Business licences and registrations became easy to obtain. Various incentives were provided. Bank loans became more readily available than they were before independence. The predominant British banks in the past considered Nigerian businessmen as risky borrowers. The liberalisation of bank credit partly explains the decline in total British investment in Nigeria. Another factor which contributed to the decline was the new policy of multilateral economic relationships with the rest of the world. The new policy threw the Nigerian economic door wide open to other foreign investors which hitherto were unable to gain access to Nigerian markets because of restrictive colonial, economic and trade policies.

The cumulative UK investments in Nigeria in 1967 were much higher than those of 1962. But in terms of overall foreign investment, British investments declined in percentage terms. Obviously, the increase in the United States’ investments in Nigeria from 8.7 per cent of aggregate foreign investments in 1962 to 23.6 per cent of total foreign investments in 1967 contributed in no small way to the decline in the United Kingdom’s aggregate investments in Nigeria by 1967. However by 1973 United States’ investments in Nigeria had declined to 17.5 per cent, while those of the UK increased slightly to 48.8 per cent in the same year.

Table 1.1: Cumulative Foreign Investment in Nigeria by Country or Region of Origin (₦ million)

Source: Central Bank of Nigeria, Economic and Financial Review (various issues).

The decline in the United States’ investments in Nigeria by 1973 may be attributed to a number of causes. A major factor was the recession in the US economy which started in the mid- 1960s and the persistent deficit in the US balance of payments, coupled with the devaluation of the dollar in 1973 arising from dollar pressure on the international foreign exchange markets. The Nigeria/Biafra war which lasted from mid-1967 to January 1970 damaged Nigeria’s investment climate. New investors were scared away, while some investors already operating in the Nigerian economy panicked and left. From 1973 United States’ investments in Nigeria began to decline as well as those of the United Kingdom although US investments declined at a much faster rate than those of the UK which in 1977 amounted to 42.37 per cent of total foreign investments in Nigeria while that of the US constituted only 11.33 per cent. The investments of West European countries have on the other hand maintained a steady growth from 1962, especially investments from France and West Germany. Asian investments, particularly those of Japan, Taiwan, Korea and India have also shown some remarkable increases since 1973. In 1977 the total investments of countries classified as ‘others’ under which Asian investments and those of Commonwealth and Socialist countries are considered stood at 17.10 per cent of total foreign investments.

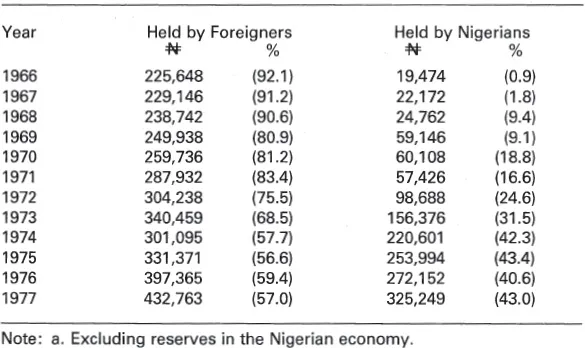

2. Capital Holdings of Foreign and Indigenous Investors in the Nigerian Economy

Since the 1970s there has been a remarkable increase in the volume of investments of Nigerian indigenes vis à vis foreign investors. Between 1914, when Nigeria became a political entity under the British administration and 1960, when Nigeria became politically independent, most investments in Nigeria were of UK origin or those of non-UK origin permitted to operate in the country during the colonial period. Until 1960 over 90 per cent of total investments in Nigeria were under foreign ownership. However, from 1966 Nigerian investors began to make incursions into the Nigerian economy. Within a decade the percentage of cumulative paid-up capital of Nigerians rose from 0.9 per cent in 1966 to 43 per cent in 1977. The developments are shown in Table 1.2. By 1970 Nigerian investors had less than 20 per cent of the total paid-up capital in the form of common stocks or preferred stocks, excluding reserves in the Nigerian economy. In 1972 the Nigerian Military Government promulgated the Nigerian Enterprises Promotions Decree (now Act), which made it mandatory for foreign investors to sell a part of their business to Nigerians and to indigenise their manpower resources. Under the Decree, businesses which were classified under Schedule I such as printing, retail trade, light industries, advertising, public relations, estate agencies etc., were reserved exclusively for Nigerians. Schedule II of the Decree permitted foreigners to own up to 40 per cent equity participation in such activities as brewery, insurance, fertiliser production, food processing, distribution and maintenance of motor vehicles; detergent industry, book publications, etc. Under Schedule III foreigners were allowed to own up to 60 per cent of the equity capital. Relatively heavy and capital intensive industries fall under Schedule III of the Decree. Activities under Schedule III are considered capital intensive and at times beyond the capacity of Nigerian private investors to mobilise the required capital for starting and operating such industries.

Table 1.2: Cumulative Paid-up Capitala Holdings of Foreigners and Nigerians in the Nigerian Economy (₦ thousands)

Source: Central Bank of Nigeria, Economic and Financial Reviews (various issues).

Following the Enterprises Promotions Decree there was a significant increase in Nigerian ownership of paid-up capital. From 18.8 per cent in 1970, Nigerian ownership of capital rose to 43 per cent in 1977.

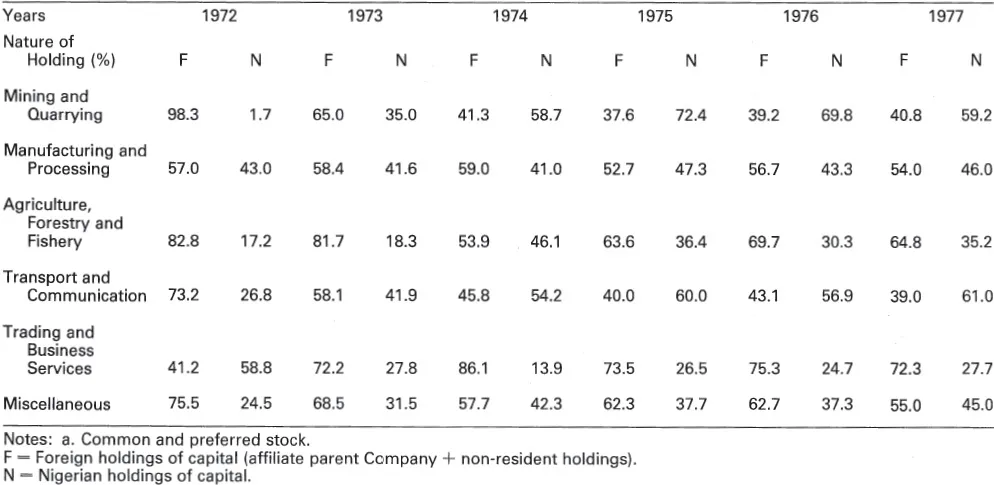

Although Nigerians hold on average a total investment of 43 per cent consisting of common and preferred stocks, an appraisal of the capital holdings of Nigerians in the various activities of the economy is not very encouraging. Table 1.3 shows a breakdown of the percentage capital holdings of foreigners and Nigerians in the various activities of the Nigerian economy. As of 1977, the last year in which statistics were available, foreigners still controlled over 50 per cent of capital holdings in manufacturing and processing activities; agriculture, forestry and fishery; building and construction; trading and business services and miscellaneous activities. It is only in mining and quarrying, and transportation and communication that Nigerians control about 60 per cent of the capital holdings of those activities.

In mining and quarrying activities Nigerian capital holdings have increased astronomically since 1974 because of changes in Nigerian oil policies which made it possible for the Nigerian Federal Government to participate actively in oil exploitation and exploration instead of the old oil policy in which Nigeria benefited from rents and royalties only under concessional agreements. Nigerians have always participated in transport activities especially road, rail and air transport. The 39 per cent foreign capital holdings in the transport and communication sector is mainly in the area of communication.

Unfortunately, activities in such important areas as agriculture, forestry and fishery, and manufacturing and processing are still in foreign hands. These activities are fundamental to any developing economy. A country which depends on foreign investors for her food production is not worth her name because if such foreigners pull out their investments the nation will starve. Manufacturing and processing activties are very important activities for developing ecnomies eager to industrialise. Manufacturing and processing industries provide rudimentary transfer of technology, technical and managerial manpower training and forward and backward linkage effects to any economy. The inability of Nigerians to participate actively in these areas does not augur well for the country. In 1970 Nigerian investors controlled 42.7 per cent of total investments in manufacturing and processing activities. By 1977, it had risen to only 46 per cent. In building and construction, trading and business services and miscellaneous activities foreign investors still have the upper hand. Building and construction activities are capital intensive; they also require a reasonably high level of technical know-how which Nigeria does not yet possess in abundance. The big names in the construction industry are foreign such as Julius Berger, Fougerole, Guffanti, MCC, Cappa and Dalberto, Michelleti, etc. Trading and business services are still controlled by foreigners who have access to foreign exchange restricted to Nigerians. Foreigners still have the upper hand especially in banking and insurance services. In these industries foreigners still control over 50 per cent of banking and insurance capital. It is in the activity of trading and business services that foreigners have the highest capital holdings.

3. Recent Changes in Overall Foreign Investments in Nigeria

Since 1972 (the year the Nigerian Enterprises Promotion Decree came into force) there has been a reasonable decline in the annual percentage change of Nigeria’s foreign private capital with the exception of 1975 (see Table 1.4). Worldwide inflation and turbulence in the foreign exchange market eroded the purchasing power of Nigeria’s external reserves. The depreciation in the value of external reserves adversely affected the foreign exchange content of domestic investments, especially in mining and quarrying; building and construction; trading and business services; and agriculture, forestry and fishery and in fact virtually all economic activities. Since 1975 there have been sudden upsurges in total cumulative foreign investments notably in mining and quarrying, manufacturing and processing and in trading and business services. By 1977 the annual percentage change in total cumulative foreign investments had declined from the 26.3 per cent level of 1975 to 8.4 per cent in 1977.

While capital flows into Nigeria it also flows out of Nigeria for reasons best known to investors. Table 1.5 shows the flow of foreign private capital in Nigeria. It suggests strongly that Nigeria is still on the gaining side, but the severe fluctuations in foreign capital flow may be attributed partly to changes in Nigerian investment policies and partly to the general world ecnomic recession. There is therefore a great need to mobilise domstic capital in the Nigerian economy and to harness scarce foreign exchange by reducing imports. By reducing the imports of non essential and luxury goods, Nigeria will be able to conserve enough foreign exchange to support the foreign exchange contents of domestic investments.

Table 1.3: Cumulative Percentage Capitala Holdings of Foreigners and Nigerians in the Nigerian Economy Classified According to Economic Activities

Source: Extracted from CBN, Economic and Financial Review (various issues).

In the First Development Plan (1962/8) the total planned capital formation was ₦2,367 million whereby the total financing expected from abroad was ₦1,049 million or 44 per cent of Nigeria’s total planned capital formation. Out of the expected ₦1,049 million from abroad, ₦396 million constituted foreign investment while ₦653 million constituted foreign aid. In the Second Development Plan (1970/4) the total planned capital formation was ₦3,190 million, whereby total financing from abroad was estimated at ₦1,127 million or 35 per cent of total capital formation. Foreign investment rose to ₦825 million as against ₦396 million in the First Plan period. On the other hand foreign aid declined to ₦302 million as against ₦653 million in the First Plan period.

In the First and Second Development Plan periods growth rates of 4 per cent and 6.6 per cent per annum were projected respectively. The Third Development Plan covered the period from 1975 to 1980. The last Plan did not envisage any foreign investment or foreign aid for its realisation, although the 1976 financial statistics have shown evidence of foreign capital flow into Nigeria even though it was discounted in the capital projection upon which the realisation of the growth rate of 9 per cent per annum depended. The 1981/5 Plan also relies heavily on domestic financing sources. The prospect has been dimmed by the world oil glut which has led to a reduction in the Nigerian output of oil. This unexpected turn of events has affected quite adversely Nigeria’s oil proceeds and the prosecution of the Plan. As of April, 1982, the Nigerian daily oil production quota has reduced by a half following the Quito OPEC Conference of March, 1982. Nigeria’s critical oil export position has been exacerb...

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Table of Contents

- List of Tables and Figures

- Preface

- 1. Multinationals in the Nigerian Economy

- 2. Developments in Nigeria’s Oil Policy

- 3. Formation of Nigeria’s Own Oil Company

- 4. The Growth of the Nigerian Petroleum and Allied Energy Industries

- 5. The Impact of Oil on the Nigerian Economy

- 6. Nigeria’s Oil Crisis in the Early 1980s

- 7. Oil in Nigerian Politics

- 8. Oil in International Economic and Power Politics in the 1970s and 1980s

- 9. OPEC – To Be or Not To Be?

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access The Nigerian Oil Economy by J. K. Onoh in PDF and/or ePUB format, as well as other popular books in Business & Business General. We have over one million books available in our catalogue for you to explore.