![]()

1

Envisioning

This book seeks to explain the real estate investment decision making process by which a real estate investment trust, or REIT, converts $1 of unitholder capital into $1 of investment real estate. Focusing equally on the people and the process, the contributions of the key participants in the real estate investment decision making process are described and analysed with a particular emphasis on both the overlap between their roles and their interaction.

The process of real estate investment decision making is a fusion of the ‘how’ and the ‘why’. In this book, the how is based on the results of new, original academic research, including structured interviews with the managers of a wide range of different types of REITs, as well as the research and publications of others as referenced, together with the author’s 25 years experience in REIT management. The why is drawn from the real estate theory, capital market theory and finance theory that underpins real estate investment management.

While the real estate investment decision making process draws on a range of tools, such as the Capital Asset Pricing Model, the role of intuition and judgment remains vital. Spreadsheets, sensitivity analysis and scenarios all have an important role to play in real estate investment decision making but need to be balanced with the intuition and judgment that come from years of practical experience.

Real estate investment decision making is presented in this book as comprising three Phases with six Stages and 30 Steps, being an ongoing, cyclical process. The first Phase, the Preparing Phase, comprises the Envisioning Stage and the Planning Stage wherein the REIT articulates where it is going and how it is going to get there, providing unitholders with a clear understanding of the risk-return profile to expect from the managers investment of their funds. The second Phase, the Transacting Phase, comprises the Dealing Stage and the Executing Stage, wherein the REIT implements the outcomes of the Preparing Phase through the creation of a tangible real estate portfolio. The third and final Phase, the Observing Phase, comprises the Watching Stage and the Optimising Stage, wherein the REIT ensures that its performance will achieve its goals and so attain its vision, thereby completing the cyclical process of REIT real estate investment decision making.

The six chapters of this book address each of the Stages of the REIT real estate investment decision making process sequentially, introducing and explaining the contribution of the relevant members of the REIT management team to that Stage. For each Stage, the relevant supporting theory, or the why for the how, is explained in detail and illustrated by application to Super REIT, a $15 billion diversified REIT.

REITs are a continuously evolving real estate investment product. Similar to listed equities investment funds, many REITs started through association with an entrepreneur who was the sole decision maker focusing on specific assets and evolved over time into a team approach focusing on a portfolio of assets. However, whereas the dominance of sophisticated international institutional investors in listed equities investment funds has pressured portfolio managers to adopt more transparent, explicable and repeatable investment decision making processes which are independent of individual decision makers, this has been less evident in REITs where the investment decision making process often appears to be opaque, curious and ad hoc.

This book seeks to increase the transparency and explicability of the real estate investment decision making process by REITs, thus contributing to the potential for repeatability, by shifting from a greater emphasis on people to a greater emphasis on process, so contributing to the continued evolution of REITs as a real estate investment product.

Extensive research over the last 25 years has shown that real estate investment is not necessarily different to other forms of investment. While many aspects of real estate investment can be explained by the application of theories and principles developed for other forms of investment, some aspects of real estate investment remain specific to the real estate sector. Similarly, many of the skills required to manage a REIT can be drawn from disciplines other than real estate while some skills remain firmly rooted in the real estate discipline. As the highly successful US real estate investor, Sam Zell, observed:

REITs are no longer different from any other industry that is dependent on access to capital markets,

and

The successful REITs are the ones that can be characterised as operating companies versus a collection of properties. (Garrigan and Parsons, 1997)

This is a view echoed by Geltner et al. (2007):

Shares of the major REITs are publicly traded in the stock exchange. Viewed by Wall Street as operational firms, that is, actively managed corporations, they are valued as such (i.e. not as passive portfolios of properties). Thus, REITs are valued in essentially the same way other publicly traded firms are valued … (Geltner et al., 2007)

This book seeks to view the REIT holistically as a major business enterprise which combines roles and skills common to all major business enterprises with roles and skills specific to the real estate sector. Similar to mining enterprises having CEOs as well as geologists or airline enterprises have CFOs as well as pilots, a REIT may be considered as just another type of business enterprise where the CEO and CFO work in a business team with dealers and developers. This reflects the increasing trend around the world for the CEO and various members of a REIT senior management team to increasingly be experts in a discipline other than real estate and for those with expertise in the real estate discipline to decreasingly occupy positions inside the C-suite.

With a REIT sector now forming part of the stock market of the US, Australia, numerous Asian countries and an increasing number of European countries, this book seeks to provide principles of real estate investment decision making that are capable of application in all countries (subject to local laws, regulations and rules) rather than focusing on decision making within the context of a specific country’s laws, regulations and rules.

For clarity, this book adopts the hierarchy whereby a REIT may comprise a group of funds and each fund may comprise a group of portfolios and each portfolio may comprise a group of properties. Also, the term ‘appraisal’ is used instead of ‘valuation’ though it is acknowledged that valuation is commonly used in Commonwealth countries.

Further, this book focuses the application of the REIT real estate investment decision making process on the acquisition of a property, though it is acknowledged that the process is equally applicable to the disposal of a property or other major transaction such as a large lease renewal or the letting of a substantial area of vacant accommodation.

Finally, where individual authors have contributed ideas specifically referred to in a chapter such authors are acknowledged individually in the text, with those authors contributing ideas generally referred to in a chapter being acknowledged in the references at the end of that chapter to which the reader is referred for greater detail.

This chapter seeks to outline REITs in principle with an overview of the REIT real estate investment decision making process and the key participants. Accordingly, by the end of this chapter, the reader should understand:

- the relevance of commercial and legal principles underlying a REIT and its characteristics;

- the importance of the structure and composition of a REIT management team for effective control of a large and often international business; and

- the significance of the Phases, Stages and Steps comprising the REIT real estate investment decision making process.

1.1 People and process

As the title Global Real Estate Investment Trusts: People, Process and Management indicates, this book focuses on both the people and the process involved in real estate investment decision making with the consideration of people intentionally coming first. This reflects the current emphasis on people relative to process in REIT real estate investment decision making which, as referred to above, is expected to reverse as REITs continue their evolution to a greater emphasis on process.

1.1.1 People

Over the last 40 years, the global REIT sector has developed from a small adjunct to the stock markets of several countries to a significant sector of the global equities market. REITs themselves have grown from small businesses collecting rents from a handful of buildings to massive multinational conglomerates undertaking a wide range of activities related to real estate.

The evolution from being small, localised entities into being large, international entities has been accompanied by an evolution in both people and real estate investment decision making processes. Accordingly, REITs today are major business enterprises, with management structures that mirror other major business enterprises, but happen to have a principal business undertaking a wide range of activities related to real estate.

As small, localised entities, REITs were often lead by an individual and managed by a small team who, between them, fulfilled all the roles necessary for the REIT to function. As is common in small business, the respective roles may not have been defined and may have overlapped.

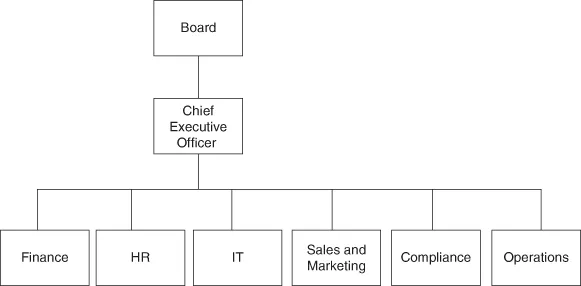

As large, international entities, REITs have evolved to adopt that management structure common to many international enterprises as illustrated in Figure 1.1. Though such line management functions as Finance, HR and IT are common to both REITs and major enterprises in other sectors such as banking, retail and so forth, REITs may be considered to have evolved the sales and marketing and operational line management functions to reflect the nature of the REIT business.

The sales and marketing line management function has evolved to comprise an investor interface function including marketing, sales and investor relations. For a business that specialises in real estate, the operational line management functions have evolved most specifically in REITs and so exhibit the greatest difference, as may be expected, to line management functions in other enterprises.

The operations line management functions for a large REIT reflect the various line management layers involved in the fund level, portfolio level, asset level, property level and facility level management of a REIT as illustrated in Figure 1.2. Those people comprising each of the management functions illustrated in Figure 1.2 contribute to the real estate investment decision making process within a REIT and are considered in the chapter outlining that part of the real estate investment decision making process with which they are most closely associated. Accordingly, the Portfolio Management, Strategy and Research Teams are considered in Chapter 2 (Planning Stage)...