![]()

SECTION III

Basics of Forecasting Methods

![]()

CHAPTER 4

Categories of Forecasting Methods

The most reliable way to forecast the future is to try to understand the present.

—John Naisbitt

Categories of Methods

To be able to make good forecasting model selection we need to first understand the types of forecasting methods and their characteristics. This will help us understand the choices we have in forecasting and decide when to use one versus the other.

All forecasting methods can be classified into two broad categories: judgmental forecasting methods and statistical forecasting methods. These are shown in Figure 4.1. These categories are fundamentally different. Also, their use in practice is very different. There are many model choices in each category from which to choose. Before we can look at models in each category—which we do in the next two chapters—we need to first understand characteristics of each category, why we would select one versus the other and how we would use them in practice.

Figure 4.1 Categories of forecasting methods

Judgmental Forecasting Methods

Judgmental forecasting methods—often called qualitative methods—are methods based on subjective opinions and judgment of individuals, such as managers, sales staff, or customers. Asking customers whether they would buy a particular product—called “intention surveys”—is a type of qualitative forecasting method. Another one is called “sales force composite” and occurs when the sales staff make a group forecast of upcoming sales.

Judgmental forecasts are made by people in the business environment. These people often have the latest information. As a result these forecasts are subjective and based on opinions. They are subject to numerous human biases. These include optimism, wishful thinking, and political manipulation. Just think if your annual budget was set based on a forecast. You would naturally be inclined to use a model that gave you the highest value in order to justify a higher budget. On the other hand, think if your performance was going to be compared against your annual forecast. The opposite would be true and you would likely select the model with the lowest possible forecast value for comparison. These behaviors are natural and part of being human. They do, however, bias the forecast.

Judgmental forecasts have the following strengths:

Highly responsive to latest changes in environment

Can include “inside” and “soft” information difficult to quantify

Can compensate for “one-time” or unusual events

Judgmental forecasts have the following weaknesses:

Judgmental methods are most common in practice. Some studies find that they are the primary forecasting method used by over 67 percent of firms. There are many reasons for this. First, statistical forecasting methods are mathematical and are seen as a “black box.” Often managers feel more comfortable using a process that they know and understand. Trusting a mathematical process is not comforting. Second, judgmental methods provide the user with a sense of ownership. They feel that they have had a part in generating the forecast as it was their opinion that was used in the formulation. This allows a “buy in” to the forecast. Third, judgmental forecasts are often easier to explain to other parties, such as executives and customers. They are easier to explain and stand behind. Remember that forecasting in an organizational context requires people involvement and using forecasts that are automated can be difficult. It is people that ultimately have to use the forecasts and have to have “buy-in.”

Key Points

Judgmental forecasting methods have

Statistical Forecasting Methods

Statistical forecasting methods are forecasting methods based on mathematics and statistics. These methods are objective and consistent, are capable of handling large amounts of data and uncovering complex relationships. Provided that good data are available, these methods are generally more accurate than judgmental methods.

One of the key advantages of statistical forecasting methods is that they are objective and not subject to the numerous biases of judgmental forecasting. They are also consistent and will provide the same numerical value on the same data set. Studies have shown just the opposite with judgmental forecasting where managers provide different numbers under the same conditions. We all know that to be true. Think about how you feel on a day you are optimistic, rested and things are going well. Chances are you would provide a different forecast or opinion on such a day versus one when you are tired and things are going poorly. That is part of being human. As statistical methods are just numerical algorithms they are objective and consistent.

Also, these methods can process huge numbers of data and variables. This is especially important today when we are in a world of big data and analytics, and are capturing data through sensors (think global positioning system (GPS) and bar code scanners). The ability to include and process this data provides great advantages. Human beings have a limited ability to process data and have a short attention span. We can easily become overwhelmed with large quantities of data and are not able to process them. We cannot consider many variables and complex relationships. In fact, numerous studies have shown that when subjects are given computer-generated random data they inevitably think they see a “pattern” in the data. This is an obvious bias as such a pattern does not exist. Statistical methods do not have these shortcomings.

Studies have shown that statistical methods are more accurate than judgmental methods. In fact, on average these forecasts improve performance by 18.1 percent according to some studies. Unfortunately, these methods are used less in practice compared to judgmental methods. For most companies statistical methods are the primary method for less than 30 percent of firms. This is not to say that most companies do not use statistical methods. In fact, almost all do. It is just that it may not be the primary or the sole method that they rely on.

There are numerous reasons for this. First, statistical methods are only as good as the data upon which they are based. In fast moving environments, some latest changes may not be incorporated in the data set. Judgmental correction—or judgmental “override”—may have to be made. This may involve a snow storm delaying shipment or a pandemic that has just occurred. It is true that we can model almost everything. However, it may be costly. When we are forecasting thousands of items it may not be possible to model every recent event. Also, such levels of modelling are possible but require deep technical understanding, which takes skill, time, and cost. This added requirement may simply not be realistic. Therefore, we rely on judgment.

Statistical forecasting models have the following strengths:

Statistical forecasting models have the following weaknesses:

Slow to react to changing environments.

Only as good as the model formulation and the data it is based upon.

Can be costly and time consuming to model “soft” information.

Requires technical understanding.

Using Methods in Practice

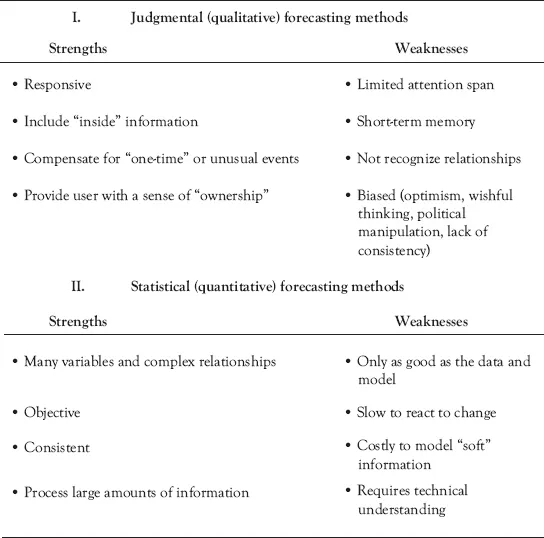

Both judgmental and statistical forecasting methods have their strengths and weaknesses, as shown in Figure 4.2. Although statistical forecasting methods are objective and consistent, they require data in quantifiable form in order to generate a forecast. Often, such data is not available, such as in new product forecasting or making long-range strategic forecasts. Also, quantitative methods are only as good as the data on which they are based. Judgmental methods, on the other hand, have the advantage of being able to incorporate last minute “inside information.” This may be last minute notice of a competitor’s advertising campaign, a snowstorm delaying a shipment, or a heat wave increasing ice cream sales.

Judgmental and statistical forecasting models are not mutually exclusive. This is a very important point. We should not use one to the exclusion of the others. As we can see, each method has its strengths and weaknesses. What we can also observe is that the strengths of one method are weaknesses of the other, and the other way around. This makes them perfect compliments. Therefore, each method has its role in the forecasting process and a good forecaster learns to rely on both.

Figure 4.2 Judgmental versus statistical forecasting methods

When forecasting, you should experiment with a variety of forecasting methods from both categories. Then you can make comparisons using the tools we discussed in Chapter 3. If the models give similar results this means you have good “forecastability.” If they don’t have similar results then you should consider combining those we discuss next. The best forecasting approach is the one that integrates both approaches. This is called “combining.”

Combining Forecasting Methods

We have seen that each forecasting category has its strengths and weaknesses. A good forecaster learns to use them both. There are different ways to accomplish this but one very successful strategy is to combine forecasting methods. Studies repeatedly document support for combining forecasts from two or more methods (see www.forecasters.org). The practice has been shown to reduce error by 14 percent on average but error reductions can even exceed 20 percent. Also, the combining process is useful in protecting against biases and avoiding large errors.

Criteria for Combining

There are three established criteria for combining methods:

Methods should be generated independently. This allows independent and honest as...