Part I

Getting an Auditing Initiation

In this part . . .

Auditing is the process of investigating information prepared by someone else in order to determine whether the information is fairly stated. If you’re a business owner, you’re responsible for the information being audited, which you present in your financial records. If you’re the auditor, you investigate the assertions made on the financial statements to make sure you agree with what the company is saying about itself.

Being audited is an essential part of doing business for many companies. This part of the book explains why audits are done; who the major audit customers are; and what type of education, licensing, and experience an accountant must have to be able to conduct audits. I also present the auditor’s code of conduct and show how auditors decide whether to accept a company as an audit client. Finally, you get an introduction to the standards that must be followed in each audit.

Chapter 1

Taking Auditing into Account

In This Chapter

Getting to know auditing and why it matters

Finding out how to become an auditor

Meeting the audit stakeholders

Introducing key auditing concepts

The fact that you’re holding this book tells me that you already know something about auditing; most people don’t buy a title like Auditing For Dummies on a whim in the bookstore. But I don’t want to make any assumptions, so consider this chapter your jumping board into the pool of auditing. Here, I explain what auditing is and how someone becomes an auditor. I also lay out the many different careers paths an auditor can follow, from being employed by a big certified public accounting (CPA) firm and working on audits of public companies to owning a boutique firm and doing specialized audits.

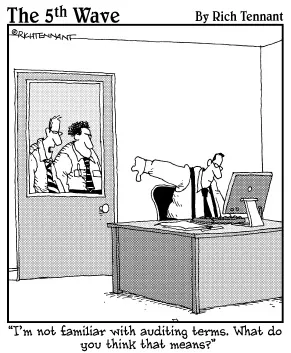

At the end of the chapter, I briefly introduce four all-important auditing concepts: materiality, audit risk, evidence, and sampling. Whether you’re a student considering a specific auditing discipline or a business owner facing an audit, you need to understand these crucial auditing terms from the start.

The Secret Lives of Auditors

Auditing is the process of investigating information that’s prepared by someone else to determine whether the information is fairly stated. So what exactly does that investigation entail and how does it play out on a daily basis? Although an auditor’s life isn’t overly glamorous, it can be somewhat exciting looking through a company’s records and uncovering relevant information.

Specifically, as an auditor, you investigate the assertions that a company makes on its financial statements. Financial statements assertions often relate to how the company conducts business, such as how it makes and spends money (see Chapters 9 and 10), how it manages its personnel (see Chapter 11), and how it manages its products (see Chapter 12). Other assertions involve the client’s financial processes, such as how it records financial information about its property, plant, and equipment (see Chapter 13), its long-term liabilities and equity (see Chapter 14), and its cash and investments (see Chapter 15).

Using the steps I spell out in Part II of this book — interviewing the client; studying how it tries to prevent fraud, theft, and other problems; and choosing an appropriate sample of records to evaluate — you consider the client’s evidence to see whether it supports all those financial statement assertions. Then, after conducting some final steps to make sure you didn’t miss any significant information (see Chapter 16), you issue a report that includes your opinion about the correctness of the financial statements (see Chapter 17).

If you’ve never taken part in an audit, you may assume that auditing is a boring, repetitive job that’s a necessary evil on the road to becoming a managing partner in a CPA firm making the big bucks. That may be kind of true. As a novice auditor, you do a lot of grunt work like looking at invoices and making sure facts in one document are the same in another document.

But along the way, as you dig through the records of the company you’re auditing, you also uncover fascinating information, from the inside, about how different types of businesses operate. For example, have you ever wondered what happens to all the water that people use at self-service car washes? Neither did I, until I audited a chain of car washes and management explained the process of cleaning and recycling the wash- and rinse-cycle water.

Every business you audit provides you with new knowledge that helps you become better at your job. Additionally, the investigative and evaluative skills you glean can open doors to other opportunities in the auditing field (see Chapter 18). I’ve known many auditors who were recruited to work for companies they had audited in the past. Regarding every audit as an opportunity to learn and expand your skills is an attitude that will serve you well. Understanding the Increasing Demand for Auditing and Assurance

Whenever government regulation increases, the demand for qualified, competent help to ensure compliance with the new regulations is sure to follow. Case in point: the passage of the Sarbanes-Oxley Act of 2002 (SOX), which is the most significant event currently affecting the auditing profession. SOX, which reforms the way companies interact with their investors and disclose financial information, increases the demand for qualified, knowledgeable auditors to provide enhanced financial and internal control reporting. See Chapters 3 and 20 for more information.

The conditions that ushered in SOX started with the stock market bubble (fueled by advances in electronic commerce, or e-commerce) in the late 1990s. At that time, it seemed like everyone and his uncle were becoming millionaires by throwing up a Web site and taking their company public: offering shares of company stock for sale to the general public. The bubble burst in 2000, leading to the massive fraud perpetrated by Enron and the like, aided by their auditors, notably the CPA firm of Arthur Andersen. Although SOX certainly has increased the demand for auditing and assurance services, other factors have promoted auditors’ job security as well. In this section, I briefly touch on two of them.

Examining the changing nature of business

The circumstances under which businesses operate have changed dramatically in the last couple decades. The combination of the introduction of e-commerce in the late 1990s and technological advances that ushered in business-to-business (B2B) and business-to-consumer (B2C) commerce allowed businesses to connect electronically with one another and with their customers. As a result, many businesses started to outsource tasks such as human resources and inventory management, allowing companies to conduct business in real-time in any part of the world via the Internet and largely eliminating the need to fax and ship paper documents.

What do all these changes mean to an auditor? Whereas in the past, businesses produced paper trails that auditors, investors, and other interested parties could follow to find clues when examining the financial statements, those trails are increasingly electronic. Electronic data can be manipulated when controls are lacking and more difficult to track down than a piece of paper in a file cabinet, and the increased use of technology can lead investors and lenders who aren’t comfortable with these advances to feel less certain about whether a business is being forthright and transparent in its dealing...