eBook - ePub

Asia Bond Monitor

June 2017

This is a test

Share book

- 100 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Asia Bond Monitor

June 2017

Book details

Book preview

Table of contents

Citations

About This Book

This publication reviews recent developments in East Asian local currency bond markets along with the outlook, risks, and policy options. It covers the 10 members of the Association of Southeast Asian Nations and the People's Republic of China; Hong Kong, China; and the Republic of Korea.

Frequently asked questions

How do I cancel my subscription?

Can/how do I download books?

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

What is the difference between the pricing plans?

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

What is Perlego?

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Do you support text-to-speech?

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Is Asia Bond Monitor an online PDF/ePUB?

Yes, you can access Asia Bond Monitor by in PDF and/or ePUB format, as well as other popular books in Betriebswirtschaft & Business allgemein. We have over one million books available in our catalogue for you to explore.

Information

Topic

BetriebswirtschaftSubtopic

Business allgemeinMarket Summaries

People’s Republic of China

Yield Movements

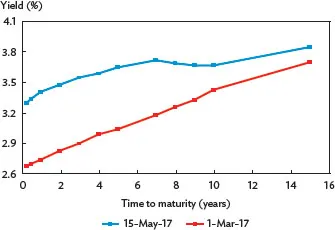

The local currency (LCY) government bond yield curve of the People’s Republic of China (PRC) shifted strongly upward between 1 March and 15 May for all tenors (Figure 1). Yields gained the most for tenors of 5 years or less, with yields rising between 60 basis points (bps) and 67 bps. For tenors longer than 5 years, yields rose between 15 bps and 54 bps. As a result of the much faster rise at the short-end of the curve, the 2-year versus 10-year yield spread fell to 19 bps on 15 May from 60 bps on 1 March.

The rise in yields in the PRC was largely due to efforts by the government to reduce credit risk in its financial markets through a mix of regulatory and market-based measures. These measures include raising interest rates on various open market operation tools to reduce lending by financial institutions and increase costs for borrowers. On 24 January, the People’s Bank of China (PBOC) raised interest rates on its 6-month and 1-year Medium-Term Lending Facility by 10 bps each. On 3 February, the central bank raised interest rates on its reverse repurchase agreements by 10 bps and on its Standing Lending Facility by 35 bps. The PBOC raised rates again on its reverse repurchase operations and Medium-Term Lending Facility by 10 bps each on 16 March.

In January, the PRC reportedly instructed banks to reduce lending, particularly mortgage lending, during the first quarter (Q1) of 2017. The PRC also sought to impose additional oversight on wealth management products by increasing disclosure requirements and, as of May 2017, was planning to raise capital requirements on banks.

Despite deleveraging efforts, the PRC reported real gross domestic product (GDP) growth of 6.9% year-on-year (y-o-y) in Q1 2017, up from GDP growth of 6.8% y-o-y in the fourth quarter (Q4) of 2016. The gains in the GDP growth rate were driven mostly by the manufacturing sector, which grew 6.4% y-o-y in Q1 2017 compared with 6.1% y-o-y in Q4 2016. The PRC is targeting slower GDP growth of 6.5% in full-year 2017 versus an actual growth of 6.7% in 2016.

Inflation in the PRC has been relatively soft. In 2017, consumer price inflation peaked at 2.5% y-o-y in January and fell to 0.8% y-o-y in February before rising slightly to 0.9% y-o-y in March and 1.2% in April.

Size and Composition

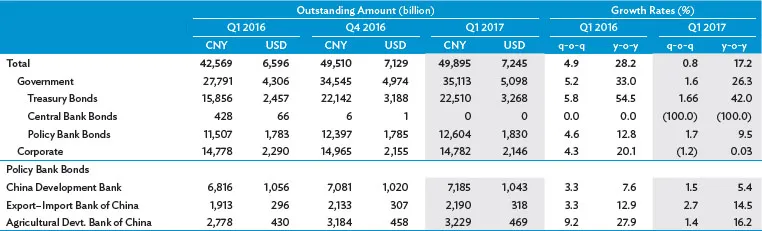

The PRC’s outstanding LCY bonds rose 0.8% quarter-on-quarter (q-o-q) and 17.2% y-o-y to reach CNY49.9 trillion (USD7.2 trillion) at the end of March (Table 1).

Table 1: Size and Composition of the Local Currency Bond Market in the People’s Republic of China

( ) = negative, CNY = Chinese yuan, LCY = local currency, q-o-q = quarter-on-quarter, Q1 = first quarter, Q4 = fourth quarter, USD = United States dollar, y-o-y = year-on-year.

Notes:

1. Calculated using data from national sources.

2. Treasury bonds include savings bonds and local government bonds.

3. Bloomberg LP end-of-period LCY–USD rate is used.

4. Growth rates are calculated from an LCY base and do not include currency effects.

Sources: ChinaBond, Wind Info, and Bloomberg LP.

Government Bonds. Growth in the PRC’s bond market was driven mostly by increases in government bonds outstanding, which gained 1.6% q-o-q and 26.3% y-o-y to CNY35.1 trillion. The slower growth rates in Q1 2017 versus Q4 2016 were due to an overall decline in government bond issuance (except policy bank bonds) as authorities concerned with credit risk in the PRC’s bond markets continued with efforts to reduce risk.

In particular, growth rates for municipal bonds slowed, with local government bonds outstanding growing 3.6% q-o-q in Q1 2017 after rising 9.3% q-o-q in Q4 2016. In April, the PRC announced that local government bond issuance would be governed by a formula to limit debt issuance by riskier local governments. However, overall local government bond issuance is still expected to increase in 2017 as the quota for local government bonds outstanding was raised from CNY17.2 trillion to CNY18.8 trillion.

Central bank bonds outstanding fell to zero in Q1 2017 as all remaining central bank bonds have matured since the cessation of central bank bond issuance by the PBOC in 2014. In contrast to slowing growth in other government bonds, policy bank bonds grew 1.7% q-o-q in Q1 2017 versus 1.5% q-o-q in the previous quarter.

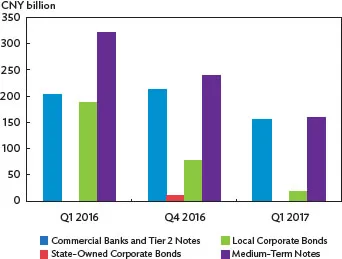

Corporate Bonds. Corporate bonds outstanding declined in Q1 2017, falling 1.2% q-o-q and growing only 0.03% y-o-y to CNY14.8 trillion at the end of March (Table 2). The decline was mostly due to slowing growth in medium-term notes and a dip in outstanding commercial paper. Medium-term notes expanded 0.5% q-o-q in Q1 2017, while commercial paper declined 10.8% q-o-q. All other major corporate bond categories showed q-o-q declines except commercial bank bonds and Tier 2 notes, albeit not to the extent of commercial paper. The decline in corporate bonds outstanding is a result of the PRC’s continued deleveraging efforts, which has led to a decline in issuance amid rising interest rates. Commercial paper was most affected with the rise in interest rates, leading to a reluctance by corporate borrowers to issue short-term debt.

Table 2: Corporate Bonds Outstanding in Key Categories

( ) = negative, CNY = Chinese yuan, q-o-q = quarter-on-quarter, Q1 = first quarter, Q4 = fourth quarter, SOE = state-owned enterprise, y-o-y = year-on-year.

Sources: ChinaBond and Wind Info.

As a result of deleveraging, corporate bond issuance declined 39.1% q-o-q, with all major corporate bond categories showing declines in Q1 2017 (Figure 2). The smallest declines were seen in commercial bank bonds and Tier 2 notes, where issuance fell 27.2% q-o-q as financial institutions continued issuance for the purpose of raising capital and boosting liquidity with long-term funding.

The decline in issuance stemmed from deleveraging, which raised borrowing costs for issuers. Risk aversion resulting from recent corporate bond defaults also led to rising interest rates.

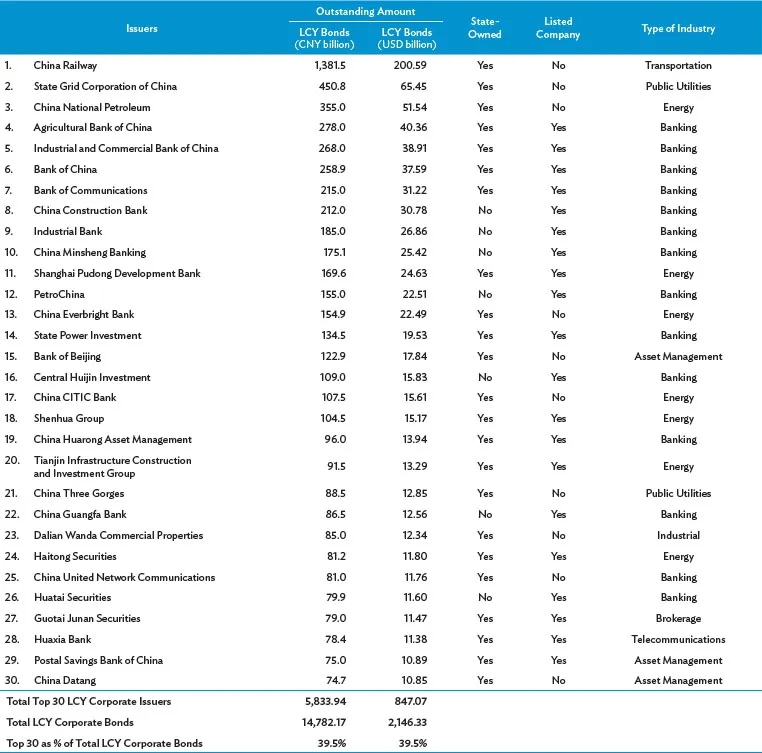

The PRC’s corporate bond market is dominated by a few big issuers (Table 3). At the end of Q4 2016, the top 30 corporate bond issuers accounted for CNY5.8 trillion worth of corporate bonds outstanding, or about 39.5% of the total market. Out of the top 30, the 10 largest issuers accounted for CNY3.8 trillion.

Table 3: Top 30 Issuers of Local Currency Corporate Bonds in the People’s Republic of China

CNY = Chinese yuan, LCY = local currency, USD = United States dollar.

Notes:

1. Data as of end-March 2017.

2. State-owned firms are defined as those in which the government has more than a 50% ownership stake.

Source: AsianBondsOnline calculations based on Bloomberg LP data.

The top 30 issuer list is dominated by banks, owing to the continued issuance of commercial bank bonds as banks accelerate their fund-raising amid turmoil in credit markets in order to strengthen their capital base and improve liquidity by using long-term funding. Among the top 30 corporate issuers at the end of March, 14 were in the banking industry.

Table 4 lists the most notable corporate bond issuances in Q1 2017. Most companies on the list are from the banking sector, while one issuer, China Railway, is from the infrastructure sector.

Table 4: Notable Local Currency Corporate Bond Issuance in the First Quarter of 2017

CNY = Chinese yuan.

Source: Based on data from Bloomberg LP.

Investor Profile

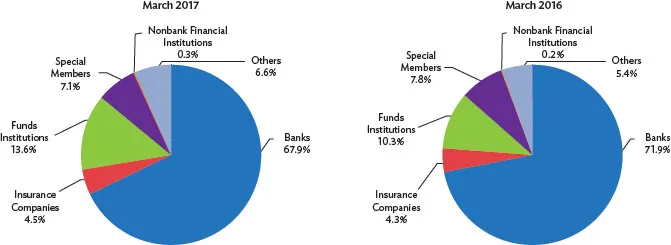

Treasury Bonds and Policy Bank Bonds. Banks’ share of investments in Treasury bonds, including policy bank bonds, continued to fall in Q1 2017, declining to 67.9% at the end of March from 71.9% a year earlier (Figure 3). The share of funds institutions rose to 13.6% from 10.3% during the review period.

Corporate Bonds. Due to continued decli...