eBook - ePub

Quantitative Finance

Back to Basic Principles

A. Reghai

This is a test

Share book

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Quantitative Finance

Back to Basic Principles

A. Reghai

Book details

Book preview

Table of contents

Citations

About This Book

The series of recent financial crises have thrown open the world of quantitative finance and financial modeling. This book brings together proven and new methodologies from finance, physics and engineering, along with years of industry and academic experience to provide a cookbook of models for dealing with the challenges of today's markets.

Frequently asked questions

How do I cancel my subscription?

Can/how do I download books?

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

What is the difference between the pricing plans?

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

What is Perlego?

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Do you support text-to-speech?

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Is Quantitative Finance an online PDF/ePUB?

Yes, you can access Quantitative Finance by A. Reghai in PDF and/or ePUB format, as well as other popular books in Commerce & Ingénierie financière. We have over one million books available in our catalogue for you to explore.

Information

Topic

CommerceSubtopic

Ingénierie financière1 |

|

Financial Modeling |

A Introduction

At the time of writing, the term model has been widely overused and misused. The US subprime financial crisis in 2008 and 2009 and its subsequent impacts on the rest of the economy have prompted some journalists and magazines to launch unfair attacks on ‘quants’, that is the designers of models.

This book presents a clear and systematic approach which addresses the problems of modeling. It discusses old and new models used on an everyday basis by us as practitioners in derivatives and also in quantitative investment.

The proposed approach is incremental as in the exact sciences.

In particular, we show the added value provided by the models and their use in practice.

Each model has a domain of validity and new models, with their added complexity, are only used when absolutely necessary, that is when older models fail to explain the trader’s or investor’s PnL.

We insist on the philosophy of modeling in the field of derivatives and asset management and offer a valuation and estimation methodology which copes with the non-Gaussian nature of returns , generally known as the Smile.

We suggest a methodology inspired from the exact sciences, allowing students, academics, practitioners and a general readership to understand developments in this field and, more importantly, how to adapt to new situations (new products, markets, regulations) by choosing the right model for the right task at the right time.

Derivatives pricing can be seen as extrapolation of the present (fit existing tradable products like vanilla options to price new ones like barrier options) and that quantitative investment is an extrapolation of the past (fit past patterns to predict the future). In our approach, we argue that derivatives pricing relies on extrapolation of both the present and the past. Our method allows the correct pricing of hedging instruments, as well as control of the PnL due to the variability of financial markets. The fair pricing of derivatives cannot ignore so-called historical probability.

Similarly, statistical models require risk-neutral models. The latter offer a benchmark, a typical set of scenarios, which should be free of anomaly or arbitrage. They constitute essential building blocks with which we compare strategies and detect cases where there is extrapolation from the past to the future in order to identify the ones that go wrong. This detection is key as it selects sane strategies and excludes those not worth playing.

In this book, stochastic calculus is not the only modeling tool for financial practitioners. We combine it with a statistical approach to obtain models well suited to a shifting reality. We insist on this beneficial mixture to obtain the right model and fair pricing, the best PnL explanation, and the appropriate hedging strategy for different products/markets.

We mix stochastic calculus with statistics. Thanks to the interaction of these two fields, we can solve the difficult problem of ‘over-fitting’ in the quantitative investment area. We define a computable measure of over-fitting. This is a measure of the toxicity of over-learning.

We also propose adapted measures of toxicity to identify the different hidden risks in financial derivative products. These risks include the Smile and its dynamic, dividends and their variability, fat tails and stochastic interest rates among typical mono underlying risk typologies.

The predictive power of exact sciences is derived from fundamental principles, as well as the existence of fundamental constants. This is a concept that is generally absent from the world of financial modeling. Financial models lack universality in time and space but we show that we can come close to quasi-truths in modeling and modestly target the most important objective of financial modeling that is the capacity to predict and explain the PnL for a financial derivative or strategy. In other words, the prime property of a model is its ability to explain the PnL evolution. We are back to basics: the origin of the Black–Scholes model (the hedging argument), construction of the replication portfolio, and exact accounting for the various cash flows.

By accepting the limitations of financial modeling (at best we can achieve quasi- or truths) we devise complementary tools and risk monitors to capture market-regime changes.

These new monitoring tools are based on volatility and correlation. Once again, they are the result of this beneficial mixture of stochastic and statistical models.

2 |  | About Modeling |

A Philosophy of modeling

Using the term ‘philosophy’ implies problems or questions with ambiguous answers. Regarding derivatives, the question that first spring to mind is the following:

Why do we need a modeling philosophy for financial products and particularly derivatives?

This is a legitimate question. The need arose from a fundamental difference between the financial sector and the field of physics. Indeed, in mathematical finance there is no universal law. Socio economic agents are rational but there is no principle, such as the principle of conservation of energy in physics, that governs them. Similarly, in the socio-economic world, which drives the financial world, we lack universal constants such as the universal constant of gravity.

So, does the lack of universal laws imply that one should abandon modeling efforts in finance all together?

The answer, fortunately, is no. Despite the absence of universal laws and universal constants, we can still observe a number of features that help us grasp financial phenomena at least to an extent. In addition, an understanding of how these features affect our positions has a major bearing on the way we think about financial actions. This greatly simplifies our modeling task. This is important because we are not trying to model exact movements of financial assets but rather to build effective theories that suffice for the financial problem at hand. We can concentrate and find characteristics that may impact the decisions we make and the positions we have.

Another equally legitimate question is whether the exact sciences and their methodology can be of some help in our approach?

The answer is yes, and in fact exact sciences contribute towards building the edifice of financial modeling.

The exact sciences offer us a wide panorama of problem-solving methods. What follows are some important examples of transfer of scientific methods to the field of mathematical finance.

•The incremental approach: Modern science has always started with simple models and then moved to more complex ones, following the fineness of the phenomena studied. The modern theory of modeling financial derivative transactions really started with the Black & Scholes model. Since then, several trends have emerged and been adapted to different usages.

•Observation and data collection: astronomy started by using this method. This has provided a huge amount of data from which the physicist conjectures laws. At present, in finance, there are huge databases. For example, about 300 gigabytes of financial series are collected every week. Today, financial engineering teams include astrophysicists, who are vital to ensuring the mastery of databases and their judicious exploitation.

•Displaying data in a synthetic way: the first models that emerged in science were based on the synthesis of observed data, collected in the wild or even produced in the laboratory. Similarly, in finance, despite the absence of a universal theory, several empirical laws, developed by both traders and quants, provide curves and surfaces that are relatively compact and easy to follow.

•Lab simulation: Simulations form part of scientific methods, with potential major impact on human society. The most prominent example in modern times is probably the Manhattan Project, which had a crucial bearing on World War II. Today, in finance, simulations greatly improve our understanding of day-to-day risks and enables us to study the behavior and reaction of portfolios to different scenarios (past and hypothetical). Tens of trillions of random numbers are generated every day (50 billion random numbers every second!) in banks to produce the valuation and risk sensitivities of assets under management. In addition, parallel computing and grid computing in farms is developed on similar scale in investment banks as in very large theoretical physics labs, like CERN or Los Alamos.

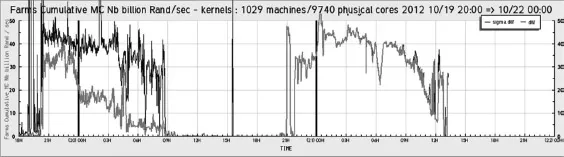

Figure 1 Number of random numbers simulated during a day for a segment of a derivative activity

In Figure 1 we show the number of random numbers simulated during the day. We observe great activity during the night to produce all scenarios and ‘greeks’ for the following day. We also see that during the day, real-time processing calls for a huge number of simulations to calculate real-time greeks.

•Calibration or ‘inverse problems’: in science, calibration is also known as an inverse problem. This exercise is undertaken in all disciplines, mainly to identify the model parameters that fit the measures taken in the field. In finance, this calibration exercise is not only repeated hundreds of millions of times every day, but also allows the aggregation of ...