eBook - ePub

World Economic Outlook, October 2016 : Subdued Demand: Symptoms and Remedies

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

World Economic Outlook, October 2016 : Subdued Demand: Symptoms and Remedies

About this book

NONE

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access World Economic Outlook, October 2016 : Subdued Demand: Symptoms and Remedies by International Monetary Fund. Research Dept. in PDF and/or ePUB format. We have over one million books available in our catalogue for you to explore.

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

2016eBook ISBN

9781513599540Chapter 1. Global Prospects and Policies

Recent Developments and Prospects

The forces shaping the global outlook—both those operating over the short term and those operating over the long term—point to subdued growth for 2016 and a gradual recovery thereafter, as well as to downside risks. These forces include new shocks, such as Brexit—the June 23, 2016, U.K. referendum result in favor of leaving the European Union; ongoing realignments, such as rebalancing in China and the adjustment of commodity exporters to a protracted decline in the terms of trade; and slow-moving trends, such as demographics and the evolution of productivity growth; as well as noneconomic factors, such as geopolitical and political uncertainty. The subdued recovery also plays a role in explaining the weakness in global trade (discussed in Chapter 2) and persistently low inflation (discussed in Chapter 3).

Relative to the global outlook envisaged in the April 2016 World Economic Outlook (WEO), the main changes relate to the downward revision to U.S. growth (mostly reflecting weaker-than-expected growth in the second quarter of 2016), further confirmation that the economies of Brazil and Russia are closer to exiting from recession, and the outcome of the U.K. referendum. Brexit is an unfolding event—the long-term arrangements in relations between the United Kingdom and the European Union will be uncertain for a protracted period of time. And the vote is not only a symptom of fraying consensus on the benefits of cross-border economic integration amid weak growth, but could catalyze pressures for inward-looking policies elsewhere as well.

On the positive side, beyond a sharp depreciation of the pound, broader market reaction to the Brexit vote has generally been contained, with equity valuations and risk appetite recovering after an initial drop, as discussed elsewhere in this chapter. Bank stocks, however, remain under pressure, especially in countries with more fragile banking systems. Based on preliminary readings, business and consumer sentiment were generally resilient in July, immediately following the referendum, except in the United Kingdom. Sentiment has improved regarding emerging market and developing economies, reflecting reduced concerns about China’s near-term prospects following policy support for growth, mildly favorable macroeconomic news from other emerging market economies in the past few months, some recovery in commodity prices, and expectations of lower interest rates in advanced economies. But with very limited post-Brexit macro-economic data so far, uncertainty about the impact of Brexit on macroeconomic outcomes remains, especially in Europe.

Growth is projected to pick up from 2017 onward, almost entirely on account of developments in emerging market and developing economies. This reflects primarily two factors: the gradual normalization of macroeconomic conditions in several countries experiencing deep recessions and the increasing weight of fast-growing countries in this group in the world economy (Box 1.1).

The World Economy in Recent Months

Global Activity Remains Sluggish

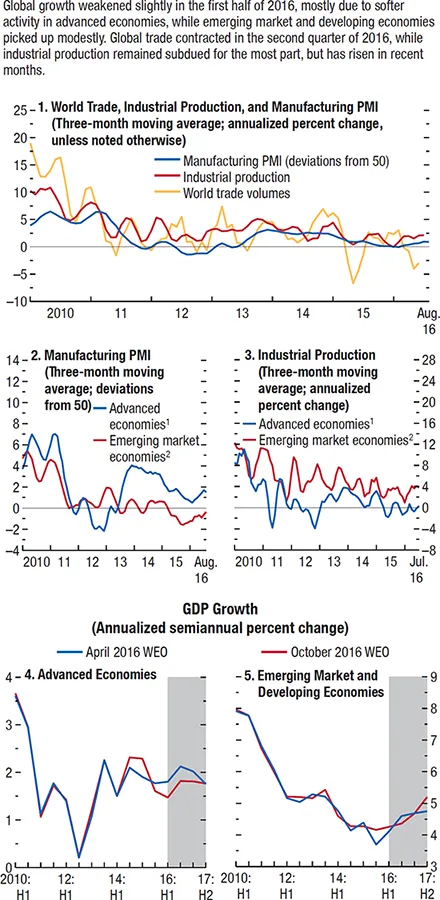

Based on preliminary data, global growth is estimated at 2.9 percent in the first half of 2016, slightly weaker than in the second half of 2015 and lower than projected in the April 2016 WEO. Global industrial production remained subdued, but has shown signs of a pickup in recent months, and trade volumes retreated in the quarter through June after several months of sustained recovery from the trough of early 2015 (Figure 1.1). The recent weak momentum is mostly a product of softer activity in advanced economies.

- The U.S. economy has lost momentum over the past few quarters, and the expectation of a pickup in the second quarter of 2016 has not been realized, with growth estimated at 1.1 percent at a seasonally adjusted annual rate. Consumption growth (at about 3.0 percent on average in the first half of the year) has remained strong, supported by a firm labor market and expanding payrolls, but continued weakness in nonresidential investment together with a sizable drawdown of inventories has weighed on the headline growth number. The weakness in business fixed investment appears to reflect the continued (albeit moderating) decline in capital spending in the energy sector, the impact of recent dollar strength on investment in export-oriented industries, and possibly also the financial market volatility and recession fears of late 2015 and early 2016. Nonfarm labor productivity declined 0.6 percent at a seasonally adjusted annualized rate in the second quarter, the third consecutive negative reading.

- Growth in the euro area declined to 1.2 percent at a seasonally adjusted annualized rate in the second quarter, after mild weather and consequent strong construction activity helped boost growth in the first quarter to 2.1 percent. Domestic demand, notably investment, decelerated in some of the larger euro area economies after successive quarters of stronger-than-expected growth. High-frequency data and corporate survey indicators for July point to a muted impact of the Brexit vote on confidence and activity thus far.

- In the United Kingdom, a strong start to the second quarter lifted GDP growth to 2.4 percent at a seasonally adjusted annualized rate (from 1.8 percent in the first quarter of 2016). A breakdown of high-frequency data within the quarter suggests that momentum had begun to weaken over May and June leading up to the referendum. Survey indicators for July and August point to a sharp post-referendum retrenchment in manufacturing activity followed by a rebound, while retail sales have held up so far.

- In Japan, growth decelerated in the second quarter to 0.7 percent at a seasonally adjusted annualized rate, from 2.1 percent in the first quarter. In part this reflects payback after an unusually strong first quarter, during which the outturn—particularly for consumer spending—was driven in part by leap-year effects. In addition, weaker external demand and corporate investment weighed on activity in the second quarter.

- Elsewhere, among advanced economies whose prospects are closely linked to systemic economies, momentum in Hong Kong Special Administrative Region and Taiwan Province of China improved in the second quarter as adverse financial and economic spillovers from China abated after the turbulence at the start of the year. Growth in Canada, by contrast, has been negatively affected by weaker-than-expected outcomes in the United States, compounding the setbacks stemming from one-off events such as the wildfires in Alberta.

Figure 1.1. Global Activity Indicators

Sources: CPB Netherlands Bureau for Economic Policy Analysis; Haver Analytics; Markit Economics; and IMF staff estimates.

Note: IP = industrial production; PMI = purchasing managers’ index.

1Australia, Canada, Czech Republic, Denmark, euro area, Hong Kong SAR (IP only), Israel, Japan, Korea, New Zealand, Norway (IP only), Singapore, Sweden (IP only), Switzerland, Taiwan Province of China, United Kingdom, United States.

2Argentina (IP only), Brazil, Bulgaria (IP only), Chile (IP only), China, Colombia (IP only), Hungary, India, Indonesia, Latvia (IP only), Lithuania (IP only), Malaysia (IP only), Mexico, Pakistan (IP only), Peru (IP only), Philippines (IP only), Poland, Romania (IP only), Russia, South Africa, Thailand (IP only), Turkey, Ukraine (IP only), Venezuela (IP only).

Despite subdued activity in advanced economies and associated spillovers, emerging market and developing economies as a group recorded a slight pickup in momentum over the first half of 2016, broadly in line with the April 2016 WEO projection. Emerging Asia continued to register strong growth, and the situation improved slightly for stressed economies such as Brazil and Russia. Many economies in the Middle East and sub-Saharan Africa, however, continued to face challenging conditions.

- In emerging Asia, growth in China in the first half of the year stabilized close to the middle of the authorities’ target range of 6½ −7 percent for 2016 on policy support and strong credit growth. Robust consumption and a further rotation in activity from industry to services indicate that rebalancing is progressing along the dimensions of internal demand and supply-side structure. India’s economy continued to recover strongly, benefiting from a large improvement in the terms of trade, effective policy actions, and stronger external buffers, which have helped boost sentiment.

- In Latin America, Brazil’s economy remains in recession, but activity appears to be close to bottoming out as the effects of past shocks—the decline in commodity prices, the administered-price adjustments of 2015, and political uncertainty—wear off.

- Russia’s economy shows signs of stabilization as it is adjusting to the dual shock from oil prices and sanctions, and financial conditions eased after bank capital buffers were replenished with public funds. Macroeconomic performance elsewhere in emerging Europe was broadly stable, although the situation in Turkey became more uncertain in the aftermath of the attempted coup in July.

- Activity weakened in sub-Saharan Africa, led by Nigeria, where production was disrupted by shortages of foreign exchange, militant activity in the Niger Delta, and electricity blackouts. Momentum in South Africa was flat, despite the improvements in the external environment—notably stabilization in China. Elsewhere, resilience in Côte d’Ivoire, Kenya, Senegal, and Tanzania partially offset generally softer activity across the region.

- The Middle East continues to confront difficult challenges with subdued oil prices, the fallout from geopolitical tensions, and civil conflict in some countries.

Inflation Remains Low

In 2015, consumer price inflation in advanced economies was, at 0.3 percent, the lowest it had been since the global financial crisis. It edged up to about 0.5 percent in the first half of 2016 as the drag from oil prices diminished (Figure 1.2). Core consumer price inflation is higher than headline inflation but differs across major advanced economies. It averaged slightly above 2 percent in the firs...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Contents

- Assumptions and Conventions

- Further Information and Data

- Preface

- Foreword

- Executive Summary

- Chapter 1. Global Prospects and Policies

- Chapter 2. Global Trade: What’s behind the Slowdown?

- Chapter 3. Global Disinflation in an Era of Constrained Monetary Policy

- Chapter 4. Spillovers from China’s Transition and from Migration

- Statistical Appendix

- World Economic Outlook, Selected Topics

- IMF Executive Board Discussion of the Outlook, September 2016

- Tables

- Footnotes