![]()

![]()

Chapter 1

Why you will Lose your Best key Accounts if you don’t Prepare a Strategic Plan for them

Summary

Chapter 1 explains the need for preparing strategic plans for key accounts and positions it firmly within the broader domain of corporate planning and marketing planning. We strongly recommend that those who have bought this book read this chapter carefully.

The Need for Strategic Plans for Key Accounts

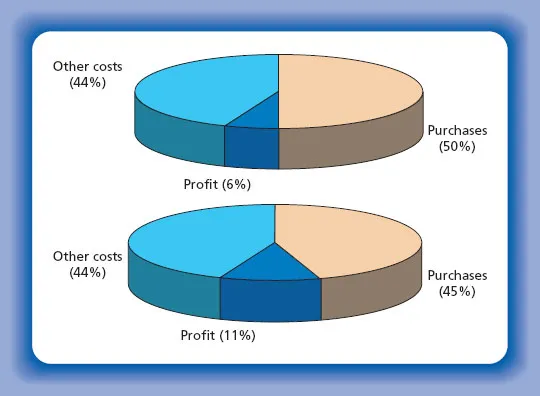

Managing powerful customers profitably is perhaps the biggest issue facing suppliers today as markets, particularly in Western Europe and America, mature and as inexpensive versions of goods which were hitherto only supplied by the West flood into their markets from lower cost countries such as China. One major response from most organizations is to put pressure on their suppliers because, as can be seen from Figure 1.1, the easiest and quickest way to increase margins which are under pressure is to cut the price paid for external goods and services.

Figure 1.1 Double your money: cut spending on purchases (Purchasing: adding value to your purchasing through effective supply management’ Institute of Directors, September 2003).

The problem with this approach, however, is that price cutting is finite (how many pence can be cut from a pound, cents from a euro or a dollar, etc.), whereas value creation is infinite and is limited only by our creativity and imagination.

So increasingly, purchasing directors are beginning to take account of the potential benefits of fostering a small number of truly strategic relationships with a privileged group of suppliers. Such relationships, however, are few and far between, because no organization has the time or the resources to align their R & D, purchasing, manufacturing, logistics, information technology (IT), finance, service, and other functions with the equivalent functions in their customers’ businesses in anything other than a few, special cases.

When it happens, however, our research at Cranfield has shown that such relationships are the wellspring of profitability for both parties and totally justify the effort.

Key account management (KAM), then, is without doubt the major challenge facing business today and is fraught with difficulties in conceiving, planning, and implementing it, involving, as it does, organizational change.

With over 10 years experience of researching buyer/seller global best practice at Cranfield, we know what are the requirements for successful KAM. Without doubt, one of the biggest barriers is the type of people who are asked to implement KAM programmes, for KAM is as different from selling and sales management as chalk is from cheese. Our experience over the years has shown us that key account managers must be experienced senior executives, fully trained in analytical techniques, financial analysis, strategic planning, political and interpersonal skills, and indeed, the very skills required by a successful general manager or chief executive officer.

The point we are making is that it is most definitely not a sales role and people who are trained to sell and who are rewarded accordingly rarely make good key account managers.

The purpose of this book is to set out in a no-nonsense way what a top-notch key account manager needs to know and do in order to build profitable relationships with powerful customers. This inevitably means spending time on analysing the customers’ businesses and DNA prior to producing a strategic plan guaranteed to build profitable relationships for both parties. It will focus on putting together strategic plans for key accounts prior to implementing the first year’s plan, for, as John Perton of Boston College said “The good thing about not having a strategy is that failure comes as a complete surprise and is not preceded by a long period of worry and depression”. It is amazing to us how many major accounts are lost because the supplying company has little more than sales forecasts and budgets for 1 year only and how surprised they are when they are dropped in favour of another supplier who has taken the trouble to work out a longer term strategy for working together.

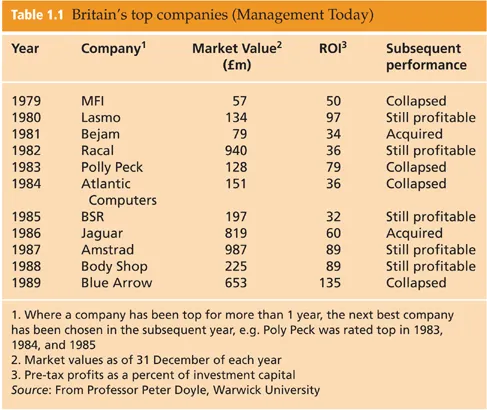

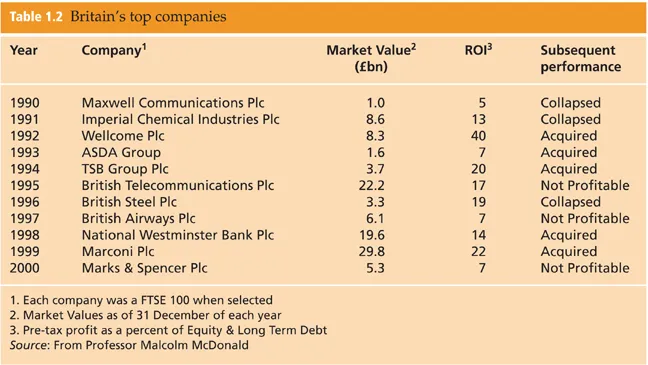

We are Not Talking About Forecasts and Budgets Don’t be fooled into thinking those words from John Perton about lack of strategy and failure represents just an academic trying to score points by being clever, as hundreds of companies all over the world have found out to their cost. Indeed, up to 1990, every UK company with the highest return on investment either went bankrupt or got into serious trouble. Neither did the best performing companies in sectors up to 2000 fare much better, with the likes of Marks & Spencer, ICI, GEC, and others either going out of business or systematically destroying shareholder funds (for evidence, see Tables 1.1 and 1.2). Some of these companies have since recovered, such as M&S, BT, and BA. Some have been acquired and are now profitable, but the lessons to be learned in the historical context of those decades are still highly relevant for companies enjoying high growth in the 21st century.

Before going into further detail about the paramount importance of having a strategic plan for key accounts covering a period of up to 3 years, however, let us dismiss once and for all the mind-bogglingly puerile belief that all the directors and senior managers need to do is to write down some numbers that these become targets and eventually, budgets.

Apart from the fact that Mickey Mouse or Donald Duck could do this without any training, it only ever works in growth markets with little competition. For example, research into the banking sector in the UK threw up the following interesting observation:

In Company X, value creation was merely a matter of protecting market share and managing costs.

The data show that the company X business model is in effect a “money printing” machine, therefore the challenge for strategists lies in how they can act as responsible stewards of a resilient business model.

Cranfield Doctoral Thesis (2005)

There are, however, always consequences of such behaviour. It is interesting to note that, of Tom Peters’ original 43 so-called excellent companies in 1982, very few survived because of a fixation with excellent tactics at the expense of strategy (Pascale, R.T. (1990). Managing on the Edge, Simon and Schuster).

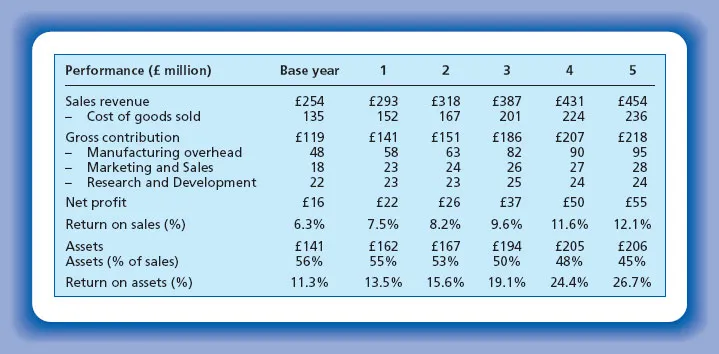

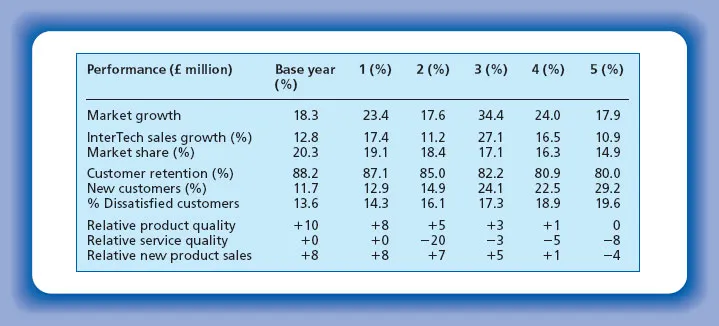

Take, for example, the hypothetical example of InterTech given in Figures 1.2 and 1.3. (Based on a real example, but disguised for reasons of confidentiality). Figure 1.2 shows the kind of information typically discussed at board meetings, most of which are based on forecasts and budgets.

Figure 1.2 InterTech’s 5 year performance.

A glance at Figure 1.3, however, shows that on every market-based dimension, the company is losing ground dramatically and is likely to suffer serious consequences the moment the market stops growing.

Figure 1.3 InterTech’s 5 year market-based performance.

Here are some recent quotes from well-known sources:

Improvements in a short-term financial measure such as economic profit can be achieved through postponing capital investments, reducing marketing and training expenditures, or by divesting assets, each of which may have a positive effect on near-term performance but could adversely affect long-term value creation performance. Nevertheless, when incentivized with bonuses to ‘manage for the measure’ this is exactly what many managers will do irrespective of the consequences on shareholder value.

(Simon Court (2002) “Why Value Based Management Goes Wrong”, Market Leader).

- Ninety per cent of US and European firms think that budgets are cumbersome and unreliable, providing neither predictability nor control.

- They are backward-looking and inflexible. Instead of focussing managers’ time on the customers, the real source of income, they focus th...