![]()

Chapter 1

Corporate Governance Theories: A Synthesis

MARIA ALUCHNA1

Introduction

Corporate governance represents a unique academic topic as its research is embedded in economics, finance, management, political economy, sociology, culture and law (Stulz and Williamson, 2003; Doidge et al., 2007). Such variety indicates the complexity of corporate governance and the interdependence of its elements and spheres, and provides analyses carried out from various approaches. Despite the dominance of the principal-agent theory, extensive analyses gave rise to the emergence of different views focusing on the business–society relationship or emphasising the virtue of cooperation and responsibilities undertaken by stakeholders and organisations. The growing awareness of the systemic interdependencies and the importance of the cultural and social norms as well as legal and political structures challenged the simplified picture of self-interest and utility maximisation provided by economics. The richness of perspectives results in competitive views on corporate governance, identifying its strengths and weaknesses and adopting alternative arguments and recommendations. It also illustrates the complexity of selected corporate governance elements and mechanisms, performance criteria or compliance problems.

The purpose of this chapter is to view and examine corporate governance theories highlighting the variety of existing perspectives. The numerous approaches and origins which serve as a starting point for the analysis of corporate governance impact the number of definitions and theoretical frameworks adopted in the literature. Generally speaking, corporate governance is defined as ‘the structure that is intended to make sure that the right questions get asked and that checks and balances are in place to make sure that the answers reflect what is best for the creation of long-term sustainable value’ (Monks and Minow, 2004: 2). Different approaches propose alternative understandings of company functioning and stakeholder behaviour which may lead to competing diagnoses on corporate governance shortcomings (Tirole, 2005) and suggest different directions for further development. This chapter also aims to indicate the dynamics of corporate governance theories, actively adopted after the financial crisis, showing that the debate on the theoretical framework is far from being settled. The chapter is organised as follows. The first section presents the definitions and mechanisms of corporate governance. The theories addressing the tasks of corporate governance at the company level are discussed in the second section with references to the relationship between shareholders and managers, the role of stakeholders and the organisation of the firm. The third section identifies the theories which provide for a macro view and study the dynamics, characteristics and differences of the national systems of corporate governance. Final remarks are presented in the concluding section.

The Definition of Corporate Governance

Corporate governance remains one of the most intensively researched themes in academic literature, integrating management, finance, political economy and law (La Porta et al., 1998; Stulz and Williamson, 2003; Doidge et al., 2007). Corporate governance studies relate to the macro issues of national systems and their dynamics (Denis and McConnell, 2003; Deakin and Reberioux, 2009) and the mezzo issues of the institutional environment and industrial determinants (Höpner, 2005; Hall and Gingerich, 2009), as well as the micro issues of organisation and value creation at the firm level (Shleifer and Vishny, 1997). The existing literature offers a wide range of corporate governance definitions depending on the theoretical perspective from which they derive. In general terms, corporate governance is understood as a set of mechanisms and institutions which are aimed at protecting investors’ rights, assuring shareholders’ representation and participation in management and control, and enhancing corporate efficiency with respect to creating shareholder value in the long term (Monks and Minow, 2004). Such formulated goals are realised by the adoption of principles, policies and practices (Tricker, 2012) that encompass the implementation of control and incentive mechanisms. These institutions and mechanisms function at the company level (the corporate governance structure, including shareholder meetings, boards, executive compensation, auditors, etc.) as well as at the systemic level (the corporate governance system based on the stock market, financial system, legal regime, state intervention, etc.) (Baker and Anderson, 2011). The way in which corporate governance is perceived and understood is the result of the set of norms and systems describing the company functioning in a given economy and society. The most important issues refer to the following issues:

• What is the company?

• In whose interests does the company act? How is the role and responsibility of the company understood?

• What is the dominant ownership structure pattern?

• What is the role and the position of the employees and other stakeholders?

• What is the role and shape of the financial system?

• What is the role of institutional investors?

• How was the pension system designed?

• What is the level of state involvement in the economy?

• Which regime does the legal system follow?

The answers to each of the above questions determine the responsibilities of the actors, the structure of corporate governance and the shape of the national system.

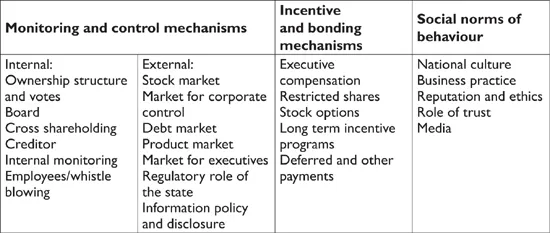

At the micro level, the large body of corporate governance literature covers the issues of ownership structure (Franks et al., 2009; Villalonga and Amit, 2009), board work (Bhagat and Black, 2002; Huse et al., 2011), executive compensation (Johnson et al., 2009; Bebchuk and Fried, 2010) and disclosure practice, as well as the legal (Roe, 2003), institutional (Djankov et al., 2003), political and cultural interdependences of corporate governance systems (Hall and Soskice, 2001; Fligstein and Choo, 2005). Therefore, on the operational level, corporate governance covers internal monitoring mechanisms, which include the board of directors, the formation of specialised board committees (audit, remuneration, nomination and related party transaction), ownership structure and votes, cross-shareholdings in ownership, creditor and external monitoring mechanisms such as the stock market, the market for corporate control, the market for executives, the debt market and information policy and investor relations (Wolf, 1999). The second group of mechanisms constitute incentive mechanisms such as executive compensation and motivation schemes, including stock options, restricted shares and long-term incentive programmes (LTIPs). The additional set of control mechanisms may be related to the values and norms recognised by the business practice and national culture which are shared by companies, investors, employees and other participants in the stock market. Social norms, ethical behaviour and reputation are viewed as being of crucial importance, particularly after the costly corporate scandals and financial crises (Mayer, 2012). These corporate governance mechanisms are summarised in Table 1.1.

Table 1.1 Corporate governance mechanisms and institutions

Source: Own compilation based upon Wolf (1999:17), Tricker (2012) and Aluchna (2014).

Finally, corporate governance recommendations deliver performance measures which act as the basis for the evaluation of a company’s efficiency in meeting shareholder and stakeholder expectations and providing a benchmark for its competitors. The universality of corporate governance best practice allows for their adoption by listed companies, financial institutions and non-profit organisations.

At the macro level, the research identifies the national systems of oversight and control, referring to the dominating patterns of ownership, company orientation, and the role and shape of the financial system, the legal regime and social norms. These studies indicate the interdependencies between law, culture, social norms politics and the financial system for the emergence of the corporate governance structures in different national differences (Fligstein and Choo, 2005; Höpner, 2005). The comparative analysis reveals that the competition between different political and power groups translates into the law benefiting or constraining various stakeholders. The rules of the game which constitute the institutional system are formed within the class struggle and remain a derivative of political decisions and political choices (Roe, 2003). Accepted social norms and beliefs represent preferences for economic activity and stimulate the emergence of certain corporate governance structures (Turnbull, 1994, 1997). The role of law is not to be overestimated for its explanatory power of corporate governance structures as it is rooted in the framework formed by agency relations and the ownership structure orientation (Orts, 2013). Studies traced the impact for the company law (Hansmann and Kraakman, 2005; Avgouuleas, 2012), law of financial system (La Porta et al., 1999, 2000) and labour law (Ahlering and Deakin, 2007; Carlin, 2009) for the development of corporate governance.

Corporate governance remains a very practical and very dynamic theme for companies, investors, economies and countries. The statement of Marco Becht and Ailsa Röell formulated in 1999 remains active today, indicating that: ‘Corporate governance is currently a subject of great international concern and debate. The rising interest is market driven. Funds want to invest on liquid stock markets and to diversify internationally. Governments need to capitalise their pension systems and find investors who are willing to fund their privatisation programs. Companies with global ambitions want to access global equity capital’ (Becht and Röell, 1999). Interestingly, the research indicates the generally observed rise of corporate governance standards and the improvement in their quality (De Nicole et al., 2008) as well as highlighting the ongoing process of convergence of corporate governance (Mayer, 2006; Richford, 2006). The phenomena of the improvement of standards and the harmonisation of corporate governance practices are undoubtedly embedded in the process of economic globalisation and the emergence of multinational companies which transmit best practice to different countries. The globalisation of the stock market forces companies and regions to compete in order to attract global investors. However, it is widely recognised that the one size fits all approach will not work doue to institutional and cultural national difference., Yet, the harmonised set of recommendations is formulated and implemented in various parts of the world, enhancing transparency (reporting, disclosure), increasing responsibilities (the accountability of executives) and developing commitment (the engagement of shareholders and stakeholders).

The Micro Perspective: Corporate Governance at the Company Level

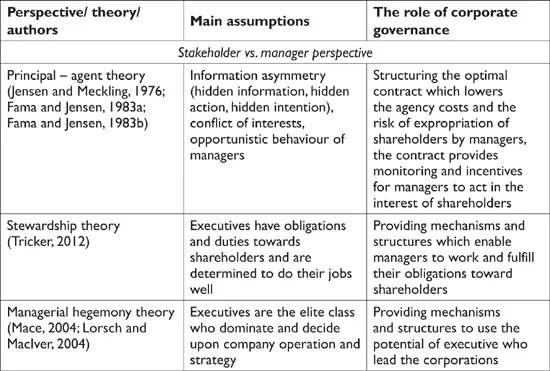

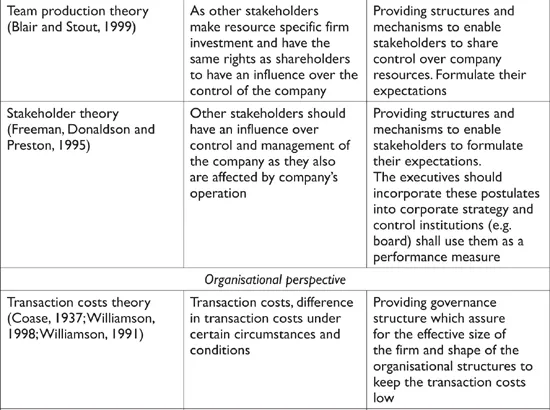

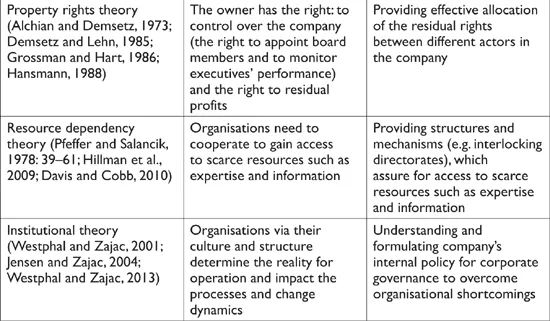

The micro perspective views corporate governance at the company level, explaining the behaviours of different actors (shareholders, managers and stakeholders) and indicating the structures and mechanisms which provide for the most efficient cooperation between them. Therefore, corporate governance represents the system by which companies are directed and controlled (Cadbury Report, 1992). The numerous micro perspectives address various aspects of the firm functioning and provide different tasks for corporate governance. Although the academic literature has been dominated by the principal agent framework, the complexity of firm operations as well as the organisational reality require a multidimensional approach. Table 1.2 presents a review of the different approaches to corporate governance, including the principal agent, stewardship and managerial hegemony theories, followed by team production and stakeholder theories as well as the organisational and behavioural perspectives provided by transaction costs, property rights, resource dependency and institutional theories.

Table 1.2 The micro perspectives on corporate governance

Source: Own compilation based on Hart (1989), Hung (1998), Rudolf et al. (2002), Tricker (2012).

The micro perspectives are discussed below, referring to three selected approaches, focusing on: 1) the relationship between shareholders and managers; 2) the role of stakeholders; and 3) the organisation of the firm.

SHAREHOLDERS AND MANAGERS

The shareholder perspective on corporate governance and the relationship between shareholders and managers are viewed as the most popular approach in the literature, dominating the main framework for research and studies. The shareholder approach is embedded in the so-called financial model of the firm and is based on the principal-agent theory (Vogel, 2005; Dore, 2008: 1997; Zumbansen, 2009). It focuses on profit generation and providing return on investment for shareholders. The principal-agent theory (also known as agency theory) studies the conflicts between shareholders (principals) and executives (agents). The main arguments that managers maximise their own wealth at the expense of shareholders gave rise to the managerialist premise (Marcus, 1996: 55). Over the last 40 years, it has become the most influential theoretical approach, determining the assumption for empirical research and having an impact on the empirical research methodology and the path of conducted analyses. Currently in the post-crisis era, this approach constitutes the debate on the role of business in society (Bainbridge, 2012).

The agency theory (Jensen and Meckling, 1976; Fama and Jensen, 1983a, 1983b) perceives the company as a nexus of contracts between various actors. The corporate results are achieved through the cooperation between these parties. Some of them act as principals, delegating different tasks for their agents to execute. The theory assumes that the principals and agents focus on their individual goals and differ in terms of possibility of risk diversification and the activity horizon. Agents tend to engage in opportunistic behaviour (hidden information, hidden action and hidden intention) acting at the expense of their principals. The so-called agency problems are present at all levels of the organisation, as they always emerge when agents perform tasks on behalf of their principals, meaning that there is a need for cooperation with and delegation of some work to a third party. The conflicts between managers and shareholders and between shareholders and debt-holders belong to the most frequently analysed problems (Jensen and Meckling, 1976). The conflicts are strengthened via incomplete contracts and information asymmetry, which translates into the residual rights of control in the hands of managers and the risk of expropriation of shareholders by opportunistically acting managers. Shareholders, who in the case of public corporations become the residual claimants, are willing to introduce and use control mechanisms to discipline managers (Eisenhardt, 1989). In the words of the principal-agent framework, corporate governance is perceived as a mechanism that ensures that investors will receive a return on their investments (Sheifer and Vishny, 1997) or a set of constraints that forms the ex post distribution of wealth (Zingales, 1997). The other definition perceives corporate governance as a ‘system by w...