![]()

V. OPERATIONAL OVERVIEW

• After reaching a peak in 1997 during the Asian financial crisis, ADB’s lending levels stagnated at around $5 billion–$6 billion a year between 1998 and 2005.

• ADB activities diversified into a broader range of sectors and themes. New policies and strategies were developed to support operationalization of various cross-cutting priorities and new priorities.

• In parallel, ADB had to respond to specific events such as the severe acute respiratory syndrome and avian flu epidemics, the Asian tsunami in 2004, and the Pakistan earthquake in 2005. It also took a proactive role in postconflict reconstruction in Afghanistan, Sri Lanka, and Timor-Leste.

A. Lending overview

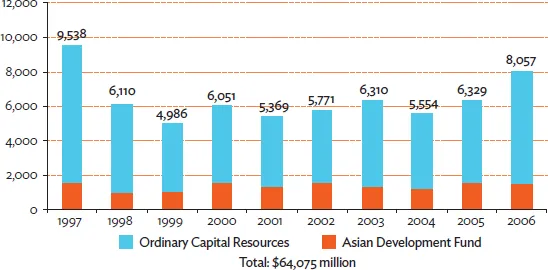

Lending operations reached $64 billion over the decade (Figure 1), compared to $43 billion over 1987–1996. ADF operations accounted for 22% of total lending (down from 30% in the previous decade). Lending peaked in 1997 in response to the AFC. Large financial sector loans to the Republic of Korea and Thailand, both financed from OCR, boosted total lending for the year to $9.5 billion, around $4 billion more than in 1996. However, the effect of the crisis dissipated quickly, with lending levels stabilizing around $5 billion–$6 billion from 1998 to 2005. Lending picked up in 2006, with eight multitranche facilities approved totaling $3.8 billion (compared with two for $1.5 billion in 2005).

Figure 1: Lending Operations by Fund Type, 1997–2006 ($ million)

Note: Lending operations include loan, grant, equity investment, and guarantee approvals.

Sources: ADB Operations Dashboard; ADB Strategy, Policy and Review Department.

The overall increase in lending volume was mostly driven by an increase in the average size of ADB loan projects rather than an increase in the number of projects. This trend was more pronounced for projects financed from OCR.37 OCR sovereign loans increased by 59% in volume term (from $28.8 billion over 1987–1996 to $46 billion over 1997–2006), despite a slight decrease in the number of loans. There was a significant increase in the share of program lending (brought about by the AFC) that lasted even after the crisis, with a corresponding decline in the proportion of investment projects. New OCR approvals for nonsovereign operations more than tripled (from $1.2 billion to $4 billion over the same period). Yet, they accounted for a relatively small share of the OCR portfolio (less than 10%). A review of OCR operations conducted in the mid-2000s highlighted the following trends in OCR public sector lending: (i) flat new approvals, (ii) concentration of new approvals in a few countries and sectors, (iii) delayed start-ups, (iv) slow disbursement, and (v) cancellation of a large portion of approved OCR loans. These broad trends caused concern that ADB’s traditional lending products (i.e., project loans) may no longer be meeting the needs of OCR clients effectively (Box 12).

Box 12: Challenges to ADB—Evolving within a Dynamic Region

The Asian Development Bank (ADB) carried out a series of country consultations with key borrowers from ordinary capital resources (OCR) to examine the possible reasons behind the stagnating OCR public sector portfolio. OCR countries expressed a number of concerns. These were not unique to ADB, as the growing mismatch between client expectations and traditional operational approaches affected the nonconcessional operations of most multilateral development banks.

Increasing Costs of Doing Business

For the most part, concerns of developing member countries focused on the rising nonfinancial costs of doing business with ADB, mainly driven by the proliferation of policies and strategies, and their complex applications. ADB-financed projects often had numerous components leading to complex institutional arrangements, increased project costs, and, at times, serious implementation problems and delays. These were perceived as “hidden” costs of ADB financing.

Limited Choices of Modalities and Instruments

The range of instruments available was not fully responsive to clients’ needs or to ADB’s wider operations coverage and strategic commitment. Lending instruments (designed primarily for nationally executed infrastructure operations) were less relevant to infrastructure operations, which were increasingly decentralized. These instruments were also not fully responsive to the needs of other sectors, which might require greater flexibility and adaptability during implementation (e.g., agriculture and natural resources, social services, institutional and policy reform). Instruments intended for country operations were increasingly applied to regional projects.

Deteriorating Quality of Services

The staff’s country and sector knowledge was perceived as eroding, leading to deterioration in the quality of ADB services. This was attributed to several factors. First, ADB’s knowledge services were being hampered by the excessive use of consultants (along with inflexible guidelines for mobilizing high-caliber consultants and long lead times for fielding them). Most countries preferred ADB staff members to be more actively engaged as conduits of knowledge transfer. Second, frequent staff turnover destabilized country and project team assignments. The long-term engagement of a critical mass of ADB staff members, leading to solid country and sector knowledge, was perceived as essential for realistic design and pace of institutional, policy, and sector reforms. Third, the dispersal of staff across many operations and support departments limited ADB’s ability to maintain a critical mass of expertise in key sectors. In addition, countries felt that attention across the operational cycle should be more balanced, with more attention paid to project implementation. There was strong demand for increased delegation of authority to the resident missions to address portfolio management issues.

Source: ADB. 2006. Enhancing Asian Development Bank Support to Middle-Income Countries and Borrowers from Ordinary Capital Resources. Manila (Sec. M64-06).

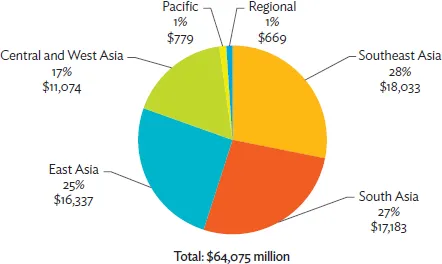

B. Geographical Distribution

Compared to the previous decade, lending operations were more equally distributed across regions with Southeast Asia, accounting for 28% of lending followed by South Asia (27%), East Asia (25%), Central and West Asia (17%), and the Pacific (1%), as seen in Figure 2.38 Lending to East Asia increased significantly, due to the large crisis support given to the Republic of Korea and continued significant lending to the PRC. So did lending to Central and West Asia, as additional members from the former Soviet Union joined the Bank and their lending gained momentum. The events of 11 September 2001 also led to increased ADB support to Central and West Asia, especially to Pakistan and Afghanistan. ADB resumed operations in Afghanistan in 2002, after a hiatus of 23 years (Box 13). Lending to South Asia also grew, as lending to India continue to expand. By contrast, lending to Southeast Asia stagnated and even decreased slightly in some countries, like the Philippines and Indonesia. No loans were made to Malaysia since 1997 and no new public sector lending was provided to Thailand since 1999. The top five borrowers over the decade were the PRC (accounting for 19% of lending), India (16%), Indonesia (13%), Pakistan (12%), and the Republic of Korea (6%). Refer to Appendix Tables 2.1 and 2.2 for breakdown of lending approvals by fund type and by DMC; and for TA approvals per DMC.

Figure 2: Lending Operations by Region, 1997–2006 ($ million)

ADB = Asian Development Bank.

Notes: Based on current organizational grouping of ADB. Lending operations include loan, grant, equity investment, and guarantee approvals.

Sources: ADB Operations Dashboard; ADB Strategy, Policy and Review Department.

Box 13: Resumption of Operations in Afghanistan

Afghanistan was a founding member of the Asian Development Bank (ADB), joining in 1966. Operations began in 1969, and in 1970, the first loan was approved. By the time of the Soviet occupation in 1979 when ADB operations were suspended, Afghanistan had received nine loans totaling $95.1 million (all funded from the Asian Development Fund). ADB focused on small- and medium-sized agriculture and irrigation projects, and did some work in transportation, hydropower, and vocational education. In the more than 2 decades that passed before ADB returned to Afghanistan, the country was devastated by external aggression and civil war. The situation was aggravated in the late 1990s by 4 years of drought, bringing the economy essentially to a standstill.

In December 2001, with the signing of the Bonn agreement, an interim government was formed. ADB assumed a key role in the international community’s efforts to plan for and assist in the reconstruction. Along with the United Nations Development Program and the World Bank, ADB prepared preliminary needs assessments in 2001 and 2002, which became the basis for the international community’s pledges of $4.5 billion in aid to Afghanistan at the Tokyo Conference in January 2002 (ADB pledged $500 million). ADB took the lead in the agriculture, education, infrastructure, and environment sectors. This work served as important input for ADB’s interim country strategy and program, which was finalized in May 2002. The objective of ADB’s reengagement was to help the government rebuild and rehabilitate the country and ensure a seamless transition from humanitarian aid to reconstruction and development assistance.

ADB approved $1,057 million in loans, grants, and technical assistance to Afghanistan from 2002 to 2006. Most of the support was drawn from ADF (almost 90%), making Afghanistan the fifth largest recipient of ADF resources behind Bangladesh, Viet Nam, Pakistan, and Sri Lanka over the decade. Some of that support (from 2005 onward) was provided through grants, in recognition of the government’s limited financial capacity. ADB’s assistance was predominantly focused on transport and information and communication technology, energy, and agriculture. Critical infrastructure was rehabilitated through ADB activities.

Source: Asian Development Bank.

C. Sectoral Developments

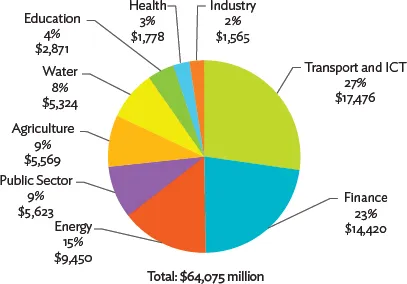

Following approval of the PRS, ADB diversified its activities into a broader range of sectors (i.e., the average number of sectors with ADB involvement by country increased). In terms of broad sector allocations, transport and information and communication technology (ICT) accounted for 27% of total lending followed by finance (23%), energy (15%), public sector (9%), agriculture (9%), water (8%), education (4%), health (3%), and industry (2%) (Figure 3). Compared to the previous decade, transport overtook energy as the largest sector. Lending in support of the finance sector and public sector management surged in response to the crisis, with corresponding reduction in the share of loans to other sectors (particularly agriculture, industry and energy, where total volume of lending actual fell compared to the previous decade).39

Figure 3: Lending Operations by Sector, 1997–2006 ($ million)

ICT = information and communication technology.

Note: Lending operations include loan, grant, equity investment, and guarantee approvals.

Sources: ADB Operations Dashboard; ADB Strategy, Policy and Review Department.

1. Transport and Information and Communication Technology

Total ADB lending to the transport sector reached $17.5 billion (a 71% increase over the previous decade). As domestic economies in most DMCs continued to expand, the need for national transport infrastructure increased. ADB’s operations remained predominantly focused on roads (72%), followed by rail transport (17%), urban roads and traffic management (a new area accounting for 5%), air and water transport (2% each), and ICT (1%). Compared to the previous decade, lending became even more concentrated on roads, with a corresponding decrease in the share of lending going to ICT and water transport. The top five country recipients were: the PRC (accounting for almost half of total lending or 45%), India (20%), Pakistan (7%), Bangladesh (4%), and Indonesia (4%). Eighty-one percent of transport sector lending was financed from OCR.

Transport sector projects aimed to promote pro-poor economic growth. Projects were increasingly focused on developing and rehabilitating roads that directly impacted on the poor by lowering transport costs and improving access to markets and social services, with 72% of road transport support focused on nonurban areas. Sustainable transport development was emphasized by implementing sector reforms on improving governance, establishing more efficient and effective sector agencies, introducing regulatory reforms for increased participation by the private sector, and improving sector financing and cost recovery. Partnerships between the public and private sectors were also promoted. In addition to country-specific assistance, ADB also implemented regional projects. According to the Operations Evaluation Department (OED), ADB’s transport projects have generally performed well. Over the period 1970–2005, 83% of transport operations were rated successful or better, increasing to 91.7% in 2000–2005. The proportion was more substantial for roads (90%) than for other subsectors (75%).

Acknowledging the powerful force of ICT in shaping the social and economic development of the region, ADB adopted a strategic approach to help DMCs seize opportunities created by ICT.40 The new strategy called for greater access by DMCs to information and knowledge, allowing them to compete in global markets and move out of poverty. More specifically, the strategy aimed to (i) create an enabling environment for ICT development by developing innovative sector policies and strengthening institutions; (ii) develop ICT facilities, related infrastructure and networks; and (iii) build human resources to improve knowledge and skills and promote ICT literacy. The strategy advocated applying ICT to improve human welfare, expand economic growth, and extend good governance practices. All stakeholders (governments, private sector, civil society and international organizations) were encouraged to work together to leverage their collective resources to ensure that the benefits of ICT improve the lives of the poor. As ICT is a cross-cutting field, its application in ADB could be wide-ranging. Many of these activities were financed through TA grants. The Japan Fund for Information and Communication Technology was established in 2001 for this purpose (see section VII.C).

2. Finance

ADB support to the finance sector reached $14.4 billion over 1997–2006 (compared to $4.7 billion in the previous decade). Half of this assistance (50%) supported development of the finance sector, mostly in response to the AFC. The rest went to inclusive finance (14%), infrastructure finance and investment funds (13%), money and capital market (7%), housing finance (6%), banking and nonbanking financial institutions; insurance; and small-and medium-sized enterprise finance (3% each), and trade finance (1%). Ninety-two percent of financial sector lending was financed from OCR.

The role of ADB in promoting reforms in the capital and financial markets became particularly critical in the wake of the AFC. ADB support focused on the following areas:

| (i) | Regulatory framework. ADB worked to enhance transparency and accountability and restore investor confidence by strengthening financial sector supervision and prudential norms. A legal framework, such as bankruptcy and foreclosure laws, had to be put in place for resolving nonperforming loans of distressed financial institutions. Liberalization of foreign investment rules was also being encouraged in parallel with banking and corporate sector restructuring. |

| (ii) | Capital markets. Recognizing that the lack of long-term capital markets in Asia caused excessive reliance on foreign short-term capital, mobilizing domestic savings and developing long-term capital markets (stocks and bonds) was perceived as important, to diversify sources of capital and reduce the risk of capital flight. |

| (iii) | Corporate governance. Greater efforts were directed at improving financial and corporate governance through information disclosure and stricter accounting standards. In addition, introduction of new corporate laws would help increase competition and realign interest of corporate management and shareholders (including stronger bankruptcy and foreclosure laws). |

| (iv) | Bank restructuring. Banks dominated financial intermediation in Asia and the banking sector was tightly linked to almost all other sectors of the economy. In light of the crisis, major banking restructuring efforts were undertaken (see section III.... |