- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

A Guide to IMF Stress Testing : Methods and Models

About this book

NONE

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

2014eBook ISBN

9781484368589Chapter 1. Stress Testing at the International Monetary Fund: Methods and Models

“Down one road lies disaster, down the other utter catastrophe. Let us hope we have the wisdom to choose wisely.”

—Woody Allen

Stress testing is a “what if” exercise. It measures the sensitivity of a portfolio, an institution, or a financial system to exceptional but plausible shocks. The answer involves identifying relevant risk drivers; selecting the appropriate method or model; using that particular method or model to calculate the effects of large shocks; and interpreting the results correctly. A number of studies provide a general introduction to stress testing, discussing its nature and purpose (e.g., Blaschke and others, 2001; Jones, Hilbers, and Slack, 2004; and Čihák, 2007). Stress tests are also being designed from another angle, which is to ask the question: What would it take to “break” a financial institution or a financial system? (e.g., Financial Services Authority, 2009).

From a technical perspective, stress testing has become more complex and sophisticated over time. A wide range of methods and statistical and mathematical models developed by academics and practitioners are now available for estimating the impact of various financial or economic shocks on financial systems. For potential users, the wealth of available techniques can be confusing—their relevance and applicability under different conditions and situations may not be always clear, and it may not be obvious how they supplement or complement each other.

Over the years, staff at the IMF also has developed a suite of stress testing methods and models, and has adapted existing ones, for use in their financial surveillance work. Indeed, this area of macroprudential risk analysis has become a central aspect of IMF staff’s assessment of individual financial systems and of the international financial system itself. It is a key component of the Financial Sector Assessment Program (FSAP) and has become an important part of the conjunctural and structural analyses in the Global Financial Stability Report (GFSR). Stress testing is also being undertaken increasingly in Article IV and crisis program work. Correspondingly, the demand by IMF member countries for technical assistance from IMF staff on stress testing has risen as well, as country authorities seek to develop and enhance their own capacity in this area.

The global financial crisis injected a dose of caution into the enthusiasm surrounding the usefulness of stress tests. It raised questions about the credibility of the exercises conducted in the run-up to the crisis, many of which were unable to adequately capture the relevant risks and exposures and hence did not provide sufficient early warning of potential vulnerabilities. Critics attributed the failures to poor data quality, weaknesses in scenario design, inadequate methods and models, or their incorrect application. At the IMF, lessons learned from the crisis have spurred staff to improve the robustness and versatility of stress tests. One of the main areas is improving the design and application of stress testing methods and models. IMF staff has developed new models and are adapting or calibrating existing ones to better capture the risks (including those that manifested during the crisis) and are working to ensure their consistent and appropriate use in different settings.

This volume puts together, for the first time, the applied stress testing methods and models built or adapted by IMF staff, some in collaboration with external colleagues, before and during the crisis. Most chapters have previously been released as IMF working papers, while some have been published in refereed journal articles. Given the very technical nature of the material presented, this book is not for the fainthearted. But for those who are interested in understanding staff’s stress testing methods and models, this book provides essential insight into the strengths and shortcomings of each technique and details the data required for implementation. In each case, related work by academics and other practitioners also are reviewed and put into context. This book aims to be innovative in several ways, by

- offering a suite of stress testing methods and models that can be

- – applied to the gamut of financial systems across the entire spectrum of development—from the most basic banking sectors, where data may be limited or of poor quality, to the most sophisticated, with a wealth of accounting and market data;

- – used for surveillance or supervisory purposes;

- – applied to individual banks or the financial system as a whole.

- categorizing the methods and models into various approaches and subapproaches and providing summary guidance to users at the beginning of each chapter on their appropriate application, the data requirements, as well as their strengths and weaknesses; and

- making available the accompanying tools or programming codes, where possible.

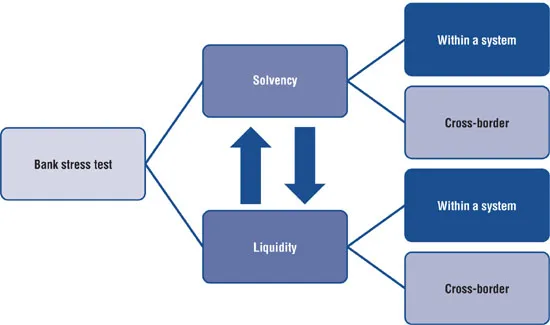

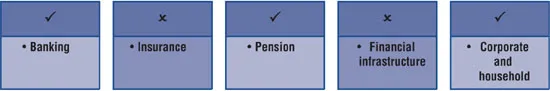

Stress tests can be conducted on the various sectors of the financial system, as well as on corporate and household balance sheets. At the IMF, work on stress tests of the banking sector is clearly the most advanced, reflecting the systemic importance of banks in practically all member countries. Within the banking sphere, stress testing for solvency risk has been the main focus, although work on liquidity risk has also come to the fore in the wake of the global financial crisis. IMF staff now has the tools to separately carry out solvency and liquidity stress tests within banking systems and across borders (Figure 1.1), and work is progressing on models to explicitly link the two risks (Part I.A). However, staff’s work on the nonbank sector remains nascent: techniques have been developed to “stress test” the pension sector (Part I.A) and to determine the impact of the corporate and household sector on the financial positions on banks (Part II.C), but little has been done to date on stress tests for the insurance and infrastructure sectors (Figure 1.2).

Figure 1.1 Stress Test Methods and Models by IMF Staff: Banking Sector

Source: Authors.

Figure 1.2 Stress Test Methods and Models by IMF Staff: Sector Coverage

Source: Authors.

Approaches, methods, and models

No single stress testing method or model is perfectly suited for all financial systems, and an important challenge for IMF staff is to ensure that the appropriate stress test is applied on each occasion. If the stress test is to be informative, it is critical that the method adequately captures the important risk drivers amid the complexity, uniqueness, and idiosyncrasies of a particular system. It is also crucial to be able to reconcile the differences across different stress testing methods and their implications for the results. As a general rule:

- Stress tests of simple financial systems dominated by domestic banks offering “plain vanilla” products normally require less sophisticated models and are less resource intensive. In contrast, stress tests of more complex systems typically apply more advanced stress testing methods to capture the gamut of risks and require more resources to implement.

- The more sophisticated the model, the greater the estimation uncertainty, an issue to be taken into account when drawing policy conclusions. The dilemma is that simpler methods might be inadequate for highly interconnected and complex banking sectors with large credit and market risk exposures.

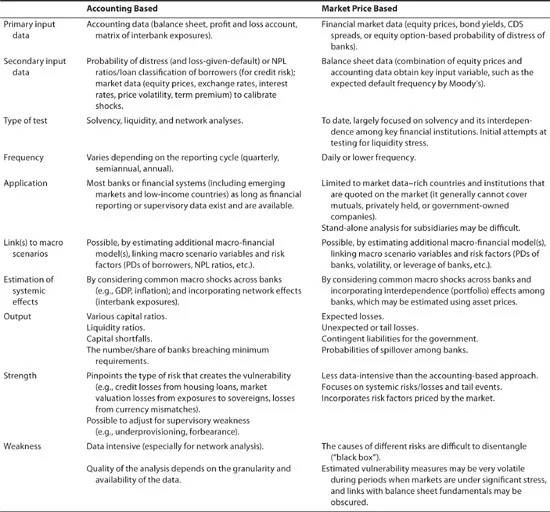

This book categorizes stress testing methods and models into three main approaches, namely, the accounting-based, the market price–based and the macro-financial approach. The first two are presented and compared in IMF (2012a) across several dimensions (Table 1.1). This book builds on that comparison and adds the third approach, which has attracted much attention in recent public supervisory stress tests for crisis management purposes in Europe and the United States. Most of the included methodologies are “bread and butter” stress tests. They estimate the capital needs or “hole” in a bank or banking system following the imposition of an adverse shock. Less conventional methods also are presented to demonstrate the variety of techniques that have been developed by IMF staff. These comprise methods that identify interconnectedness, spillover or systemic risks under stress, and feedback between the macroeconomy and financial sector and also include innovative adaptations of existing theory and models to stress testing.

Table 1.1 Comparing the Accounting-Based and Market Price–Based Approaches

Source: IMF (2012a).

Note: CDS = credit default swap; NPL = nonperforming loan; PD = probability of default.

The accounting-based approach

The accounting-based approach uses accounting data from the financial statements of individual institution...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Contents

- Foreword

- Acknowledgments

- Abbreviations

- Contributing Authors

- 1. Stress Testing at the International Monetary Fund: Methods and Models

- Part I: The Accounting-Based Approach

- Part II The Market Price-Based Approach

- Part III The Macro-Financial Approach

- Index

- Toolkit Contents

- Footnotes