![]()

III. OPERATIONAL OVERVIEW

• The decade was marked by a substantial expansion in ADB lending operations. Energy and agriculture remained top priorities, accounting for over half of total lending. Support to the social sectors increased.

• ADB sponsored various research studies and seminars, ultimately seeking to become a regional resource center.

• ADB also pursued greater and deeper policy dialogue and put more emphasis on institutional capacity building in its developing member countries.

A. Operational Priorities and Plans for the 1980s

In 1981, ADB took stock of its experience, reviewing the entire range of its operational policies and procedures, and developing medium-term strategies up to the end of 1987. A landmark study, the Study of Operational Priorities and Plans of the Asian Development Bank for the 1980s, would have a profound influence on ADB operations, particularly during the second half of the decade.4 President Yoshida highlighted its importance during the 1981 Annual Meeting: “In my first address to the Annual Meeting, in 1977, I said that ‘no institution can progress unless it takes stock of itself from time to time, reviews its past and postulates its future’.... One of the strengths of the ADB has been its willingness to review what it had been doing, and to plan new initiatives based on careful reviews of its past performance. Accordingly, the Bank has decided to undertake a comprehensive review and assessment of its operational priorities and plans. In undertaking this study, the Bank is seeking to identify ways in which it can best assist its DMCs to meet the new and more challenging economic circumstances they will face in the coming decade.”5

The study was carried out by an interdepartmental team coordinated by the newly created Development Policy Office. An external advisory group of five eminent experts, chaired by John P. Lewis, a professor at Princeton University, was commissioned to provide overall guidance. DMCs were selectively consulted through five in-depth country studies on Bangladesh, the Republic of Korea, Malaysia, Nepal, and Thailand. The review was completed in 1982, the first full year of President Fujioka’s term of office. It provided an opportunity for the new President to draw from its findings and chart new directions for ADB. The study made far-reaching recommendations. It suggested a new corporate strategic planning approach that was country-centered and based on an analysis that moved logically from an examination of the country’s macroeconomic situation, to sector and other cross-cutting priority issues, and only then to project selection. It called for greater flexibility in ADB’s lending modalities. Finally, it redefined ADB’s developmental role by blending its traditional lending function with provision of knowledge and advice to countries in Asia and the Pacific.

The study findings would lead to various policy and strategy changes, as well as new ways of doing business within the institution. In particular, the study recommended that ADB

| (i) | ensure maximum concessional assistance to the poorest DMCs in light of ADB’s resource constraints and anticipated decline in external aid flows; |

| (ii) | continue its emphasis on agriculture and rural development, energy, and social infrastructure as priority concerns; |

| (iii) | adopt a multiyear country programming approach based on detailed sectoral analysis and strategies at the country level; |

| (iv) | pursue greater and deeper policy dialogues with DMCs; |

| (v) | promote institutional development within DMC executing agencies; |

| (vi) | increase the amount of local cost financing as well as the amount of program and sector lending; |

| (vii) | improve ADB’s project implementation by delegating certain procurement activities to borrowers and executing agencies; |

| (viii) | play a catalytic role by helping to mobilize additional resources for development in the region, taking new initiatives such as cofinancing with commercial and export credit sources, equity investments and providing partial guarantees and nonguaranteed loans; and |

| (ix) | become a “regional resource center” that would provide analyses and assessments of issues relevant to the development of DMCs (see section III.F). |

B. Lending overview

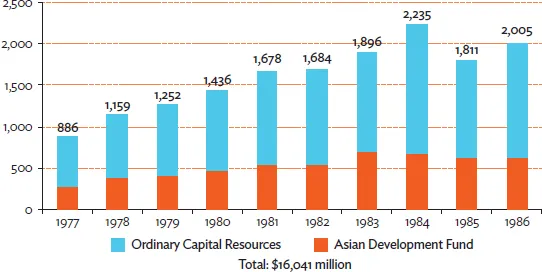

The second decade was marked by a substantial expansion in ADB’s lending operations. In 1978, annual lending level exceeded $1 billion for the first time. For the entire second decade, ADB lending operations reached over $16 billion, an almost fivefold increase from the previous decade. A third of this amount was sourced from the Asian Development Fund (ADF), representing a slightly higher ratio of concessional lending compared to the first decade (27%). The Bank had indicated its intent to progressively increase the share of its concessional lending in its total operations, as ADF operations were found to be relatively low compared to the World Bank’s International Development Association lending to ADB’s borrowing DMCs. The Bank’s lending commitments leveled off slightly in 1985 and 1986, reflecting generally slower world economic conditions as well as high debt levels and budgetary constraints in many DMCs. The decline was more pronounced for ordinary capital resources (OCR), as lending was lower to most traditional major borrowers (Figure 1).6

Figure 1: Lending Operations by Fund Type, 1977−1986 ($ million)

Note: Lending operations include loan, grant, equity investment, and guarantee approvals.

Source: ADB loan, technical assistance, grant, and equity approvals database.

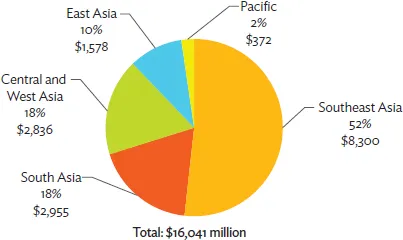

C. Geographic Distribution

In terms of geographic distribution, ADB lending remained heavily concentrated in Southeast Asia, with more than half (52%) of total lending going to that region. South Asia and Central and West Asia, however, overtook East Asia, each accounting for 18% of total lending versus 10% for East Asia as seen in Figure 2. Both Hong Kong, China and Singapore received relatively modest amounts of OCR lending, consistent with their increased ability to borrow from private capital markets. Both stopped borrowing from ADB over the decade.7 ADB’s last loan to Taipei, China, meanwhile, was in 1971, during the first decade. The Republic of Korea graduated from marginal ADF eligibility (hard blend) to noneligibility (OCR lending only) in 1978. The top five borrowers over the decade were Indonesia (21%), Pakistan (17%), the Philippines (12%), Bangladesh (11%), and the Republic of Korea (9%) (Appendix Tables A2.1 and A2.2 provide more detailed data on lending and technical assistance approvals by country).

Figure 2: Lending Operations by Region, 1977−1986 ($ million)

Notes: Regional breakdown is based on current country groupings of ADB. Lending operations include loan, grant, equity investment, and guarantee approvals.

Source: ADB loan, technical assistance, grant, and equity approvals database.

1. Special Attention to the South Pacific

While the Pacific subregion accounted for the smallest share of total lending (2% or $372 million over the entire period), ADB continued to pay special attention to this subregion, in line with the ADB Charter provision to give special consideration to small and less developed countries. In 1978, ADB started a review of its operations in the agriculture sector in the South Pacific.8 These countries were not covered in the Second Asian Agriculture Survey (published in 1978) as it was felt that the special features and distinct development needs of South Pacific DMCs warranted a separate study by experts familiar with the subregion. The study was published by the Australian National University Press in 1980, generating keen interest in the subregion from its key findings, among which were (i) the need for increased adoption of the plantation mode of management for major crops and new forms of landholding; (ii) the shortage of rural labor in some areas and the consequent need for capital intensive development; (iii) the generally poor state of the coconut industry; (iv) the need for rural service centers to coordinate the development of transport and agriculture; (v) the problem of providing services in economically nonviable locations; (vi) the role of government in national development (including national development banks); and (vii) the scope for regional cooperation, especially in marketing.

Multiproject loans were introduced in 1978 as a financing option for smaller DMCs. Under this form of financing, a number of very small projects were grouped together under one loan agreement. This new instrument was expected to provide a more effective way for ADB to support projects that individually would be below the scale normally considered appropriate for Board review. The first such loan was made in Tonga in 1979 to finance small but high priority subprojects in the transport and communications, industry, health, and water supply sectors. In 1980, another multiproject loan was made to the Cook Islands for the construction of a drainage and flood control system, new wharf and health centers, and improvement of plantation roads. Over the period 1977–1986, total multiproject loans were over $31 million. All of them were in Pacific DMCs, with the exception of Bhutan.

ADB also conducted a Study of the Bank’s Role in the South Pacific DMCs in the 1980s (completed in 1983).9 The study confirmed the validity of ADB’s existing operational framework that focused on (i) concessional lending with flexible implementation; (ii) building productive capacities of South Pacific DMCs with priority to fisheries and forestry projects; (iii) supporting the main rural development thrust using less sophisticated approaches and technology; and (iv) tailoring its approach to the respective size, potential, and circumstances of each Pacific DMC. The study also recommended establishing a modest-sized regional office with appropriate delegation of authority (which eventually led to the opening of a Regional Office in Port Villa in 1984).

2. Start of Operations in India

A major landmark occurred in 1986, when ADB began operations in India (Box 3).

Box 3: The Beginning of the India–ADB Relationship

Although a founding member of the Asian Development Bank (ADB) in 1966, India opted to be a nonborrowing member for 2 decades. This was due in part to the perception by the Government of India that India’s borrowing would strain ADB’s resources, without contributing much to addressing India’s requirements. In the mid-1980s, however, India reconsidered and decided to borrow from ADB mainly due to (i) the need for increased foreign borrowings to finance the investment needs of its economy, which had started to grow at higher rates; (ii) the views of some ADB shareholders that India’s participation in ADB’s lending operations would strengthen ADB’s role and profile as a regional institution; (iii) potential access to the Asian Development Fund (ADF) at a time when the World Bank Group had reportedly advised India to diversify its sources of concessional financing; and (iv) the possibility of the People’s Republic of China joining ADB.

For its part, ADB needed to familiarize itself with India’s administrative and government system. It was aware that India was highly experienced in dealing with multilateral financial agencies, was one of the largest borrowers of the World Bank Group, and had enjoyed considerable leeway in shaping its borrowing operations. ADB’s first country operational strategy covering 1986–1990 did not attempt to explicitly link ADB lending to policy or institutional reforms. Planned operations over 1986–1990 remained confined to areas of ADB’s traditional strength, particularly in core infrastructure sectors. ADB’s first loan (a $100 million lending facility to the Industrial Credit and Investment Corporation of India) was approved in 1986 for onlending to private enterprises in the industrial sector. Although India was qualified to apply for concessional loans, it did not do so to avoid crowding out existing beneficiaries of ADF loans.

Source: ADB. 2007. Country Assistance Program Evaluation for India. Manila.

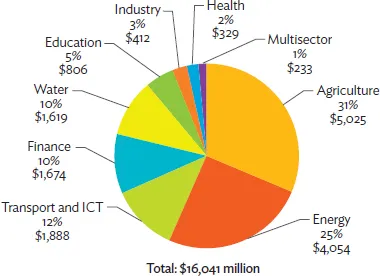

D. Sectoral Developments

Energy and agriculture remained top priorities, accounting for over half (56%) of total lending over the decade. The rest went to transport and information and communication technology (ICT) (12%), finance (10%), water (10%), education (5%), industry (3%), health (2%), and multisector (1%). Significant changes compared to the previous decade included an even greater emphasis on agriculture; and a relative shift in lending toward the social sectors (education and health) with a corresponding reduction in share of lending going to transport, finance, and industry (Figure 3).

Figure 3: Lending Operations by Sector, 1977−1986 ($ million)

ICT = information and communication technology.

Note: Lending operations include loan, grant, equity investment, and guarantee approvals.

Source: ADB loan, technical assistance, grant, and equity approvals database.

1. Agriculture

The priority given to agriculture continued and even intensified. President Yoshida, in his first Annual Meeting address in 1977 said, “Any effort to solve the problems of development in the Bank’s region must focus on the role of the agricultural sector.”10 In response to the recommendations of the Second Asian Agricultural Survey, ADB completed in 1979 a broad review of its operations to support agriculture and rural development and decided to increase its lending in this area by 20% annually from 1979 to 1982.11 Another review of ADB’s role in the sector was undertaken in 1983, leading to a new policy paper that reconfirmed the following priority areas for ADB: (i) accelerating and sustaining agricultural production and growth, (ii) ensuring participation of small farmers in production and income expansion, (iii) providing employment for the r...