Mergers and acquisitions (hereinafter M&As) are one way of achieving the objectives of business and corporate strategies. The corporate sector all over the world is restructuring its operations through different types of consolidation strategies1 like M&As in order to face challenges posed by the new pattern of globalisation, which has led to the greater integration of national and international markets. The intensity of such operations is increasing with the deregulation of various government policies as a facilitator of the neoliberal economic regime. Earlier also the firms were widely using consolidation strategies, but one of the striking features of the present M&As scenario is the presence of a large number of cross-border deals. The intensity of cross-border operations recorded an unprecedented surge since the mid-1990s, and the same trend continues (World Investment Report, 2000). Earlier, foreign firms were facilitating market expansion strategy through the setting up of wholly owned subsidiaries in overseas markets (Jones, 2005), which has now become a ‘second best option’ since it involves much time and effort that may not suit to the changed global scenario.2 Getting into cross-border M&As (hereinafter CM&As) became the ‘first-best option’ to the leading firms and others depended on the ‘follow-the-leader’ strategy.3

The Indian corporate sector too experienced such a boom in M&As that led restructuring strategies especially after liberalisation; this is due to the increasing presence of subsidiaries of big Multinational Corporations (MNCs) here as well as due to the pressure exerted by such strategies on the domestic firms. Besides, many MNCs realised the fact that the Indian market is a big consumer base to meet their desired objectives. Thus, the entry is unavoidable. They found that resorting to mergers, acquisitions and similar strategies is an easy way of entry into Indian market without much cost of time and money. In order to facilitate globalisation, the Indian government also implemented various policies which marked a paradigm shift in the operation of the domestic firms as it removed the patronage enjoyed by the domestic firms under the assumptions like Infant Industry argument and opened them for the free play of market forces. More importantly, globalisation reduced the product life cycles, and the firms began to bring out new products quickly to the market as compared to the past. Computer aided manufacturing helped to reduce the time needed for production. Shortened product life cycles meant high R&D intensity, and this has to be recouped before the technology becomes obsolete, which becomes especially important if a rival firm ‘wins-the-race’ to innovate a new generation product (Levin et al., 1997 as in Narula, 2003). These circumstances again prompted firms to engage in various kinds of agreements to reduce the high risk associated with innovation and to become successful through the sharing of tangible and intangible assets. These issues are equally important for the domestic deals in the present scenario. Given this broad context, the present study is an attempt to analyse the changing nature of foreign investment in the form of M&As. The second section of this chapter discusses, why firms are crossing borders through M&As and the third section will be dealing with the opportunities and challenges from such deals. The fourth section is an attempt to explore the issues emerging from the new pattern of internationalisation of Indian firms, and the subsequent sections discuss the data and methodology, objectives and chapter scheme of the study.

1.1 Why firms are crossing borders?

When we look at the business history, we can see at least four types of growth strategies were adopted by the firms. Firms started with domestic production and began to export to the foreign markets, the establishment of subsidiaries in overseas market was the third stage, and as a fourth phase, firms started to make an association with the foreign firms in the overseas market either through joint ventures or through acquisitions instead of establishing subsidiaries.4 The increasing magnitude of investment through CM&As and its emergence as a major component of Foreign Direct Investment (FDI) even in the case of developing countries such as India demand us to think why firms are engaging in cross-border consolidations5 instead of establishing subsidiaries or to engage in export-oriented growth. Answering this requires us to merge the prime objectives of foreign investment with that of M&As. We have observed that in many cases, the objectives of foreign investment are achieved through consolidation in an easier way, which is the reason behind the increasing importance of cross-border consolidation strategies. In this section, we shall try to bring together the two issues mentioned above, why do firms invest abroad and what makes M&As, a preferred mode to other strategies.

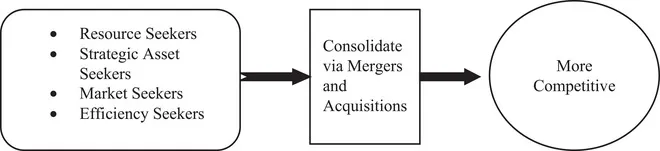

Behrman (1972) distinguished four major types of foreign investors based on the underlying motives, which later adapted and extended by Dunning.6 They are (1) resource-seekers, (2) market-seekers, (3) efficiency- seekers and (4) strategic assets or capability-seekers. Presently, firms have multiple objectives, and they fall under more than one of these categories. We shall discuss each of these categories and try to incorporate, how M&As enable to achieve the desired objectives of each of these categories of investors.7

Resource Seekers are the firms investing abroad for obtaining specific resources at lower prices. They are either prompted by the nonavailability of these resources in the home market or lower prices prevailing in foreign locations compared to their home country. Resources include physical resources, skilled and semi-skilled labourers, technological capabilities, marketing and managerial expertise and organisational skills. The Strategic Asset Seekers are the firms, which try to sustain or enhance their international competitiveness or weaken that of other firms through acquiring the assets of foreign corporations. Their major motive is to add to the existing product portfolios rather than to exploit the marketing and other types of synergies. The Market Seekers, as the name suggests, seek new markets in order to expand and strengthen their operations outside the home country. Multinational Enterprises (MNEs) may consider it necessary to have a physical presence in leading markets served by its competitors and construct production units and research centres there. This will enable them to adapt their products to the local needs and to indigenous resource and capabilities,8 which is essential to compete with the local firms. Hymer (1960) argued that local firms have better information about the economic environment of their country than do foreign firms and foreign firms should possess countervailing capabilities in order to overcome this (Calvet, A.L., 1981). Moreover, subsidiaries in foreign locations will help to reduce the production and transaction cost to a great extent compared to export from home market.9 Efficiency Seekers (Rationalised FDI) tries to operate more efficiently by deriving economies of scale and scope and by reducing risk. They are mainly aiming to take advantage of different factor endowments, cultures, institutional arrangements, economic systems and policies and market structures by concentrating production in a limited number of locations. There are two types of Efficiency Seekers. First is to take advantage of the availability and cost of traditional factor endowments in different countries and the second is to take advantage of economies of scale and scope.

Most of these categories will be able to achieve their objectives through M&As in a better way compared to Greenfield investment, which will take much more time and effort. The Resource Seekers who are more interested in getting the physical and labour resources at cheaper rates will be better off through M&As compared to Greenfield investment since they will be able to use the already established resources of the partner firm. They can access the local firm’s cheap labour and such other resources. The case of Strategic Asset Seekers is almost the same as the Resource Seekers. They can very well strengthen or diversify their product portfolio through acquiring the brands of their partner and make the firm more competitive.

Regarding the other two types of investors i.e. the Market Seekers and Efficiency Seekers, the advantages of market power and efficiency creation through M&As are well established since both categories of firms are aiming at the creation of economies of scale and scope and thereby market power. If they are following Greenfield mode of entry, major advantages to them are the expansion of their market to a foreign country. Whereas if they are entering a foreign market through M&As, they can achieve this objective with less cost and effort compared to the new entry. They can also access and share the already established market and avail critical resources of an established firm in a better way. They can not only achieve the benefits of large scale of operation but also reduce many expenses such as marketing, advertisement, distribution, R&D etc. through avoidance of duplicate expenses since consolidation allows the sharing of common resources compared to the pre-consolidation period. The effect of cutting R&D expenditure would be substantial since it will save much time and effort and it can be used more efficiently. Moreover, from a firm’s point of view, they can raise the market power to a large extent through the reduction of the number of firms in the industry and the expansion of their operation, which enable them to have a say in the determination of prices. The major advantages to the Efficiency Seekers and Market Seekers from consolidation can be discussed with the help of the simple model developed by Williamson (1968).

If consolidation is taking place in a perfectly competitive market, assuming both the consolidating firms are producing their previous level of output, the cost of production will decline compared to that of the pre-consolidation period (i.e. C0 > C1) through increasing efficiency. With the reduced cost of production, the firm has three options. One is to sell their product at the previous level of price (P0), second at a reduced price (P1) and third at a higher price (Pm) using their increased market power.10 In the first case, there will not be any change in prices and the firm will get profit (Π0). In the second case, the firm can capture the entire market through a small marginal reduction in prices. Under the third case, allowing for an increase in the market power of the firm and restricted entry, the firm can set the prices at a profit maximising the level of a monopolist, say Pm, which will enable them to achieve a higher level of profit given the cost of production, C1 < C0. The consumers will be harmed due to the price hike.11 The net welfare impact depends on the trade-off between cost saving due to consolidation and the deadweight loss arising out of monopoly pricing. The difference between these two has been an evergreen topic of debate in M&As literature. Williamson (1968) favoured the net efficiency gains and said, ‘even then the cost differential is too low; the net benefits will offset the losses’. We will be discussing it again in Chapter 5.

Thus, from the above discussion, it follows that M&As is a better solution for firms, which want to internationalise their operations quickly, which is captured in Figure 1.1. As we discussed earlier, globalisation induced the disappearance of national borders. Now the firms are facing international competition even within the domestic boundaries due to the opening of the markets. It necessitates firms to strengthen themselves in the home market too, in the absence of it; they may be wiped out in the acute competition. Thus, on the one side, various policy changes are pushing firms to engage in consolidation strategies, whereas on the other hand consolidation strategies are acting as a pull factor for the challenges arising out of policy changes.

Figure 1.1 Investors choice of consolidation.

Source: Authors compilation.

1.1.1 The policy aspects

Broadly, there are three sets of major regulations faced by the firms under the present global scenario. They are, Corporate Law including Competition Law (CL), Intellectual Property Rights (IPRs) and Sectoral Policy Regulations. Amongst this, the Competition Law aims at enhancing consumer welfare through maintaining competition. IPRs give temporary monopoly for the owners of innovation, which is expected to enhance the innovation incentives of the innovating firms. The third set of regulations that is sectoral policies also aims at the consumer welfare, but the policy changes according to the welfare implications of different sectors. The policy makers are facing a dilemma whether to allow big firms to get into M&As and permit them to undertake costly innovations, or to restrict them on the grounds that it can lead to concentration of market power in the hands of a few big firms. If they allow, it can be argued that M&As will enhance consumer welfare in future with the introduction of better quality products at lower prices through engaging in innovation facilitated by consolidation as well as the enhancement of efficiency through synergy creation. On the other hand, it can also lead to the monopolisation of innovation and the consequent rise in prices, which will adversely affect the welfare of consumers in the long run. Thus, the central task with the regulators is to ensure maximum consumer surplus without harming that of producers’. Towards achieving this goal, most of the competition authorities relied on fixing a maximum ceiling limit for M&As; beyond this limit, the firms have to get prior permission from the respective authorities. Needless to say, the fixing of the ceiling raised several questions regarding the extent of the ceiling, which would have its impact on the market structure and performance. This limit varies from country to country due to the differences in the legal, economic and social framework existing in different countries. However, there are prelim...