![]()

PART I

How to Use Theory to Analyze

![]()

CHAPTER ONE

THE SIGNALS OF CHANGE

Where Are the Opportunities?

How can we tell that the formula that led to success in the past might not work in the future, or that firms that were successful in the past might not be successful in the future? What specific developments matter the most? What customer groups should we watch to detect such developments? How do contextual factors influence innovation?

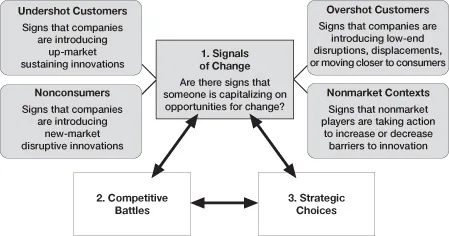

The first part of our analytical process shows how to identify the signs that indicate something potentially important is happening. Looking at nonconsumers, undershot customers, and overshot customers and evaluating the nonmarket context for innovation allows us to answer the signals of change question: “Are there signs that someone is capitalizing on opportunities for change?” Figure 1-1 summarizes the topics covered in this chapter.

The first part of using theory to predict industry change involves understanding when to reasonably expect innovation to lead to the emergence of new companies or business models that could be harbingers of industry change.

The core of the signals of change question involves evaluating three customer groups:

FIGURE 1-1

Signals of Change

- Customers not consuming any product or consuming only in inconvenient settings (nonconsumers)

- Consuming customers who are undershot

- Consuming customers who are overshot

Each customer group creates unique opportunities. Companies can create new-market disruptive innovations to reach nonconsumers; they can launch up-market sustaining innovations to reach undershot customers; and they can launch low-end disruptive innovations or modular displacements to reach overshot customers. Identifying the industry circumstance is important because it defines what sorts of innovations will not flourish. In other words, if circumstances favor up-market sustaining innovations, we should expect firms following a low-end disruptive strategy to struggle.

Most of this chapter focuses on the first and third customer groups. Interestingly, observers often watch developments among a subsegment of the second group known as lead customers—those at the high or performance-demanding end of the market—to assess how a market will change. Sustaining innovations are often deployed there first, and then trickle down into the volume tiers of the market. But for disruptive innovations, the lead customers are in new markets or in the low end of existing markets. Therefore, predicting whether disruptive innovations are taking root, and predicting how they will affect the mainstream of a market in the future requires watching the low end, new markets, and new contexts.

Table 1-1 summarizes these customer groups and shows how to identify each group, the opportunity each group presents, and the signals indicating something or someone is emerging to capitalize on the opportunity.

TABLE 1-1

Overview of Potential Customer Groups

| Customer Group | Indentifier | What Could Happen | Signals |

| Nonconsumers | People who lack the ability, wealth, or access to conveniently and easily accomplish an important job for themselves; they typically hire someone to do the job for them orcobble together a less- than-adequate solution | New-market disruptive innovation | • Product/service that wealth, or access to helps people do more conveniently and easily conveniently what they accomplish an important are already trying to job for themselves; they get done • Explosive rate of growth in new market or new context of use |

| Undershot customers | Consumers who consume a product but are frustrated with its limitations; they display willingness to pay more for enhancements along dimensions most important to them | Sustaining up-market innovation (radical and incremental) | • New, improved products and services introduced to existing customers • Integrated companies thrive; specialist companies struggle |

| Overshot customers | Customers who stop paying for further improvements in performance that historically had merited attractive price premiums | Low-end disruptive innovations | • New business model emerges to serve least demanding customers |

| | Displacing innovation | Emergence of specialist company targeting mainstream customers |

| | Downward migration of required skills | • Emergence of rules and standards—widely propagated statements of what causes what • Migration of provider closer to end customer |

Nonconsumers and Opportunities for New-Market Disruptive Growth

The first group of customers to look for, interestingly, is people who are not consuming. Nonconsumers exist when characteristics of existing products limit consumption to people who have significant financial resources or specialized skills or training. Nonconsumers have a job they need to get done. But they are left on the sidelines, unable to achieve the outcome they desire satisfactorily. No existing market offering is designed to serve them. What can they do? They either pay professionals to provide the service for them, or do the best they can to cobble together a solution from existing products and services.

In the 1870s, most people were trying to communicate over long distances, as evidenced by the letters they wrote. Few of them had the skill to communicate by telegraph—and doing so was expensive and inconvenient. It required traveling to a central facility and working with an expert operator trained in Morse code. If the expert happened not to be there (and you could not call ahead to check), you were out of luck. The telephone competed against nonconsumption because it enabled individuals to communicate over longer distances without an expert’s assistance. The fact that its signal carried only a few miles didn’t matter, because the telephone initially didn’t compete against the telegraph.

Nonconsumers are ubiquitous. They exist in every market. Even people consuming a product can be nonconsumers. How? A person might not be consuming a product in a particular context or environment. For example, in the 1980s, almost every U.S. resident used land-line telephone service. Whether they were at home or in the office, they could simply pick up the nearest receiver and hear a familiar dial tone. However, most people were not consuming telephony services in mobile contexts. Public pay phones were typically inconvenient, if they worked at all. In the mobile environment, most people were nonconsumers.

Because identifying nonconsumption is easy, the important issue is whether a company is doing anything about it. Companies can reach nonconsumers with new-market disruptive innovations such as the telephone or wireless telephony. Successful new-market disruptive innovations follow two patterns:

- They introduce a relatively simple, affordable product or service that increases access and ability by making it easier for customers who historically lacked the money or skills to get important jobs done.

- They help customers do more easily and effectively what they were already trying to get done instead of forcing them to change behavior or adopt new priorities.

The first element of the pattern points to the importance of competing against nonconsumption rather than competing against consumption. New-market disruptive innovations lack the raw functionality of existing products but bring new benefits such as convenience, customization, or lower prices. The attribute bundle means the product will only find success if it takes root among new customers or in a new context of use. Demanding customers who are already consuming a potentially competing project will reject the innovation because of its performance limitations. Competing against nonconsumption entails clearing a lower acceptance hurdle.

For example, one natural entry strategy for emerging telephony companies in the 1870s would have been to compete against consumption and target telegraphy users. But the original technology was too limited to be of much use to demanding communications customers. Sophisticated telegraph users would have instantly rejected the telephone because it could not transmit information over long distances. However, in a different context—local communications—there was no real competition to beat; to talk to someone beyond shouting distance, you either had to walk or ride a horse to get to that person or make do without communicating at all. The telephone just had to be better than these options in order to delight the customer.

Following the second element of the pattern requires that companies make it easier for consumers to accomplish important unfulfilled (and often overlooked) outcomes—jobs people need to get done but can’t.1 The telephone made it easier for people to communicate over short distances using the familiar nature of speech. Users had to pick up a phone and ask an operator to connect the call. Later, when wireless phones were introduced, they also clearly fit with customers’ existing behavior patterns. Customers turned on a familiar-looking device, dialed a number on a standard keypad, and spoke into a receiver. Even the basic features and pricing model based on minutes of use mimicked the familiar landline alternative. The only major difference was the absence of a dial tone. Wireless phones made it easier for people to do jobs they historically prioritized but could not adequately satisfy, such as “make my commute more productive” or “protect me in case of emergency.”

New-market disruptive innovations have the greatest potential for long-term industry change. However, they are the hardest innovations to identify. What are the signals that a company is creating new-market disruptive growth? One clear signal is a high and increasing rate of growth in a new, emerging market. The key is looking beyond the sheer size of a new market to the growth rate and increases to the growth rate. Identifying new markets with increasing rates of growth can allow you to spot important developments while they are still quite small.2 Both the telephone and wireless phone created strong growth in new communications contexts. Another signal is action in targeted customer segments—for example, teenagers, college students, hackers, small business owners, or people in developing countries. Each of these groups typically puts up with performance imperfections when a new product or service makes it easier to do something they could not do in the past.

How can you identify whether nonconsumers exist? One way is to map the product or service delivery chain. New-market disruptive innovations tend to take a link out of this chain—allowing people to do for themselves what previously required expertise. The right kind of market research that seeks to identify unfulfilled jobs can also be quite useful.3

One note about price: New-market disruptions are always relatively low-priced. They are not always cheap on an absolute scale, however. The first mobile phones, personal computers, cameras, and so on—all were expensive. However, they all were significantly more affordable than available technological solutions. For example, the only real alternative to a mobile phone in the late 1970s was to provide CB radios to everyone you hoped to contact. That solution was prohibitively expensive, highly inconvenient, and difficult to implement. The expensive nature of some new products limits consumption to people who desperately need to get a job done. Subsequent improvements typically create production efficiencies that enable price reductions that make the disruptive product or service available to wider customer groups.

Undershot Consumers and Opportunities for Up-Market Sustaining Innovations

After identifying whether companies are establishing new ways to reach nonconsumers, the next step is to evaluate current customers. Every market consists of...