![]()

Chapter 1: Eligibility

A Health Savings Account (HSA) is an account for you to save money for your qualified medical expenses. You own the money in your HSA, and once money is contributed to your account you can access it whenever you need.

Establishing an HSA requires a little more than just putting some money in a jar and claiming it on your taxes, though. Only eligible individuals can establish an HSA, and only with an IRS-approved custodian or administrator.

Eligibility is determined on the first day of each month and lasts for the entire month. If you become eligible in the middle of a month, you’ll need to wait until the next month to establish your HSA. To be eligible, you must be:

1) Covered by an HSA-eligible health plan,

2) Not covered by any disqualifying medical coverage,

3) Not receiving Medicare benefits, and

4) Not claimable as a dependent on anyone else’s taxes.

You can be eligible if you are covered under your own HSA-eligible health plan, your spouse’s plan, or, in some cases, your parents’ plan. Each account is based on an individual person’s eligibility, and each person has their own HSA that belongs only to them. Family HSAs or shared HSAs do not exist. However, if you have an HSA, you can use it to reimburse your own, your spouse’s, and your tax dependents’ qualified medical expenses. Your spouse can also start their own HSA as long as they are eligible.

HSA-Eligible Health Plans

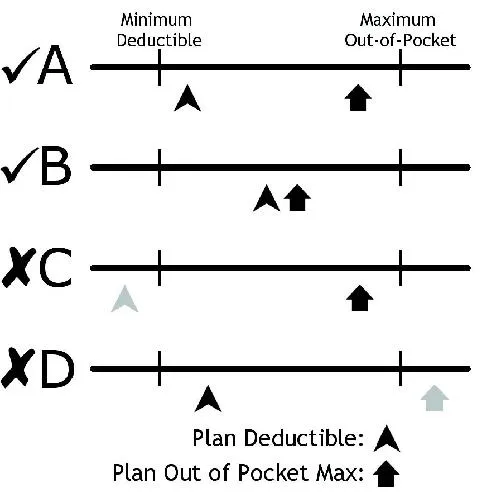

The major difference between a traditional health plan and an HSA-eligible high-deductible health plan is in the name: “high deductible.” In insurance, the deductible is the amount that you need to pay before the insurance company (or employer, in the case of a self-funded health plan) will help to pay for qualified expenses. Anything you pay before you meet your deductible will be your responsibility, with no co-pays.

![]()

The IRS sets limits every year on the minimum deductible a plan must have to be considered HSA-eligible. For 2018 and 2019, the minimum deductible for an individual is $1,350 and the family minimum is $2,700.

Some plans have an embedded deductible for their family plans where the deductible is lower for each individual person than for the whole family amount. For example, the family deductible might be $3,000, which would qualify the plan for HSA eligibility. But if it has an embedded deductible at $1,500 per person, that amount is lower than the family minimum and means the health plan is not HSA-eligible.

| 2018 | 2019 |

Minimum Deductible | Self only: $1,350 Family: $2,700 | Self only: $1,350 Family: $2,700 |

Maximum Out of Pocket | Self only: $6,650 Family: $13,300 | Self only: $6,750 Family: $13,500 |

The other thing an HSA-eligible plan must include is an out-ofpocket maximum, which is also set by the IRS. There is a limit on how much money you pay out of pocket before your insurance starts paying for everything, including deductibles, copayments, and coinsurance. This protects you against sudden emergency expenses that leave you without any remaining savings. The out-of-pocket maximum only applies to in-network coverage; out of network coverage can have a limit higher than the IRS statute.

If a plan doesn’t have both a minimum deductible at or above the limit and an out-of-pocket maximum at or below the limit, then it doesn’t qualify as an HSA-eligible health plan. These limits change annually, so most insurance companies and employers will adjust their high-deductible health plans as needed to maintain HSA-eligibility.

Anything between the deductible and the out-of-pocket maximum is covered by coinsurance. You’ll pay part of the cost, usually somewhere between 5% and 20%, and your insurance will cover the rest.

Traditional health plans also have a deductible, but it is generally much lower. The trade-off is that high-deductible health plans usually have lower premiums, so that you don’t pay as much out of your paycheck. The money you save on premiums can then be put into your HSA and used for current or future health care expenses.

While an HSA-eligible health plan doesn’t offer you a low copay at the doctor’s office, it will usually negotiate better prices for you within a network of doctors. It will also cover you for preventive care, including regular check-ups and specific medicines.

Other Coverage

In addition to being enrolled in an HSA-eligible health plan, you also need to make sure that you aren’t enrolled in any disqualifying coverage. Common types of disqualifying coverage include:

? Medicare

? A spouse or parent’s health insurance or other health coverage

? Health FSAs/HRAs (yours or your spouse’s)

Accident, disability, long-term, and property insurance will not impact your HSA eligibility. You are also allowed to have insurance for a specific disease and tort insurance that provides a set amount of money for specific situations like hospitalization. A discount card for prescriptions is allowed, since you aren’t being reimbursed for any costs.

![]()

Eligibility Example 1

Alex’s workplace has just started offering an HSA-eligible health plan. He and his wife Barbara decide to switch from a traditional health plan to the HSA-eligible health plan. They have no other disqualifying coverage, so both Alex and Barbara are eligible to establish their HSAs on the first day of the month following their switch.

Eligibility Example 2

Abigail and her husband Ben are interested in signing up for HSAs. Ben has individual coverage on a traditional health plan through his workplace. Abigail has an HSA-eligible plan that covers herself, Ben, and their two children, Candice and Daniel. Candice i...