Managing Energy Risk

An Integrated View on Power and Other Energy Markets

Markus Burger, Bernhard Graeber, Gero Schindlmayr

- English

- ePUB (apto para móviles)

- Disponible en iOS y Android

Managing Energy Risk

An Integrated View on Power and Other Energy Markets

Markus Burger, Bernhard Graeber, Gero Schindlmayr

Información del libro

An overview of today's energy markets from a multi-commodity perspective

As global warming takes center stage in the public and private sectors, new debates on the future of energy markets and electricity generation have emerged around the world. The Second Edition of Managing Energy Risk has been updated to reflect the latest products, approaches, and energy market evolution. A full 30% of the content accounts for changes that have occurred since the publication of the first edition. Practitioners will appreciate this contemporary approach to energy and the comprehensive information on recent market influences.

A new chapter is devoted to the growing importance of renewable energy sources, related subsidy schemes and their impact on energy markets. Carbon emissions certificates, post-Fukushima market shifts, and improvements in renewable energy generation are all included.

Further, due to the unprecedented growth in shale gas production in recent years, a significant amount of material on gas markets has been added in this edition. Managing Energy Risk is now a complete guide to both gas and electricity markets, and gas-specific models like gas storage and swing contracts are given their due.

The unique, practical approach to energy trading includes a comprehensive explanation of the interactions and relations between all energy commodities.

- Thoroughly revised to reflect recent changes in renewable energy, impacts of the financial crisis, and market fluctuations in the wake of Fukushima

- Emphasizes both electricity and gas, with all-new gas valuation models and a thorough description of the gas market

- Written by a team of authors with theoretical and practical expertise, blending mathematical finance and technical optimization

- Covers developments in the European Union Emissions Trading Scheme, as well as coal, oil, natural gas, and renewables

The latest developments in gas and power markets have demonstrated the growing importance of energy risk management for utility companies and energy intensive industry. By combining energy economics models and financial engineering, Managing Energy Risk delivers a balanced perspective that captures the nuances in the exciting world of energy.

Preguntas frecuentes

Información

1

Energy Markets

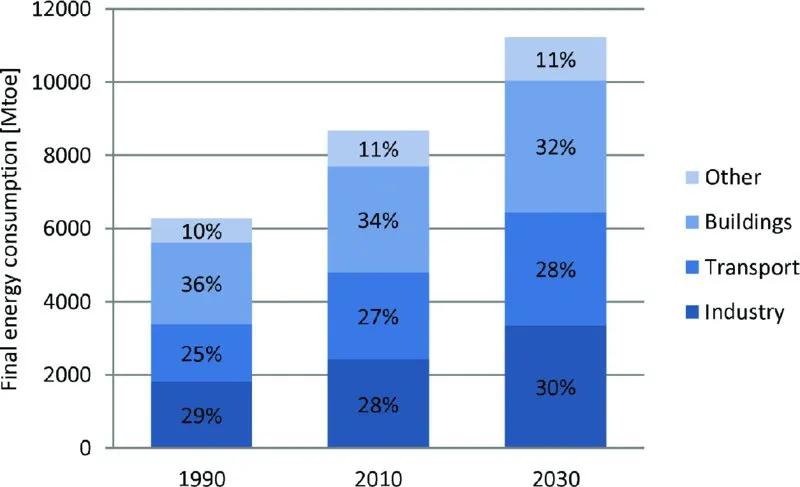

- Industry: The industrial sector accounts for 28% of the total energy consumption and has the highest growth rate among the sectors. The main energy sources are coal (28%), electricity (26%), gas (19%) and oil (13%). It is expected that electricity and gas will gain importance at the expense of coal and oil.

- Transport: The transport sector, which makes up 27% of the energy demand, is strongly dominated by oil (93%). On a worldwide scale, biofuels (2%) and electricity (1%) still play a minor role, but are expected to increase their share to 2% (respectively 6%) in the reference scenario. The actual development will be strongly influenced by future governmental policies.

- Buildings: This sector includes heating, air conditioning, cooking and lighting. It accounts for 34% of the total energy consumption. The energy is delivered mainly in the form of electricity (29%), bioenergy (29%), gas (21%) and oil (11%). There is a clear trend towards a higher share of electricity and gas at the expense of bioenergy and oil.