![]()

CHAPTER 1

Overview of the Development Process

Where does the real estate development process begin? It begins with an idea. It does not begin with crunching numbers. It does not necessarily begin with a site. It begins with an idea. Real estate development is a highly creative endeavor, as the reader will see. Frankly, those in the creative arts, such as movie or television production, often do very well transitioning into the real estate development industry.

ECONOMIC PERSPECTIVE

Before we delve too deeply into the development process, it is important to gain a perspective on its role in the U.S. economy. (Do not focus on the absolute numbers in the list below; instead, focus on the relative magnitude of the numbers as you read them.)

Real Estate Development

1 • Is more than a US$5 trillion U.S. market segment

• Generates about a third of U.S. GDP

• Creates jobs for more than 9 million Americans

• Is responsible for nearly 70 percent of local property tax revenue, which pays for schools, roads, police, and other essential public services

Clearly, the real estate industry has a major impact on the U.S. economy, and on the world economy as well. I cannot think of any business or activity that does not directly or indirectly use real estate or is not a supplier of the real estate industry. Most important, focus on that last bullet point. If a municipality gets 70 percent of its revenue from property taxes, it is logical and true that municipalities are in favor of real estate development, that is, real estate development improves values and hence the tax base and thus generates increased property tax revenues. Therefore, municipalities inherently are positively inclined toward new property development and regeneration. Yes, there are municipalities that say they do not want new development, but eventually they all come around because property tax revenue has such a significant impact.

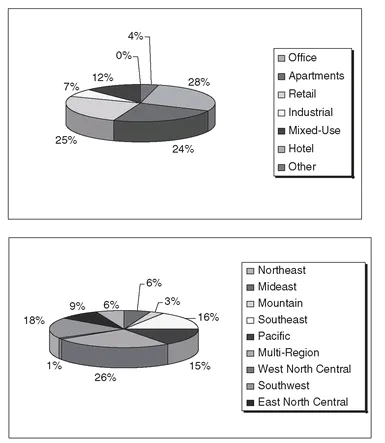

Figure 1.1a 200X REIT Transactions: Total Acquisitions US$9.7 Billion

I mentioned earlier that the real estate industry has a major impact on the U.S. and world economy. Every business, every person, uses a building or real estate every day. Even the homeless person sitting in a cardboard box has his piece of real estate. Hence, the balance sheet of every company and every person in this world has real estate as a major line item. Municipalities know this. Hence, over the years, governments have provided many financial and legal subsidies to enable additional real estate development and investment.

Figure 1.1b 200X REIT Transactions: Total Dispositions US$3.8 Billion

Let’s look at Figures 1.1a and 1.1b.

Figures 1.1a and 1.1b were derived from information from public real estate investment trusts (REITs). The information is labeled as coming from 200X because the specific year is not important for this discussion. In Figure 1.1a, we see that REITs acquired US$9.7 billion of property. (The top pie charts indicate distribution of property types, and the bottom pie charts indicate geographic distribution.) In Figure 1.1b, we see that REITs in this year disposed of or sold US$3.8 billion of property. So, what do we learn by studying these pie charts? Well, we see that the REITs in this year are net holders of property. We see that the REITs concentrated their preferences in property type and concentrated their geography where the properties are located. So again, what do we learn from these pie charts? The correct answer is, as a developer, nothing; the information is useless. It is interesting but useless. Some might say that the information would be better presented as a trend over several years. Again, I would still say the information is useless to a developer. Primarily, when was this information gathered and presented? The data is from the end of a year. It probably took several weeks to compile the information into these nice pie charts. So, the information is outdated. A development project takes on average three to five years before construction begins, maybe another year or two for construction to finish, and perhaps another year before the building is fully occupied. So if a developer had a site today and started planning, before a building is completed and operating, five years or more will pass. What will the markets be like in five years? What will be the demands of any particular city or town five years from now? No one knows. So performing a trend analysis is barely a beginning. What a developer needs to do is establish the trend beyond the trend. Once a trend has been determined, the trend is old and common. A developer cannot gain an advantage by using known trend information. To be successful, a developer needs to perceive what is next to come. Now this is not easy to do, but this skill distinguishes successful developers from very successful developers.

Consider a group I worked with several years ago. The group presented an idea to me for creating a suite hotel project in New York City, seeking an opinion. The central idea was that the project would attract families. Currently, families had to secure multiple rooms to accommodate family members. A suite hotel would contain individual hotel rooms, but each room would contain two bedrooms, a sofa bed, and perhaps a folding cot. The group’s concept included a children’s museum on the ground floor, open to nonguests, and provided child care, should parents want to attend a Broad-way show or go to dinner some evening. I thought this was a good idea. The next day, I received an e-mail newsletter that highlighted the fact that the concept was already being used in Germany. A week letter, I received another e-mail newsletter with an article discussing the concept in use in South Africa. Ideas, good ideas, are everywhere. Just because a developer has an idea rarely means he or she is the only person with that idea. There are many people in this world with good ideas. The key is to act quickly or to devise an idea that is the next step, or the trend beyond the trend.

A useful tip in trying to determine the trend beyond the trend is to look for the negative in a circumstance. That is, what is it that is not happening? You will find that focusing on what is not happening is far easier than focusing on what is happening. Consider this example: Imagine you are with a friend, colleague, or spouse. There often comes a point when you might be a little hungry. So, what does one person say to the other? “I’m hungry. Where do you want to go to grab a bite?” What does the other person say? “I don’t know. Where do you want to go?” And this questioning goes back and forth without immediate resolution. On the other hand, imagine if the dialogue went as follows: “I’m hungry. Where don’t you want to go?” The answer usually comes quickly. “Well, I don’t want Italian food because I just had Italian food last evening” (and so on). It is far easier to determine the negative because most people have definite ideas of the negative. A developer should do the same. Don’t ask a city, “How about we build a shopping center here?” A developer should instead ask what the city does not want built. The answer often comes quickly.

Essentially, we are following demographic—that is, people—trends when we plan a real estate development. What are the population trends? What regional population or development shifts are occurring? Are there any specific city development trends discernible? In short, real estate development is about people. What is it that people are doing or, more important, not doing? If a developer becomes a student of people and how people go about their daily lives, that developer will become adept at formulating the trend beyond the trend.

The State of New Jersey created a number of years ago the Blueprint for Intelligent Growth (B.I.G.) Map. The color-coded map indicated where in the state the government would encourage development or regeneration, where in the state the government would discourage development or regeneration, and where in the state the government would be open to argument. These areas were depicted by the use of three colors: green, red, and yellow, respectively. (If you would like to look at the B.I.G. map, then go to the New Jersey Department of Environmental Protection web site.) To my knowledge, this is the only map of its kind created by any state in the country. It is a very creative and progressive effort for a state to exercise control on a statewide basis.

If you look closely at the B.I.G. Map, you will see a clear concentration of the green-colored areas. They are located across from the major cities of New York and Philadelphia. So why did New Jersey concentrate on these areas to encourage development? Well, what is physically in these areas? What is the condition of those improvements? The areas are built-up, but old. Infrastructure is inadequate and in need of repair. The state, in essence, has unproductive assets in these green areas. Unproductive assets from the government’s viewpoint are assets that have low or nonexistent value for tax purposes. (Remember, 70 percent of property tax revenue supports the local municipality’s efforts at maintaining roads, schools, and the like.) Therefore, it is easy to picture that where there is a concentration of nonproductive assets, the government would like new development or regeneration. Conversely, the red-colored areas are already built, but the state would like to promote the preservation of open, green space and hence discourages additional development.

As I said, this is a creative and progressive effort. However, as of the writing of this book, the B.I.G. Map has been tabled indefinitely. That is, the purpose and execution of the B.I.G. Map will not be pursued for the foreseeable future. This is not to say that the concept was stopped. What happened? Well, what do you think would happen to elected officials in the red areas of the map? They would lose political power. How would this happen? Since new development would be discouraged in the red areas, the population would probably move to areas where they would find newer development (buildings). Thus the population in the red areas would probably decline. Along with reduced population and older buildings, property tax revenues would decline. With reduced property tax revenues, the town’s basic and essential services would not be funded. Without the funding, politicians such as the mayor would initially be without purpose and eventually not have a town to govern.

In addition, New York and Pennsylvania were not too happy with the B.I.G. Map. The two states clearly understand that they would lose population to adjacent, newly rebuilt towns across the rivers in New Jersey, and as a result, the two states would lose tax revenue to New Jersey.

So, developers have to always address two factors when pursuing a development anywhere: What political changes will occur, and what property tax revenue changes will occur as a result of new development? Every town will ask this question, so be prepared with a logical answer.

RELEVANCY OF UNIVERSAL KNOWLEDGE

Everything you see, everything you hear, and everything you read is relevant to real estate development. Let me offer a couple of scenarios and take you through the thinking process of why universal knowledge is so important. Gasoline prices seem to be going higher, for a time they seemed to be going lower, but no one really knows what the trend is going to be. Recently, gasoline prices were at historically high prices, placing pressures on the population. What kind of pressures am I speaking about? Well, consider people who drive 30 minutes or more to get to their workplace or to a local train station to get to their workplace. When gasoline prices doubled or more, personal budgets were extended to pay for gasoline. These people who drive in many cases do not have a choice about driving because public commuter services are limited or nonexistent in the areas in which they live. Thus, they had to pay the higher gasoline prices. While many of these people were willing to bear the higher cost of gasoline, other expenses, particularly discretionary expenses, were reduced or eliminated. Perhaps people have become frustrated as a result of having to cut back on their luxuries or even their necessities of life as a result of the high gasoline prices. So what might be a commonsense solution? I suppose one possible solution might mean moving closer to the workplace or to the urban center. Very well; if people start moving closer to or into the city, what do they need? Where is the opportunity for a real estate developer? Well, the answer is quite simple. More housing has to be built in these urban centers.

One day you read in the newspaper that a foreign car manufacturer is moving into a southern U.S. state. What does that foreign car manufacturer need? Some argue that the foreign car manufacturer needs to move to a specific location that has a job pool of qualified employees for the manufacturing plant. Extending this thought, that means that perhaps new housing needs to be built to house the new employees. In addition to the new housing, perhaps some retail of various types has to be developed to service the people who are moving into the area. And of course, the foreign car manufacturer needs a building to establish the plant. Does this building exist currently? Does this building have to be built? On what site? If this building has to be built, what are the foreign car manufacturer’s requirements? Again, another opportunity for a real estate developer.

Universal knowledge is critical. Always be aware of everything that is going on around you, whether you read about it in a newspaper, hear it on the radio, see it on television, or catch it on the Internet. This universal knowledge is an application of what I referred to earlier as the trend beyond the trend. If you, as a real estate developer, want to be successful, you will be aware of everything and be thinking about what opportunity is presenting itself to you.

“Don’t forget nothing.”

—Rogers’ Standing Orders for Rangers, 1739

So, what is the development process? Let me offer a comprehensive, and somewhat lengthy, definition of the development process: The improvement of raw land or property through the development process is a highly creative process in which physical ingredients such as land and buildings are effectively combined with financial and marketing resources to create an environment in which people live, work, and play.

Let’s dissect this definition, so you have a thorough understanding of what the development process is really about.

The improvement of raw land or property. As a real estate developer, you improve things, whether you are starting a development from the ground up or renovating an existing property. When we say we are improving raw land or property, what we really are saying is that we are creating value. Many people who get involved with real estate development think they want to get involved to make money. The reality is that a real estate developer cannot make money without first creating value. Once value ...