![]()

CHAPTER 1

Technology Policy: Determining Effects of Incentives for Industry Competitiveness Using System Dynamics

Martin Kaggwa,* Jasper L. Steyn† & Anastassios Pouris‡

In an effort to support competitiveness in domestic industries, many late developing countries offer incentives based on investment in machinery and tooling, and local R&D. The configuration of the incentives is often based on internalized judgment rather than on formal models, making it difficult to assess such interventions objectively and to improve on them. Formalization of such policy interventions makes explicit the factors underlying performance and can reveal high-leverage policy options available to policy makers to influence performance. This chapter is aimed at showing how formalization of incentives policy for competitiveness can reveal insights useful in understanding performance of the target industry and how it can guide subsequent improvement of such policy interventions. This was done using the case of South Africa’s automotive industry.

Like in many developing countries, South Africa’s adoption of an outward-looking industrial development policy strategy after its 1994 democratic transition was motivated, in part, by the desire to detach domestic industry performance from national economic growth (Black, 2001). It was acknowledged that the domestic market was not able to support sufficiently high production volumes that could allow efficient and competitive domestic production. Given the emphasis put on exports and foreign investment to drive national growth, international competitiveness became an important component of overall national development strategy. South Africa’s policy makers hoped to emulate the successful interventions of some East Asian governments that had achieved high economic growth rates through exporting (Edwards and Golub, 2004). In 1995, the South African government launched a Motor Industry Development Program (MIDP) aimed at establishing a competitive industry, both locally and globally. Under the program, government provided the industry with import duty rebates based on local content exported and with a duty free allowance. The MIDP replaced a series of protection measures and local content requirements that had previously characterized the industry (Black, 2001). The main objectives of the MIDP were to increase competitiveness of the industry, encourage industry growth through export, stabilize employment levels, and improve the industry’s trade balance and to make vehicles more affordable in the domestic market (Barnes and Black, 2003). In 2000, government introduced an investment incentive for the industry, the Productive Asset Allowance (PAA). The PAA was intended to support further efforts to make the domestic industry competitive in the long term. Investment qualifying for the PAA was widely defined to include capitalized R&D expenditure (Kaggwa et al., 2007).

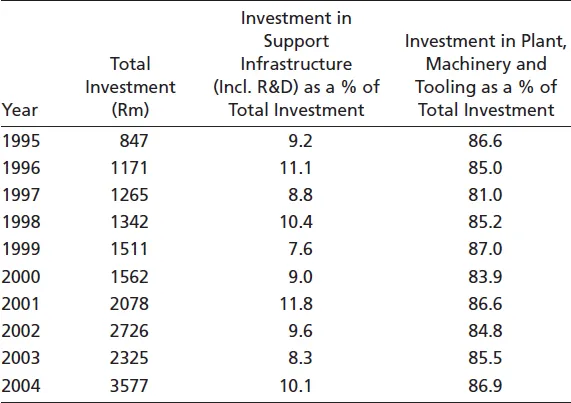

Despite government’s offer of substantial incentives to the local automotive manufacturing industry, investment in R&D remained minimal. For the first decade of the incentives offer, 1995–2004, R&D investment as a proportion of total industry investment was less than 10% on average (Table 1). These low levels are corroborated by R&D expenditure of only 0.8% of sales in the general machinery and equipment sector (Oerlemans et al., 2003). Investment in R&D in South Africa’s automotive sector continued to decline post 2004. The average portion of total investment in the sector devoted to R&D was a meager 6% in the second decade, 2005–2014 (NAAMSA, 2015).

The nature of investment realized under the MIDP was an issue of concern in as far as the industry competitiveness objective was concerned since R&D investment, as opposed to capital investment, is associated with improved industry competitiveness (Stumpf and Vermaak, 1996).

Investment in plant, machinery, and tooling is important in the realization of short- to medium-term profitability of firms, but in the long run it is the R&D investment and the subsequent potential to innovate that is likely to determine industry competitiveness (Fan, 2006; Özçelik and Taymaz, 2004; Lee, 2000; Koschatzky et al., 2001).

Table 1:Investment expenditure by South African vehicle manufacturers.

Source: Department of Trade and Industry South Africa (2004) and NAAMSA Annual Report (2001, 2006, p. 15).

This chapter presents a system dynamics (SD) model as a proposed instrument in formalizing the offer of incentives, applied to the South African government’s offer of incentives to the automotive manufacturing sector. The model was developed from qualitative and quantitative information on how the incentives had been structured. It was used to test how changes in the incentive policy rules affected industry performance dynamics pertaining to progress toward competitiveness.

The Link between R&D Investment and Industry Competitiveness

R&D can be defined as a formal improvement-driven undertaking to discover new knowledge about products, processes, and services. It comprises of the bulk of creative systematic activities undertaken to increase the stock of knowledge and the subsequent use of this knowledge to devise new applications (Fang-Ming et al., 2009). According to Zhouying (2005), R&D entails developing of technologies that can be commercialized under independent intellectual property rights. R&D is seen as the foundation of technology progress and sustainable competitiveness in the modern era (Frankema and Lindblad, 2006; Wint, 1988; Lim, 1994; Lengnick-Hall, 1992; Solow, 1957).

Competitiveness, on the other hand, refers to the ability of a firm or industry to increase in size, market share, and profitability. Quoting the US Presidential Commission on Industrial Competitiveness, Clark and Guy (2000) define competitiveness as “the degree to which it (a nation) can, under free and fair market conditions, produce goods and services that meet the test of international markets while simultaneously maintaining and expanding the real income of citizens”.

The contemporary thinking is that the link between R&D and competitiveness is via its effect on technological development and subsequent innovation. Innovation, technological advances, and country competitive advantage happen to be connected by complex multidimensional relationships (Lengnick-Hall, 1992). It is reasoned that competitiveness depends on average production costs. Production costs are a function of price and nonprice factors, some of which are R&D capabilities and the ability to adopt and use new technologies. Sustainable competitiveness depends on the ability of a country or industry to offer comparable products to its competitors at lower prices on an open market. This requires that a country or industry is able to lower its production costs without sacrificing quality. Technology innovation offers one of the most practical ways to reduce production costs while at the same time maintaining or even increasing product quality. R&D investment has a powerful positive correlation with industrial profitability, product quality, and return on investment, hence overall competitiveness (Merrifield, 1989). R&D activities generate knowledge, which is a factor of production, as such, an indirect input in the neo-classical production function (Özçelik and Taymaz, 2004). Therefore, there is general agreement that countries seeking to enhance their international competitiveness, have to engage in domestic R&D and subsequent innovative activities (Kuen-Hung, 2004; Wint, 1988).

Nonetheless, the link between R&D effort, innovation, technical progress, and competitiveness has to be qualified; it is not straightforward and is characterized by time lags. For competitiveness to be realized, R&D generated knowledge has to be adopted and commercialized by industry; otherwise, the knowledge remains valueless. R&D is an input in the long process of achieving competitiveness. Like any other input in a chain of interrelated activities of a system, the relationship between input and output may be hard to establish. One has to consider time lags and control for other “competitiveness-determining” factors that simultaneously change with R&D efforts over time.

Another challenge in the R&D and competitiveness analysis relates to measuring the effectiveness of R&D. Frankema and Lindblad (2006) point out that “figures on R&D activities and numbers of people employed in R&D activities, the commonly used indicators of R&D activity, merely inform us about the scope of efforts and financial commitments but do not offer insight into the effectiveness of R&D efforts”. The R&D success rate is dependent on a range of intermediary factors such as knowledge management, technology absorptive capacity of the environment, and other soft technological variables. Zhouying (2005) claims that soft technological factors that relate to the emergence of new business technologies and cultures, such as modern management techniques, venture capital, virtual technology, incubators, and so on, constitute soft technology that provides an environment for innovation and effective application of technologies, hence attainment of competitiveness. Because of the complex relationship between R&D investment and competitiveness, governments ought to carefully develop evaluation criteria for R&D sponsored programs in order to direct the behavior of recipient firms (Fang-Ming et al., 2009).

Notwithstanding concerns on R&D effort and competitiveness, there is no doubt that new knowledge drives innovation and new knowledge is rooted in R&D activities. Innovation and technological capability are important assets for any country or industry in getting a competitive edge over its rivals in free and contestable markets. Achieving competitiveness is closely related to and intertwined with technology progress. Stumpf and Vermaak (1996) emphasize that global competitiveness is inseparably linked to productivity improvement and technology upgrade. Carayannis and Roy (2000) on the other hand postulate that a firm’s long-term competitiveness is directly proportional to its speed and acceleration of innovation. Global technology improvement has led to a decrease in product life cycles. Facilities, equipment, and worker skills are rendered obsolete long before their useful lives have been realized (Merrifield, 1989). In order to remain competitive, firms have to innovate continuously and need to ensure that they realize a positive return to innovation-related investment over shorter periods.

Firm expenditure on R&D and innovation activities is a long-term, high-risk form of investment but one that is necessary for industrial survival and profitable growth (Merrifield, 1989; Papadakis, 1995). Because R&D and subsequent innovative activities often requires substantial investment with high risk, governments have to play a key role in encouraging and facilitating this type of investment (Frankema and Lindblad, 2006). One of the ways for governments to do this is through the offer of industry incentives.

The beginning of the 21st century has seen multinational corporations (MNCs) increasingly globalizing their R&D activities by taking advantage of governments’ support mechanisms (Gupta and Godindarajan, 2000; Iwata et al., 2006). The phenomenon has motivated more developing countries to introduce incentives and institutional arrangements that can attract investment, including R&D activities, in local economies. This is done with the expectation that government R&D incentives will have a positive effect on a country’s innovation effort and subsequently on its competitiveness (Herrera and Nieto, 2008).

Although empirical evidence on the effect of government incentives and private sector investment in R&D is still inconclusive (Jenkins and Thomas, 2002), for the South African automotive industry, with a location disadvantage, it was unlikely that the country could attract significant investment in R&D without some sort of compensatory incentives. Against this background, the South African government introduced automotive incentives for the local industry. The PAA in particular targeted state-of-art asset investment, R&D, and capitalized expenditure on technical expertise. The expectation was that the incentives would encourage, fairly equally, all the forms of investment, and ultimately contribute toward efforts to make the domestic industry competitive in the long term. More than 10 years after the commencement of the incentives, most of the investment realized in South Africa’s automotive sector has been in form of plant, machinery, and equipment rather than R&D.

The ineffectiveness of South Africa’s automotive manufacturing incentives to direct investment in R&D and subsequent innovative activities necessitated a review of the automotive industry incentives model. For this to be done rigorously, however, a formal model had to exist. Like many policies in developing countries, the MIDP policy framework was based on judgment or intuition and on consensus among stakeholders. Its assumptions remained embedded in the mental models of its historical promoters, making it hard to discern internal inconsistencies. The problem with intuitive models is that they cannot be assessed scientifically to allow objective analysis and improvement (Sterman, 2000; For...