eBook - ePub

Fiscal Monitor, April 2012 : Balancing Fiscal Policy Risks

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Fiscal Monitor, April 2012 : Balancing Fiscal Policy Risks

About this book

NONE

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Fiscal Monitor, April 2012 : Balancing Fiscal Policy Risks by International Monetary Fund. Fiscal Affairs Dept. in PDF and/or ePUB format. We have over one million books available in our catalogue for you to explore.

Information

Publisher

INTERNATIONAL MONETARY FUNDYear

2012eBook ISBN

97816163524861. Continued Fiscal Tightening Is in Store for 2012, Particularly among Advanced Economies

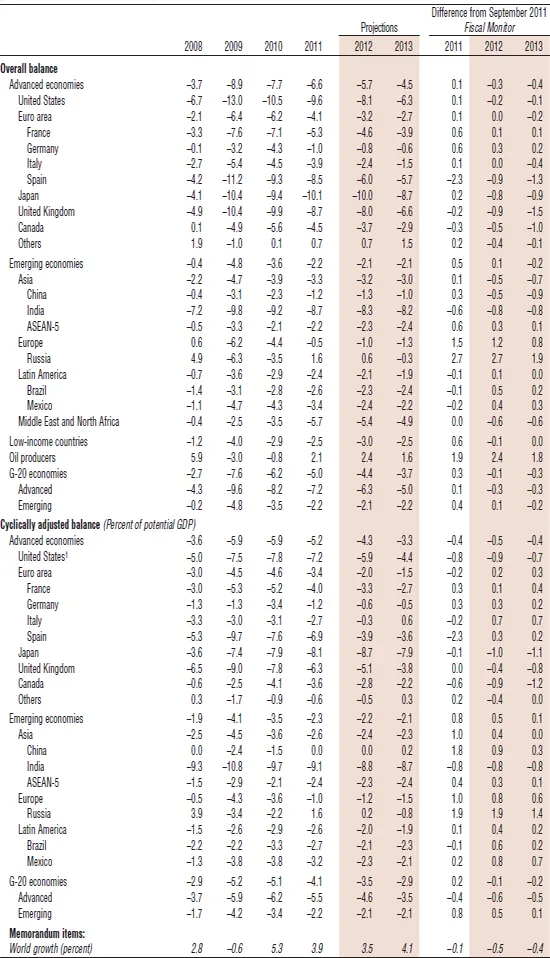

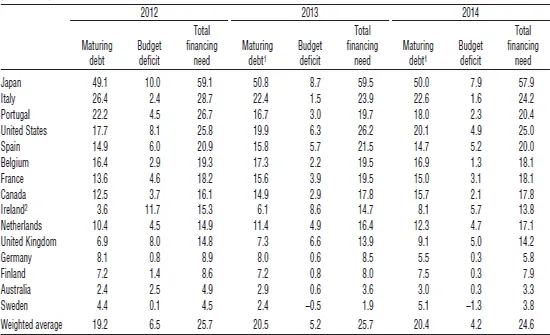

Notwithstanding the deceleration in global activity in late 2011 and weaker growth prospects (see the April 2012 World Economic Outlook), fiscal deficits in most advanced economies are projected to continue to decline in 2012 (Table 1). Headline deficits will fall by almost 1 percentage point of GDP among the advanced economies, as countries unwind fiscal stimulus and, in a few cases, implement austerity measures in response to market pressures. At about 1 percentage point of GDP, deficit reduction in cyclically adjusted terms would be slightly higher than that implemented in 2011. In many cases, the challenge will be to ensure continued progress toward sound public finances while avoiding an excessive fiscal drag on activity. Gross financing needs are expected to decline only slightly, hovering around 25 percent of GDP per year over the coming three years in advanced economies, as lower deficits are offset by higher rollover requirements on a larger maturing debt stock (Table 2).

Table 1. Fiscal Balances, 2008–13

(Percent of GDP, except where otherwise indicated)

Sources: IMF staff estimates and projections.

Note: All country averages are weighted by GDP at purchasing power parity using rolling weights, and calculated based on data availability. Projections are based on IMF staff assessment of current policies. ASEAN-5: Indonesia, Malaysia, the Philippines, Singapore, and Thailand; G-20: Group of Twenty.

1 Excluding financial sector support.

Table 2. Selected Advanced Economies: Gross Financing Needs, 2012–14

(Percent of GDP)

Sources: Bloomberg L.P.; and IMF staff estimates and projections.

Note: Averages are weighted by GDP at purchasing power parity using rolling weights. Data on maturing debt refer to government securities. For some countries, general government deficits are reported on an accrual basis.

1 Assumes that short-term debt outstanding in 2012 and 2013 will be refinanced with new short-term debt that will mature in 2013 and 2014, respectively. Countries that are projected to have budget deficits in 2012 or 2013 are assumed to issue new debt based on the maturity structure of debt outstanding at the end of 2011.

2 Ireland’s cash deficit includes exchequer deficit, other government cash needs, and bank/credit union recapitalization.

- In the United States, the deficit in 2012 is expected to decline by 1½ percent of GDP in headline terms, or by 1¼ percent of GDP in cyclically adjusted terms. Congressional approval of a full-year extension of payroll tax cuts and emergency unemployment benefits averted a more substantial fiscal withdrawal that would have had significant negative repercussions for economic activity. Additional fiscal consolidation of 1.5 percent of GDP is in the pipeline for 2013, including from the automatic spending cuts expected to be triggered by the failure of the congressional “supercommittee” to agree on a deficit reduction plan. This would be a significant adjustment to undertake, and the overall pace of consolidation could be reduced should growth disappoint and Treasury bond market conditions remain favorable. Moreover, the decline in the overall deficit could roughly double if temporary tax reductions and stimulus measures are allowed to expire. President Obama has unveiled a budget proposal that envisages additional stimulus measures over the next several years and a plan to overhaul the corporate tax code by reducing the corporate income tax rate from 35 to 28 percent and closing loopholes. However, prospects for congressional approval of either of these proposals are uncertain.

- In Canada, deficits are set to decline in 2012 and 2013 with expenditure restraint and the withdrawal of fiscal stimulus.

- In Germany, the cyclically adjusted deficit fell significantly in 2011, reflecting the expiration of one-off financial sector measures implemented in 2010,1 sizable discretionary fiscal tightening due to both stimulus withdrawal and consolidation measures, and continued structural changes in the labor market (leading to lower payments of unemployment benefits). In 2012 the decline in the headline deficit is projected to be modest; the larger improvement in the cyclically adjusted balance reflects in part tightening measures (amounting to ¼–½ percentage point of GDP), together with cyclical improvements that may not be fully filtered out owing to methodological difficulties.

- In the United Kingdom, actual and potential GDP growth estimates have been revised down, resulting in weaker projections for both headline and cyclically adjusted balances. In cyclically adjusted terms, adjustment is projected at about 1¼ percent of GDP this year and next, about ½ percent of GDP annually less than previously expected.

- In France and Italy, the authorities are complementing recent fiscal packages with measures aimed at boosting growth. In France, starting October 1, a “social VAT,” also known as fiscal devaluation, will reduce the labor tax wedge, offset by increases in the value-added tax and taxes on capital revenue. As noted in the September 2011 Fiscal Monitor, such a reform can reduce the cost of exported goods (through lower labor taxes) and increase the relative price of imported goods to consumers (through the higher VAT), like a currency devaluation. In Italy, reforms in the areas of product market liberalization, infrastructure investment, and administrative simplification have been introduced, and the government has submitted to parliament a package of reforms aimed at making the labor market more flexible.

- In Spain, the authorities have announced in the budget for 2012 measures complementing the fiscal consolidation package of end-2011, in an effort to reach an overall deficit target of 5.3 percent of GDP for 2012. The new deficit target understandably aims for a very large consolidation and is broadly appropriate, although a slightly more moderate adjustment that better accommodated cyclical developments would have been preferable.

- In Ireland and Portugal, tax increases, revenue-enhancing measures, and expenditure cuts are being introduced to maintain the committed path of deficit reduction over the medium term.

- In Greece, in line with their commitment to return to a sustainable fiscal position in the medium term, the authorities approved additional fiscal measures amounting to 1.5 percent of GDP in the context of a new program and against the backdrop of a large debt-restructuring operation. The pace of fiscal consolidation, centered on a sizable reduction in public employment, pensions, and health spending, as well as the broadening of the VAT and personal income tax bases, would be more moderate than in 2010–11, with increasing emphasis on structural reforms to boost competitiveness and medium-term growth, including a 22 percent decline and subsequent three-year freeze in the minimum wage. The program also involves a renewed effort to fight tax evasion through stronger enforcement, aligning tax administration operations with international best practices, and raising social security collection compliance.

- Japan is the only advanced economy in which the cyclically adjusted deficit will increase further in 2012 before returning to slightly below the 2011 level next year.

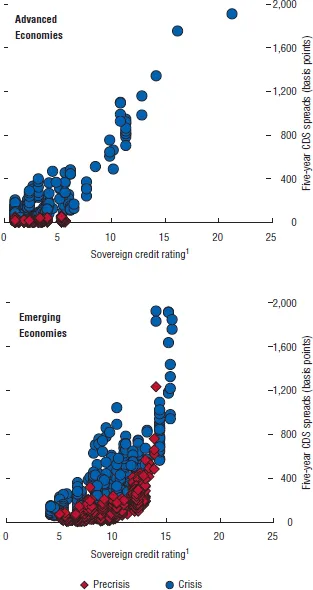

Front-loaded adjustment in a few advanced economies is being undertaken in the context of severe market pressure, but—as noted in the January 2012 Fiscal Monitor Update—other advanced economies would seem to have more scope for discretion. Policymakers may be hesitant to exploit this apparent “fiscal space” out of concern regarding a potential market backlash to any policy change. This wariness is understandable: in practice, fiscal space is difficult to measure precisely (Box 1), and to the extent that it reflects market perceptions, it can be volatile. Prior to the crisis, there was little differentiation among sovereign bond spreads across advanced economies, but the dispersion and volatility of spreads has since increased markedly (see the April 2012 Global Financial Stability Report), complicating the task of policymakers, who must assess the extent to which policy can be eased without losing credibility (Figure 1). This is especially true because confidence can be more easily lost than restored. Of course, the general macroeconomic environment—such as the risk of overheating pressures—as well as the overall policy mix being implemented is also relevant in determining the appropriate course of fiscal policy. For example, in some economies, a loosening of monetary policy could prove more effective than additional fiscal stimulus at supporting demand. Nevertheless, in 2012 and 2013, advanced economies with fiscal space should at a minimum allow the automatic stabilizers to operate around their currently envisaged adjustment plans in the event that growth slows more than expected. Among these countries, those with a strong position, in terms of fiscal accounts and credibility with markets, can consider going further and slowing the pace of fiscal consolidation to reduce downside risks to growth. In some countries, market interest rates remain relatively high despite significant fiscal consolidation that has been implemented or is in the pipeline. The availability of adequate financing for countries that are undertaking adjustment could provide an important confidence boost while market perceptions gradually adjust to strengthened fundamentals. In this regard, the recently agreed-upon combination of the European Stability Mechanism and the European Financial Stability Facility, along with other recent European efforts, will strengthen the European firewall.

Figure 1. CDS Spreads and Sovereign Ratings

Sources: Fitch Ratings; Markit; Moody’s Analytics; Standard & Poor’s; and IMF staff calculations.

Note: CDS: credit default swap.

1 Sovereign credit ratings and outlooks from Fitch Ratings, Moody’s Investor Services, and Standard & Poor’s are converted to a linear scale, then averaged across the three agencies, with AAA equal to 1; data as of end-2011.

Box 1. Measuring Fiscal Space: A Critical Review of Existing Methodologies

The notion of fiscal space is closely related to the concept of fiscal sustainability. The fiscal stance of a country is considered su...

Table of contents

- Cover Page

- Title Page

- Copyright Page

- Contents

- Preface

- Executive Summary

- 1. Continued Fiscal Tightening Is in Store for 2012, Particularly among Advanced Economies

- 2. Debt Ratios Are Still on the Rise, but Peaks Are within Sight

- 3. Easy Does It: The Appropriate Pace of Fiscal Consolidation

- 4. High Gross Debt Levels May Overstate Challenges in the Short Run …

- 5. … But Long-Run Debt-Related Challenges Remain Large

- 6. Anchoring Medium-Term Fiscal Credibility: The Second Generation of Fiscal Rules

- 7. Conclusion and Risk Assessment

- Appendixes

- Methodological and Statistical Appendix

- Acronyms

- Country Abbreviations

- Glossary

- References

- Boxes

- Footnotes