Rising from the Mailroom to the Boardroom

Unique Insights for Governance, Risk, Compliance and Audit Leaders

Bruce R. Turner

- 450 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Rising from the Mailroom to the Boardroom

Unique Insights for Governance, Risk, Compliance and Audit Leaders

Bruce R. Turner

About This Book

Boards and business leaders expect their key advisors to deliver fresh insights, and increasingly expect them to demonstrate foresight. To achieve what is expected, it is crucial to understand the dynamics of conversations in the boardroom and around the audit committee table. This book provides those unique perspectives.

The journey from the 'mailroom to the boardroom' follows the story of a young banker who moved into the internal auditing profession as part of the 'new breed', then rose through the ranks into senior leadership and chief audit executive roles, before assuming audit committee and board roles that had an immense influence on governance, risk, compliance, and audit professionals. Success does not always follow a smooth and uneventful trajectory, and this story reflects insights from both the ups and the downs of the journey.

Each chapter shares insights, better practices, case studies, practical examples, and real-life challenges and draws them together into 101 building blocks, each one providing crucial career-long learnings.

The storytelling provides insights to people at all levels on the importance of positioning oneself to step into leadership roles, helps them understand how to evaluate and pursue potential career growth opportunities, provides tips on how to holistically manage and advance their career, and inspires higher-level thinking that enhances governance, risk, compliance and audit practices.

Frequently asked questions

Information

Part 1

Learning the Ropes

“Bruce Turner is one of the most capable officers I have had the pleasure to work with. The potential for him is unlimited because with his knowledge and ability he would be able to undertake without difficulty any position.Mr Turner has been a tower of strength at this office and everything asked of him has been done with speed and accuracy. His cooperation with other staff including me has been unbeatable.”Clive MorleyBank ManagerState Bank of New South WalesJune 1983

1

Packing a Pistol in the Mailroom

Entity Profile and Role | |

|---|---|

Sector: | Financial services sector – retail banking |

Entity: | Rural Bank of New South Wales |

Entity description: | The Rural Bank operated as a state-owned limited-scope financial institution that primarily lent to and dealt with farmers during its early years. It operated from 1933 until 1982 when its mandate was extended to a standard commercial bank, and its name was changed to the State Bank of NSW. Because of its limitations on operating as a savings bank, the Rural Bank established a relationship with the Tamworth Building and Investment Society (TBIS) in November 1976. The TBIS changed its name to the Rural Building and Investment Society (RBIS) with transactions accepted throughout the Rural Bank network. The RBIS ultimately transferred its engagements to the State Building Society in October 1982 For entity metrics, see Chapter 4 |

Primary role: | Clerical, accounting, and customer services |

Main responsibilities: | Entry-level (junior) clerical and ledger-keeping roles. Steady rise into customer service, telling (cashier) then examining and supervisory roles |

Timeframe: | The First Decade. (Descriptors for the timeframe are provided at the beginning of the book to reference the different decades throughout my working career. These descriptors are indicative and are not intended to align precisely with the different stages of growth) |

Purpose of Table (relevant to all chapters): | The content in this table is included at the start of each chapter to provide context to the storytelling in terms of the role and responsibilities I held at that time, and the nature of the organizations where I was working |

PERSONAL STORY

- Gough Whitlam was a transformational political leader who was elected Australian Prime Minister in 1972. One of his early decisions was to abolish conscription and end Australia's involvement in the Vietnam war. This was personally significant, as I was nearing an age where I could well have been compelled to enter military service.

- The banking industry was on the cusp of computerization which made many of the manual processes obsolete. I am glad though that I learnt the bank's back-office operations from the ground up as it gave me “street cred” through my later banking roles.

- Importantly, banks had traditionally used “seniority” as the sole basis of promotion, but this was transitioning to a “performance-based” regime. As I had been identified as a high performer, this aided my career trajectory.

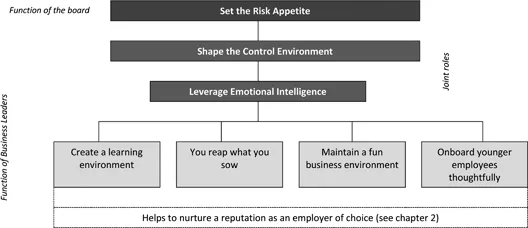

- Onboard younger employees thoughtfully.

- Create a learning environment.

- Maintain a fun business environment.

- You reap what you sow.

- Leverage emotional intelligence.

- Apply the risk appetite.

- Shape the control environment.

CONTEXT

KEY TAKEAWAYS AND DEEP DIVES

ONBOARD ENTRY-LEVEL EMPLOYEES THOUGHTFULLY

Setting the Scene

Program... |

|---|