eBook - ePub

Global Financial Stability Report, October 2007 : Financial Market Turbulence Causes, Consequences, and Policies

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Global Financial Stability Report, October 2007 : Financial Market Turbulence Causes, Consequences, and Policies

About this book

NONE

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Global Financial Stability Report, October 2007 : Financial Market Turbulence Causes, Consequences, and Policies by International Monetary Fund. Monetary and Capital Markets Department in PDF and/or ePUB format. We have over one million books available in our catalogue for you to explore.

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

2007eBook ISBN

9781589066762CHAPTER 1. ASSESSING RISKS TO GLOBAL FINANCIAL STABILITY

Financial risks have increased and underlying conditions have worsened since the April 2007 Global Financial Stability Report (GFSR). The period ahead may be difficult, as bouts of turbulence are likely to recur and the adjustment process will take some time. Uncertainty about the final size of losses, and when and where they will be revealed, will likely continue to keep market sentiment and conditions unsettled in the near term. This chapter outlines a number of the causes and consequences of the recent episode of turmoil and offers some initial thoughts on possible responses that the private and public sectors might consider to help improve global financial resilience.

Following an extended period of exceptionally favorable financial market conditions, international markets have entered a difficult period. The current episode of turbulence represents the first significant test of several categories of innovative financial instruments used to distribute credit risks broadly. Although the dislocations, especially to short-term funding markets, have been large and in some cases unexpected, the event hit during a period of above-average global growth. Credit repricing and the constriction of liquidity experienced to date will likely slow the global expansion. Systemically important financial institutions began this episode with more than adequate capital to absorb the likely level of credit losses. Corporations have, for the most part, been able to secure the financing they need to maintain their operations. However, the adjustment period is continuing, and if the intermediation process stalls and financial conditions deteriorate further, the global financial sector and real economy could experience more serious negative repercussions.

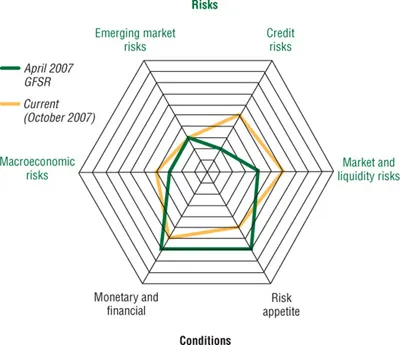

This chapter first summarizes our overall assessment of global financial stability using the global financial stability map introduced in the April 2007 GFSR (IMF, 2007a). Although the stability map treats the various risk factors and underlying conditions as separate so as to facilitate their formal analysis, the latest episode highlights their interrelatedness in practice—with liquidity risks, both market and funding liquidity, at the forefront of the current episode of turbulence. What began as a deterioration in credit quality altered the market liquidity of a number of structured credit products. Market illiquidity, in turn, produced uncertainty about those products’ valuations, which translated into a disruption in the underlying funding markets. Thus, monetary and financial conditions, as well as the risk appetite of market participants, have been adversely affected.

This chapter delves into some of the relevant areas in more detail, examining how weakening credit discipline in the U.S. mortgage market—especially the subprime market—and the overly rapid expansion of the leveraged buyout market have extended to the broader structured finance sector. The ensuing disruptions in the short-term funding markets are then examined. Global linkages are addressed with particular attention to the impact that investment flows to emerging markets have on financial stability. Lastly, the chapter highlights a number of conclusions that emerge from the analysis.

Global Financial Stability Map

The global financial stability map (Figure 1.1) presents an overall assessment of how changes in underlying conditions and risk factors are expected to bear on global financial stability in the period ahead.1

Figure 1.1. Global Financial Stability Map

Source: IMF staff estimates.

Note: Closer to center signifies less risk or tighter conditions.

Credit risks have increased significantly.

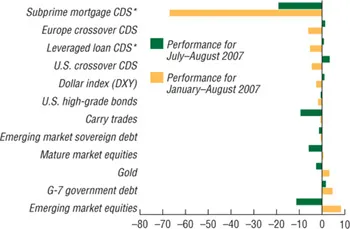

The largest increase in risks is represented by an increase in our assessment of credit risks.2 The April 2007 GFSR highlighted rising credit risk in U.S. mortgage-related instruments, a loosening of credit standards across a range of markets, and risks of spillovers to other credit markets. Since then, these credit risks have materialized and intensified, with ratings agencies downgrading significant amounts of mortgage-related securities, and spreads on mortgage-related securities widening (Figure 1.2). These risks have been exacerbated by signs of similar credit indiscipline in the leveraged buyout (LBO) sector. Through mid-2007, there had been a marked rise in covenant-lite loans, less credit-worthy deals, leverage, and price multiples on acquisitions. Moreover, now that ratings agencies are revising their model assumptions for structured products collateralized by mortgages, uncertainty has risen about the ratings of the broader structured credit market, including collateralized loan obligations (CLOs) that distribute leveraged loan financing to institutions. Reflecting the broader repricing of credit risk, spreads on high-yield corporate debt have widened from the tight levels reached earlier in the year (Figure 1.3). Although aggregate corporate leverage remains relatively low, its increase over the past year, particularly for those entities that have been the subject of buyouts, has heightened vulnerabilities, especially as financial, and possibly economic, conditions turn less benign.

Figure 1.2. Selected Asset Class Returns

(In percent)

Sources: Bloomberg L.P.; JPMorgan Chase & Co.; Merrill Lynch; and IMF staff estimates.

Note: DXY is a weighted average of the dollar exchange rate vis-à-vis six major world currencies. CDS = credit default swaps; crossover CDS indices consist of mostly speculative grade and some higher yielding investment grade entities.

* From inception date of index.

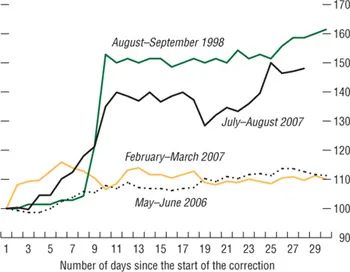

Figure 1.3. U.S. High-Yield Corporate Bond Spreads Index

Sources: Merrill Lynch; and IMF staff estimates.

Note: Spreads are normalized to 100 at the beginning of the crisis.

Meanwhile, mature market financial system default risk, as reflected in credit derivatives referencing large complex financial institutions (LCFIs), has risen sharply (Figure 1.4).3 The rise was driven mainly by large U.S. investment banks that are especially exposed to the nonprime mortgage and leveraged loan markets. The widening in interest rate swaps and credit default swaps (CDS) referencing some investment banks illustrates market concerns of deeper stress for financial institutions. While potential losses appear to be manageable and banks appear well capitalized to weather more severe stress, there is at present considerable uncertainty regarding the magnitude and distribution of losses stemming from the correction in credit markets, and their possible impact on broader financial stability.

Figure 1.4. Probability of Multiple Defaults in Select Portfolios

(In percent)

Sources: Bloomberg L.P.; and IMF staff estimates.

Note: LCFIs = large complex financial institutions.

Uncertainty regarding overall losses and exposure has raised market and liquidity risks, with potentially broader implications for financial institutions.

Reflecting the potential rise in market losses, we have raised our assessment of market and liquidity risks.4 Uncertainty regarding ultimate losses has increased market risks associated with a wide range of assets, beyond structured credit products. In the face of this uncertainty and higher volatility, lenders have raised margins, even for highly rated borrowers, and lowered the mark-to-market value of collateral. Other indicators also suggest that market risks have risen. For instance, the correlation of returns across asset classes has continued to rise, eroding the benefits of portfolio diversification, while speculative positioning in futures markets has become increasingly concentrated. At the same time, the reduction in market liquidity is evident in a range of indicators, including wider bid-ask spreads, reduced turnover volume, and higher financing rates across a range of typically liquid markets.

The overall deterioration in market and liquidity risks has been partially mitigated by the recent increase in risk premia. Realized and implied volatility has risen across fixed income and equities. There has been an upward shift in the entire swaption volatility curve, suggesting that the rise in risk premia may last longer.

Risk appetite generally declined, albeit from a high level.

As investors have become more generally discriminating across the credit spectrum, they have also become more risk averse. From the elevated levels at the time of the April 2007 GFSR, we have reduced our indicator of risk appetite, bringing the overall level of risk appetite to neutral. Although recent turbulence has been associated with increased market volatility and an unwinding of positions predicated on a low volatility environment, some broad global indicators still signal a willingness to establish or extend positions in risky assets. We expect continued prospects for global expansion to underpin investor attitudes toward risk.

Emerging market risks are balanced.

Our overall assessment of emerging market risks represents a delicate balance between slightly lower sovereign risks a...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Contents

- Preface

- Executive Summary

- Chapter 1. Assessing Risks To Global Financial Stability

- Chapter 2. Do Market Risk Management Techniques Amplify Systemic Risks?

- Chapter 3. The Quality of Domestic Financial Markets and Capital Inflows

- Glossary

- Annex: Summing Up by the Acting Chair

- Statistical Appendix

- Boxes

- Footnotes