![]()

Part One

Forex Is a Game

Chapter 1 introduces the forex market. It begins by describing the total daily turnover and the seven major currency pairs. It then explains how to read a forex quote and how prices move. The chapter ends with a framework of how margin and leverage are employed in a forex trade.

Chapter 2 focuses on how money is made in a forex trade. We learn about long and short and the three points in every trade. We then move to the four big reasons that cause currencies to move and get a grasp of the fraction theory. Chapter 2 ends with an understanding of market structure.

Chapters 3 and 4 cover the six major players in the forex market and the numerous advantages associated with trading the market. Some of the major players include central banks, commercial banks, multinational companies, and retail traders. We also get a glimpse of three of the biggest blow-ups in proprietary trading in banking history.

Chapter 5 is devoted to discovering your unique profile in trading. It includes a profiling test to help you find out how your personality can help or hurt your trading style. There are essentially five types of traders: scalper, day trader, swing trader, position trader, and mechanical trader. By the end of this chapter, you will know which group you belong to.

![]()

Chapter 1

How to Play the Game

This chapter presents some of the essentials that you must know when you start trading the forex market. In it we describe the seven major currency pairs that are most commonly traded worldwide and explain how prices move. We also discuss the yen factor, which quotes forex prices in two decimal places as opposed to the normal four. The final part of the chapter defines the value of a pip and explains how margin and leverage affect trades.

THE FOREX GAME

The forex game has changed much over the years. Today, it is undisputedly the largest financial market in the world, with a daily trading volume in excess of USD4 trillion. The authoritative source on global forex market activity is the Triennial Central Bank Survey of Foreign Exchange and Derivatives Market Activity, published by the Bank for International Settlements (BIS).

Available official figures for daily forex turnover are taken from the last survey done in April 2010. Fifty-three central banks and monetary authorities participated in the survey, collecting information from 1,309 market participants.

An excerpt from the BIS report reads:

At the heart of the report, an interesting fact stood out. Apparently, 48% of the growth was in spot transactions, which represented 37% of the total turnover of forex transactions worldwide. Spot transactions are mostly traded by retail traders—that’s everyday people like you and me. This group is rapidly expanding and is expected to contribute an even larger portion of total forex turnover by the time the next survey is out.

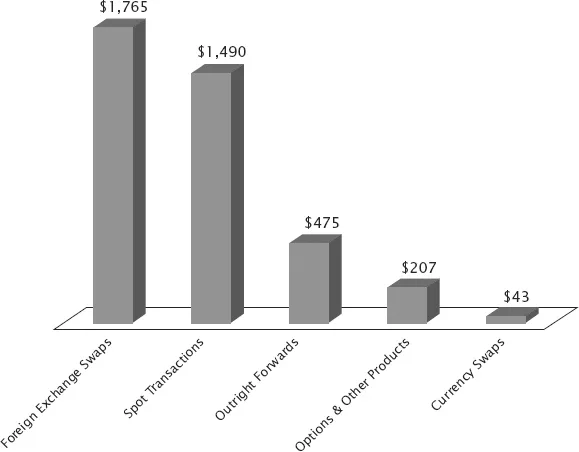

This Triennial Survey is done once every three years, and the next one is due in April 2013. Publication of preliminary results will follow four months later. The official figure for daily forex turnover is expected to be well over USD4 trillion at that time. Figure 1.1 shows the breakdown of the daily turnover by instrument.

The USD4 trillion daily turnover on the forex market is truly staggering. According to the April 2010 BIS Triennial Survey, this figure is:

- More than 23 times the average daily turnover of global equity markets

- More than 40 times the annual turnover of world gross domestic product

In fact, in the latest BIS Quarterly Review, dated March 2012, Morten Bech, senior economist in the Monetary and Economics Department of BIS, estimated that “global FX activity was around $4.7 trillion a day on average in October 2011, compared with $4.0 trillion reported by the latest triennial central bank survey of foreign exchange activity conducted in April 2010.”

Imagine that: USD4.7 trillion in a day on average in October 2011!

It certainly won’t be surprising to see the figure top the USD5 trillion mark when the official figures are released from the April 2013 survey. The good news for the retail trader is this: As a result of increasing demand, transaction costs such as spreads have decreased, technology offerings have improved, and value-added services on forex brokerage firms have exploded.

There truly never has been a better time to start trading on the forex market. This exciting message is further reinforced by the record numbers of everyday folks—people like you and me—who continue to jump onboard the forex bandwagon at an accelerated pace.

FOREX AND THE SEVEN MAJORS

Foreign exchange, or forex for short, is a market where one currency is exchanged for another. This is the reason why forex is quoted in currency pairs. Each world currency is given a three-letter code as set out by the International Standards Organization (ISO) and governed by the ISO 4217.

The eight most commonly traded currencies are:

1. USD (U.S. dollar)

2. EUR (euros)

3. GBP (Great Britain pound)

4. AUD (Australian dollar)

5. JPY (Japanese yen)

6. CHF (Swiss franc)

7. CAD (Canadian dollar)

8. NZD (New Zealand dollar)

The eight most commonly traded currencies form the seven major currency pairs. These seven majors dominate the forex market in terms of traded volume. Since January 2012, it is estimated that the seven majors account for over 85% of the daily traded volume in the forex market.

These seven major currency pairs are:

1. EUR/USD: euro versus U.S. dollar

2. USD/JPY: U.S. dollar versus Japanese yen

3. GBP/USD: Great Britain pound versus U.S. dollar

4. AUD/USD: Australian dollar versus U.S. dollar

5. USD/CHF: U.S. dollar versus Swiss franc

6. USD/CAD: U.S. dollar versus Canadian dollar

7. NZD/USD: New Zealand dollar versus U.S. dollar

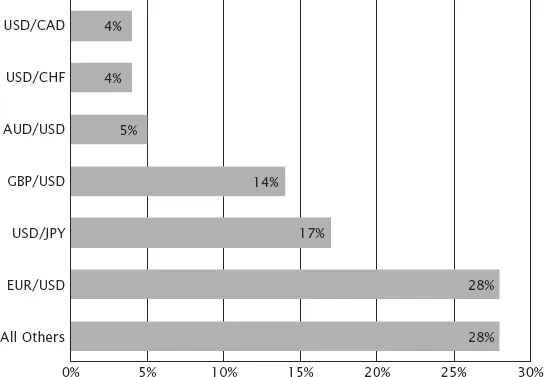

Figure 1.2 shows how much volume is contributed by the seven majors. It also shows that the EUR/USD currency pair contributes the highest percentage of daily traded volume, with 28%.

For all of the listed seven majors, the U.S. dollar features in either the left-hand side or the right-hand side of the currency pair. This is why the U.S. dollar is the most liquid currency in the forex world.

Reading a Forex Quote

Forex prices are quoted in currency pairs and almost always to four decimal places. For example, if a forex quote is given as EUR/USD = 1.3255, the currency on the left is termed the “base currency” while the currency on the right is termed the “counter currency.” The base currency always has a value of 1. In the example, the euro is the base currency while the U.S. dollar is the counter currency. This is how we would read the forex quote: 1 euro is equivalent to 1.3255 U.S. dollars at that point of time.

This forex quote tells us two things. First, if traders are eager to purchase one unit of the base currency, th...