![]()

Chapter 1

The Problem of Conformity in Financial Organizations

The stock market crash of 2008 is an interesting example of the override of numbers and economic logic in and around an unexpected financial shock. Although dramatic and recent, similar underlying social processes that eclipse numbers have existed in previous excesses since the beginning of banking and continue to prevail.

This book, using case studies for illustrative purposes, will seek to explain why many large financial organizations, full of seemingly rational individuals, were defrauded by large bets that did not make organizational economic sense. It will discuss how social sense was managed and mismanaged by numerate practitioners, before and after the taking of massive financial provisions and write-downs.

More specifically this book presents four alternative risk models that seek to explain how these very risky bets happened. They are the dominant and mainly quantitative risk analysis (quant) model, the contrarian model, the evolutionary model, and the institutional structure model. These risk management models shed light upon the non-economic activities of rainmaking quant in-groups that engaged in large and costly speculation in opaque and highly risky “investments.” This is further reinforced at higher levels of analysis by a mimetic institutional field and the boom phase of an economic cycle. Many of the principal actors who suffered heavy losses in these case studies ostensibly responded to quantitative analyses by betting upon so-called innovative displacements and applied quantitative financial models. This book outlines how the rules, cognitive routines and ideological pressures of an institutional environment and systemic mania wove together to eclipse the technical and economic rationality of risk governors within these organizations. This abdication and override of technical rationality, fraudulently masquerading as innovation and risk management, is explored.

Retrospective and Prospective Explanations

The recent spectacular and unexpected financial losses of 2008 and other crises (i.e. Latin American debt 1981, US Savings and Loan 1980s and early 1990s, the dot-com bubble of 1999) have shocked many financial institutions to the point of threatening their survival. In hindsight, organizational observers, investors and researchers have pointed to seemingly obvious signs of systemic excess and massive risk taking over time.1,2. How then is it possible that such large warning signs were either not seen or, alternatively, seen and yet ignored?3 Also, given the tidal wave of $700 billion in US Treasury financial support (TARP) to the banking system and recent volatility in financial markets, what, if anything, is different now? Chapter 2 helps us understand how numbers were, are and will continue to be manipulated by proposing four alternative risk management models that, when combined, form the Holistic Risk Management Model (HRMM). It is exploratory in nature. This book will focus upon processes within cases of risk taking that resulted in large runaway losses for financial institutions and the failure to detect the massive legal and illegal bets. For the most part, the illustrative cases involve substantial risk taking by rainmaking elites. Although retrospective accounts provide 20/20 hindsight, I wish to underline processes that can be applied prospectively. For example, presciently (or coincidentally), in 2006 some observers raised significant doubts about the opacity of numbers, bogus transactions, and synchronicity, that also were apparent in the crash of 2008, at various levels of analysis such as in-house trading groups, investment banks, the banking industry and the economy. This is outlined in Chapter 4.

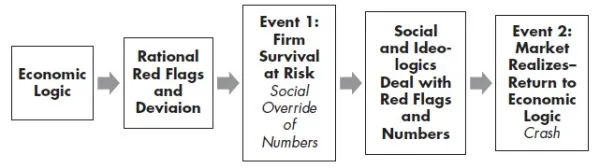

The Override of Numbers: A Dynamic View

When viewing a financial crisis in hindsight and in foresight, there are two important packages of logics and processes that become apparent at an organizational level of analysis. These processes lead to two important outcomes (Events 1 and 2). The first is the accumulation of risky activities by employees within a group of insiders, of an organization, which at some point secretly “bets the farm” or threatens the survival of an organization. Somehow the economic rationality and control of internal and external risk governors using mainly quantitative models is undermined and overridden (see Figure 1.1). The second event is when management and related parties realize that there is a dire problem on hand. This results in the recognition of large existing or potential losses, and often causes a credit, liquidity and confidence crisis. This may even end in a firm’s demise and bankruptcy, sale to a more solid acquirer, a bail-out by government, or some combination thereof. Given the synchronous nature of most large financial institutions and markets, imitative behavior at a higher industry or institutional field level of analysis may occur. When this happens, the sum of many of the same processes and assumptions within organizations within an industry and institutional field can add up to big problems.

Figure 1.1 The Dynamics of the Social Override of Numbers and a Crash: Events 1 and 2

I have compressed these two processes, bubble building and bubble bursting, into two discrete events (Event 1 and Event 2) for illustrative purposes. Within an organization, first there is a period of sustained success by a quantitative products in-group based upon knowingly taking large risks (and a focus upon revenue growth and cash flow irrespective of this risk) that is not completely understood by internal and/or external risk governors. The magnitude of risks taken eventually reaches a point whereby hidden losses threaten the survival of the firm. Next, red flags and seemingly obvious facts (often numerical) warn that the system is at risk. These warning signs are ignored by risk governors and denied by risk takers. This decoupling of economic and technical rationality and its override by social forces drive revenues and asset prices even higher. Adam Smith calls this “over-trading.”4 Although a careful look at numbers and fundamental analyses may tell a different story, a highly profitable fictive quantitative model/money machine is hailed by quant insiders as having been found. I call this Event 1 Social Override.

The focus of this book is on how non-economic social logics deal with the seemingly obvious massive red flags thrown up by a risk management system’s economic and technical warnings. Eventually there is the collective realization by a consensus of managerial and market participants that there is a clear absence of numerate technical/economic rationality behind asset price gains and a return to assumptions of technical rationality (and an examination of numbers and their attendant assumptions), which then results in financial collapse. I call this Event 2 Crash. The logics leading up to Event 1 and Event 2 are the focus of this volume. Illegal deception is fraud, while the intentional legal override of economic logic is innocent fraud.5

Two Events: Social Override of Numbers and Crash

It follows that if social decoupling and override can be better understood by examining logics and processes around these events, future financial bubbles and crashes might be mollified or avoided by risk governors (or, alternatively, fueled and exploited by manipulative quant in-groups within organizations). The bubble reinforces conformity and creates favorable conditions for contrarian deviation and fraudulent activity.6,7 In the cases discussed in this volume, contrarian in-groups used this social space and numerous processes in order to deviate and profit from conformist processes. Often, opaque quantitative models provided to analysts and debt rating agencies further catalyzed the process.

Cheerleaders and Models

Since the crash of 2008, much has been written about the inherent inappropriateness of David Li’s Gaussian copula formula’s application to the pricing of tranches in the credit default swap market, which resulted in silk purse AAA ratings being created from sow-ear bad mortgage loans. For example, the US Government’s Financial Crisis Inquiry Report (FCIR) notes that “of all mortgage backed securities it had rated AAA in 2006, Moody’s downgraded 76% to Junk.”8

Post-crash scrutiny reveals that the lower boundary condition of the complex valuation models used flawed assumptions such as a constant recovery assumption of 75 percent of bad mortgages that may have trumped other model parameters such as expected default rates and correlations and resulted in AAA ratings for large tranches of packaged “junk” securities.

For example, the FCIR notes that Moody’s credit ratings of packages of junk (sub-prime mortgages) were based upon three main mathematical models that were meant to produce credit ratings (AAA = most credit worthy, etc.) that would allow investors to compare across other asset classes and time.9 Investors relied upon credit ratings despite disclaimers buried in prospectuses saying that ratings are solely statements of opinion (this is analogous to the disclaimers found in business school cases that disclaim that cases are intended only for teaching purposes, but not as an example of how to manage …). Furthermore, in testimony to Congressional investigators, a former head of Moody’s sub-prime rating department noted massive inconsistencies in their rational analytic approach and that quantitative analysis, although flawed, was eclipsed by qualitative considerations: “One common misperception is that credit ratings are derived solely from a mathematical process … Ultimately, ratings are subjective opinions that reflect the majority of the (rating) committee’s members.”10

Curiously, Moody’s and the other major rating agencies (Standard & Poor’s and Fitch) appear not to have legal liability regarding the accuracy of their ratings since courts have ruled that they are de facto immune to prosecution. They have also been deemed to be merely exercising their right to free speech under the first amendment of the US Constitution, although this may be contested.11 Thus credit ratings belong to the magical potions of management such as financial forecasting, market research and capital budgeting, that build legitimacy, reduce uncertainty and endeavor to predict the unpredictable.12,13 It is also very interesting to note, in the context of the cornering of the junk bond market and subsequent Milliken prosecution, that numbers related to junk bonds have been manipulated and misrepresented as being a money machine and safe in the past.14

Discourse is used to build legitimacy as artifacts and texts such as “bad loans” not “bad bankers” are blamed and infused with value and causality.

![]()

Chapter 2

The Holistic Risk Management Model (HRMM)

Understanding Multiple Logics: Economic, Social and Ideological

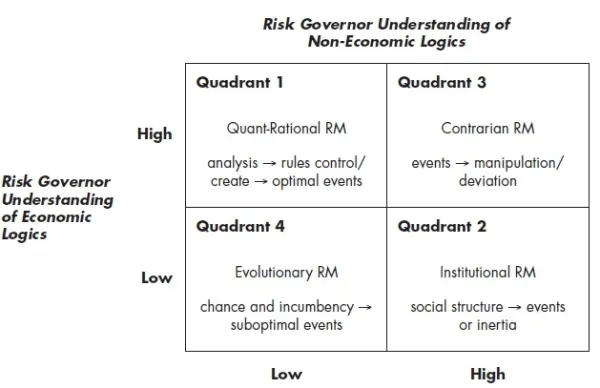

The observations of risk managers, boards of directors, bank examiners and other observers that unfold in this book point to the override of economic rationality by ideological and social logics as outlined in Figure 2.1. The Holistic Risk Management Model’s (HRMM) basic premise is that a combination of different and powerful views of risk management can be used to explain why large organizations that are full of clever people often do silly things. These are shown in the quadrants of Figure 2.1.

Figure 2.1 The Holistic Risk Management Model (HRMM)

Source: Vit (2006; 2007; 2009)

Numerous economic-rational red flags existed in most of the cases discussed in this book. Quadrant 1 represents the dominant rational economic risk management model that most banks utilize. Subsequent chapters will highlight the cases of banks that were at the forefront of quant-rational risk management, such as National Bank of Australia, UBS and Société Générale (SocGen), and how their systems were overridden by other non-economic logics. Parmalat’s bankers, National Bank of Australia, UBS and SocGen all relied upon sophisticated mathematical models and micro-processes to control risk via quantitative and rational risk models. This process is Cartesian as risks are anticipated, and rules are created to manage and to flag breaches and deviations from the norm.1 Figure 2.2 outlines these rational risk management processes.2

Figure 2.2 Quant-Rational Risk Management

Source: Vit (2009)

This dominant risk management model is mechanistic and prescriptive. The model assumes that rigorous internal and external analysis is ongoing, that this in turn results in optimal rules, decisions and action. It assumes a high degree of technical and economic rationality and predictability. Routines are put in place to manage risk.3

I have noted that there exist implicit assumptions behind this model that should be made explicit. First, the model is highly prescript...