![]() Section D

Section D

Non-market context and challenges![]()

17

Corporate climate change adaptation

An emerging non-market strategy in an uncertain world

Peter Tashman, Monika Winn, and Jorge E. Rivera

In this chapter, we discuss non-market strategies associated with corporate climate change adaptation (CCCA), or the “changes in behavior of a business organization aimed at coping with the effects of any climate-related event” (Bleda and Shackley, 2008: 517). Most scholarly attention to non-market strategy has explored how firms confront and manage opportunities and threats in their institutional environments, whether political, social, or ethical in nature, with very little attention being paid to forces in the ecological environment of the firm with strategic implications. The situation is changing somewhat as a growing number of studies are exploring the implications of climate change on businesses and their stakeholders through the lens of CCCA (Winn et al., 2011). In particular, a number of scholars have turned their attention to studying explicit climatic impacts on firms, including disruptions to operations, supply and distribution chains, infrastructure, insurable risk, migration patterns of workers, consumer behavior, and the institutions that support markets and economies (Kuhn, Campbell-Lendrum, Haines, and Cox, 2005; Maddison, 2001; Schlenker, Hanemann, and Fischer, 2005). Still, research on CCCA is in a very early stage.

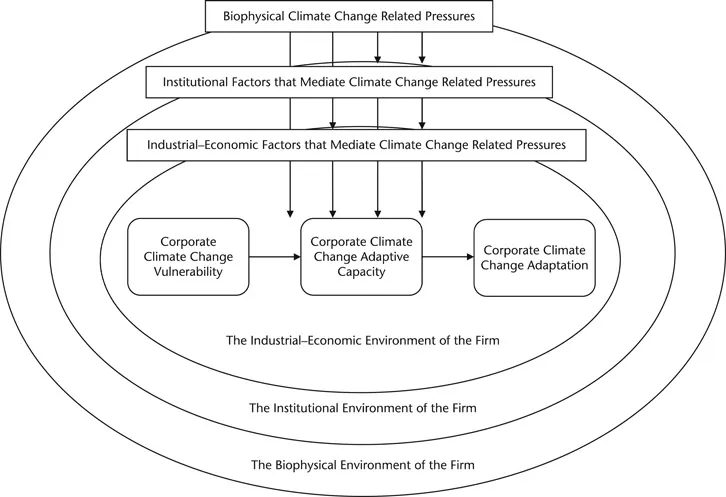

Our goal in this chapter is to draw attention to the importance of non-market strategies for managing climate change-related phenomena, specifically through the area of CCCA. Currently, the area lacks a common organizing framework that scholars can use to structure their approach to identifying, framing, and studying important questions. For this reason, we develop one such framework around the diversity of exposure pathways through which climate change-related pressures may affect the firm, and then propose how this framework might be used as a basis for future research. Firms may be directly biophysically exposed to climate change “perturbations,” which are abnormally extreme episodes, or continuous “stressors,” which are more subtle changes in weather trends that can disrupt business operations if they persist for long enough (Füssel, 2007). Firms also face a number of indirect exposures to climate variability and change, since they are embedded in “highly variable political, economic, institutional, and biophysical conditions” (Belliveau, Smit, and Bradshaw, 2006: 364) that channel climatic pressures to the firm in unintended and unforeseeable ways. In brief, firms may be subject to a number of climate change-related influences depending on the set of exposures facing them. Thus, we build our framework around categories reflecting the firm’s exposure in its biophysical, industrial–economic, and institutional environments, which include political, social, and technological forces related to climate change.

Within each category, we address the constructs of corporate climate change vulnerability (CCCV), corporate climate change adaptive capacity (CCCAC), and CCCA, which have each received consistent attention from scholars of the area (e.g. Belliveau et al., 2006; Berkhout, Hertin, and Gann, 2006; Bleda and Shackley, 2008; Hoffmann et al., 2009; Scott and McBoyle, 2007; Tashman, 2011). CCCV refers to the “possible negative impacts of climate change in real terms” on business (Hoffmann et al., 2009: 257). CCCAC refers to the “ability of business organizations to adjust, moderate potential damages, take advantage of opportunities, or to cope with the consequence of climate related events (both physical and institutional)” (Bleda and Shackley, 2008: 519). As mentioned above, CCCA describes the resultant efforts by firms to cope with threats or seize opportunities related to climate change-related forces. Our framework relies on these constructs because they reflect the external drivers of organizational action on climate change (e.g. CCCV), firms’ willingness and capacity to respond to those drivers (e.g. CCCAC), and resultant efforts in this regard (e.g. CCCA). Finally, after reviewing the research on CCCA as it pertains to each climate change exposure pathway, we outline research opportunities for scholars with interests in this area.

The rest of this chapter will be organized as follows. First, we will review the key concepts of CCCV, CCCAC and CCCA. Second, we will organize the extant research on these concepts into categories that reflect how they pertain to the biophysical, industrial–economic, and institutional climate change exposures that are confronting business. We will also outline unanswered research questions and opportunities associated with each type of exposure. Finally, we will discuss the implications of our framework for scholars and practitioners.

Corporate climate change vulnerability

In the broadest sense, CCCV refers to the extent to which businesses can be harmed by climate change-related pressures. Scholars have identified several conditions that determine the presence and extent of a firm’s climate change vulnerability, including exposure, sensitivity, and resilience to climate change pressures (e.g. Belliveau et al., 2006; Hoffmann et al., 2009; Linnenluecke, Griffiths, and Winn, 2013; Scott and McBoyle, 2007; Tashman, 2011). Exposure refers to the presence of climate change pressures in the external environment of the firm. Sensitivity refers to the extent to which the firm may be adversely affected by those pressures (Belliveau et al., 2006). Resilience refers to the firm’s capacity to recover from adverse climate change-related effects in both substantive (the extent to which affected resources may be restored to their previous state) and temporal (the extent to which the recovery timeframe is feasible for the firm) dimensions (Linnenluecke, Griffiths, and Winn, 2012).

As mentioned above, CCCV can involve “perturbations,” which are discrete extreme episodes, or continuous “stressors,” which are more subtle changes in weather trends that disrupt business operations if they persist for sufficiently long timeframes (Füssel, 2007). Firms experience CCCV directly through biophysical exposure, or indirectly through industrial–economic and institutional actors and systems that may be sensitive to climate change-related pressures (Belliveau et al., 2006). Finally, direct and indirect forms of CCCV can be highly interactive (Smit, McNabb, and Smithers, 1996), implying that firms can simultaneously experience multiple forms of exposure, sensitivity, and resilience to climate change as well as the effects of these factors in combination.

Corporate climate change adaptive capacity

Like CCCV, CCCAC is an inclusive concept that refers to organizational resources that help firms cope with threats or take advantage of opportunities created by climate change (Berkhout, 2012). Research on this construct has focused on how managerial sensemaking abilities determine recognition of CCCV, as well as the capabilities that are useful in adapting to climate change. Generally, scholars believe that managerial interpretations and responses to climatic stimuli are boundedly rational, where managers face diverse competing demands on their attention that complicate recognizing and responding to CCCV (Berkhout, 2012).

In addition, there is a small but growing amount of research on the capabilities that help firms adapt to climate change by enabling responses to CCCV (e.g. Berkhout et al., 2006; Hertin, Berkhout, Gann, and Barlow 2003; Tashman, 2011; Winn et al., 2011). In particular, Winn and colleagues (2011) suggest that several existing capabilities could be developed and deployed in response to CCCV, including sustainability management, crisis management, and risk management, since CCCV often involves uncertainty- and risk-associated ecological pressures, including massively destructive extreme weather events. These scholars carefully note the discontinuous and non-linear nature of climate change exposure, along with its unknown destructive potential, and suggest that current capabilities will need to become more robust to the future realities of climate change.

Berkhout and colleagues (2006) observed an evolutionary economics approach to building CCCAC in the UK water and housing sectors. They found that firms deployed learning routines and dynamic capabilities to establish a better organizational fit with their changing climatic environment. Less work has examined how industrial–economic and institutional factors shape CCCAC, although organizational theories suggest that they may either enable or constrain such capabilities. Berkhout’s (2012: 94) review of the CCCA literature led him to conclude that these contexts “may provide the knowledge, resources, incentives, and legitimacy for (collective) adaptive action, but they may also promote climate vulnerability and constrain adaptive responses.”

Corporate climate change adaptation

Management scholars have used a number of definitions for CCCA in their research (Nitkin, Foster, and Medalye, 2009). Bleda and Shackley (2008: 517) view it as “changes in behavior of a business organization aimed at coping with the effects of any climate-related event.” Hoffmann and colleagues (2009: 257) define it as “the measures that a company chooses to implement in order to adapt to climate change.” Linnenluecke and colleagues (2012: 18) suggest that climate change adaptation involves “longer-term, anticipatory adjustments to observed or expected impacts from weather extremes and greater climate variability.” While Belliveau and colleagues (2006), Tashman (2011), and Winn and colleagues (2011) avoid explicit definitions, their papers suggests that adaptation to climate change is consistent with organizational adaptation described in a number of management theories, including the behavioral view of the firm, institutional theory, the resource-based view, and resource dependence theory. We contend that the concept should remain general enough to accommodate a wide range of potential adaptive responses to the various exposure pathways that may confront firms, as well as be inclusive of multiple organizational theories to explain different mechanisms at play with these various exposures.

Current research asserts that CCCA can vary along several dimensions, including type of adaptation, degree of proactivity, and scope of adaptation (Nitkin et al., 2009). Researchers focusing on type adaptation have discussed the measures that firms can take to reduce the CCCV of their current business models, or adapt their business models into activities that are less vulnerable (e.g. Hertin et al., 2003; Hoffmann et al., 2009; Tashman, 2011). Degree of proactivity refers to whether firms are engaged in anticipatory (proactive), autonomous, planned, and/or reactive adaptation. Anticipatory adaptation involves measures to reduce CCCV ahead of the firm’s climate change exposure. Autonomous adaptation is not consciously planned by managers, but rather is triggered by climate change exposure. Conversely, planned adaptation is deliberately undertaken by management. Reactive adaptation comprises responses to the effects of climate change on firms after the fact (Nitkin et al., 2009). Finally, scope of adaptation refers to whether the adaptation is aimed at providing private benefits for only the firm itself, club benefits for sets of organizations, or public benefits for non-market stakeholders in the firm’s institutional environment (Berkhout, 2012). In the next sections, we map the different types of climate change-related exposures that have been discussed in the literature and relate them to CCCV, CCCAC, and CCCA, respectively. Figure 17.1 illustrates these relationships.

Figure 17.1 Factors and levels of analysis of the corporate climate change adaptation process

Climate change adaptation and biophysical pressures

Biophysical exposure and corporate climate change vulnerability

Biophysical CCCV refers to vulnerability to abnormal weather trends caused by dynamics in the atmospheric environment of the firm (IPCC, 2001). As mentioned above, abnormal weather trends may manifest as perturbations (abnormally extreme weather events) or stressors (prolonged deviations in the statistical norms of climatic variables such as temperature and precipitation amounts) (Füssel, 2007). It is important to note that extreme weather events are not necessarily climate change-related. They are, by definition, rare and expected to happen on an infrequent basis. Extreme weather is a reflection of climate change when events become more frequent, intense, and/or geographically dispersed than historical averages (IPCC, 2001).

Several articles have studied the massive destructive potential of biophysical perturbations that can affect firms (Linnenluecke et al., 2012; Winn et al., 2011). This research has generally focused on extreme weather events and their potential to create spectacular physical impacts on firms. Organizational sensitivity to these events appears to be a function of p...