eBook - ePub

Global Financial Stability Report, April 2009 : Responding to the Financial Crisis and Measuring Systemic Risks

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Global Financial Stability Report, April 2009 : Responding to the Financial Crisis and Measuring Systemic Risks

About this book

NONE

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Global Financial Stability Report, April 2009 : Responding to the Financial Crisis and Measuring Systemic Risks by International Monetary Fund. Monetary and Capital Markets Department in PDF and/or ePUB format. We have over one million books available in our catalogue for you to explore.

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

2009eBook ISBN

9781616352080Chapter 1: Stabilizing the Global Financial System and Mitigating Spillover Risks

Summary

Systemic risks remain high and the adverse feedback loop between the financial system and the real economy has yet to be arrested, despite the wide range of policy actions and some limited improvement in market functioning. Further effective government action—particularly geared toward cleansing balance sheets and strengthening institutions—will be required to stabilize the global financial system and to provide the foundation for a sustainable economic recovery. The banking system needs additional equity to absorb further writedowns as credit deteriorates, and risks are broadening to encompass nonbank institutions. The crisis has spread to emerging markets with the collapse of international financing, posing challenges to corporates, households, and banks as well as raising sovereign risk. The global policy response, including the IMF’s enhanced lending framework, should help to mitigate crisis risks. There remains considerable scope for further public commitments in larger economies, but extensive provision of financing and the transfer of balance sheet risk from the private to the public sector have increased tail risks for certain mature market sovereigns.

Against this backdrop, Chapter 1 first outlines the key financial stability risks that have materialized since the October 2008 Global Financial Stability Report. Then, it examines the deleveraging process and its effects on the real economy. The following section assesses the vulnerability of emerging markets to global stress, especially focusing on the refinancing risks facing corporates. The outlook for global credit markets is then evaluated, along with IMF staff estimates of potential global financial writedowns. The stability risks facing financial institutions are assessed and the effectiveness of the policy response evaluated. The chapter concludes with a discussion on sovereign risks.

Box 1.1. summarizes the key financial stability challenges and policy priorities detailed in the chapter.

A. Global Financial Stability Map

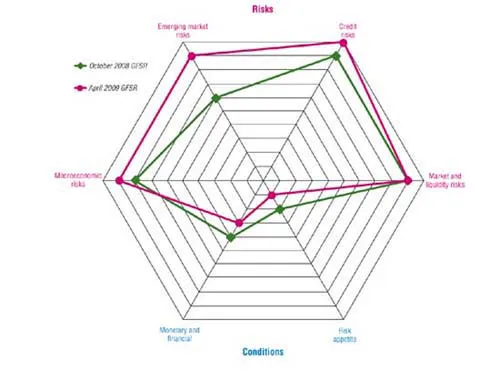

The global financial stability map (Figure 1.1) presents an overall assessment of how changes in underlying conditions and risk factors bear on global financial stability in the period ahead.1

Figure 1.1. Global Financial Stability Map

Source: IMF staff estimates.

Note: Closer to center signifies less risk, tighter monetary and financial conditions, or reduced risk appetite.

Nearly all the elements of the map point to a degradation of financial stability, with emerging market risks having deteriorated the most since October 2008.

The economic downturn has gathered momentum, resulting in a deterioration in macroeconomic risks. The IMF’s baseline forecast for global economic growth for 2009 has been adjusted sharply downward to the slowest pace in at least four decades. The reduction in trade financing has exacerbated the slowdown in global trade, particularly affecting emerging economies. A raft of official measures that transfer risk from private sector financial institutions to the public sector has increased pressures on sovereign balance sheets and credit (see Section E).

Box 1.1. Near-Term Financial Stability Challenges and Policy Priorities

Global financial stability has deteriorated further, with emerging market risks having risen the most since the October 2008 Global Financial Stability Report.

Notwithstanding some improvements in shortterm liquidity conditions and the opening of some term funding markets, other measures of instability have deteriorated to record or nearrecord levels.

The global credit crunch is likely to be deep and long lasting. The process ultimately may lead to a pronounced contraction of credit in the United States and Europe before the recovery begins. IMF analysis suggests that financing constraints have been a large contributor to the widening of credit spreads, making repairing funding markets imperative to help avert a deeper recession.

Credit cycles have turned sharply, with the deterioration moving to higher–rated credits and spreading globally. The deterioration in credit quality has increased our estimates of loan writedowns, which would put further pressure on financial institutions to raise capital and shed assets.

The deleveraging process is curtailing capital flows to emerging markets. On balance, emerging markets could see net private capital outflows in 2009, with slim chances of a recovery in 2010 and 2011. This decline is likely to slow credit growth, impairing corporate refinancing prospects.

Within emerging markets, European economies have been hardest hit, reflecting their large domestic and external imbalances, fueled by rapid credit growth prior to the crisis. Banks operating in emerging markets may face mounting writedowns and require fresh equity, while corporates face large refinancing needs, increasing risks for emerging market sovereigns. While authorities have been proactive in responding to the crisis, policies are being challenged by the scale of resources required.

Fiscal burdens are growing as a result of bank rescue plans and macroeconomic stimulus packages. Increased funding needs and illiquid capital markets have exerted pressure on sovereign credit spreads and raised concerns about the market’s ability to absorb increased debt issuance and about the crowding out of other borrowers. The United States faces some of the largest potential costs of financial stabilization, as do a number of countries with large banking sectors relative to their economies or concentrated exposures to the property sector or emerging markets (e.g., Austria, Ireland, the Netherlands, Sweden, and the United Kingdom).

Stabilizing the financial system requires further policy actions. The global policy response to date has been unprecedented, but has not prevented the onset of the adverse feedback loop with the real economy. It is thus necessary to undertake further forceful, focused, and effective policy action to stabilize the financial system. In particular, the public sector should ensure viable institutions have sufficient capital when it cannot be raised in the market, accelerate balance sheet cleansing and bank restructuring, and harmonize measures supporting funding markets. Public support measures also need to consider the risk of solvency pressures among other financial institutions (e.g., insurance companies, pension funds).

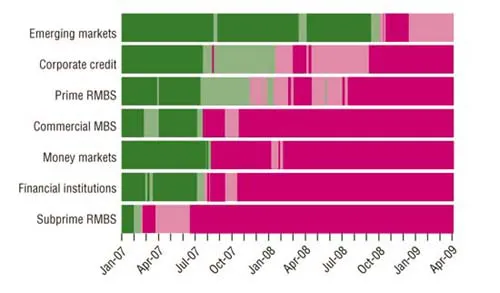

Uncertainty about the scale of the downturn and continued stress on the financial system has further increased credit risks. The core financial system remains fragile and public confidence low, as the credit deterioration has intensified and spread to higher–quality assets (Figure 1.2). The global financial system is facing a once–ina–century event, where credit risks have risen to extremely high levels. Activity has improved in credit markets receiving government support, but other sectors remain moribund (see Section D). Household balance sheets have come under pressure due to mounting job losses, falling net worth, and tight credit conditions. Expected credit writedowns by financials have ballooned, and, with private markets largely unwilling to provide capital to the banking system, the tail risk of more public sector ownership has increased.2 Estimates for U.S. and European banking systems suggest both are undercapitalized (see Section E).

Figure 1.2. Heat Map: Developments in Systemic Asset Classes

Source: IMF staff estimates.

Note: The heat map measures both the level and one-month volatility of the spreads, prices, and total returns of each asset class relative to the average during 2004–06 (i.e., wider spreads, lower prices and total returns, and higher volatility). That deviation is expressed in terms of standard deviations. Dark green signifies a standard deviation under 1, light green signifies 1 to 4 standard deviations, light magenta signifies 4 to 7 standard deviations, and dark magenta signifies greater than 7 standard deviations. MBS = mortgage-backed security; RMBS = residential mortgage-backed security.

Our assessment is that emerging market risks have heightened the most since the last GFSR, moving out three notches. Cross–border bank lending to emerging markets has begun to contract. Capital market financing is sporadic, and limited to higher–quality borrowers. Emerging market corporates face falling revenues and large financing needs and household balance sheets are under pressure (see Section C). Emerging market banks face liquidity and solvency pressures. Financing conditions could tighten further as a number of mature market banks active in emerging markets may ration credit and sell subsidiaries to preserve capital for their home markets. These pressures are most pronounced in central and eastern Europe, given their higher reliance on cross–border and wholesale funding, weaker balance of payme...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Contents

- Preface

- Joint Foreword to the World Economic Outlook and the Global Financial Stability Report

- Executive Summary

- Chapter 1. Stabilizing the Global Financial System and Mitigating Spillover Risks

- Chapter 2. Assessing the Systemic Implications of Financial Linkages

- Chapter 3. Detecting Systemic Risk

- Glossary

- Annex: Summing Up by the Acting Chair

- Statistical Appendix

- Boxes

- Footnotes