- 64 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

About this book

This report presents the rationale for and design of a city government disaster insurance pool in the Philippines. Insurance pools help governments enhance their financial preparedness for disasters, focusing on the provision of rapid post-disaster financing for early recovery. The Philippine City Disaster Insurance Pool was developed under the guidance of the Department of Finance as part of the 2015 Disaster Risk Financing and Insurance Strategy. It utilizes a parametric insurance structure, basing payouts on the occurrence of earthquakes and typhoons according to their physical features, rather than actual losses.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

1| INTRODUCTION

The Philippines’ position on the Pacific Ring of Fire and within the western North Pacific basin exposes it to the severe effects of both earthquakes and severe typhoons (Figure 1). Recent events causing significant damage and loss in the Philippines include the Surigao Earthquake in 2017, the Bohol Earthquake in 2013, Typhoon Haiyan (Yolanda) in 2013, Typhoon Bopha (Pablo) in 2012, and Typhoon Ketsana (Ondoy) in 2009.

City governments typically face particularly high disaster risk, reflecting the concentration of people, assets, infrastructure, and economic activities in urban areas in the Philippines. Cities also face significant challenges in securing adequate resources for timely post-disaster recovery and reconstruction, thereby accentuating the indirect economic and social impacts of direct physical losses.

The Government of the Philippines has undertaken a number of steps to enhance its disaster resilience, including through the passage of the comprehensive Philippine Disaster Risk Reduction and Management Act of 2010 (RA 10121) addressing all aspects of disaster risk management and the approval of the National Disaster Risk Reduction and Management Plan 2011-2028, as well as through a range of disaster risk reduction and preparedness projects.

The Philippines has emerged, in particular, as a leading nation among emerging economies in Asia with regard to its approach to financial preparedness for disasters. In 2015, the government formulated a Disaster Risk Financing and Insurance Strategy, positioning existing measures within a broad framework and outlining additional measures to further enhance its resilience. This strategy delineates 3 tiers of instruments to enhance financial resilience, focusing on national government, local government, and individuals (Figure 2).

This report presents a proposed disaster insurance pool to support city governments, focusing on the second tier of the strategy. A disaster insurance pool is a structure under which participating entities, in this case city governments, collectively buy insurance through a single platform. The pool essentially operates as an insurance company acting for the benefit of the insured cities.

In this case the pool, referred to as the Philippine City Disaster Insurance Pool (PCDIP), would complement existing indemnity insurance cover for public assets already provided by the Philippine Government Service Insurance System (GSIS), offering a parametric insurance scheme which would provide rapid and cost-efficient financing in the aftermath of a disaster. Indemnity insurance provides payouts (compensation) in accordance with the actual losses suffered by a policyholder. Payouts under parametric insurance are determined based on physical features of the natural hazard event experienced (e.g., wind speed or earthquake magnitude) rather than actual losses suffered by the policyholder.

PCDIP is intended to (i) help reduce the cost of premiums by diversifying risk and supporting the first layer of loss via pool reserves, in turn reducing the amount of reinsurance required to protect the pool; (ii) share administrative costs associated with the creation and management of the pool, further reducing premium costs; and (iii) allow for cross-learning of experience among participating cities. The pool has been designed to offer insurance cover against tropical cyclones and earthquakes, with the expectation that cover against floods will be added once existing data and modeling limitations have been addressed.

Ten cities participated in the design of the pool. Participation was objectively determined based on a range of factors including disaster risk, demographic and economic size, geographic location, data availability, and disaster risk management governance. The relative scale of government and public facilities, and thus of potential post-disaster levels of expenditure, was also taken into account. Two cities from each of Luzon, Visayas, and Mindanao were selected, together with 4 cities from Metro Manila. The selected cities were Bacolod City, Baguio City, Butuan City, Caloocan City, Dagupan City, Davao City, Iloilo City, Marikina City, Paranaque City, and Quezon City. Once implemented, the pool is expected to expand to cover additional cities.

This report provides further details on the steps taken in developing the pool, focusing on the assessment of city disaster risk (Section 2); a review of existing disaster risk financing arrangements, and related needs (Section 3); development of the technical, legal/regulatory, and administrative structure of the pool (Section 4); premium pricing (Section 5); and pool benefits (Section 6). Final concluding remarks are provided in Section 7.

2| ASSESSING CITY DISASTER RISK

Purpose of risk modeling

Risk modeling is central to the development of any disaster risk financing instrument, including insurance products. It plays a key role at several stages in the development of a parametric disaster insurance pool:

• Initial risk assessment. Risk modeling is required to quantify the underlying disaster risk to a city and express it in monetary terms.

• Trigger structuring. Risk modeling is required to assess the level of financing needed to meet post-disaster relief, early recovery and reconstruction spending needs, and to design disaster risk financing instruments, such as parametric insurance structures, which provide cost-efficient funding to meet these needs.

• Pricing. Risk modeling is required to calculate fair premium prices, based on actual levels of risk faced.

Most frequent causes of loss, such as the risk from car accidents or thefts, can generally be reliably estimated based on historical data. For more severe—and typically less frequent—events like typhoons or earthquakes, however, their historical record is typically too short to adequately capture the full range of risks from these events. Just because an earthquake has not happened in a certain location or with a certain magnitude within the available historical record, does not guarantee that such earthquake will not happen in the future. The 2013 Bohol Earthquake, which occurred on a previously unknown fault line, was a devastating demonstration of this in recent Philippine history.

In the case of such severe, infrequent events, an assessment based on a robust risk model is required to capture the full range of potential impacts. Risk models combine latest scientific knowledge on natural hazards, such as typhoons and earthquakes, with their historical record in order to achieve a more complete view of the risk these hazards pose.

Modeling approach

Framework for Modeling Physical Asset Damage

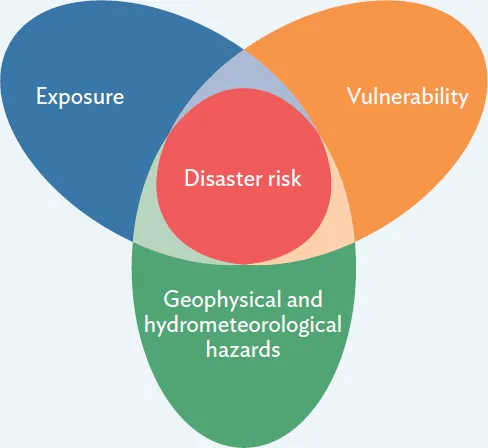

A disaster is caused by 3 factors in combination: the occurrence of a natural hazard event, the presence of asset exposure (such as buildings and other infrastructure) in the affected region, and vulnerability of that exposure to damage from that event (Figure 3). As such, risk modeling requires a series of steps to determine (i) the types of natural hazard that could occur in a particular location (in this case, particular cities) and levels of frequency at different levels of intensity; (ii) the physical characteristics of those hazard events (e.g., wind speed, storm surge, and ground shaking); (iii) the physical assets exposed to those hazards; and (iv) the degree of vulnerability of those physical assets to hazard events of varying levels of intensity and physical characteristics. These factors come together in a final, fifth stage to determine the scale of physical losses, expressed in monetary terms, that can be expected to occur at different levels of frequency.

The risk modeling undertaken to assess disaster risk for the 10 cities participating in the design of PCDIP was based on the Risk Management Solutions (RMS) Philippine earthquake and typhoon models (Box 1 and Box 2). Both models are based on the modeling steps outlined above and described in further detail below. These modeling steps are widely used by modern catastrophe models to quantify risk from severe events. Recognizing the broad range of typhoon and earthquake risk across the Philippines, the 2 models enable the assessment of individual city risk profiles and comparison of risk between cities and types of natural hazard.

Box 1 : The Risk Management Solutions Southeast Asia Earthquake Model

The Risk Management Solutions Southeast Asia Earthquake Model captures earthquake risk across Southeast Asia, including the Philippines. The current model (released in 2017) assesses damages caused by ground shaking, landslides and liquefaction. It calculates losses from both well-known faults (such as the Manila and Philippine Trench systems), and less identifiable background seismicity which still has the potential to cause damage.

The model applies established ground motion equations, which link key high-level parameters of an earthquake (such as its location and magnitude) and local characteristics (distance from the epicenter and soil conditions) to quantify ground shaking at specific locations. The ground shaking information at each location is overlaid with vulnerability and exposure information to determine the loss each simulated event causes to a specific asset. The vulnerability information used by the model takes account of the characteristics of each asset (e.g. structure, occupancy, age), as well as local construction practices and building regulations.

Source: Risk Management Solutions, 2018.

Box 2 : The Risk Management Solutions Philippines Typhoon and Inland Flood Model

The current Risk Management Solutions Philippines Typhoon and Inland Flood Model (released in 2018) assesses damages caused by typhoon-related wind, flood, and storm surge, and by seasonal and monsoon flood events.

The wind hazard characteristics of simulated events contained in the model were validated against data from the Philippine Atmospheric Geophysical and Astronomical Services Administration to ensure that expert local knowledge and experience is reflected in the model.

Similar to the earthquake model, the typhoon model applies wind field equations to quantify the wind and surge hazard experienced by specific locations based on their local topography and bathymetry. The resulting hazard level at each location is then overlaid with vulnerability and exposure information to assess the damage and losses to a given set of assets of interest. The vulnerability information has been developed based on a detailed assessment of local design codes, wind maps and construction practices, damage data from historical events, and insights gained from damage inspections after Typhoon Haiyan (Yolanda) in 2013.

Source: Risk Management Solutions, 2018.

1. Defining possible types and frequencies of hazard. Thousands of hypothetical eve...

Table of contents

- Cover

- Title Page

- Copyright Page

- Contents

- Tables, Figures, and Boxes

- Abbreviations

- Acknowledgments

- Executive Summary

- 1 Introduction

- 2 Assessing City Disaster Risk

- 3 Existing City Government Post-Disaster Financing Arrangements, and Needs

- 4 Pool Structuring

- 5 Premium Pricing and Affordability

- 6 Benefits of Disaster Insurance Pools

- 7 Conclusions

- Glossary

- Footnotes

- Back Cover

Frequently asked questions

Yes, you can cancel anytime from the Subscription tab in your account settings on the Perlego website. Your subscription will stay active until the end of your current billing period. Learn how to cancel your subscription

No, books cannot be downloaded as external files, such as PDFs, for use outside of Perlego. However, you can download books within the Perlego app for offline reading on mobile or tablet. Learn how to download books offline

Perlego offers two plans: Essential and Complete

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 990+ topics, we’ve got you covered! Learn about our mission

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more about Read Aloud

Yes! You can use the Perlego app on both iOS and Android devices to read anytime, anywhere — even offline. Perfect for commutes or when you’re on the go.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app

Yes, you can access Philippine City Disaster Insurance Pool by in PDF and/or ePUB format, as well as other popular books in Business & Insurance. We have over one million books available in our catalogue for you to explore.