eBook - ePub

Financial Management

USGAAP and IFRS Standards

Aldo Levy, Faten Ben Bouheni, Chantal Ammi

This is a test

Share book

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Financial Management

USGAAP and IFRS Standards

Aldo Levy, Faten Ben Bouheni, Chantal Ammi

Book details

Book preview

Table of contents

Citations

About This Book

This book combines the fundamentals of finance with relevance and effectiveness. It allows for the practice of this subject and covers all the programs of business schools, universities' finance courses, and engineering schools. This book is a relevant tool to acquire all the knowledge required for examination success and the achievement of proven practical competences.

Frequently asked questions

How do I cancel my subscription?

Can/how do I download books?

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

What is the difference between the pricing plans?

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

What is Perlego?

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Do you support text-to-speech?

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Is Financial Management an online PDF/ePUB?

Yes, you can access Financial Management by Aldo Levy, Faten Ben Bouheni, Chantal Ammi in PDF and/or ePUB format, as well as other popular books in Business & Management. We have over one million books available in our catalogue for you to explore.

Information

1

Value: IFRS vs. US GAAP

“… value does not wait for the number of years …” wrote P. Corneille. This may be true for humans but certainly not for capital. It is of course not equivalent to have a sum of money now or later. If we invest this amount, we will not hold it until maturity and we lose the opportunity to invest it elsewhere. This time lost opportunity has a cost. The latter, which would make immediate or later provision equivalent, is called interest. The legal or normal person who needs money and the person who wants to make capital available will agree on the price, that is to say, the equivalent interest rate. Therefore, value and time (1.1) are functions of the interest rate. As in the future, there is no certainty that the expected value carries a share of risk (1.2) that is paid in proportion to the risk incurred, so there will be a risk premium to pay. The better the investor is informed about the readability of his investment horizon, the better he can adjust the requested rate. Therefore, the value and the information (1.3) available are correlated. Thus, the interaction between value, time, risk and available information is discussed in this chapter.

1.1. Value and the time1

“Is it worth the cost” – is this common sense often referred to? For financial investment, this cost of money is an expected profit, called interest rate.

1.1.1. Cost of money, interest rate (nominal and real)

The rates fixed for financial transactions are annual. If the latter takes place on a space–time less than the year (months, quarters, semesters), the rate is pro-rated at the annual rate.

EXAMPLE.– An annual rate of 5% is equivalent to the following rates:

- – monthly: 5% / 12 = 0.42%;

- – quarterly: 5% / 4 = 1.25%;

- – half-yearly: 5% / 2 = 2.5%.

The economic agents can choose a fixed rate (rate unchanged until the end of the transaction) or a variable rate (rate revised according to a reference rate based on the money or bond market).

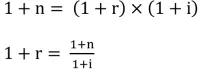

The real interest rate corresponds to the nominal interest rate adjusted for inflation. Let:

where:

- – n: nominal rate

- – r: real rate

- – i: inflation rate

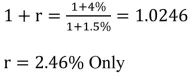

EXAMPLE.– The one-year inflation rate is 1.5%. What is the real interest rate for a paid investment at 4%?

The non-disposition of ann...