![]()

1

Music Industry Study and Facts

The global music industry is a 50 billion-dollar business despite constant shifts in the way music is enjoyed by fans—music lovers are still here!

According to Nielsen, 2015:

The Year-end Music report recently released by Nielsen details an unprecedented music consumption pattern in the United States. Sales of albums in every format except one are down from 2015. Digital songs downloads are also down. Despite this, total music consumption went up by 3%. The reason is not far-fetched. The music business was overtaken by on-demand streaming. Not surprising, just long overdue.

On-demand audio streaming accounted for the largest share of total audio music consumption with a slice that consumed 38% of the pie. For the first time, on-demand audio streaming bested digital music sales. Overall music streams (audio and video) increased by 39.2% year-over-year. Audio streams which increased by a whopping 76.4% from 2015 to 2016 account for most of that gain. There was a 7.5% increase in Video streams.

Sales of albums and songs boozed up in contrast by 2016. Downloads of digital songs were down 25% from 2015. Album sales (CD, cassette, vinyl and digital) in its entirety were off by 16.7%. There was a drop in digital album sales by 20.1% and a drop in CD sales by 16.3%. The Mass market went down by 24.5% while chain stores, which nosedived by 21.4%, counted the biggest losses in terms of physical album sales.

The fancied album format remains the CDs accounting for approximately 52.3% of sales. The second most popular format is the digital with 41% of album sales followed closely by vinyl with 6.5% sales.

The music industry’s sole bright spot for sales in 2016 is the Vinyl LPs even when they accounted for a small proportion of album sales. Their sales increased by 10% from 11.9 million units sold in 2015 to 13.9 million units in 2016. There was an outstanding production of year-over-year increase in sales by Vinyl LPs for the 11th consecutive year.

The star of the music consumption show in 2016 was on-demand streaming. On-demand music streaming was measured by Nielsen through the combination of audio and video streams from Spotify, YouTube, Apple, Google Play, Amazon, Rhapsody Song, Tidal, Soundcloud, Xbox Music, Slacker, Tidal Video, Medianet, Aol Radio and Disciple.

431.7 billion music streams abound in 2016. That amounts to an average of about 1.2 billion streams per day or 49.3 million streams every hour. That’s roughly estimated as 3.7 streams per day for every man, woman and child in the US. There were 251.9 billion audio (690.1 million daily) and 179.9 billion video (492.9 million daily) streams in 2016, breaking out audio and video.

Money was continually raked in by the music industry in 2016 because the loss in sales was offset by income from subscription streaming services. A report by BuzzAngle states that on-demand streams from paid subscriptions increased 124% from 85.3 billion in 2015 to 191.4 billion in 2016. There was an increase of 14.3% by Ad-supported on-demand streams. Subscription accounts streams up to approximately 76% of on-demand audio streams.

Talk about the on-demand cat that got out of the bag in 2011 when Spotify launched in the US, growing into a lion that is now the king of the music industry jungle (Murnane, 2017)!

Music Lifestyle

According to Music 360—2015 report (Nielsen, 2015), Nielsen’s fourth annual study of US music listeners, 91% of the national population listens to music, spending more than 24 hours each week tuning into their favorite songs. While total listening figures are roughly the same as last year, how we access and engage with music is changing (Nielsen, 2015).

In looking at the report data, 75% of Americans listen to music online in a typical week, up nearly 12% from last year. And online listening trends are having a significant impact on our on-demand listening habits. While Americans streamed more than 164 billion on-demand tracks across audio and video platforms in 2014, they streamed 135 billion in the first half of 2015 alone—up more than 90% from the same period last year (Nielsen, 2015). And Americans’ music listening isn’t just becoming increasingly digital, it’s becoming more mobile. In fact, 44% report using smartphones to listen to music in a typical week, a 7% increase over last year, while listening on our desktop computers less (Nielsen, 2015).

Radio continues to be the number one source of music discovery in the United States, with 61% of respondents saying they find out about new music from AM/FM or satellite radio, a 7% increase over last year. Word of mouth is also important, particularly for teens: 65% say they discover new music through family and friends, well above the average of 45% (Nielsen, 2015).

Americans are also discovering more music at live events. 12% of respondents say they discover music through live events, up more than 70% from last year. Americans are so engrossed in live events that they now spend more than one-half of music-related expenditures on them each year, and 50% of Americans say they’ve attended a live event in the last year (Nielsen, 2015). And what would the music year be without festivals? Eleven percent of Americans claim to have attended a music festival in the past 12 months, with Millennials comprising 44% of all festival-goers. Most attendees choose festivals based on the lineup, and about two-thirds choose based on proximity to where they live and price of tickets (Nielsen, 2015).

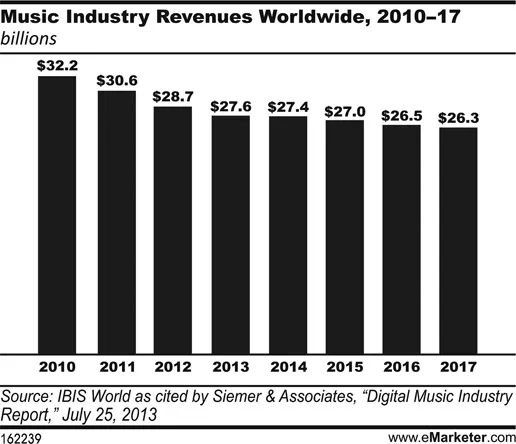

Figure 1.1 Music Industry Revenues Worldwide, 2010–2017 (billions)

Today’s Celebrity Culture

Celebrity culture is alive and well. 19% of people say that they would “give anything” to meet their favorite music artists, though exactly what that might be is anyone’s guess! Fans in the United States (33%), UK (32%) and Spain (30%) are the most obsessed with this idea, while consumers in China, Hong Kong and Hungary aren’t ready to do anything special to meet their favorite music stars. Only 7% each would even make an attempt, the lowest among all markets surveyed (Siemer & Associates, 2013).

16% were excited about the idea of going on weekend getaways with their favorite musical artists and fellow fans, including access to a few concerts during that time, but not everyone was impressed with the idea. Those indicating they were “very interested” in this were the Americans (44%) and Brits (39%), while only 2% of those in Hungary and 3% in Hong Kong would be interested (Siemer & Associates, 2013).

“The rise of artists’ own websites, along with their use of social media like blogs, Twitter and Facebook, have gotten music fans even closer to their favorite stars,” says Steve Garton, global head of media research for Synovate.

We’re also living in fame-obsessed times, so the media helps fuel the frenzy. However, in many eastern markets, while things like celebrity endorsements can work quite well, if done right, a certain amount of pragmatism sets in. People think, yes, my favorite singer is gorgeous and sings songs that capture my feelings now, but they’re not going to help me get a promotion in my job. In Hong Kong and China, there is a pop culture. But it remains a means to an end, not an end in its own right.

(Rise Artist, 2016)

When respondents were asked which music “extras” they’d be willing to pay for, their answers suggest that Western markets overall are more interested in paying for exclusive items such as access to exclusive unreleased MP3s, members-only web content, private gigs, etc.

Americans topped the charts as most willing to pay for more access to and information about their favorite music stars. More than two-thirds of Americans say they’d pay for the following: text alerts about upcoming shows and tickets availability (70%); access to “members only” exclusive Internet gigs (67%); a “queue jumper” feature, including guest list entry and an upgrade for “all access” to areas (67%); access to a “members only” section on an artist’s website (67%).

According to Bob Michaels, Senior Vice President of Consumer & Business Insights for Synovate in the US, “Americans are willing to pay for these ‘rights,’ because they want to be part of the inner circle. While anyone can go online and get a song, paying for unreleased music or special access to the member-only section of an artist’s website makes fans feel that they ‘know’ the artist and are getting something that only really dedicated fans have. It’s like having a front row seat every day.”

Mobile Music

The advent of MTV in 1981 ushered in a whole new way for musical artists to connect with their fan base, and TV still remains a key medium for consumers to watch music videos. But the computer and mobile phone are becoming strong contenders. When asked how they watched music videos over the past month, more than half of those surveyed (57%) say they watched them on TV, while 46% watched them on the computer. Another 16% used their mobile phones, which was highest in India (38%), Philippines (23%) and China (20%).

Mick Gordon, Managing Director for Synovate in India, said:

It’s not surprising that 38% of Indians have watched music videos on their mobile. A fully loaded mobile phone is a basic in India—the market is growing phenomenally, adding millions of mobile phone subscribers every year.

73% of Indians polled say they have watched music videos on TV. In India, it’s still the Bolly wood music that is most popular; ditto for music videos. Lately we’ve seen some migration of Hindi pop stars into Bollywood music as standalone albums of Indian pop stars do not have the wide-reaching acceptance that Bollywood does. And among the youth and certain urban pockets, western music is very popular. That accounts for the popularity of MTV and Channel 5 in India.

China, at 16%, ranked the highest globally for “paid for music apps on my mobile phone,” compared to only 8% of people globally. This activity was also popular in Korea (13%), India (9%) and the UK (8%). The global average for “paid to download a music track to my computer” was 14%, topped by Korea (49%) and the UK (26%).

Robert Alleyne, Research Manager for Synovate in the UK, said:

The scores of less than one in ten people globally paying for music apps on their mobile is not really surprising because, despite mobile capturing many headlines recently, penetration is still relatively low. That said, I would expect this proportion to grow over time. While older mobile users may not be so open to downloading music and music apps via mobile, young tech-savvy consumers have done this for some time now. And as gadgets such as the iPhone reduce the need for people to carry separate music players and mobiles it will continue to grow.

Licensing and ownership of mobile music is also important to bear in mind. If I download a song on my mobile, do I then have the right to transfer that to my PC, burn it to a CD, or transfer it to my MP3 player? The vast majority of consumers would believe they had the right to do so; however, many of the licensing agreements restrict what people do with the music they download using their phones.

Although I do expect the numbers on this to grow in the UK, I would envisage a faster growth in people streaming music on their mobiles. If I can stream any song I want while on the move, why would I need to own it?

(Synovate, 2016)

Downloading and Streaming

Despite what some may think, the record store is not dead. Even with the rise in digital music, many still want to own music in its physical form. In the past month...