- 126 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

The Asian Development Bank conducted a Philippine enterprise survey during April and May 2020 to gauge the impact of the novel coronavirus disease (COVID-19) on the business community. This report provides a rich set of initial facts and ideas for the government to develop evidence-based policymaking to support the revival of Philippine enterprises hurt by the pandemic. It also provides survey-based information for current and future analytical use.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

1. METHODOLOGY

In collaboration with the Philippine Department of Finance, the Asian Development Bank (ADB) conducted an enterprise survey during 28 April–15 May 2020. The questionnaire was designed to investigate the impact of coronavirus disease (COVID-19) on Philippine enterprises, along with the effect of the 16 March 2020 quarantine and lockdown measures—such as the enhanced community quarantine (ECQ) imposed by the government around the National Capital Region (NCR). It also aimed to help the government in developing their economic bounce-back strategies in response to the crisis.

The survey was designed to grasp each respondent’s basic characteristics, the COVID-19 impact, potential needs for policy measures, and preparation for reopening. Accordingly, the survey questionnaire had four components: (i) the company’s profile at the end of 2019; (ii) the COVID-19 impact on business operations, sales, employment, wage payments, and actions taken to retain business; (iii) the most needed policy interventions that could help enterprises both during and after the COVID-19 crisis; and (iv) the firm’s social distancing practices.

The emergency unexpectedly disrupted businesses; yet nimble data collection was needed. Thus, non-standard sampling procedures were inevitably chosen. The survey was carried out online via social media (Facebook) and other internet portals through the networks of the Philippine Chamber of Commerce and Industry and the Bankers Association of the Philippines. As the sampling frame was not used, the data structure was compared with an existing Philippine enterprise survey to review potential data bias and guide the reader on how to interpret the survey results. A list of establishments surveyed by the Philippine Statistics Authority (PSA) in 2018 was used for comparison.

Follow-up surveys will be conducted every 2 months to continuously monitor the Philippine business environment and assess the effects government policy measures have in supporting Philippine enterprises. ADB plans follow-up surveys in July and September 2020.

2. KEY FINDINGS FROM THE ADB PHILIPPINE ENTERPRISE SURVEY

A. Data Structure

As of 15 May 2020, ADB had received 2,481 complete responses from private sector businesses including micro, small, medium-sized, and large enterprises. In general, the aggregate data had the same qualitative size, sectoral, and regional distribution structure as the list of establishments surveyed by the PSA in 2018 (Table): the smaller the firm size, the larger the numbers in the survey; the wholesale and retail trade sector held the largest share; and the largest numbers of responding firms were from the NCR. Quantitatively, the wholesale and retail trade sector appeared underrepresented and the NCR appeared overrepresented compared with the PSA survey.

By industry, the difference of each sector’s share to total respondents between the ADB and PSA surveys was less than 5 percentage points, except for wholesale and retail trade (24.6 percentage points below the PSA survey), construction (8.2 percentage points above the PSA survey), and other services (7.7 percentage points above the PSA survey). By region, the difference of each region’s share to total respondents between ADB and PSA surveys was below 5 percentage points, except for the NCR (29.2 percentage points above the PSA survey).

In the Philippines, there are two different official criteria to classify firm size: (i) employment levels as set by the PSA for statistical purposes and (ii) total assets (excluding land) as defined by the Small and Medium Enterprise Development Council Resolution No.01 Series of 2003.

In comparing ADB and PSA survey data, the definition of enterprise size based on the employment criterion set by the PSA—a microenterprise has 1–9 employees, a small enterprise has 10–99 employees, a medium-sized enterprise has 100–199 employees, and a large enterprise has more than 200 employees—was adopted.

For the rest of this report, ADB uses total assets to define firm size as it provides a more realistic picture for analysis. Under this criterion, a microenterprise has assets (excluding land) of 3 million or less, a small enterprise up to ₱15 million, a medium-sized enterprise has total assets up to ₱100 million, and a large enterprise has total assets exceeding ₱100 million.

B. Company Profile

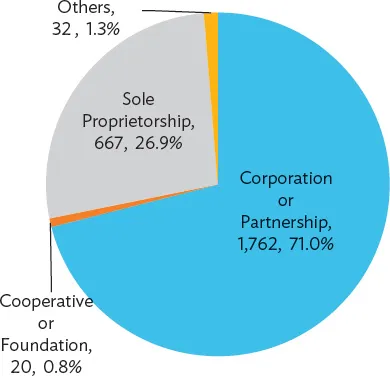

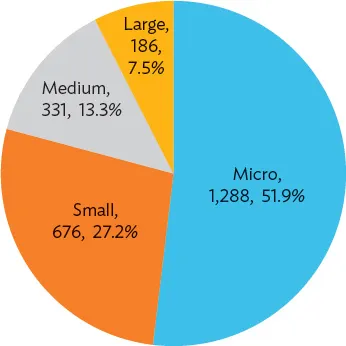

Corporations or partnerships accounted for 71% of survey respondents, followed by sole proprietors (26.9%) (Figure 1). By firm size (using the total asset criterion), microenterprises comprised 51.9% of respondents, followed by small enterprises (27.2%), medium-sized enterprises (13.3%), and large enterprises (7.5%) (Figure 2).

The majority of enterprises surveyed belonged to the services sector. More concretely, enterprises engaged in wholesale and retail trade (including repair of motor vehicles and motorcycles) had the largest share of respondents (21.5%), followed by accommodation and food services which includes tourism (14.3%); other services such as worker dispatching, beauty salons, laundry, personal repairs, and publishing (14.3%); manufacturing (10.5%); construction (8.6%); and information and communication (7.6%) (Figure 3).

Table: Survey Comparison between Asian Development Bank and Philippine Statistics Authority

– = no number; ADB = Asian Development Bank; BARMM = Bangsamoro Autonomous Region in Muslim Mindanao; MIMAROPA = Mindoro, Marinduque, Romblon, and Palawan (Southwestern Tagalog Region); PSA = Philippine Statistics Authority; SOCCSKSARGEN = South Cotabato, Cotabato, Sultan Kudarat, Sarangani, and General Santos.

Note: Firm size classification of ADB survey data is based on the number of employees for comparison with PSA data.

Source: Asian Development Bank, Philippine Enterprise Survey.

By firm size (total asset criterion) and sector, microenterprises in wholesale and retail trade held the largest share (22.0% of total microenterprises), followed by other services (17.9%), accommodation and food services (14.8%), and construction (8.3%). Small enterprises engaged in wholesale and retail trade were highest (22.9% of total small enterprises), followed by accommodation and food services (13.5%), manufacturing (11.7%), and other services (10.5%). Medium-sized enterprises in wholesale and retail trade had a 19.0% share of total medium-sized enterprises, followed by manufacturing (18.4%), accommodation and food services (16.9%), and construction (9.1%). Large enterprises engaged in wholesale and retail trade held a 17.7% share of total large enterprises, followed by other services (15.6%), manufacturing (15.1%), and accommodation and food services (10.2%).

By region, 79.7% of those surveyed operated on Luzon Island (49.6% in the NCR, 14.0% in Calabarzon, 9.3% in Central Luzon, and 6.8% in other areas—Cordillera Administrative Region, Ilocos, Cagayan Valley, MIMAROPA, and Bicol), followed by the Central Visayas (7.5%), Western Visayas (4.0%), and Davao (3.4%) (Figure 4).

By firm size in each region, microenterprises operating in the NCR held a 48.2% share of total microenterprises, followed by Calabarzon (14.2%) and Central Luzon (9.9%). Small enterprises operating in the NCR had a 51.0% share of total small enterprises, followed by Calabarzon (12.4%) and Central Luzon (9.2%). Medium-sized enterprises operating in the NCR were 50.8% of total medium-sized enterprises, followed by Calabarzon (14.5%) and Central Visayas (8.2%). Large enterprises operating in the NCR stood at 52.2% of total large enterprises, followed by Calabarzon (17.2%) and Central Luzon (11.3%).

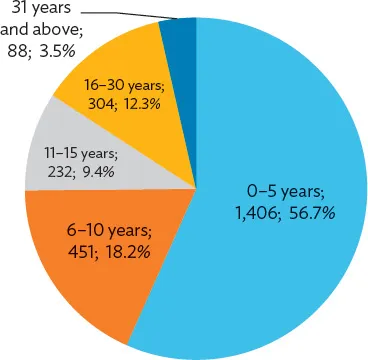

The majority of enterprises surveyed were relatively young firms, operating for 5 years or less (accounting for 56.7% of total respondents), followed by firms operating for 6–10 years (18.2%), firms operating for 16–30 years (18.2%), firms operating for 11–15 years (9.4%), and firms operating for 31 years and above (3.5%) (Figure 5).

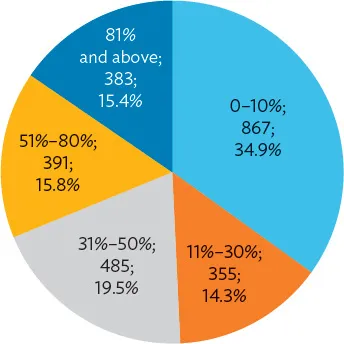

In terms of the gender composition of workers, more than one-third (34.9%) of the enterprises surveyed reported that only 10% or less of a firm’s total employees were women (Figure 6). However, another one-third (15.8% plus 15.4%) of those surveyed said women comprised 50% or more of the firm’s total workforce.

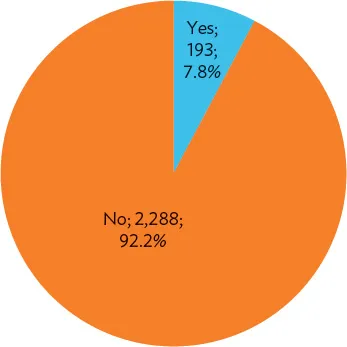

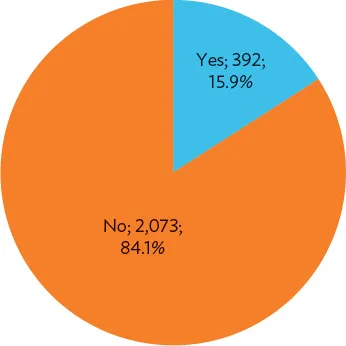

As for international trade orientation, most enterprises concentrated on domestic markets. Only 7.8% of enterprises surveyed were engaged in exports while 15.9% were importers (Figures 7 and 8). Of those exporting, 40.1% said that exports were their primary business (accounting for more than 90% of total sales), while for 41.7% exporting was a supplementary business (accounting for 50% or less of sales). Production relied highly on imported goods and services for 17.9% of importers (accounting for more than 90% of their total production inputs), while 49.3% reported imports accounted for not more than 50% of inputs. Just 14.2% of those surveyed used online selling or e-commerce, suggesting traditional channels for marketing products and services remain dominant.

C. COVID-19 Impact on Business

Business Conditions after Quarantine Implemented

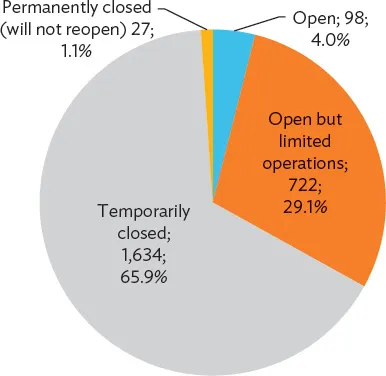

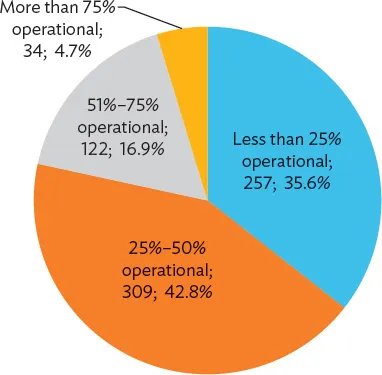

While critical in safeguarding public health against the spread of COVID-19, the enhanced community quarantine and other quarantine/lockdown measures (henceforth referred to as ECQ) dramatically limited business activities throughout much of the Philippines. After the 16 March1 lockdown of the NCR, Calabarzon, and other regions, most Philippine enterprises faced the immediate closure of business or limitation of business operations. According to the survey, 65.9% of enterprises surveyed temporarily closed their business after the ECQ came into effect (Figure 9). Limited operations continued in 29.1% of the enterprises surveyed. Among those with limited operations, one-fifth reported more than 50% of their business continued, while 78.4% reported less than 50% of their business operational (Figure 10). Only 4% of those surveyed remained fully open. Meanwhile, 1.1% closed permanently.

There was a clear correlation between business closures and firm size. Temporary closures were most widespread among microenterprises (71.2% of total microenterprises), followed by small enterprises (63.2%), medium-sized enterprises (57.4%), and large enterprises (53.8%). Among large enterprises, 7% remained fully operational while 38.2% stayed partially open. The smaller the firm size, the ...

Table of contents

- Front Cover

- Title Page

- Copyright Page

- Contents

- Table and Figures

- Foreword

- Acknowledgments

- Executive Summary

- 1. Methodology

- 2. Key Findings from the ADB Philippine Enterprise Survey

- 3. Policy Implications

- Annexes

- Back Cover

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access The COVID-19 Impact on Philippine Business by in PDF and/or ePUB format, as well as other popular books in Medicine & Infectious Diseases. We have over one million books available in our catalogue for you to explore.