eBook - ePub

Hit and Run Trading

The Short-Term Stock Traders' Bible

Jeff Cooper

This is a test

Compartir libro

- English

- ePUB (apto para móviles)

- Disponible en iOS y Android

eBook - ePub

Hit and Run Trading

The Short-Term Stock Traders' Bible

Jeff Cooper

Detalles del libro

Vista previa del libro

Índice

Citas

Información del libro

Jeff Cooper is back with a newly updated Hit & Run Trading Volume I. Delivering a day-by-day trading plan of attack, this comprehensive manual is your key to conquering the market on a daily basis.

Join Jeff as he reveals his most intimate winning methods for daytrading and short trading the market. While the traditional "buy and hold" strategy may work well in bull markets, Cooper's "Hit & Run" methods work in ALL markets. His easy to follow methods will show you exactly:

- Which stocks to focus on each day

- Where to place your buy stops and sell short stops

- The precise amount of risk you should take

- And how to take the psychology out of trading in his new "Mind Over Money" chapter!

PLUS, you'll gain access to Jeff's personal arsenal of strategies including:

- Stepping in Front of Size™ – learn how to buy a stock just moments before the big boys!

- 1-2-3-Pullbacks™ – discover the three-day setup that consistently triggers 4–15 point gains within just days!

- Expansion Breakouts™ – master the one breakout that consistently leads to further gains.

- The power of Creating the Daily Hit List – learn how to recognize which stocks are rapidly moving and which setups to use to trade them – invaluable knowledge to keep you ahead of the game!

A true trading sensation and classic – now in it's newly updated format!

Preguntas frecuentes

¿Cómo cancelo mi suscripción?

¿Cómo descargo los libros?

Por el momento, todos nuestros libros ePub adaptables a dispositivos móviles se pueden descargar a través de la aplicación. La mayor parte de nuestros PDF también se puede descargar y ya estamos trabajando para que el resto también sea descargable. Obtén más información aquí.

¿En qué se diferencian los planes de precios?

Ambos planes te permiten acceder por completo a la biblioteca y a todas las funciones de Perlego. Las únicas diferencias son el precio y el período de suscripción: con el plan anual ahorrarás en torno a un 30 % en comparación con 12 meses de un plan mensual.

¿Qué es Perlego?

Somos un servicio de suscripción de libros de texto en línea que te permite acceder a toda una biblioteca en línea por menos de lo que cuesta un libro al mes. Con más de un millón de libros sobre más de 1000 categorías, ¡tenemos todo lo que necesitas! Obtén más información aquí.

¿Perlego ofrece la función de texto a voz?

Busca el símbolo de lectura en voz alta en tu próximo libro para ver si puedes escucharlo. La herramienta de lectura en voz alta lee el texto en voz alta por ti, resaltando el texto a medida que se lee. Puedes pausarla, acelerarla y ralentizarla. Obtén más información aquí.

¿Es Hit and Run Trading un PDF/ePUB en línea?

Sí, puedes acceder a Hit and Run Trading de Jeff Cooper en formato PDF o ePUB, así como a otros libros populares de Betriebswirtschaft y Investitionen & Wertpapiere. Tenemos más de un millón de libros disponibles en nuestro catálogo para que explores.

Información

Chapter 1

THE OPENING BELL

“It’s not whether you get knocked down, it’s whether you get up.”

—Vince Lombardi

In the late 1950s, my father could have been the poster child for “The American Dream.” He was 42 years old, had sold his textile business for millions, and was retired, living the good life with his wife and two kids in Beverly Hills. In order to keep himself busy, he invested in the stock market.

Brokers would call my father two, three, four times a day with their “investment” ideas. “Jack, Bethlehem Steel looks good, . . . Jack, I like the autos, . . . Jack, how about we buy Woolworth and put it away for 20 years?” After my father invested all his cash, the brokers introduced him to a new investment technique: margin. “Jack, we can buy twice the amount of companies by using the stocks in your portfolio as margin. You will make double the amount of money when the stocks go up. Remember, stocks always go up if you hold them long enough.”

This made sense to my father and he went along with the strategy. In May 1962, my father went bankrupt. On the day my mother was being operated on for cancer, the brokers who told my father that stocks always go up if you hold them long enough were mass liquidating his portfolio to meet the margin calls. My family’s net worth was not only wiped out, but we owed the brokerage houses money. This was my first experience with the buy-and-hold strategy that has once again become so popular with Wall Street.

My family packed a moving van and was forced to move back east. This was hard enough, but fate was not done with my father. Our moving van caught fire in Needles, Arizona, and all our possessions were destroyed.

There is an old saying that a dog will do one of two things if you kick him when he’s down. The first is, he will roll over and die. The other is, he will not take it anymore and will jump up and bite you. The second analogy describes my father. Within five years, he had again created and again sold a multimillion dollar textile company. The Cooper family was able to sing, “California here we come, just back where we started from . . .”

This time, even though my father decided he was going to enjoy the country club life he was entitled to, there was a lingering matter that needed to be settled. He was going to make back the money he had lost in the stock market!

With this goal in mind, my father knew he needed to create a method that wasn’t a buy-and-hold strategy. After doing much research, he discovered that the most profitable game was to buy “hot” initial public offerings (IPOs) and secondaries and sell them for small gains. Within a few years, my father was not only the largest player on Wall Street in the IPO game, but he had earned back all the money he had lost in 1962. A couple of years later, he had his revenge and retired with many more millions than he started with. This is where I come in.

By the early 1980s, I had started and sold a small business and found myself gravitating toward Wall Street. After a brief six-month stint at Drexel Burnham, I went off on my own and attempted to replicate my father’s success in the IPO market. Unfortunately for me, the rules had now changed. Mutual funds, not individuals, were the major beneficiaries of the brokerage house allotments for the deals, and I was given such a small amount of stock that I knew I could never make a decent living at it. I therefore decided to apply myself to studying the markets and, lo and behold, by 1987, I had become a big-picture, buy-and-hold investor. I can remember the calls from brokers. “Hey Jeff, Enzobiochem Information Systems Technologies is going to earn $0.30 this year, $2.00 next year, and $15.00 the year after. Even though the stock is at 100 times earnings today, it’s at two times 1989’s numbers! It’s a steal!!!” And, as a rising tide lifts all ships, a rising bull market lifts all stocks. I was making great money until October 1987 when the buy-and-hold curse hit another member of the Cooper family. Fortunately, I did not go bankrupt, but I did get hurt and I learned a bitter lesson. Just as my father had twenty years earlier, I set out on a quest to create a methodology to beat the stock market.

It is now nine years later and I can confidently say that my quest has been successful. I make my living trading stocks and, more importantly, I do it from both the long side and the short side. If and when we go into a bear market, I know there will be no effect on my earnings and I will be one of the few players out there whose lifestyle will not change.

My strategies are simple and to the point. They revolve around price action and the notion that a stock in motion will remain in motion for at least the short-term (a few minutes to a few days). My techniques are the culmination of 15 years of observation, testing, and most importantly, real-life results. Unlike what many other authors of investment books would have you believe about their strategies, my techniques are not perfect (not even close). They do, though, give me an edge, and this edge, combined with proper risk control, allows me to make a comfortable living.

Before we proceed to the chapters describing my trading strategies, we will look first at the background and rules you need to know to properly trade my methodology. I recommend you give special attention to chapter 4. This is the chapter that teaches you how to identify the proper stocks to trade, and I consider this to be the backbone of my success.

Finally, my goal in writing this manual is to teach you a handful of short-term, low-risk setup patterns. The patterns will allow you to avoid the disasters associated with buy-and-hold and will give you a set of tools to use to profit from the stock market for the rest of your life. After you have studied the manual, I hope you will find I achieved my mission.

Chapter 2

TERMS YOU NEED TO KNOW BEFORE STARTING

“I shall not mingle conjectures with certainties.”

—Sir Isaac Newton

Before we go on to how I create my hit list and my trading strategies, I feel it would be best to review the definitions of the terms we will be using.

ADX—A mathematical formula used to measure the strength of a trend. A measurement of above 30 means the stock is trending strongly. Note that a downtrend will also create a high ADX number, just as will an uptrend. (See appendix for formula.)

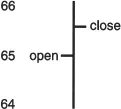

Bar Chart—Shows the trading range (today’s high minus today’s low) of the day, its open, its high, its low, and its close. For example, if a stock opens at 65 and trades as low as 64 and as high as 66 and closes at 65 1/2, the bar would look like this:

Bid—The highest price for a stock that buyers are willing to pay.

Breakdown—A stock that trades below a previously established low.

Breakout—A stock that trades above a previously established high.

+DI, −DI—A companion to ADX. As we just noted, ADX only measures the presence of a trend. +DI and −DI tell the direction of the trend. When a stock is trending higher, its +DI reading will be higher than its −DI reading and vice versa. (See appendix for formula.)

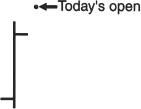

Gap—This means today’s opening is above or below yesterday’s high or low.

Inside Day—Today’s high is equal to or less than the previous trading day’s high, and today’s low is equal to or greater than the previous trading day’s low.

Price Persistency—One-way continuation of price. For example, a stock trades higher today, and again tomorrow, and again the next day, etc.

Relative Strength (as measured by Investor’s Business Daily)—This tells the percentage of other stocks this stock has outperformed in price appreciation over the period of the last 12 months. The higher the number, the stronger the stock and vice versa.

Reversal—When a stock moves up and then changes direction and moves down (and vice versa).

Secondary Offering—When a public company sells additional stock to the public.

Moving Average—The average closing price of a stock over X number of days, i.e., a 10-day moving average is the average closing price of the previous 10 trading sessions.

Offer (also the “Ask”)—The lowest price for a stock that sellers are willing to sell the stock for.

Stops—An order to buy or sell at the market if a stock trades at or through a specified price (stop price).

Chapter 3

RULES ARE MADE TO BE BROKEN—EXCEPT THESE

“I base my calculation on the expectation that luck will be against me.”

—Napoleon

1. Money management is more important than entry strategies. This means keeping losses to a minimum. In my opinion (and unfortunately, experience) 98 percent of all large losses were originally small losses. This fact must be ingrained into your psyche! Controlled position size combined with stop-loss management increases returns while decreasing risk.

2. The trend rules! About 90 percent of the time, I trade in the direction of a strongly trending market. This is identified by ADX, Relative Strength, New Highs/New Lows, and Moving Averages (see chapter 4).

3. Sponsorship is critical. I do not have the patience to wait for Wall Street to discover the next Microsoft. I trade in the stocks that the momentum growth funds are in. Louis Navellier’s MPT Review newsletter and Investor’s Business Daily each do superior jobs of identifying which stocks are gaining sponsorship (participation in a stock by major players) and which stocks are losing sponsorship (more on this in chapter 4).

4. I start every day at zero. This means I will eliminate immediately any and all positions not moving in my favor. This reduces my overall risk and allows me to protect my profits.

5. Never forget: The longer a position is held, the more things can go wrong.

6. Because of the high turnover of trading, commission costs must be kept to a minimum. You will have a difficult time maximizing your profits if you trade for more than 6¢/share.

7. Most stockbrokers are good people. Unfortunately, most (not all) do not have a clue. I therefore make all of my own decisions.

8. Trading is a serious business! If you were to open a retail store you would need a cash register, phones, etc. The same is true for trading. I recommend you get the best data ...