eBook - ePub

Options for Risk-Free Portfolios

Profiting with Dividend Collar Strategies

M. Thomsett

This is a test

Share book

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Options for Risk-Free Portfolios

Profiting with Dividend Collar Strategies

M. Thomsett

Book details

Book preview

Table of contents

Citations

About This Book

An advanced strategic approach using options to reduce market risks while augmenting dividend income, this titlemoves beyond the basics of stocks and options. It shows how the three major segments (stocks, dividends, and options) are drawn together into a single and effective strategy to maximize income while eliminating market risk.

Frequently asked questions

How do I cancel my subscription?

Can/how do I download books?

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

What is the difference between the pricing plans?

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

What is Perlego?

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Do you support text-to-speech?

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Is Options for Risk-Free Portfolios an online PDF/ePUB?

Yes, you can access Options for Risk-Free Portfolios by M. Thomsett in PDF and/or ePUB format, as well as other popular books in Economics & Banks & Banking. We have over one million books available in our catalogue for you to explore.

Information

C H A P T E R 1

THE DIVIDEND PORTFOLIO, AN OVERVIEW

The easiest job I have ever tackled in this world is that of making money. It is, in fact, almost as easy as losing it. Almost, but not quite.

H. L. Mencken, in Baltimore Evening Sun, June 12, 1922

DIVIDENDS ARE PERCEIVED IN MANY WAYS, SOME VERY INACCURATELY.

Traders who want to be in and out of positions short term, tend to ignore or undervalue dividends altogether. Because the dollar amount is quite small compared to a stock transaction, dividends often are viewed as nuisance factors to short-term traders. On the far end of the spectrum, value investors might ultimately pick one value investment over other choices based mainly on the dividend yield of the moment.

The point is, traders and investors cannot just buy stocks yielding higher than average dividends and expect to outperform the market. Dividend risk is one form of risk that is easily ignored or misunderstood. So while dividend yield can represent a major portion of overall yield, it has to be balanced against market risk. The dividend collar developed throughout this book is based on generating income from dividend yield, but the most crucial component of that strategy is protecting against the inherent risks that can accompany high-dividend stocks, at times to a greater extent than market risk in the overall equity market.

DIVIDEND YIELD AS PART OF OPTION RETURNS

In considering how dividends work along with long stock and long or short options positions, they cannot be ignored. Even in a more or less vanilla strategy such as the covered call, dividend yield might represent a major portion of the overall annualized return. Consider these important qualifying points:

1.If the covered call is open only a few days, but that period includes the ex-dividend date, the covered call writer’s annualized yield is substantially higher due to the dividend yield than it would be if the strategy were round-tripped one week earlier or later.

2.In selecting two otherwise identically attractive underlying stocks to be used for a covered call strategy, the higher-yielding dividend may serve as a deciding factor.

3.Long-term potential growth in earnings per share as well as a potential underlying issue for options strategies might be affected by the historical and future dividend record. Those companies paying higher dividends every year for 10 years or more (so-called “dividend achievers”) tend to outperform the markets over time and to be less volatile both technically (predictability of price breadth and range) and fundamentally (in terms of predictability of revenue and earnings trends).

These are significant examples of how dividend yield is related to the selection of underlying issues as well as options strategies. The covered call cannot be viewed in isolation from the dividend yield. In fact, calculating returns from covered call writing is complex, but may include dividend yield in addition to capital gains or losses on the underlying and premium income from selling the call. This method, at times called “total return,” attempts to validate comparisons of net return among covered calls on a variety of stocks. These may include stocks yielding various dividend yields or offering no dividend at all. Because dividend yield changes the return (both basic and annualized), it makes sense to include the yield in the analysis of option-based return.

With this in mind, the higher the dividend yield, the better the overall return will be as well. Does this mean that selection of a covered call candidate should be limited to only those stocks yielding better-than-average dividends? No. In fact, in comparing only the covered call strategy (without considering any other hedging that might be included) the appropriate underlying stock should be selected based on sound fundamental analysis, and not on the basis of (1) richer-than-average option premium or (2) higher-than-average dividends.

Remembering that attractive yields often accrue because a company’s share price has plummeted, selecting covered call candidates based solely on dividend yield is quite dangerous. Share price might have fallen due to any number of causes, including the impending demise of the company and anticipation of a further price decline in the stock. In this case, a 7% yield on a stock yielding only 1.2% a few months earlier is not likely to be a sound candidate for covered call writing.

Assuming, however, that you have narrowed down selection for covered call writing to three different companies, and also assuming that all three share the same or similar fundamental attributes, how do you know which to purchase for a covered call strategy? While you can apply a number of sensible fundamental (or technical) criteria to pick one of the three, dividend yield may certainly act as one deciding factor.

This decision is not merely a matter of opting for the highest dividend yield. Depending on your analytical standards and on the ratios and trends you follow, you are likely to prefer one company over others without consideration of the dividend level. However, as a starting point for describing any options strategy, it makes sense to analyze the components that are included; how those components affect value; and what levels of risk are caused or mitigated as a result. Dividend yield is one of those components, and traders have struggled for years to determine the role of dividends and their effect on option valuation.

THE DIVIDEND EFFECT ON OPTION VALUES

Few will doubt that dividend yield has a direct effect on both stock and option value. A higher dividend makes a company’s stock more desirable than that of a company whose dividend is lower. The exception: If the yield has increased because the share price has declined, then a comparison of dividend yields is not valid. You also have to consider the reasons for changes in a stock’s price, both upside and downside, before equating one dividend yield to another.

Pricing models for options have provided a dismal indicator. The most popular among these, the Black-Scholes Pricing Model,1 is a very flawed method for identifying fair value for options, because it contains several variables and excludes many important attributes that make the model inaccurate. These include

1.Dividends: Exclusion of any dividend yield, with the original Black-Scholes modeling assumption based on a zero dividend. Today, with so many securities declaring and paying dividends, the model is inaccurate to the extent that it compares and estimates option valuation between companies declaring dividends and those not declaring dividends.

2.Exercise: Assumption of European-style exercise, even though American stocks nearly always are exercised American-style. Thus, early exercise, which occurs frequently, is not built into the assumption.

3.Volatility: Black-Scholes provides a factor for volatility, but is flawed because it assumes that volatility remains unchanged all the way to expiration. Every options trader knows that extrinsic value (volatility) changes continually and, in fact, provides a key timing criterion for both entry and exit of most options strategies.

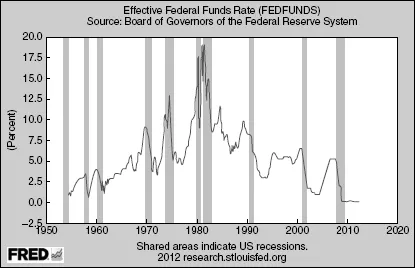

4.Interest: The formula assumes a theoretical “risk-free” interest rate, which is a questionable assumption based on today’s debt security market. If this interest rate increases, call premium is expected to rise and put premium to decline. These effects are caused by the leverage of options in comparison to owning 100 shares of the underlying. However, in practice, when federal funds effective rates are as low as 1% or lower, the effect of risk-free interest (such as interest on US Treasury securities) is insignificant. As of 2012, the Fed effective rate was approaching zero, as shown in figure 1.1.

The complexity of how dividends and interest rates affect option valuation is not a small issue. Dividends are certainly a direct component of option and stock valuation, and interest affects the valuation of both calls and puts. It is noteworthy, however, to recognize that at the time the Black- Scholes model was devised, there was no standardized trading of puts in the US markets. In fact, even calls were available on the stock of only 16 companies.

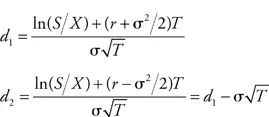

Black-Scholes works as a pricing model in a comparative sense; however, it is so inaccurate that it provides little value in terms of changes in interest rates, and no value for dividend-paying stocks. The factor for volatility is based on assumption that the volatility level remains constant. The Black-Scholes formula is

Figure 1.1 Effective federal funds rate

Source: Federal Reserve Bank of St. Louis Federal Reserve Economic Date (FRED).

c = SN (d1) – Xe–rT (d2)

p = Xe–rT N (–d2) = SN (–d1)

where

c = call

p = put

S = Stock price

X = Strike price of the option

r = risk-free interest rate

T = time to expiration (in years)

σ = volatility of the relative price change of the underlying stock price

N(x) = the cumulative normal distribution function

The formula demonstrably excludes dividends, assumes unreliably about interest risk-free interest, sets volatility as a constant, and is based on European-style exercise. All of these assumptions make the model highly unreliable if applied in the “real world” of trading. It may be beneficial in an academic setting where the interest is in trying to estimate a pricing level, given the assumptions (wrong or not). But in practice, Black-Scholes is a flawed model

Among those flaws is the assumption that a risk-free interest rate exists. That is unlikely today, when even the debts of the US government have been downgraded. This does not mean they are likely to default, but it does take away the historical risk-free assumption related to Treasury securities.

Interest rates affect option values directly and also serve as a guide for when or if to exercise an option early. If interest that can be earned on the proceeds received for selling a put at a higher level than is possible from holding until expiration, then early exercise is justified, at least in theory. This assumption is based on the additional assumption that if you close out an option position, you will immediately transfer capital to an instrument yielding a more favorable net return. This is the rationale often cited in support of Black-Scholes and similar pricing models. But in the modern-day environment of very low interest rates, this comparison is not valid. When it is possible to earn as much as 4–5% or more on stock ownership, the dividend yield is a far more important measure of return than interest rates for those companies could ever expect to be.

Dividends are likely to have much greater impact on option valuation than interest rates, notably when early exercise before the ex-dividend date is compared with exercise on or after the ex-dividend date. A general assumption about dividends is that the higher the cash dividend, the lower the call premium and the higher the put premium. While there is truth in this general rule of valuation, traders will still want to time their exercise decisions to be stockholders of record two days after the ex-dividend date—and this might lead to a decision to time entry and exit, even more than the relative value of the dividend yield or potential yield from closing stock and option positions and investing elsewhere.

These decisions are complicated by the additional considerations of whether the option is in or out of the money, the rate of time decay, and whether in-the-money (ITM) calls are vulnerable to exercise as the ex-dividend date approaches. The day before the ex-dividend date is the second most likely time for exercise, after the last trading day. Thus, proximity of the short call to current price is a crucial factor in option valuation, meaning that dividend yield is a key factor in the overall evaluation of options. It is not just proximity but time as well as actual yield that determines the option’s fair value.

PICKING DIVIDEND GROWTH STOCKS

The “dividend growth stock” is highly favored by investors as a smart way to limit the search for portfolio components. A mistake often made by investors focused on dividends is the failure to analyze price prior to selecting such stocks for inclusion in a portfolio.

If ...