Why are women entrepreneurs missing out on funding? : Reflections and considerations - Executive summary

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Why are women entrepreneurs missing out on funding? : Reflections and considerations - Executive summary

About this book

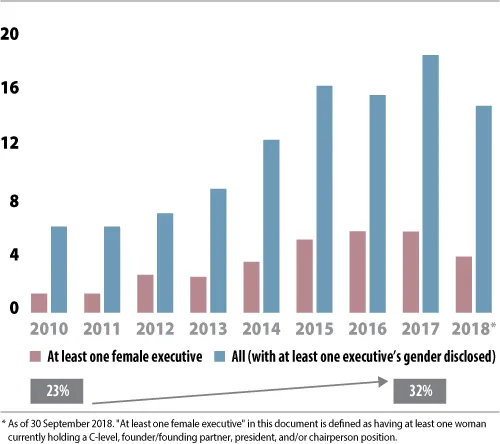

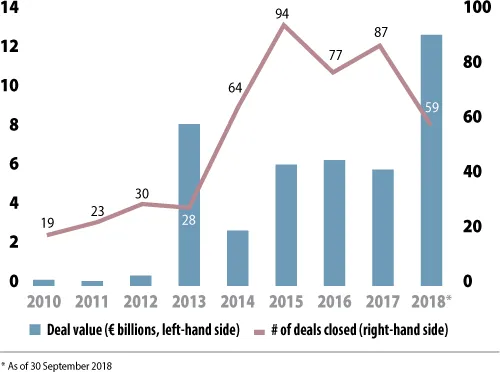

The study assesses the access-to-risk-capital conditions for women-driven companies in Europe in comparison to the US and Israel to contextualise emergent cross-country and regional barriers and gaps. The study finds that while women-led companies still account for a small portion of deal flow and overall volume invested the rate of growth has increased across all the examined regions. Nevertheless, structural inequalities and persistent biases both on the supply of and demand for finance for women-driven companies still hinder the transition to a more balanced, more accessible and ultimately better functioning funding environment. For this reason the study puts forth and analyses a number of options and considerations – both financial and policy related – that could help accelerate this transition. As multiple evidence-based studies and data points show, women's economic empowerment makes not only ethical but also economic and business sense. InnovFin Advisory carried out the study with support of PitchBook, complementing market data with interviews of market practitioners of the European Venture community and other stakeholders.

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app.

Information

Key findings

Promising trends…

Table of contents

- Disclaimer

- Executive summary

- An overview of venture capital investment into women-led companies

- Key findings

- Recommendations and way forward

- Notes