eBook - ePub

Global Financial Stability Report, October 2016 : Fostering Stability in a Low-Growth, Low-Rate Era

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Global Financial Stability Report, October 2016 : Fostering Stability in a Low-Growth, Low-Rate Era

About this book

NONE

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Global Financial Stability Report, October 2016 : Fostering Stability in a Low-Growth, Low-Rate Era by International Monetary Fund. Monetary and Capital Markets Department in PDF and/or ePUB format. We have over one million books available in our catalogue for you to explore.

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

2016eBook ISBN

9781513559582Chapter 1. Financial Stability Challenges in a Low-Growth, Low-Rate Era

Financial Stability Overview

Short-term risks have moderated in the past six months as markets have shown resilience to a number of shocks. Pressures on emerging market assets have eased, helped by firmer commodity prices, reduced uncertainty about China’s near-term prospects, and expectations of lower interest rates in advanced economies. But medium-term risks are rising in a new environment of increased political and policy uncertainty. Expectations for monetary normalization in advanced economies have shifted even further into the future, and weak growth and low interest rates are increasing the challenges for banks, insurers, and pension funds. Although most advanced economy bank balance sheets are robust, sustainable profitability is weak, reflecting unresolved legacy problems and bank business model challenges. Corporate leverage in many emerging market firms has peaked at high levels, and debt servicing capacity remains weak. These developments have complicated the outlook for attaining a more balanced and potent policy mix, and could lead to a prolonged era of economic and financial stagnation. Policymakers must take a more comprehensive and collaborative approach to protect and advance financial stability and inclusion and revitalize the global economy.

Short-Term Risks Are Abating

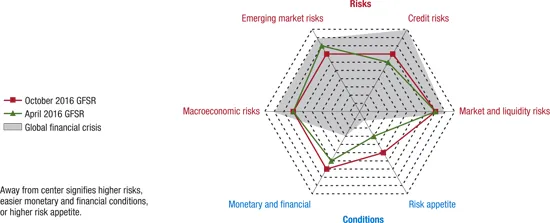

Short-term risks to global financial stability have moderated in the past six months (Figures 1.1 and 1.2). As noted in the October 2016 World Economic Outlook (WEO), the macroeconomic outlook has weakened modestly in advanced economies, leaving macroeconomic risks largely unchanged. Central banks have provided additional monetary stimulus in response to the subdued outlook for growth and inflation, which has eased monetary and financial conditions. Easier financial conditions have supported the recovery in risk appetite from the turmoil earlier in the year and the unexpected outcome of Brexit, the June 2016 U.K. referendum result in favor of leaving the European Union.

Figure 1.1. Global Financial Stability Map: Risks and Conditions

Source: IMF staff estimates.

Note: The shaded region shows the global financial crisis as reflected in the stability map of the April 2009 Global Financial Stability Report (GFSR).

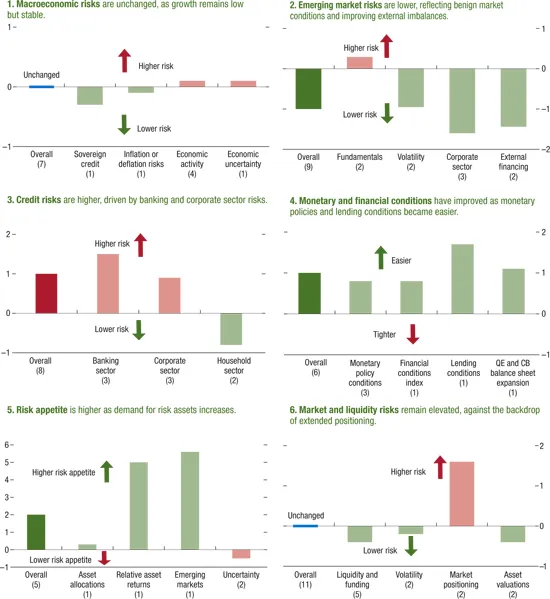

Figure 1.2. Global Financial Stability Map: Assessment of Risks and Conditions

(Notch changes since the April 2016 Global Financial Stability Report)

Source: IMF staff estimates.

Note: Changes in risks and conditions are based on a range of indicators, complemented with IMF staff judgment (see Annex 1.1 in the April 2010 Global Financial Stability Report and Dattels and others 2010 for a description of the methodology underlying the Global Financial Stability Map). Overall notch changes are the simple average of notch changes in individual indicators. The number in parentheses next to each category on the x-axis indicates the number of individual indicators within each subcategory of risks and conditions. For lending standards, positive values represent a slower pace of tightening or faster easing. CB = central bank; QE = quantitative easing.

Emerging market risks have declined, led by a modest recovery in commodity prices and improved external financial conditions, fueling a pickup in capital flows. The economic outlook has improved for the recession-hit economies of Brazil and Russia, while supportive external conditions are providing an opportunity for a smooth deleveraging of firms in many emerging market economies. Market and liquidity risks are still elevated in an environment of extended positioning across major asset classes.

A key driver of short-term risks in the past six months was the Brexit vote (see Box 1.1), which caught investors by surprise and initially roiled global markets. The global financial system has been strengthened since the crisis, and the political shock was absorbed by markets:

- Despite the large adjustment in prices, markets managed high volumes well, without significant disruption, and no major disorderly events surfaced, other than a sharp sell-off in some U.K.-based real estate funds. Contingency plans and central bank communications helped underpin confidence in market functioning.

- New firewalls in the euro area, including the European Central Bank’s asset purchase programs and other backstops, supported smooth market adjustment and prevented contagion.

- In contrast with past episodes of global turbulence, flows into emerging markets were resilient and have, in fact, increased since the referendum.

Box 1.1. Impact of Brexit

The unexpected decision by U.K. voters to leave the European Union (EU) in June 2016 (Brexit) caught investors by surprise and initially roiled global markets. The post-referendum bout of market volatility faded after central banks responded promptly; no major disorderly market events surfaced, other than a sharp sell-off in some U.K.-based real estate funds.

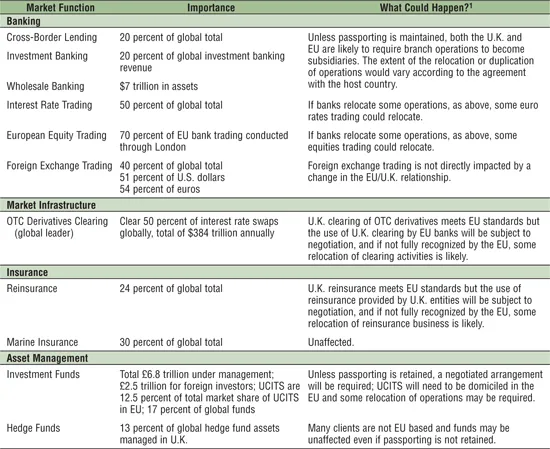

Yet the biggest challenges remain ahead. The shape of future trade arrangements and the uncertain impact of Brexit on the United Kingdom’s large and globally integrated financial system have created uncertainty over the longer-term financial prospects of the United Kingdom.1 As noted in recent IMF publications,2 there is a high degree of uncertainty surrounding future arrangements and the implications for the U.K. financial sector. Table 1.1.1 highlights the relative importance of different financial activities carried out in London, and how decisions on future relations with the EU may impact the provision of financial services in the United Kingdom. The impact on the financial sector and economy could work through three different channels:

- Bank operating costs. Unless passporting for banking services is preserved under future trade arrangements, banks could incur additional expenses associated with moving operations out of London or duplicating functions in the United Kingdom and EU. They may also have to bear the cost of setting up and maintaining subsidiaries rather than branches, including additional capital, liquidity, and total loss-absorbing requirements for new subsidiaries. EU banks, which have €1–€1.5 trillion in assets (excluding derivatives) in U.K. branches, could also incur some of these same costs.

- Changes in the financial services “rulebook.” The financial sector more broadly could be subject to change depending on the outcome of negotiations. Some 60 percent of the current financial services “rulebook” is estimated to be composed of EU rules.3 Even if only modestly revised, these revisions would require legal, compliance, operational, and information technology changes.

- Macroeconomic impact. Protracted negotiations could weigh on confidence, not only postponing consumption and investment decisions, and thus reducing short-term growth, but also leading to permanently lower foreign investment and physical and human capital flows into the United Kingdom. The U.K. economy’s longer-term prospects could be affected. Sustained declines in portfolio inflows could create more challenging financing conditions for firms.

Table 1.1.1. Brexit Implications for the U.K. Financial Sector

Sources: Autonomous Research LLP; Bank for International Settlements; Boston Consulting Group; Financial Conduct Authority 2015; The City UK 2016; and IMF Staff estimates.

Note: OTC = over the counter; UCITS = Undertakings for Collective Investment in Transferable Securities.

1 Reflects a combination of estimates from Autonomous Research LLP, Boston Consulting Group, and IMF staff.

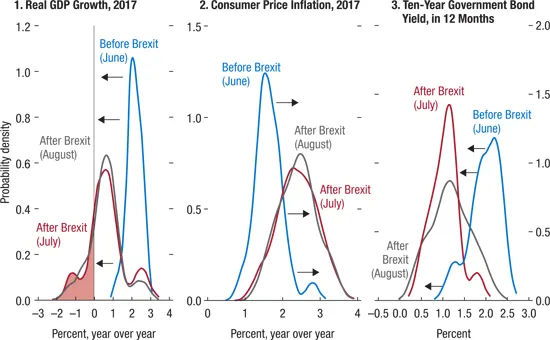

Heightened concerns about the financial and macroeconomic impact of Brexit have contributed to a sharp drop in market participants’ expectations of the (median) growth of U.K. GDP, especially for 2017, and the perceived risk of recession in 2017 remains elevated (Figure 1.1.1, panel 1). This reflects major uncertainties about negotiations of several trade, financial, and regulatory arrangements not just with the EU, but also with the rest of the world. Further, the post-Brexit upward shift in investors’ inflation expectations did not ease back in August (Figure 1.1.1, panel 2), reflecting the continued anticipation of a weaker exchange rate in lifting domestic inflation. Finally, investors’ forecasts of U.K. 10-year government bond yields became even more widely dispersed in August (Figure 1.1.1, panel 3), signaling elevated uncertainty and a prolonged period of low interest rates, reflecting persistent economic and financial risks.

Figure 1.1.1. Brexit Implications for the United Kingdom

Source: IMF staff calculations, based on Consensus Economics data.

Note: The probability distributions of market participants’ forecasts were estimated using a Kernel density estimation approach—a nonparametric algorithm to estimate probability density functions of random variables. Data before and after Brexit were obtained from the June 13, 2016, July 11, 2016, and August 8, 2016 surveys, respectively. Brexit = June 2016 U.K. referendum result in favor of leaving the European Union.

Commercial Real Estate and Housing

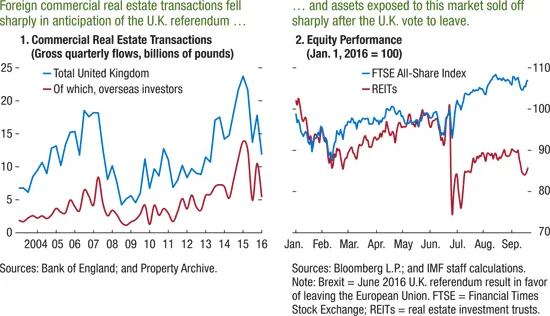

Expectations that Brexit would trigger investor outflows from the real estate market prompted especially pronounced market volatility for financial assets exposed to this sector, and broader concern over the funding of the external current account, given the sizable participation of foreign investors in these sectors. As shown in Figure 1.1.2, commercial real estate transactions fell sharply in anticipation of the referendum. The exit of the United Kingdom from the European Union is expected to result in further significant declines in foreign investment in U.K. commercial real estate. These concerns triggered an abrupt wave of redemptions in U.K. property funds following the decision to leave the European Union.

Figure 1.1.2. Brexit Impact on the U.K. Commercial Real Estate Markets

This box was prepared by Jennifer Elliott, Vladimir Pillonca, and Luca Sanfilippo.

1 See IMF 2016c. This paper discusses the potential macroeconomic impacts and ramifications in detail.

2 See IMF 2016a and 2016b.

3 Morel and others 2016.

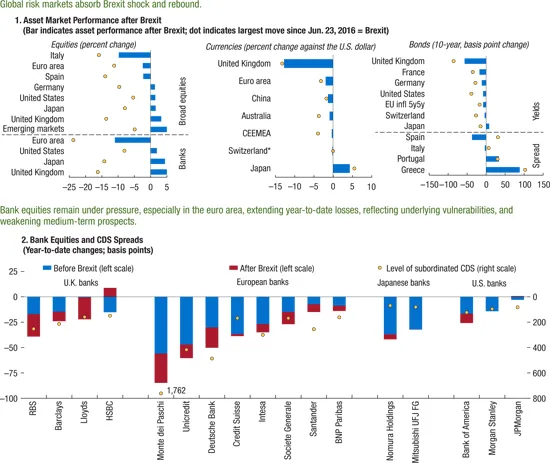

In the aftermath of the Brexit vote, markets quickly rebounded (Figure 1.3, panel 1). Equity markets in the United States rose to record levels, and the volatility of major asset classes dropped to levels below where they were at the beginning of the year as markets passed this severe stress test.

Figure 1.3. Brexit’s Impact on Financial Markets

Sources: Bloomberg L.P.; Federal Reserve; Haver Analytics; and IMF staff estimates.

Note: In Panel 2, the positive values are below the zero line for the right scale. Brexit = June 2016 U.K. referendum result in favor of leaving the European Union; CDS = credit default swap; CEEMEA = central and eastern Europe, Middle East, and Africa; EU infl 5y5y = euro area inflation-linked bond, five year, five year forward.

* Against the euro.

Medium-Term Risks Are Rising

Despite lower short-term risks, medium-term risks are rising as policymakers grapple with a wide range of pre-existing vulnerabilities and new challenges. Credit risks are increasing as banks and insurance companies struggle to remain profitable in th...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Contents

- Assumptions and Conventions

- Further Information and Data

- Preface

- Executive Summary

- IMF Executive Board Discussion Summary

- Chapter 1 Financial Stability Challenges in a Low-Growth, Low-Rate Era

- Chapter 2 Monetary Policy and the Rise of Nonbank Finance

- Chapter 3 Corporate Governance, Investor Protection, and Financial Stability in Emerging Markets

- Tables

- Footnotes