Ah, to have enough. Enough money to pay the bills. Enough to have a little fun. Enough to put something aside for the future. Enough to feel some real confidence. Sounds good, doesn’t it?

Have you ever wondered why one person can manage just fine on $40,000 a year, while another person is in big trouble on $140,000? The second person isn’t spending wildly on trips to Vegas or bathing in grande lattes at Starbucks. And the first person isn’t wearing 20-year-old hand-me-downs. So what’s up?

The difference comes down to one simple, but very powerful, idea: Get your money in balance.

What is balance? You’ve heard of a balanced diet, with enough of each of the basic food groups. Balancing your money follows the same general idea. The right amount of this, the right amount of that, and not too much of any one thing—and you have the formula for a sustainable, lifetime plan. When your money is in balance, you spend just the right amount on each of your major expense categories. You allocate a certain amount to what you need, like your house and your insurance. That’s a little like the meat and potatoes—the stuff that fills your belly and keeps you from going hungry. You also allocate a certain amount to savings, so you can get ahead, each and every month. That’s like your vitamins and your exercise program—it’s the stuff that helps you get stronger and healthier, so you’ll be better off tomorrow than you are today. And last comes the money that’s just for fun. This is for a trip to the movies and a new set of speakers (and an occasional ice-cream cone!), because life is about more than just boiled vegetables.

All Your Worth balances your money into these three categories:

- Your Must-Haves (the things you need)

- Your Savings (the money you save)

- Your Wants (the stuff that’s just for fun)

This is just like a diet where you look at your carbs, your protein, and your fat intake. In fact, it is even simpler than a diet, because we won’t get into complex versus simple carbohydrates or polyunsaturated fats. There are just three categories, and every dollar that you spend falls into one of these three categories.

We’ll explain each category in more detail later on, but for now understand this: Getting these three categories right will be the key to getting your money into balance. It’s that straightforward.

If something gets out of balance, you can spot the results pretty fast. If you start to go hog wild on potato chips, the effects will show up on your hips. Likewise, if you blow too much on designer clothes or a brand-new luxury car, you’ll feel the pinch in your wallet right away.

When you get your money into balance, your money worries fade away. It’s like a balanced diet: If you know you should have four servings of meat, you don’t worry about whether it’s okay to order the roast chicken. Likewise, if you know it’s okay to spend a certain amount on fun stuff, you don’t have to constantly ask, “Can I really afford this?” You already know what is okay, so you can relax and enjoy your money.

Balancing your money

is the key to having enough.

Step One will help you master the principle of financial balance. By the end of this step, you’ll know where you’re starting from and where you need to go. As any good general will tell you, knowing exactly where you’re headed is half the battle—and this is only Step One! So let’s get started.

The Must-Haves:

Why the Old Advice No Longer Applies

You may already have a sense of where your spending is out of balance, in which case this will be pretty easy. On the other hand, you may not have a clue—and that’s okay too.

Later in this chapter we’ll use a step-by-step process to help you determine your exact financial balance. For now, let’s get a quick sense of your starting point.

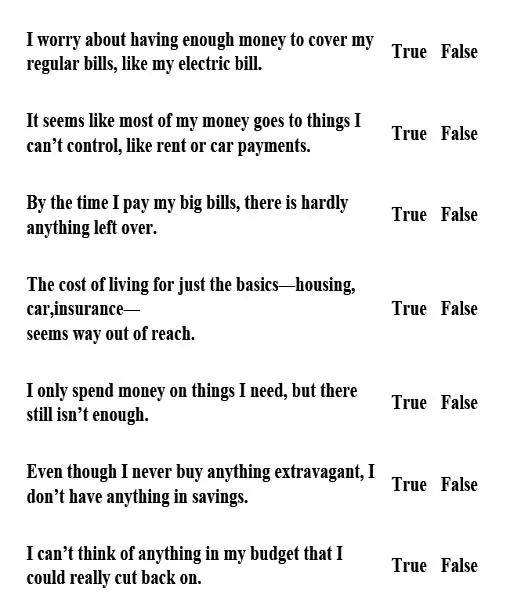

Self-Test: Are You Heavy on the Must-Haves?

We start with the Must-Haves, which are the heart of your Balanced Money Plan. Later on, we’ll give you exact guidelines for figuring out what counts as a Must-Have, but for now, just think of these as the basic bills you need to pay each and every month like your mortgage and your car payment. Respond with True or False to the following statements:

How many statements did you agree with? If you marked “True” more than once, you are probably heavy on the Must-Haves. For you, the old financial advice no longer applies.

What do we mean by “the old advice”? We bet you have heard it before. Your mother-in-law, some expert on TV, or your significant other says something along the lines of, “You’re in trouble because you buy too much stuff. If only you wouldn’t buy those designer jeans (or restaurant meals or satellite TV) all your problems would go away.” The advice is nearly always followed by that self-righteous little shrug, the one you can see even over the telephone, the one that seems to say, “If only you weren’t so superficial and silly. Oh well, I guess not everyone is as enlightened as I am.” Sound familiar?

We’re going to let you in on a secret. For an awful lot of folks, that old mother-in-law advice is just plain wrong.

But before we explain why the old advice is wrong, we need to start by saying that it used to be right.

Remember how we told you back on the very first page of this book that the rules have changed? This is one of those rules. Back when your parents were young, it was a pretty reliable rule that if they held regular jobs and lived regular lives, their money was pretty much in balance. Why? Because your parents just couldn’t spend all that much on their basic monthly bills. If they earned a middle-class income, the odds were good they could afford a middle-class home without much stretching—and they could buy that home on Dad’s salary alone. Your folks didn’t have to hire a whiz-bang accountant to figure out what they could afford. All they had to do was walk down to the local bank to apply for a mortgage. If your parents tried to buy a home that cost more than they could manage, the bank just wouldn’t lend them the money. Mom and Dad and their friends didn’t have to worry too much about getting in trouble because it just wasn’t possible to take on a mortgage that was more than they could afford.

The same held true in other areas. If your dad wanted to buy a car that was more than he could really afford, he couldn’t get the car loan. If your mom wanted to rent an apartment that was out of balance with your family’s income, the landlord wouldn’t rent it to her. If your parents wanted to take out a loan—say, for an addition on the house or just to make ends meet for a while—they had to meet with a banker, face-to-face, to explain why they wanted the money. The banker would have asked for pay stubs, tax returns, and all kinds of financial records, so he could evaluate the prospects for repayment. And if things looked out of balance, the banker would have rejected the loan.

As a result, in those days it was really, really rare to spend too much on the basic monthly bills. Why? It’s not because your parents’ generation was smarter or thriftier or “more in touch with what matters.” No, things were different in your parents’ day because the rules were different. Your parents lived in a time when the government strictly regulated the banking industry. The amount of interest a lender could charge was tightly limited, so banks had to be very careful to lend money only to people who could comfortably pay them back. As a result, in your parents’ generation there were no “zero-down” mortgages. Almost no one was “house poor,” spending too much on a home or apartment. There were no offers on TV to “cash out” your home equity. No one had a car payment the size of Texas, and car leases hadn’t even been invented.

The rules were different in other ways. Tuition at State U was less than $1 a day, so no one started out life with a six-figure student loan. Once someone found a job, if they worked hard, they could pretty much count on keeping that job until it was time to collect a gold watch at retirement. No one trembled in fear over the prospect of mass corporate layoffs that swept out even the hardest-working employees, and “downsizing” referred to the size of a lady’s dress, not the size of the workforce. The boss generally picked up the tab for health insurance and a pension, so no one spent half their salary on medical care, and not too many people fretted about getting by after retirement.

So when your parents say that all you need to do to be secure is to work hard and lay off the T-bone steaks, keep in mind that they were once right. When they got married, it was a pretty safe assumption that if someone earned a decent living, drove a typical car, and lived in a regular neighborhood, then the money would work out just fine. Back in their day, if someone was struggling financially it was probably because they were blowing too much cash on silly stuff.

But the rules of the game have changed.

The old guarantees no longer exist. In today’s world, you can get a mortgage that is too big for you—and the banks will help you do it. You can get a car lease that chews up half your income. You can wind up with a student loan bigger than some home mortgages. And as sure as the sky is blue, you can rack up credit card debt without blinking an eye, even if you don’t have 50 cents to make the payments.

Does that mean it’s impossible to keep your money in balance today? Of course not! But it means that you can’t take things for granted the way your parents could. You have to understand the new rules. Because unlike your parents, you can’t count on the mortgage lender, or the car dealer, or the landlord, or your boss, or even the so-called financial experts to protect you. You have to protect yourself. And that starts by getting your money in balance.

Brett and Brandi: Never Enough

Just ask Brett and Brandi Caldwell. The day I (Elizabeth) met Brandi, I thought she would wear a hole right through her shirtsleeve where her right hand kept rubbing her left arm. She explained that she and Brett both work hard—really hard. Brett takes overtime whenever he can. They don’t go to movies, and they never eat out. They haven’t taken a vacation since their honeymoon in Mexico, which was nearly five years ago.

They were desperate to get out of debt, but whenever they started to pull out of the hole, something always went wrong. The baby got another ear infection that she just couldn’t shake. Brett’s car broke down. The insurance came due. Every month, the credit card balance got a little bigger, as they fell a little further behind. Confused and hurt, they found themselves feeling a little suspicious of each other. If they weren’t spending extravagantly, what in heaven’s name was wrong?

They tried scrimping even more. Brandi started cutting the kids’ hair, and Brett climbed up on the roof to replace the flashing around the fireplace. They turned down the heat and told the kids to put on sweaters. Brandi scoured the newspaper for coupons, joking that she would make a casserole out of three-day-old roadkill if it were on sale at the grocery store.

Nothing seemed to help. There was never enough.

When their 4-year-old was invited to a birthday party, Brandi cruised the aisles at the discount s...