eBook - ePub

Funding women entrepreneurs : How to empower growth

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Funding women entrepreneurs : How to empower growth

About this book

Intervention is needed to improve women-led companies' access to finance. In a recent study, EIB's InnovFin Advisory assessed the availability of finance for women-owned and managed companies in Europe as compared to the United States. While women-led companies account for only a small portion of financing deals and investment flows, their share is growing. Nevertheless, structural inequalities and persistent biases continue to distort the funding environment. The study puts forth a number of innovative finance and policy recommendations. Restarting the EU economy after the coronavirus pandemic provides a unique opportunity to tackle gender barriers to finance.

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription.

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes! You can use the Perlego app on both iOS or Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Yes, you can access Funding women entrepreneurs : How to empower growth by Alessandro De Concini, Surya Fackelmann in PDF and/or ePUB format, as well as other popular books in Business & Finance. We have over one million books available in our catalogue for you to explore.

Information

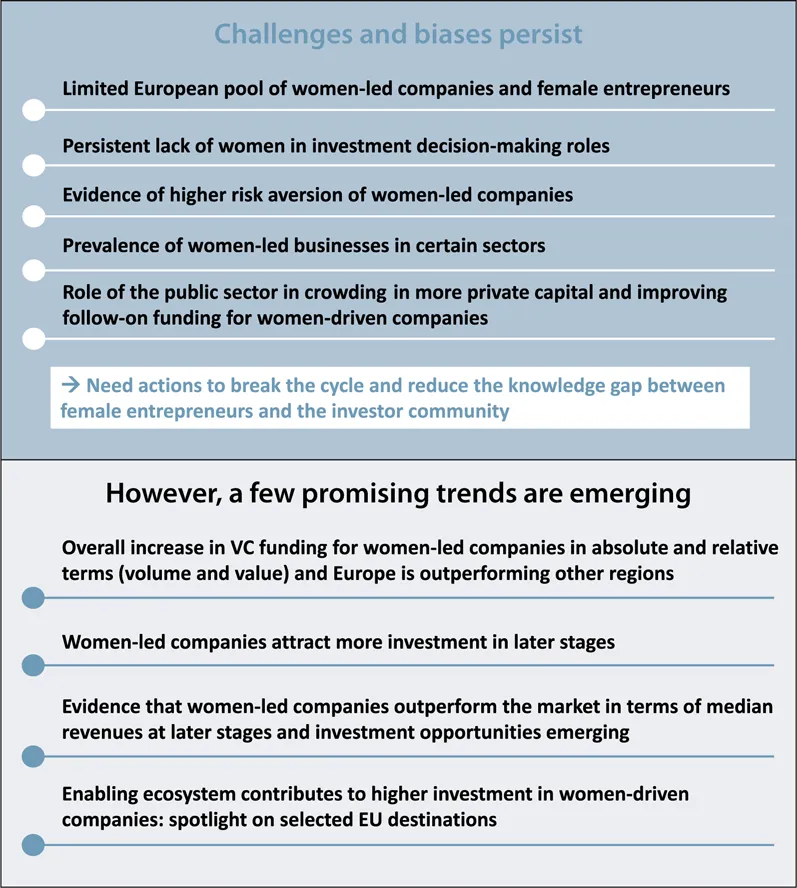

Key findings

We find evidence of a persistent funding gap between male and female entrepreneurs, despite some promising trends emerging. Overall, the data suggest that the investment climate for women-led companies in the European Union is slowly improving, despite starting from a lower base than, for example, the United States. However, differences in the overall proportions still exist. Women-led startups are not funded on an equivalent basis to men-led startups, owing to structural inequalities in the population of entrepreneurs and investors as well as persistent biases. For example, since 2006, the World Economic Forum has annually issued the Global Gender Gap Report, which includes the Global Gender Gap Index. At the current rate of progress, it will take another 108 years to close the gender gap and 202 years to reach economic gender parity, according to the 2018 report.[5]

Challenges and biases persist

A combination of lack of female representation among founders and investors, gender investment bias and risk aversion creates a vicious circle that is difficult to break.

The European pool of female-led companies and female entrepreneurs is still limited

While the European Union shows some promising trends concerning venture capital funding for women-led companies, as we examine later in the study (Section A few promising trends emerging; subsection Women-led companies are raising record levels of finance, with Europe outperforming other regions), it is worth noting that venture capital funding for female-led companies in the European Union is lower than that of the more mature US venture capital market. As PitchBook data show, while women-driven companies in the European Union received a record €5 billion in venture capital funding in the first three quarters of 2018 (up from €1.1 billion in 2010), this is a fraction of the €34.2 billion (€7.2 billion in 2010) that women-driven companies received for the same period in the United States. This might contribute to the fact that the European pool of female-led companies and entrepreneurs is still limited in comparison to the North American pool in particular.

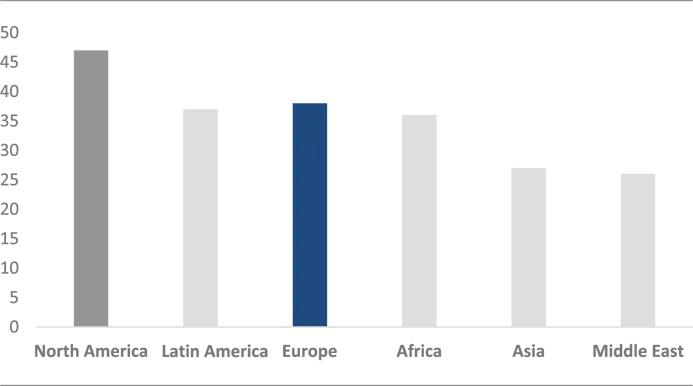

As Figure 2 shows, the share of female entrepreneurs worldwide varies considerably, but in all instances is below that of male entrepreneurs, which likely contributes to lower demand for external financing by female entrepreneurs. North America (Canada, the United States and Mexico), where women comprise 47% of entrepreneurs, most closely represents true parity in the overall supply of male and female entrepreneurs. Meanwhile, across Europe, there is a relative lack of female to male entrepreneurs: women represent roughly 52% of the overall population in Europe, according to the European Commission, but constitute 34.4% of the self-employed and 30% of startup entrepreneurs.

Figure 2. Female entrepreneurs as a % of total number of entrepreneurs per region

Source: Facebook, OECD and World Bank (2018)

Even though the US venture capital ecosystem overall is at a more mature stage than that of the European Union, more needs to be done in the United States to increase funding for women-driven companies. For example, only 2% of investment in startups goes to women-led startups even though 38% of startup founders are women. One outcome of the lack of female investors, which we explore in the subsection below, and the lack of funding for female-founded companies is gender imbalance among shareholders. For example, according to a 2018 study by Carta and #Angels, women comprise 35% of equity-holding employees of startups in Silicon Valley yet own only 20% of the equity. Worse, women account for 13% of startup founders but only 6% of founder equity. Even when they are on founding teams and assigned equity, women are far fewer in number than their male counterparts.[6]

Persistent lack of women in investment decision-making roles

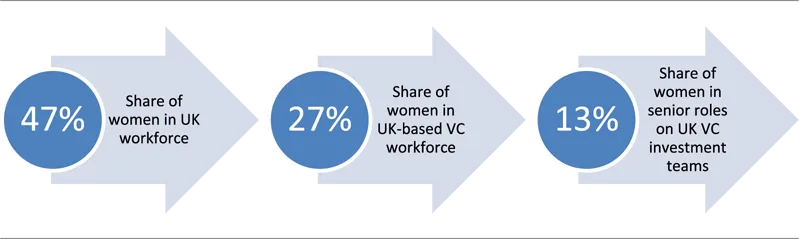

Figure 3. A breakdown of women’s participation in the UK workforce and venture capital industry

Source: Diversity VC, British Venture Capital Association and Craft.co (2017)

Research undertaken by non-profit organisation Diversity VC and the British Venture Capital Association found that women remain underrepresented across a variety of roles at investment firms in the United Kingdom (Diversity VC, British Venture Capital Association and Craft.co 2017). Moreover, women’s share of the investment decision-making roles within the investment committees of these organisations remains much smaller than men’s share. Women represent just 27% of the venture capital workforce in the United Kingdom compared to 47% of the country’s overall workforce. Meanwhile, 18% of investment roles at UK-based venture capital firms are held by women and a mere 13% of the investment decision-making roles at these firms are occupied by women. Finally, of the 160 firms surveyed, 66% did not employ women in any investment decision-making capacity.

In the United States, recent research has found that roughly four out of five venture capital firms have never employed a woman in a senior investment role, just one in 10 new hires are women and less than 9% of venture capitalists are women (Gompers et al. 2014; Gompers and Wang 2017). Women and minority-led funds manage just 1.3% of the €69 trillion asset management industry even though they perform just as well as, or better than, funds that are majority owned by white men (Lerner et al. 2019).[7] Moreover, only about 10% of decision-makers at US venture capital firms are women....

Table of contents

- Cover

- Contents

- Title

- Forewords

- Executive summary

- Objective and methodology

- Working assumptions and hypotheses

- Key findings

- Recommendations and way forward

- Bibliography

- PitchBook data collection

- Annex

- Copyright