eBook - ePub

The Tools & Techniques of Financial Planning, 12th Edition

Stephan R. Leimberg

This is a test

Share book

- 608 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

The Tools & Techniques of Financial Planning, 12th Edition

Stephan R. Leimberg

Book details

Book preview

Table of contents

Citations

About This Book

The Tools & Techniques of Financial Planning, 12th Edition

Frequently asked questions

How do I cancel my subscription?

Can/how do I download books?

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

What is the difference between the pricing plans?

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

What is Perlego?

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Do you support text-to-speech?

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Is The Tools & Techniques of Financial Planning, 12th Edition an online PDF/ePUB?

Yes, you can access The Tools & Techniques of Financial Planning, 12th Edition by Stephan R. Leimberg in PDF and/or ePUB format, as well as other popular books in Business & Insurance. We have over one million books available in our catalogue for you to explore.

Information

WHAT IS FINANCIAL PLANNING?

CHAPTER 1

INTRODUCTION

In the purest sense, financial planning is, quite simply, cash flow planning. It is planning to have available the amount of cash needed at the time it is needed, or in the hands of the desired person, to accomplish an individual’s financial goals.

The steps taken to implement a financial plan will be in response to these cash flow goals. For example, if a couple is currently retired and their only source of cash to maintain their lifestyle is the limited investments in their Individual Retirement Accounts (IRAs), those investments will need to be structured more for current income and less for appreciation. On the other hand, if the couple is comfortable, and that have more than enough assets to handle their personal financial needs for the rest of their lives, they may allocate more of their investments for growth in order to enhance their ultimate bequests to their children or to charity.

Financial planning can also be defined as:

1. creating order out of chaos;

2. a deliberate and continuing process by which a sufficient amount of capital is accumulated and conserved and adequate levels of income are attained to accomplish the financial and personal objectives of the client;

3. the development and implementation of coordinated plans for the achievement of a client’s overall financial objectives;

4. an effective and responsive combination of income tax planning, retirement planning, estate planning, investment and asset allocation planning, and risk management planning.

Select one of the above, or select all. There seems to be no one universally accepted definition of financial planning. That’s understandable since the planner’s role must be as different as the needs of clients and their ability or willingness to pay for advice. No two people or problems will ever be exactly the same.

For many clients, the creation of a simple and workable system that will help them control their cash and pay their bills on time will be highly successful financial planning. For others, successful financial planning will involve the full time efforts of a planner, staff, and sophisticated computer and administrative support. Most planners will be working with clients whose needs fall somewhere between these two extremes.

The financial problems our clients face in their lives can be categorized by the letters L-I-V-E-S.

L. Lack of Liquidity. Liquidity is the possession of sufficient cash and/or income to pay bills, debts, taxes, and other expenses on time. A lack of liquidity is the inability to quickly turn invested capital into spendable cash without incurring unreasonable cost. This problem can result in a forced sale of assets at pennies on the dollar. For instance, if a client must sell stocks or mutual fund shares in a down market, or if an executor must sell a valuable real estate portfolio to pay federal or state death taxes and administrative expenses, the buyer will offer to pay the lowest possible price for the most precious asset. This forced sale often becomes a fire sale, a loss of prime growth or income producing assets at a fraction of their real value.

I. Inadequate Resources. Insufficient capital or income in the event of death, disability, at retirement, or for special needs such as college or preparatory school or to provide needed services for a handicapped child.

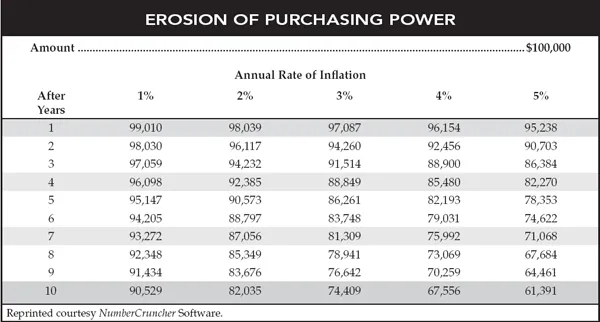

I. Inflation. Not enough has been done to inflation proof the client’s portfolio. Figure 1.1 emphasizes the crippling impact of inflation on each dollar’s ability to buy goods and services.

I. Improper Disposition of Assets. The client is leaving the wrong asset to the wrong person at the wrong time and in the wrong manner. Picture, for instance, a client leaving a sports car to a ten-year old child or $100,000 cash outright to a twenty-one-year-old college student.

V. Value. Not enough has been done to stabilize and maximize the financial security value of the client’s business and other assets.

E. Excessive Taxes. Excessive taxes add to the cost of an investment and retard progress toward a client’s objectives.

S. Special Needs and Other Issues. Clients have desires that go beyond mere quantifiable goals. Psychological assurance and comfort should be part of the financial planning process. For example, a client may want to provide additional levels of financial care for a spouse or children who are disabled or emotionally troubled.

No matter how you define financial planning, all clients are confronted with the need to determine whether their available resources are adequate to accomplish their financial goals and objectives.

The financial planning resources are:

1. earned income (salary, wages, business income) while still working (full time or part time);

2. accumulated investment assets; and

3. employer pension plans and Social Security benefits.

The usual financial planning goals and objectives can be broadly categorized as:

1. current lifestyle;

2. children’s education;

Figure 1.1

3. retirement funding;

4. parental issues;

5. estate planning; and

6. other special needs (such as a disabled child).

In addressing these goals, the client’s charitable desires often come into play. Some clients want to maximize the charitable giving during their lifetime while other clients prefer to give less while they are living but are desirous to leave much of their estate to charities.

When focusing on parental issues, keep in mind that there are two distinct sides to this coin. While it is most common for clients to consider the needs of their parents as a use for their resources, many clients look to their parent’s assets as a resource to fund their own retirement. But, as people are living longer, and are often afraid to let go of their assets while living, it has become common for clients counting on inheritances to fund their retirement to find that they are well beyond retirement age before they see a penny of their parent’s money. The clients’ planning for their own retirement has been, to put it simply, poor.

One critical point in looking at what financial planning is and what it is not – most clients are in the position where their resources are not adequate to attain all of their goals and objectives. Sometimes compromises need to be made, but, more commonly, and more accurately, the clients must engage in a process of prioritization. The financial resources must be focused on whichever goal or goals the client determines is most important.

For example, when a client wants to determine whether he will be able to retire at a certain age, the process usually involves comparing the expected accumulated resources at the desired retirement date to the remaining lifetime financial needs from the retirement date on. If it is determined that the resources are not adequate to cover those needs, the client must evaluate three options (or combinations thereof):

1. Reduce lifestyle, currently and/or during retirement

2. Modify his investment strategy to yield a higher return, knowing that there will be a commensurately higher risk; and/or

3. Retire later

It is very difficult for most individuals approaching retirement date to significantly reduce their lifestyle. It is also foolhardy for someone nearing retirement, with limited resources, to take the risk of investing for a significantly higher rate of return. There simply is no time to recover from a negative result. Consequently, the alternative that typically takes priority is extending the retirement date. There is very little room to compromise. In addition, any desire to leave a significant estate for the next generation will usually take a back seat to the priority of maintaining current lifestyle.

WHAT A FINANCIAL PLANNING REPORT SHOULD COVER

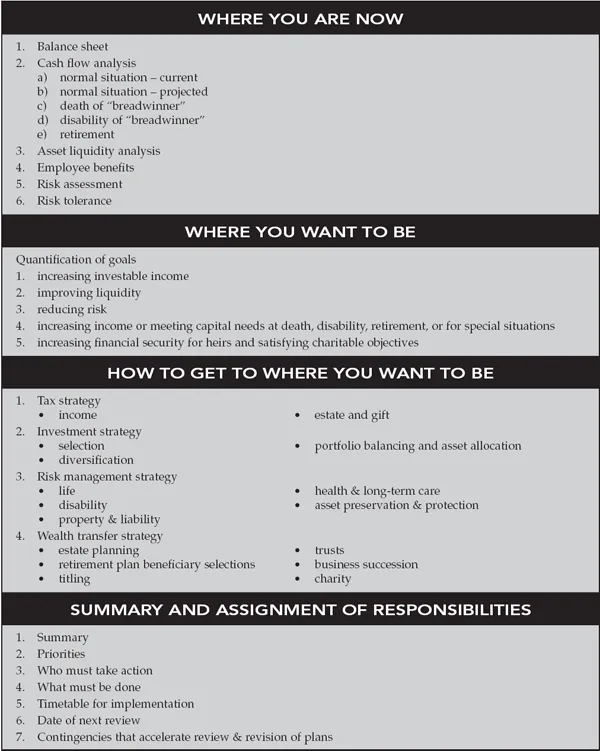

Many clients look to the formal Financial Planning Report as THE PLAN. This, of course is an over-simplification. In any event, the report is the product of the financial planning professional’s analysis, and should be a carefully prepared document that summarizes for the client, the client’s family, and the client’s advisers, the following:

1. Analysis: Where You Are Now

2. Objectives: Where You Want to Be

3. Strategy: How to Get to Where You Want to Be

The actual presentation can be brief, or it can be long. The length of the report must be determined by the task set by the client (does the client want you to do a full analysis or just solve one or two problems?), by time and cost considerations, by your style as a professional, and by your feelings as to how much the client needs to know to have confidence in and take action on your suggestions.

A good rule of thumb is, “overstate and bore, understate and score.” Most clients prefer to have their problems and potential solutions stated as succinctly, and as graphically as possible. We suggest liberal use of graphs and checklists.

See Figure 1.2 for a table of contents for a full-blown analysis.

THE HUMAN SIDE OF FINANCIAL PLANNING

A financial plan is a dynamic expression of ever changing circumstances. Clients’ goals change, as do their resources. These changes often occur without warning and require an immediate response. Obviously, in those situations, there is no time for a formal planning document. Too few of us are really ever formally taught the “human side,” sometimes referred to as the “soft side” or “qualitative side,”1 of financial planning. We usually learn these lessons in the “school of hard knocks” (i.e., by making mistakes through trial and error in our everyday work with clients).

Figure 1.2

Despite that too many planners still focus primarily on the numbers in financial planning, almost in a Jenny Craig-esque before and after picture way of justifying the value of their services to clients, financial planning is very much a people-oriented business.2 We suspect that some of these ...