![]()

1 CONFIDENT RESURGENCE IN DEVELOPING ASIA

Confident resurgence in developing Asia

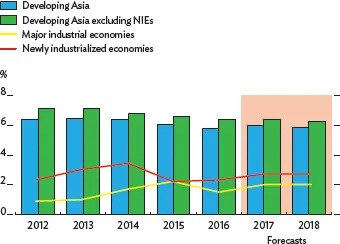

The growth outlook for developing Asia over the short term is remarkably healthy. This Update expects slightly higher growth than forecast in Asian Development Outlook (ADO 2017) in April. Gross domestic product (GDP) in the region is expected to grow by 5.9% 2017 and 5.8% in 2018, slightly up from 5.8% in 2016 (Figure 1.0.1). A synchronized export recovery has emerged from solid recovery in the major industrial economies, including a small second-quarter rebound in the United States, along with strong investment growth in the region. Developing Asia is expected to maintain its growth momentum into 2018 as strong trade reinforces gains from domestic demand. The key growth drivers remain healthy consumer demand amid rising incomes and spillover from global commodity price increases in the past year, though these are likely to dissipate.

1.0.1 GDP growth outlook for developing Asia and the industrial economies

Note: The major industrial economies are the United States, the euro area, and Japan. The newly industrialized economies (NIEs) are the Republic of Korea, Singapore, Taipei, China, and Hong Kong, China.

Source: Asian Development Outlook database.

Risks to the outlook are more contained and broadly balanced than in April. Sustained improvements in global trade and stable oil prices around current levels provide upside potential for the region. However, any suddenly unannounced changes to US monetary policy could induce capital outflows from developing Asia. Possible tax cuts and higher infrastructure spending in the US would, if implemented, help developing Asia, but political stalemate over budget details could unsettle business plans. Geopolitical and weather-related disasters pose unlikely but significant downside risks, as they could abruptly interrupt growth momentum in trade, particularly in the high-tech manufactures that led the recent trade surge and depend heavily on global production chains.

Most of Asia’s economies are currently in an upswing stage of their business cycle, but with variation across the region. A notable norm is that the pace of the upswing is slower than the average in the past. Knowing where each economy is in the business cycle can inform policy makers on the desirability of policy stimulus. Moreover, despite the slower pace of the upswing, business sentiment across major trading regions seems to be optimistic.

This chapter was written by Valerie Mercer-Blackman, Donghyun Park, Arief Ramayandi, Madhavi Pundit, Shu Tian, Benno Ferrarini, Shiela Camingue-Romance, Cindy CastillejosPetalcorin, Marthe Hinojales, Nedelyn Magtibay-Ramos, Pilipinas Quising, and Dennis Sorino of the Economic Research and Regional Cooperation Department, ADB, Manila.

![]()

Trade strength lifts regional prospects

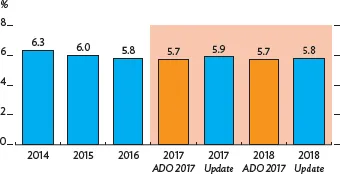

Developing Asia is projected to grow by 5.9% this year and 5.8% in 2018, as headwinds that stymied global activity last year are likely to dissipate this year (Figure 1.1.1). Excluding the region’s newly industrialized economies (NIEs), growth should reach 6.4% in 2017 and 6.3% in 2018. Helping the acceleration in growth is the continued implementation across the region of countercyclical policies to ease drag from external and domestic factors and, starting in the fourth quarter of 2016, the resurgence in trade to its highest value since 2011. Thanks to the favorable global trade environment, higher exports underpin the region’s growth prospects for the remainder of 2017. Supporting the pickup in external demand, the outlook for the major industrial economies has improved, with the US, the euro area, and Japan collectively forecast to expand by 2.0% in 2017 and 2018, an uptick of 0.1 percentage points from ADO 2017 forecasts for both years (Box 1.1.1).

1.1.1 GDP growth forecasts for developing Asia, 2017 and 2018

Source: Asian Development Outlook database.

Gathering momentum

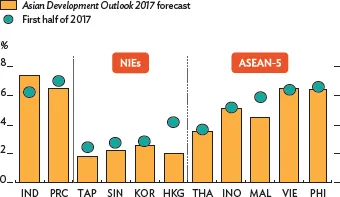

Developing Asia is expected to perform better this year than earlier forecast in large part because growth exceeded expectations in the first half of 2017 in some of the region’s larger economies (Figure 1.1.2). Projected growth in the PRC is revised up on a strong first half for consumption and continued fiscal support. Better growth prospects for Southeast Asia and solid expansion in the NIEs will further lift growth in the region. The forecast for growth in the region’s second-largest economy, India, is trimmed, reflecting unexpectedly slower expansion in the first quarter of FY2017 (ending 31 March 2018). India notwithstanding, the region is expected to enjoy a growth resurgence in 2017 that is broadly based on stronger demand at home and abroad.

1.1.2 2017 GDP forecasts in Asian Development Outlook 2017 versus first half results

Note: For India, data are for the first quarter of FY2017 (April–June).

Source: Asian Development Outlook database.

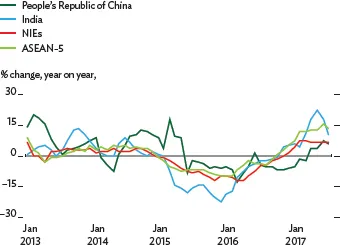

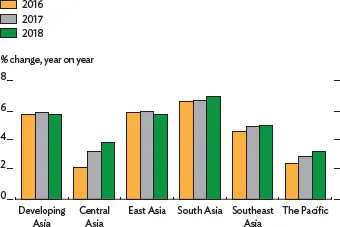

The higher growth forecasts for developing Asia primarily reflect unexpected momentum in export-oriented economies, especially for suppliers of semiconductors and other high-technology products (Figure 1.1.3). Forecasts for 2017 have risen for 22 of the region’s 45 economies, with another 13 retaining their April projections. The significant revisions are in Central, East, and Southeast Asia. Growth forecasts for East and Southeast Asia are now revised up by 0.2 percentage points for 2017, with a similar revision for East Asia in 2018, while the Southeast Asian increment is 0.1 percentage points. Meanwhile, the forecasts for South Asia are downgraded by 0.3 percentage points for 2017 and 0.2 points for 2018. The forecasts are unchanged for the Pacific in 2017 but slightly down for next year (Figure 1.1.4).

1.1.3 Exports growth, selected developing Asian economies

ASEAN-5 = Indonesia, Malaysia, the Philippines, Thailand, and Viet Nam, NIEs = Republic of Korea, Singapore, Taipei, China, and Hong Kong, China.

Source: Haver Analytics (accessed 26 August 2017).

1.1.4 GDP growth by subregion

Source: Asian Development Outlook database.

1.1.1 Clear recovery by mid-2017

Growth in the major industrial economies of the US, the euro area, and Japan is now seen to be stronger than anticipated in ADO 2017 (box table).

GDP growth in the major industrial economies (%)

ADO = Asian Development Outlook.

Notes: Average growth rates are weighted by gross national income, Atlas method. More details in Table A1.1 on page 36.

Sources: US Department of Commerce, Bureau of Economic Analysis, http://www.bea.gov; Eurostat, http://ec.europa.eu/eurostat; Economic and Social Research Institute of Japan, http://www.esri.cao.go.jp; Consensus Forecasts; Bloomberg; CEIC Data Company; Haver; World Bank, Global Commodity Markets, http://www.worldbank.org; ADB estimates.

GDP in the US expanded by a seasonally adjusted annualized rate (saar) of only 1.2% in the first quarter, revised down from the 1.4% reported earlier in the year because of technical revisions to the GDP series. An unusually warm winter having trimmed first-quarter expansion, US growth rebounded in the second quarter to 3.0% saar. All domestic demand components picked up in the second quarter, most notably government consumption, which had suffered a slow start in the protracted transition to a new administration. Consumer confidence and retail sales also improved steadily in the first half of 2017, while fixed investment recorded strong growth at an average of 5.9% saar. Unemployment remains low, and labor market improvement is evident in a 2.6% rise in average weekly earnings in the first 8 months of 2017.

Headline inflation nevertheless continued to slow, reaching in July a 12-month rate of 1.6% as core inflation fell to 2.0%. These numbers led the US Federal Reserve to raise its federal funds rate more gradually than earlier anticipated. Nonetheless, as the labor market continues to strengthen, the Fed is expected to proceed with its normalization of monetary policy.

Although the growth rebound is expected to continue, surprisingly slow growth in first half prompts a downward revision to the 2017 growth forecast for the US from 2.4% to 2.2%. The forecast for 2018 remains at 2.4%.

The euro area sustained its growth momentum in the second quarter of 2017 after a strong first quarter. The region grew by 2.6% saar on improvements both domestic and external. Expansion in the region finds broad support. Industrial production expanded by 0.3% in the second quarter after near stagnation in the first, and despite a dip in June. Businesses appear more optimistic thanks to higher new orders and robust job growth. The European Central Bank left its rates unchanged at its July meeting. Inflation in the year to date stood at 1.6% to July, not much below the central bank’s target of 2.0%, and recent movement in core inflation suggests that price pressures may be resurfacing.

Reflecting positive developments in recent months, the forecast for growth this year is revised up to 2.0% from 1.6% in April. Investment has benefitted from a calming of political uncertainty that earlier in 2017 had firms holding off on investment decisions.

Japan has seen economic growth exceed expectations. The economy expanded for a sixth consecutive quarter, recording its fastest growth in over 2 years in the second quarter, at 2.5% saar. While business investment has risen occasionally in recent quarters, an unexpected boost to growth came from private consumption, which surged by 3.4% in the second quarter as consumers bought more durable goods. Robust consumption comes against a backdrop of falling unemployment, which remained at a low of 2.8% in July. Government fiscal stimulus on top of a rise in spending for the 2020 Tokyo Olympics further supported growth. Exports and imports alike seem to be increasing, but imports at a much faster clip, by 5.7% in the second quarter.

With wage and price pressures contained, inflation remained low at 0.4% in July. In its July 2017 meeting, the Bank of Japan stuck to its expansionary monetary policy with the aim of achieving stable consumer price index inflation above 2%. With output growth in the first half of 2017 higher than expected and indications of resilient domestic demand in the coming quarters, the growth forecast for Japan is revised up to 1.5% in 2017, moderating to 1.1% in 2018.

East Asia is now expected to expand by 6.0% in 2017, up from April largely in tandem with a higher forecast for the PRC, the region’s principal growth driver. Developments in this important economy are discussed in more detail below. Growth is expected to remain elevated even with weather-related disruptions, slowing investment, and a squeeze on demand from government efforts to drive down debt. The 0.2 percentage point upgrade to projected PRC growth in 2017 and 2018 bodes well for economies with strong trade links to the PRC, particularly exporters of primary products such as Mongolia. The growth forecast for the Republic of Korea is also raised largely on higher global demand but on a fiscal spending jolt as well from a $9.85 billion supplementary budget approved in July. Taipei, China and Hong Kong, China are also expected to perform well this year and next as external demand remains strong, with growth in Hong Kong, China much higher this year on a stellar first half.

Southeast Asia is now expected to grow by 5.0% after 3 years of respectable but lackluster growth, with three of the subregion’s ten economies now forecast to outperform their earlier projections and only two forecast to underperform. Growth projections have been raised for Malaysia, the Philippines, and Singapore on surpr...