Your basic nonnegotiables

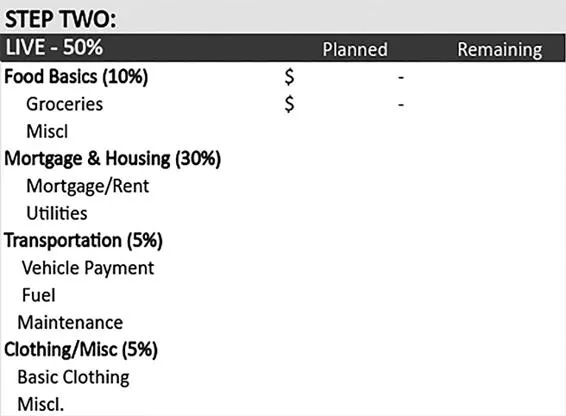

Your family deserves their basic needs met before you give anyone else your attention. The basics are often called your four walls. I call them your basics. Food, shelter, clothing, and transportation. Food—it is your responsibility to make sure your family is fed. Let me be clear, food doesn’t mean eating out every day or having an expensive steak dinner every night. Well, at least it shouldn’t. There is a reason why it’s called and included in the basic nonnegotiables. Food for your family should be basic. You can loosen this up after you become stable in your finances. Keep your meals simple and cheap! When you make sure you and your family has enough to eat, it will lower yours and your family’s stress levels and help you focus on winning in your finances.

Shelter—this is where you get current on your mortgage and all the bills that come with it. The last thing you need to be worrying about is where you are going to sleep or if the power is going to be cut off. This will help keep fear at bay and help unify your family to a common goal.

Clothing and transportation—make sure you have them. Wear some clothes. Bail is more expensive than a T-shirt and jeans. Basic clothing is all you need. Secondhand clothing is okay. Remember it’s only for a short period of time. When it comes to transportation, make sure you can get from point A to point B. You do not need a fancy car, you can buy that later. Get something that runs and drives, and take pride in all the imperfections! Make sure your basics give you a solid foundation to fall back on when things don’t go as planned!

Budgeting and getting current.

In order to get current on your basic nonnegotiables, you may need to raise your income, cut your lifestyle, or both. With the discipline you created by giving, you will be able to understand it is possible to live on less than you make. It’s time to start learning to live simply. This starts with a detailed zero-dollar-based budget. Every month, you need to make every dollar have a name so you can easily see where your money is being spent. Remember, money is a tool and works for you, not the other way around!

Myths about budgeting.

Before we go any further, we need to understand what a budget is and what it is not. There are two types of people—people who hate budgets, and those who love them. This section is for those who hate them. Budgeting gets a bad name because it is seen as a restriction on your finances. This is one of the biggest misconceptions of budgeting. I have worked with a lot of people and have taken lots of time pleading with them to put their spending on paper. The most common response after they commit to trying it out is how far they can actually make their income stretch. I understand there are cases where the income just is not enough to stay afloat. We always have to remember that income is a factor, but even if it is a lack-of-income problem, we have to change the behavior first and foremost. “Budgeting gives you the freedom to spend, but the discipline not to.”

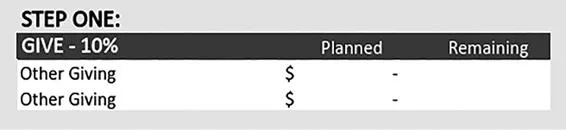

Simply writing your expenses down on a piece of paper is a great start. When we write our goals down, we are 42 percent more likely to achieve them. Here is how you set up a simplified budget to set goals for your money. First step, prioritize things that are important to you. Another way you can view them is individual goals you want to succeed at. This is where your nonnegotiables go. Start by putting giving as your first category and then putting a dollar amount next to it.

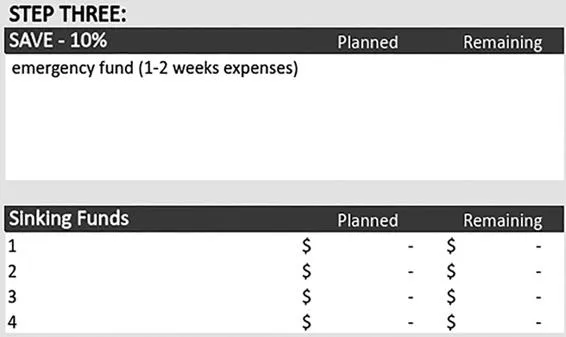

Then list your second and third nonnegotiable, live and save and do the same thing. When you put these first on your budget, you are subconsciously telling yourself to keep these a top priority in your life.

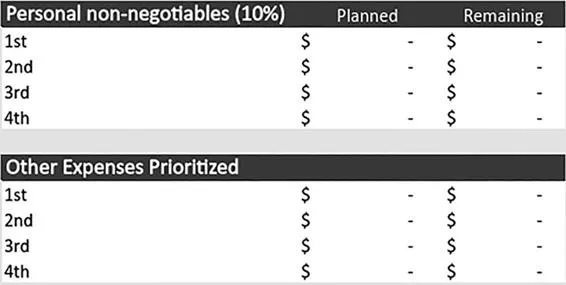

After you list your three nonnegotiables, then go ahead and list your personal nonnegotiables. This is essentially your fun money that helps fuel you as you are trying to get stable. Prioritizing this section is crucial to not becoming burnt out, especially when you are trying to get out of debt. The next chapter, we will be going in depth on nonnegotiables and personal nonnegotiables, but of importance here is that you start prioritizing your budget.

Once you have your personal nonnegotiables listed out, then it is time to prioritize the money left over, from most important to least.

Make sure every dollar has an assignment in your budget and you mentally spend your money on everything in your budget before the month begins. What you are doing when you do this is setting individual goals for your income and telling your money where to go; your money needs to work for you. When all your money has an assignment, you will be able to see from your next budget if you overspend, and you can easily figure out where. If you do not have every dollar having an assignment, it is way too easy to spend that money rather than just keep it for the next month.

When you prioritize your spending, it is easier to sacrifice in other areas of your budget. You actually start sacrificing in other areas without realizing it, and even when you do notice it, it does not hurt as much as you thought it would. When we prioritize and set goals for our money, we are more likely to find extra money in our budget and be able to do the things you want to do with it.

Nonnegotiables and personal nonnegotiables

There are two types of nonnegotiables. There are your big nonnegotiables. These are things that no matter who you are or your walk of life, it is effective for you to prioritize these things in your life and your budget. If you read the book title, you know the big three nonnegotiables—give, live, save. Then we have personal nonnegotiables. These are things that are specific to your situation, things that fuel you and help prevent you from burning out while trying to get disciplined in your finances.

Nonnegotiables.

Your nonnegotiables should stay as your top priorities in both your financial and personal lives. To help them stay a priority, you need to have them written down. There is no better way to write down personal financial goals than to list them first on your budget. Whenever you make something a priority in the world of personal finance, your budget will be your best accountability partner to tell you if what you spend your money on is actually a priority in your life or not. If you ever wondered what you care about most, a great place to look is your bank account. List the starting three nonnegotiables (give, live, save) at the top of your budget and assign a dollar amount to each of them. For giving, it is recommended that you try 10 percent. Live—this is where you list out your family’s basic needs and give each of them a dollar amount. This will differ from family to family, so follow the guidelines listed on the budgeting form (e.g., housing: 30 percent). Now list your third nonnegotiable of save. Save differs depending on where you are in your life, whether you are just starting to get out of debt or whether you are out of debt and just starting your savings journey. Once you have these all listed out and have a dollar amount added to each one, you can move on to your personal nonnegotiables.

Parameters of personal nonnegotiables.

This area can be very easy to overspend in. A good guide to making sure that you do not overspend in this area is to keep it under 10 percent or less of your budget. Later on down the road, you can loosen up on this category. The reason why 10 percent is a good parameter is to keep you focused on winning financially, whether this be getting stable in your finances, paying off debt, or learning how to save. This will keep this di...