eBook - ePub

Determinants Of Brazil's Manufactured Exports

An Empirical Analysis

Ugo Fasano-Filho

This is a test

Share book

- 130 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Determinants Of Brazil's Manufactured Exports

An Empirical Analysis

Ugo Fasano-Filho

Book details

Book preview

Table of contents

Citations

About This Book

This study seeks to identify the determinants of Brazil's favourable export performance until the mid-1980s, especially in the field of manufactured goods. Two hypotheses figure prominently in the analysis. The export success may be due to Brazil's specialization in industries which made intensive use of the country's relatively abundant productive factors. Alternatively, economic policies may be responsible for the success in manufactured exports.

Frequently asked questions

How do I cancel my subscription?

Can/how do I download books?

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

What is the difference between the pricing plans?

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

What is Perlego?

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Do you support text-to-speech?

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Is Determinants Of Brazil's Manufactured Exports an online PDF/ePUB?

Yes, you can access Determinants Of Brazil's Manufactured Exports by Ugo Fasano-Filho in PDF and/or ePUB format, as well as other popular books in Economics & Exports & Imports. We have over one million books available in our catalogue for you to explore.

IV. Comparative Advantage, Economic Policy, and Export Performance

1. Brazil’s Revealed Comparative Advantages in Different Markets

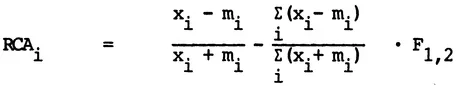

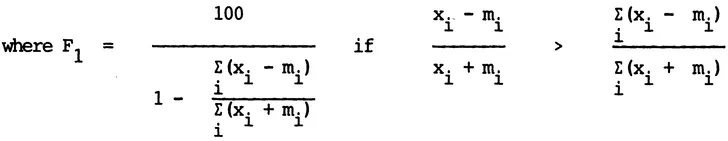

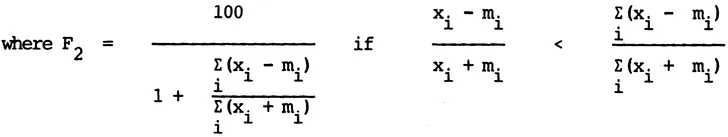

A frequently-applied method of obtaining information on the relative competitiveness of different industries is the concept of revealed comparative advantage (RCA), which calculates the excess of an industry's exports over its imports, relative to the country's total net exports. Thus, RCA analysis allows a ranking of the different Brazilian industries with respect to their international competitive position. The following formula presents the basis for the RCA calculations reported below (1):

and xi = exports of commodity i;

mi = imports of commodity i.

A clear distinction has to be drawn between the RCA concept and comparative advantages which, according to the theory of international trade, determine the structure of production and, therefore, also trade patterns. Instead of referring to factor endowments, the RCA concept tries to evaluate the international competitiveness of industries by referring to their actual export performance. In cases of serious distortions in goods and factor markets, favourable RCA values may result from these distortions rather than from comparative advantage.

Table A9 provides an overall picture of the RCA values of 47 branches of Brazil's industrial sector in their trade with the world for selected years during the 1965-1982 period [Dippl, 1986, pp. 22 ff.]. As regards non-manufactured export items (1), the competitiveness of many branches of the (natural) resource-intensive food industry has been strong since 1965 (e.g., the production and/or processing of meat, fruits, sugar, coffee and cocoa). The same holds true for the production of non-alcoholic beverages as well as for the tobacco industry. Some products that were not traded at the beginning of the investigatory period quickly proved to be competitive in world markets (e.g., oil from soy-beans, SITC 421, and non-alcoholic beverages, SITC lll). As regards metals, the evidence is mixed. Whereas in iron and steel production (SITC 67) competitiveness in world markets improved considerably in the early 1980s, highly negative RCA values are shown for non-ferrous metals.

The international competitiveness of manufacturing industries of Brazil is considered in more detail below, especially by looking at different export markets (2). In addition to the RCA concept, the international competitiveness across manufacturing industries is analysed on the basis of the export-performance ratios presented in Table 9. These ratios confront Brazil's commodity structure of manufactured exports with the corresponding structure of world exports (for the formula of calculation, see the note to Table 9). The basic notion is that Brazil may possess a competitive advantage (disadvantage) if the share of an export category in

![Table 9 - Export Performance Ratios for Brazilian Manufactured Exports to Different Markets, 1962-1981 (a) Source: UN [a]; own calculations.](OEBPS/Images/fig00014-plgo-compressed.webp)

Table 9 - Export Performance Ratios for Brazilian Manufactured Exports to Different Markets, 1962-1981 (a)

Source: UN [a]; own calculations.

Source: UN [a]; own calculations.

Brazil's total manufactured exports is greater (smaller) than the respective share of this category in total world exports of manufactures.

As was to be expected, great differences in export-performance ratios existed both between SITC groups and export markets (1).

- - Brazil seems to be most competitive in exporting products falling into the basic and miscellaneous manufactures category (SITC 6-(67+68)+8) which consists largely of relatively labour-intensive goods. Export-performance ratios improved considerably during the 1960s and early 1970s, when outward-looking economic policies were implemented. Though still above one, ratios declined after 1973 when Brazil returned to import-substitution policies. Even though this trend applied to all major export markets, some differences are worth mentioning. Export-performance ratios were higher than average in the case of exports to developed countries and ALADI members, but considerably lower for non-ALADI developing countries. The favourable performance in developed country markets supports the hypothesis that, vis-à-vis advanced economies, Brazil is most competitive in manufacturing labour-intensive products. High performance ratios for exports of SITC groups 6 and 8 to ALADI may be partly attributed to discriminations against imports from outside this region. Brazil probably benefited from trade diversion at the expense of Asian competitors, for example. This reasoning is consistent with the comparatively poor export performance in non-protected Third World markets.

The net trade measures for basic manufactures (SITC 6) reveal a somewhat different picture (Table A10). At the overall level, RCAs are positive for ALADI and other Third World markets but negative for the developed country market (apart from in 1978). Brazil experienced a trade surplus in almost all the sub-groups of SITC 6 with developing countries and ALADI, except in paper and leather products. In trade with developed economies, positive RCAs are concentrated on the most labour-intensive sectors (leather and wood products, textiles); trade deficits prevailed in sectors such as paper products, metallic and nonmetallic mineral products, i.e., the more capital-intensive industries (see Table A6).

RCAs for miscellaneous manufactures (SITC 8) improved during the 1970s for all Brazil's major export markets. However, this trend started much earlier and was more pronounced for (net) exports to all developing countries and particularly to ALADI. It was obviously harder to become competitive in exporting miscellaneous manufactures to developed country markets than to the protected ALADI market. Again, considerable differences exist between industries at the 2-digit SITC level. Throughout the whole period, trade performance with both developing and developed countries was most favourable for furniture and footwear. Improvements were most remarkable for travel goods and clothing, especially in trade with developed countries. On the other hand, Brazil failed to achieve trade surpluses vis-d-vis advanced economies as regards instruments and printed matter.

- - For machinery and transport equipment (SITC 7), the traditional RCA concept generally results in negative values as regards Brazil's trade with the world. However, the net trade measure (Table A10) as well as export performance ratios (Table 9) show significant differences between Brazil's major export markets. For markets in developed countries, RCAs are negative and export performance ratios below one throughout the whole period, but the latter measure improved considerably after 1973. Production may have become more standardized in the 1970s so Brazil may achieve competitiveness in developed country markets if this trend continues. On the other hand, Brazil has experienced surpluses in trade with total developing countries and the ALADI region. Export-performance ratios were above or very close to one. The performance was most remarkable in non-electrical machinery and transport equipment. Presumably, preferential trading arrangements within ALADI gave a major impetus to Brazilian exports of these categories to the protected Latin American market. However, the success in trade with other developing countries also supports the hypothesis that Brazil, which is better equipped with physical and human capital than the majority of developing countries, is competitive in exporting relatively capital-intensive products to less advanced economies. This confirms expectations that Brazil was better prepared than the developed countries to meet developing countries' import needs due to similarities in demand. Exports of vehicles have, for example, gone almost exclusively to developing countries [World Bank, a, p. 119].This was partly related to similar fuel conditions in the importing countries (i.e., low octane fuel) and better adaptation to the typically rough road conditions in the Third World (1).

There is some evidence to show that the assessment of Brazilian export performance would be biased rather on the low side if based on RCA calculations. If traditional RCA values are compared to an index based on production rather than trade data (2), the number of sectors with a revealed comparative advantage will be greater according to the latter measure (3). This holds true for industries within SITC 7 and 8 in particular.

Due to the aforementioned conceptual limitations, the analysis of export performance ratios and RCAs can only serve as a starting point in assessing the international competitiveness of Brazilian manufacturing industries. It will be supplemented below by applying the so-called Lary concept in analysing factor intensities of Brazilian manufacturing industries (Section IV.2) and by assessing the role of economic incentives in explaining Brazil's manufactured export performance (Section IV.3).

2. Factor Intensity and Export Performance of Brazilian Industries

The analysis in the preceding paragraphs has shown significant differences in Brazilian trade patterns with developed economies on the one hand and developing countries (especially ALADI members) on the other. In trade with advanced countries, Brazil's export performance was most favourable in products generally considered to be labour-intensive. This was predicted by the standard Heckscher-Ohlin theory of international trade, according to which the potential for export growth lies in products that intensively use the relatively abundant factors of production. In trade with developing countries, competitiveness was also achieved in rather capital-intensive industries, which again is consistent with the expectations raised in Section III.4.

However, after 1973 Brazil considerably expanded its exports of machinery and transport equipment to developed countries as well, so that the differences in the commodity composition of Brazilian manufactured exports to its major trading partners were somewhat reduced. It is mainly this observation that requires further investigation, since conflicting hypotheses are involved. A first hypothesis suggests an explanation in terms of factor absorption in Brazilian industries. Notwithstanding high overall capital intensity, Brazil may have comparative advantage in machinery and transport equipme...