- 212 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Q&A Equity & Trusts

About this book

Routledge Q&As give you the tools to practice and refine your exam technique, showing you how to apply your knowledge to maximum effect in an exam situation.

Each book contains essay and problem-based questions on the most commonly examined topics, complete with expert guidance and fully worked model answers that help you to:

-

- Plan your revision:

-

-

- introducing how best to approach revision in each subject

-

-

- Know what examiners are looking for:

-

-

- identifying and explaining the main elements of each question to help you understand the best approach

-

- providing marker annotation to show how examiners will read your answer

-

-

- Gain marks, and avoid common errors:

-

-

- identifying common pitfalls students encounter in class and in assessment

-

- providing revision advice to help you aim higher in essays and exams

-

-

- Understand and remember the law:

-

-

- using diagrams as overviews for each answer to demonstrate how the law fits together

-

The series is also supported by an online resource that allows you to test your progress during the run-up to exams. Features include: multiple choice questions, bonus Q&As and podcasts.

www.routledge.com/cw/revision

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

1 | The Creation of Trusts |

INTRODUCTION

It might be thought prudent at the start of any book on the law of trusts to attempt to define exactly what a ‘trust’ is. Unfortunately, that is not as easy as we might hope. Of course, the essential ingredients of a trust are well known: there is a ‘trustee’, who is the holder of the legal (or ‘paper’) title to property, and this person holds the trust property ‘on trust’ for the ‘beneficiary’ (or cestui que trust). The beneficiary is the equitable owner of the property and this is the person (or persons) to whom the real or ‘beneficial’ advantages of ownership will accrue. The interest enjoyed by the beneficiary is proprietary, or ‘in rem’. Thus, he is able to trace his property and recover it from any intermeddler with the exception of the bona fide transferee of the legal estate for value without notice. Further, although, as just indicated, the trustee usually holds the ‘legal’ title and the beneficiary holds the ‘equitable’ title, it is perfectly possible for an equitable owner to create a trust of that interest. In such cases, the first equitable owner is the trustee (as well as the beneficiary under the first trust!), holding an equitable interest on trust for a beneficiary. Sometimes this is known as a ‘sub-trust’. However, whatever the precise configuration of legal and equitable ownership, necessarily there is a relationship between the trustee and the beneficiary – sometimes referred to as a ‘fiduciary relationship’ – and it is clear that the former has certain responsibilities and duties to the latter. Furthermore, sometimes the property which is the subject matter of the trust – and this can be any property, tangible or intangible, real or personal – will have been provided by a ‘settlor’ or a ‘testator’ and it is they who have set up the trust either during his or her lifetime (settlor) or on death (testator). Indeed, in the case of a trust established by inter vivos gift (that is, not by will), the settlor and the trustee may be the same person and, in such cases, the settlor is said to have declared himself or herself trustee of the trust property. Finally, it should be noted that a trustee may also be a beneficiary under a trust. This quite often happens with trusts of cohabited property where the man may hold the property on trust for himself and his lover in some defined shares.

This, then, is a very simple picture of a trust and beyond this it is not easy to make general statements about the nature of a trust without also explaining the one or more exceptions that exist to nearly every rule. The law of trusts is not something that can be neatly dissected, nor can its principles be safely pigeonholed. Perhaps the best way to understand it is through an analysis of the substantive law without recourse to a priori definitions and assumptions that may prove wholly inadequate in explaining how the unique legal concept of the trust actually works in practice. With that in mind, the first topics to consider are the requirements imposed by general statute law and general principles of common law for the creation of a valid trust.

There are two sets of formal requirements which must be met before a valid trust can exist. On the one hand, there are those rules imposed by statute – principally the Law of Property Act 1925 – which establish formality requirements for the creation of trusts of certain kinds of property. These are requirements of writing and the like which are not inherent in the concept of the trust per se, although failure to comply with them will render the trust unenforceable. Rather, they are ‘external’ requirements imposed in order to ensure the proper working of the trust concept, especially the prevention of fraud by the trustee. Second, there are those rules of common law and equity which require the declaration of trust and/or the transfer of ownership of the trust property to the trustee to be achieved in specific ways according to the particular type of trust property. Examples include the need for a deed or registered disposition for the transfer of land to the trustee and entry in the company’s register for the transfer of shares. These rules are not peculiar to the law of trusts, but given that the property which is the subject matter of the trust must pass into the hands of the trustee before the trust can exist (if it is not already there), the mode of transfer appropriate to each particular kind of property must be used if the trust is to be regarded as properly constituted. Failure to constitute the trust because of a failure to transfer the trust property to the trustee by the appropriate method has serious consequences.

Thus, the issues covered in this chapter require an understanding of the following matters:

(a) the different formality requirements for the creation of trusts of land and those for the creation of trusts of other property;

(b) the distinction between the creation of a trust and the ‘disposition’ of a ‘subsisting’ equitable interest under an existing trust and the reasons why an accurate distinction must be made;

(c) the necessity of properly constituting a trust and the manner in which this may be achieved relative to specific types of trust property; and

(d) the consequences of failure to constitute the trust properly.

QUESTION 1

‘Although equity will not aid a volunteer, it will not strive officiously to defeat a gift’ (per Lord Browne-Wilkinson in Choithram International SA v Pagarani (2001)).

How to Read this Question

This is a broad essay question on the constitution of a trust and the consequences of creation. The focus of the question is whether the court is prepared to relax the Milroy v Lord rule in favour of volunteers in order to give effect to the clear intention of the transferor.

How to Answer this Question

A good answer to this question will deal with the principle in Milroy v Lord by reference to structured discussion of the relevant cases. The main issue is when would a gift or trust be fully created and do the courts have a discretion to develop the law in this area? The permutation of legal principles determining this question are required to be discussed as well as the effects of constitution and the ineffectual creation of an express trust or gift.

Up for Debate

Students are urged to read the judgments in the controversial decision Pennington v Waine. In this case, Arden L J’s view of unconscionability was based on the discretion of the court and varies with the circumstances of each case. This approach introduces notions of justice and fairness in outcomes to transactions that involve the process of the transfer of the legal title to property. In Pennington v Waine, what would have been the position if registration of the shares were declined by the company? If the constructive trust theory is to be maintained, despite the refusal to register the new owner, this would result in equity treating an ineffective transfer as a valid declaration of trust. But in Pennington v Waine the donor had not declared a trust, nor made a gift, nor had she done everything in her power to make a gift, yet the court decided that the transfer was effective in equity.

The following articles are instructive in order to get a better understanding of the subject: J Morris ‘Questions: when is an invalid gift a valid gift? When is an incompletely constituted trust a completely constituted trust? Answer: after decisions in Choithram and Pennington’ (2003) 6 PCB 393; M Halliwell ‘Perfecting imperfect gifts and trusts: have we reached the end of the Chancellor’s foot?’ (2003) Conveyancer 192.

Answer Plan

Answer Structure

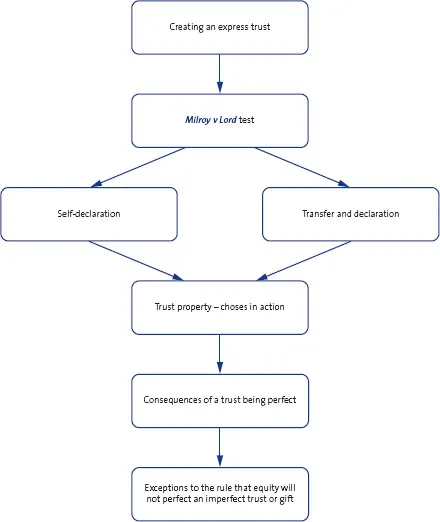

This diagram illustrates the methods and consequences of creating trusts, including gifts.

ANSWER

This statement by Lord Browne-Wilkinson highlights two fundamental principles of equity: the notion that equity will not assist a volunteer and that there is no policy in equity to defeat a perfect gift. These are self-evident propositions. However, a number of landmark cases have striven to perfect gifts which, on orthodox theory, ought to be considered as imperfect.1

The principle laid down by Turner LJ in Milroy v Lord (1862) identifies the two modes of constituting an express trust. The onus is on the settlor to execute one (or in exceptional circumstances both) of these modes for carrying out his intention. The two modes of creating an express trust are:

(a) a self-declaration of trust; and

(b) a transfer of property to the trustees, subject to a direction to hold upon trust for the beneficiaries.

A settlor may declare that he presently holds specific property on trust, indicating the interest, for a beneficiary. In this respect he simply retains the property as trustee for the relevant beneficiaries. Clear evidence is needed to convert the status of the original ...

Table of contents

- Cover

- Half Title

- Title Page

- Copyright Page

- Table of Contents

- Table of Cases

- Table of Legislation

- Guide to the Companion Website

- Introduction

- 1 The Creation of Trusts

- 2 Secret Trusts

- 3 The Inherent Attributes of a Trust: The Three Certainties and the Beneficiary Principle

- 4 The Law of Charities

- 5 Resulting Trusts

- 6 Constructive Trusts 1: The Duty Not to Make a Profit from the Trust and Co-ownership Trusts

- 7 Constructive Trusts 2: The Liability of Strangers to the Trust

- 8 The Law of Tracing

- 9 Breach of Trust

- 10 The Office of Trustee and its Powers and Duties

- 11 Equity

- 12 Pick and Mix Questions

- Index

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Q&A Equity & Trusts by Mohamed Ramjohn in PDF and/or ePUB format, as well as other popular books in Law & Estates & Trusts Law. We have over one million books available in our catalogue for you to explore.